Table of Contents

Report Overview

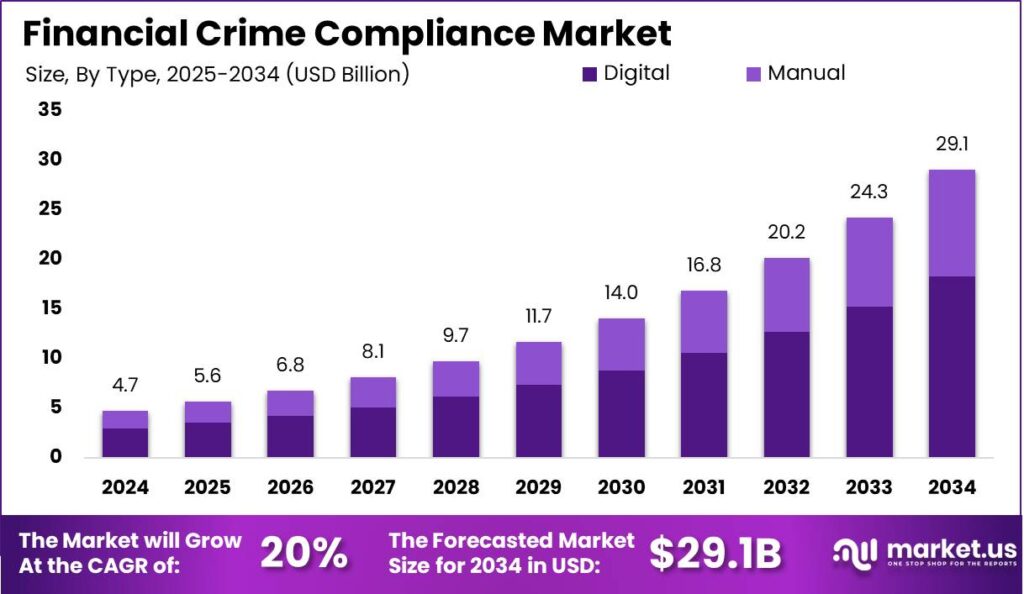

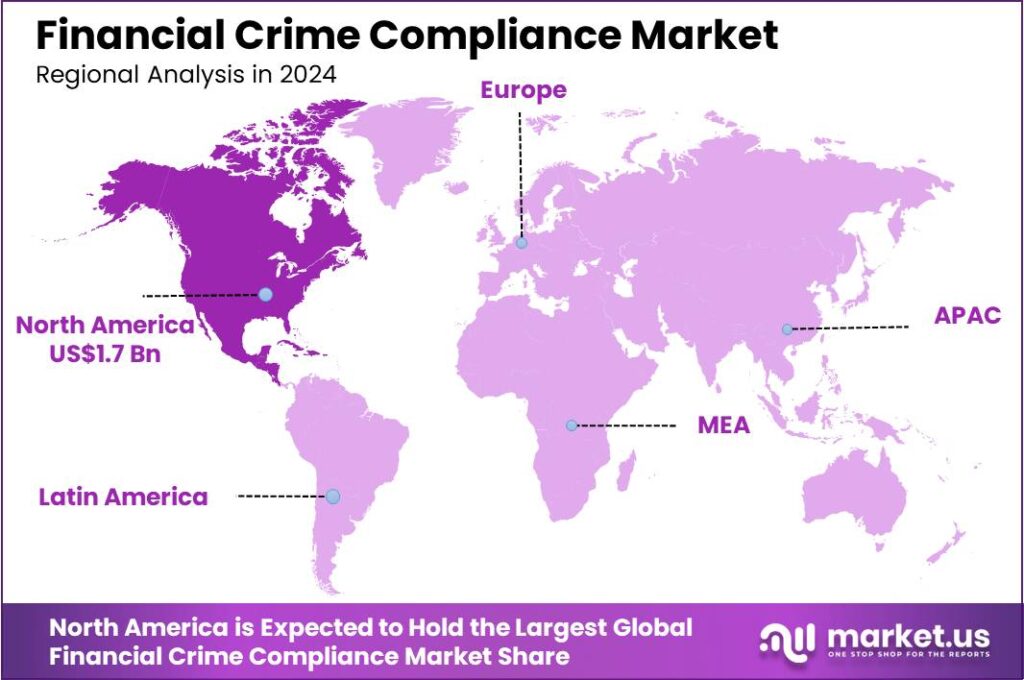

The Global Financial Crime Compliance Market is projected to soar from USD 4.7 billion in 2024 to an impressive USD 29.1 billion by 2034, reflecting a robust compound annual growth rate (CAGR) of 20.00% throughout the forecast period from 2025 to 2034. In 2024, North America led the market, holding a dominant 36.5% share, generating revenues of approximately USD 1.7 billion.

Financial crime compliance refers to the practices and strategies employed by financial institutions and businesses to prevent, detect, and respond to various forms of financial crime. These crimes include money laundering, fraud, terrorist financing, bribery, and corruption, among others. As financial transactions become increasingly complex and globalized, regulatory bodies have imposed stringent compliance requirements to ensure that organizations mitigate the risk of financial crimes.

The growth of financial crime compliance is driven by increasing global regulatory pressure, with governments focusing more on anti-money laundering (AML) and countering the financing of terrorism (CFT), prompting businesses to invest in compliance to avoid penalties. Additionally, the rising sophistication of financial crimes, including the use of AI and cryptocurrencies, is driving the need for advanced compliance technologies to detect and prevent complex schemes.

Key applications of financial crime compliance include monitoring transactions for money laundering or terrorism financing, reporting suspicious activities to authorities as required, and managing risks by identifying threats and vulnerabilities within operations. These measures enable institutions to take proactive steps to mitigate potential risks.

A major challenge in financial crime compliance is integrating new solutions with existing systems, which can be costly and time-consuming. Additionally, the constantly evolving regulatory landscape requires continuous updates to compliance programs, making it hard for organizations to stay current. The high cost of compliance, including investments in technology, training, and personnel, can be particularly burdensome for smaller institutions, limiting their ability to fully meet regulatory requirements.

Technological innovation is transforming financial crime compliance, with AI and machine learning enhancing the detection of unusual behavior patterns through fast and accurate data analysis. Additionally, blockchain technology is emerging as a tool to improve transparency and traceability of transactions, potentially revolutionizing compliance practices in the financial sector.

The market for financial crime compliance is expanding beyond the banking sector to include industries such as real estate, luxury goods, and digital currencies. This expansion is partly due to the recognition that financial crimes can permeate any sector where significant money transactions occur, necessitating broader regulatory measures and compliance programs across various industries.

Key Takeaways

- In 2024, Adverse Media Screening captured a dominant share of over 29.5% in the market.

- The Digital segment emerged as the leader in the Financial Crime Compliance (FCC) market, holding more than 62.8% of the market share.

- When it came to market dominance in terms of company size, the Large Enterprises segment stood out, securing over 66.2% of the total market share.

- Within industry sectors, the Banking, Financial Services, and Insurance (BFSI) segment continued to dominate, maintaining more than 27.5% of the overall Financial Crime Compliance market share.

- Regionally, North America led the way in the Financial Crime Compliance market in 2024, commanding over 36.5% of the global market, with revenues totaling USD 1.7 billion.

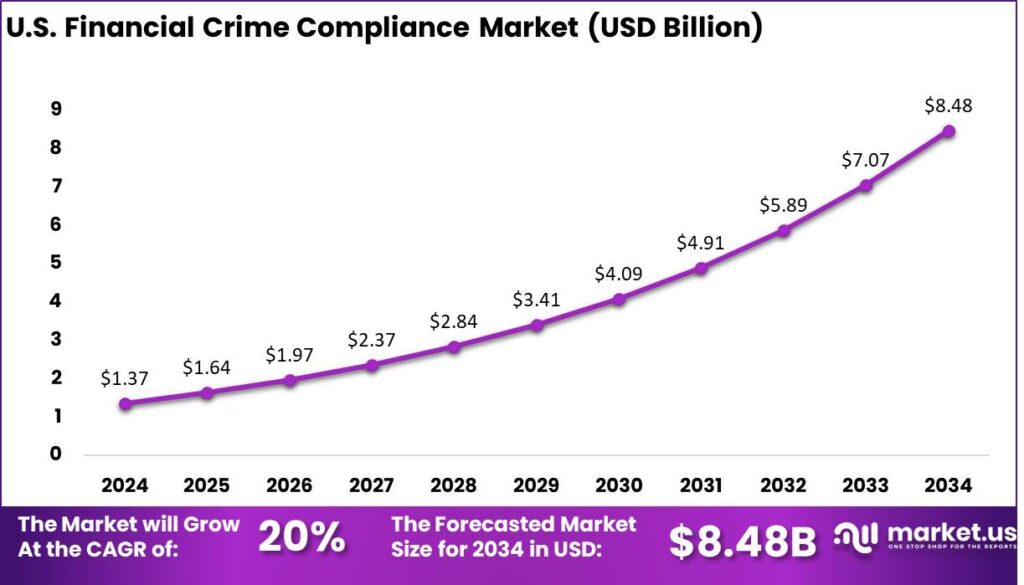

- The U.S. market for financial crime compliance was valued at approximately USD 1.37 billion in 2024 and is projected to see rapid growth, with a CAGR of 20.00%.

Impact Of AI

- Enhanced Detection of Suspicious Activities: AI technology helps financial institutions monitor transactions more effectively by analyzing patterns and flagging unusual behaviors. Machine learning algorithms can automatically detect anomalies that might go unnoticed by traditional methods, such as sudden large transfers or activities that don’t align with a user’s usual behavior.

- Real-Time Alerts and Faster Decision-Making: AI-powered tools can generate real-time alerts, enabling compliance teams to act quickly. This rapid response is crucial in preventing financial crimes like money laundering or fraud before they escalate. With AI, businesses can make faster and more informed decisions about whether a transaction is legitimate or suspicious.

- Improved Accuracy and Reduced Human Error: AI reduces the chances of human error by automating repetitive tasks such as transaction monitoring, data entry, and report generation. This improves the accuracy of compliance efforts and ensures that regulations are followed more strictly without the risk of overlooking critical details.

- Better Risk Assessment: AI can assess the risk level of various clients or transactions by analyzing past behaviors and other data points. This enables financial institutions to prioritize their efforts on higher-risk areas, ensuring that resources are allocated where they are needed most and making compliance more efficient.

- Cost-Effective Compliance Management: By automating many aspects of financial crime compliance, AI can significantly lower the costs associated with manual processes. Financial institutions no longer need to employ large teams for routine compliance tasks, freeing up resources for more strategic activities while ensuring they still meet regulatory standards.

U.S. Financial Crime Compliance Market

In 2024, the U.S. market for financial crime compliance was valued at approximately USD 1.37 billion, with projections indicating robust growth driven by the increasing need for stringent regulatory measures and enhanced security protocols. The market is anticipated to expand at a compound annual growth rate (CAGR) of 20.00%, reflecting the growing recognition of the importance of safeguarding financial systems from fraudulent activities, money laundering, and other illicit transactions.

The expansion of the financial crime compliance market is also fueled by increased regulatory scrutiny and the need for advanced compliance management solutions. Financial institutions and fintech firms are investing in AI-driven tools, automated transaction monitoring, and real-time reporting to detect and prevent financial crimes, meet evolving compliance requirements, and address emerging threats in the digital economy.

In 2024, North America emerged as the leading region in the financial crime compliance market, securing a substantial market share of over 36.5%, with total revenues surpassing USD 1.7 billion. The region’s extensive infrastructure, coupled with the increasing prevalence of cyber threats and financial fraud, has driven the demand for advanced compliance tools, positioning North America as a key player in the global market for financial crime compliance.

The market’s strong performance in North America is also supported by the stringent regulatory frameworks and enforcement measures imposed by both federal and state authorities. Key regulations such as the Bank Secrecy Act (BSA), the USA PATRIOT Act, and the Dodd-Frank Act have created a framework that mandates strict compliance for financial institutions, driving investments in compliance management systems. Moreover, North American financial institutions are increasingly adopting cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) to enhance fraud detection, risk management, and regulatory reporting processes.

Emerging Trends

- Increased Use of AI and Machine Learning: Financial institutions are increasingly adopting AI and machine learning technologies to enhance their financial crime compliance efforts. These technologies help detect suspicious patterns in transactions, reducing the reliance on manual reviews and improving accuracy in identifying fraud and money laundering. AI’s predictive capabilities enable real-time risk assessments, making compliance more proactive and less reactive.

- Regulatory Technology (RegTech) Adoption: RegTech, a technology-driven solution for managing regulatory processes, is gaining traction as financial institutions seek to comply with complex and ever-evolving regulations. These tools help streamline compliance tasks, automate reporting, and improve transparency in transactions. With growing regulatory scrutiny, RegTech ensures faster, more efficient compliance without increasing manual effort.

- Enhanced Focus on Customer Due Diligence (CDD): As global regulations tighten, financial institutions are placing more emphasis on Customer Due Diligence (CDD) to identify and verify the risk associated with customers. This includes a deeper investigation into customer backgrounds, transaction history, and geographical risk factors. Strengthening CDD practices helps financial institutions mitigate risks such as money laundering and terrorist financing.

- Collaboration Across Industries: Financial institutions are increasingly collaborating with other sectors, including technology firms, to strengthen their financial crime compliance frameworks. Sharing data across industries helps spot suspicious activities faster, improves detection, and reduces fraud. Partnerships between banks, regulators, and tech companies are also improving the speed and accuracy of compliance operations.

- Focus on Blockchain and Cryptocurrencies: With the rise of cryptocurrencies, there is a growing emphasis on integrating blockchain analytics into financial crime compliance practices. Financial institutions are using blockchain to track the movement of funds across borders, making it easier to trace illicit transactions linked to money laundering or terrorist financing. Increased regulation and monitoring of cryptocurrency exchanges are becoming central to ensuring financial crime compliance.

Top Use Cases

- Transaction Monitoring: Transaction monitoring is vital to identify suspicious activities in real-time, such as unusual transactions or patterns that may signal money laundering or fraud. By analyzing large volumes of transactions, financial institutions can detect anomalies and trigger alerts for further investigation. This process helps banks stay compliant with regulations and protect against financial crime.

- Know Your Customer (KYC): KYC processes ensure that financial institutions verify the identity of their customers to prevent fraudulent activities like identity theft and money laundering. By collecting personal information, financial institutions can assess potential risks associated with a client. Effective KYC procedures also help to build a secure customer base and foster trust.

- Sanctions Screening: Sanctions screening involves cross-checking customers and transactions against government lists to ensure compliance with financial regulations. Institutions need to identify if their clients are involved in illegal activities or sanctioned countries. This helps prevent institutions from unknowingly engaging in transactions that might breach international laws.

- Anti-Money Laundering (AML) Risk Assessment: AML risk assessments help financial institutions identify and mitigate potential risks related to money laundering activities. By analyzing customer data and transaction histories, banks can prioritize high-risk accounts and focus on them for deeper investigations. This proactive approach reduces the chance of being involved in illicit financial transactions.

- Fraud Detection: Fraud detection systems analyze customer behaviors and transaction trends to identify any fraudulent activity like unauthorized charges or account takeovers. By using machine learning and pattern recognition, these systems can spot fraud before it escalates. Timely detection minimizes the impact of fraud on both customers and institutions.

Major Challenges

- Evolving Regulatory Landscape: Financial institutions face increasing complexity due to constantly changing regulations. Keeping up with new rules, particularly when operating across multiple jurisdictions, can be overwhelming. Failure to stay compliant could lead to hefty fines or damage to reputation.

- Sophisticated Money Laundering Techniques: Criminals are using more advanced methods to hide illicit funds, making detection more difficult. Techniques like layering and using cryptocurrencies or shell companies to disguise transactions are common. This demands more robust and technologically advanced tools for monitoring suspicious activity.

- Increasing Volume of Transactions: With digital banking and mobile payments, the sheer volume of transactions has risen significantly, making it harder to spot irregularities. Banks need to filter through vast amounts of data, which can result in missed alerts or false positives. This puts added pressure on compliance teams to improve efficiency.

- Insufficient Skilled Workforce: Finding professionals who are well-versed in financial crime compliance is a major challenge. The increasing complexity of regulations and techniques makes it difficult to fill these roles, resulting in gaps in critical compliance functions. Without the right expertise, banks may struggle to maintain robust anti-crime systems.

- Balancing Security and Customer Experience :Institutions must ensure they’re preventing crime without making the customer experience cumbersome. Excessive checks and delays for customers can lead to dissatisfaction, but rushing the process can leave vulnerabilities for criminals to exploit. It’s a delicate balance that is tough to maintain.

Competitive Landscape

- Capgemini is a global leader in consulting, technology services, and digital transformation. In the financial crime compliance domain, Capgemini offers advanced solutions that use artificial intelligence (AI) and machine learning to help businesses automate and streamline their compliance processes. They provide a wide range of services, including fraud detection, anti-money laundering (AML) solutions, and compliance monitoring.

- LexisNexis Risk Solutions is a key player in the financial crime compliance market, offering powerful data analytics and risk management solutions. Their advanced technologies help businesses detect and mitigate risks related to financial crimes by analyzing large volumes of data. LexisNexis is known for its comprehensive risk management solutions, which include identity verification, AML screening, and fraud prevention.

- WNS (Holdings) Ltd. is a leading provider of business process management (BPM) services, with a significant focus on financial crime compliance. They offer end-to-end solutions for managing financial crime risks, including AML, fraud detection, and risk assessment. WNS excels at using data-driven insights to help financial institutions comply with regulatory frameworks and improve operational efficiency.

- Tookitaki Holding Pte. Ltd. is an emerging player in the financial crime compliance space, known for its AI-driven approach to financial crime detection. The company provides an advanced suite of tools that focus on AML, fraud prevention, and transaction monitoring. Tookitaki uses machine learning to continuously improve its systems, ensuring that businesses can stay ahead of evolving financial crime threats.

Market Opportunities for Key Players

- Expansion of Digital Finance & Cryptocurrencies: The rapid adoption of digital currencies and decentralized finance (DeFi) has opened new avenues for financial crime. This creates a pressing need for enhanced compliance solutions that can track and monitor digital transactions. Companies that can offer tools to detect illicit activities in the crypto space will likely see significant demand.

- Integration of AI & Machine Learning for Enhanced Detection: Financial crime is becoming more sophisticated, with criminals leveraging new techniques to evade detection. The integration of artificial intelligence (AI) and machine learning (ML) in compliance systems offers a major opportunity for companies. These technologies can analyze large volumes of data in real-time, enabling financial institutions to detect suspicious activities faster and more accurately.

- Regulatory Changes & Cross-Border Compliance : With governments and financial regulators introducing stricter laws to combat financial crime, particularly across borders, FCC firms are positioned to help organizations navigate these complexities. As more countries adopt similar regulatory frameworks, there is a significant opportunity for companies that can provide cross-border compliance solutions that streamline operations and reduce risk exposure.

- Financial Institutions’ Digital Transformation: As financial institutions continue their digital transformation, they are increasingly investing in technologies to protect against financial crime. Banks, insurance companies, and fintech firms are looking for robust compliance solutions to secure their operations. Financial crime compliance companies that offer tailored solutions for digital-first financial institutions will find ample growth opportunities.

- Focus on Financial Crime Prevention for SMEs: Traditionally, large banks and corporations have been the primary clients for compliance solutions. However, small and medium-sized enterprises (SMEs) are now facing growing pressure to meet compliance standards, especially as regulators increase their focus on smaller entities. Financial crime compliance companies that can offer affordable, scalable solutions for SMEs will tap into a largely underserved market.

Recent Developments

- In March 2024, Capgemini acquired the Financial Crime Compliance division of Exiger. This acquisition is intended to bolster Capgemini’s capabilities in regulatory compliance and financial crime services by integrating Exiger’s expertise in AML, KYC, and fraud prevention into its offerings

- In March 13, 2024,Genpact has been named a Leader in the Everest Group’s PEAK Matrix® Assessment for financial crime and compliance. This recognition highlights Genpact’s expertise in enhanced due diligence, fraud management, and its proprietary riskCanvas software suite, which leverages generative AI to automate compliance processes.

Conclusion

In conclusion, The Financial Crime Compliance (FCC) market is witnessing significant growth driven by increasing regulatory pressures, evolving financial crime risks, and the need for robust anti-money laundering (AML) and fraud prevention measures. As financial institutions adopt advanced technologies like artificial intelligence and machine learning, they enhance their ability to detect suspicious activities, automate compliance processes, and reduce operational risks. Moreover, regulatory bodies worldwide are tightening their standards, making it essential for firms to invest in more comprehensive and sophisticated compliance systems to safeguard against penalties and reputational damage.

The FCC market is positioned for continued expansion as financial institutions face mounting scrutiny and operational challenges in managing financial crime risks. With the rise of digital banking, cryptocurrency, and other financial innovations, the demand for advanced compliance solutions will grow. Companies that invest in cutting-edge technology and maintain a proactive approach to financial crime prevention will be better equipped to navigate an increasingly complex regulatory landscape, ensuring long-term success and sustainability.