Table of Contents

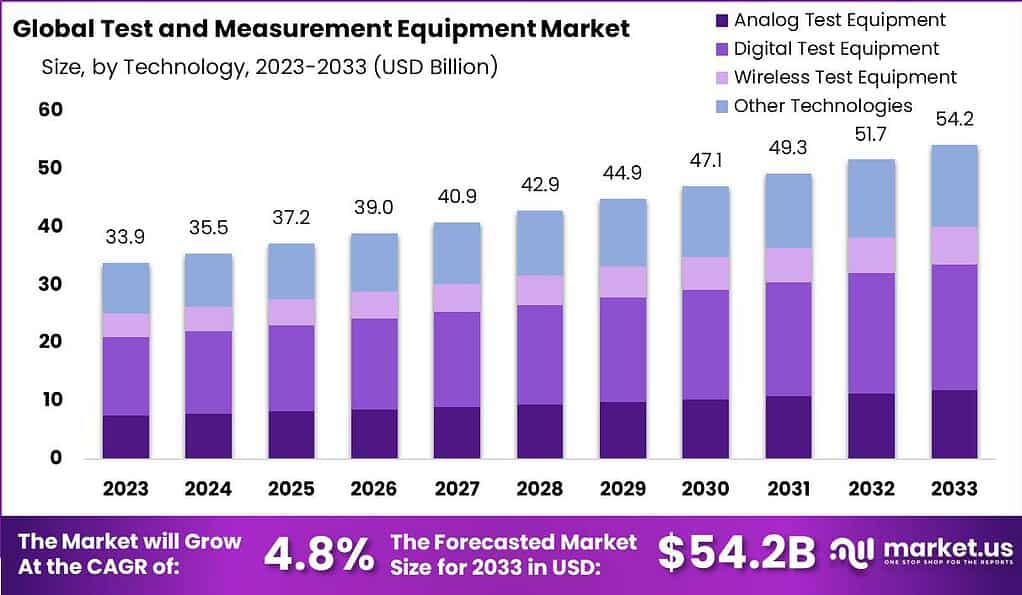

Based on data from Market.us, the global Test and Measurement Equipment Market is projected to reach approximately USD 54.2 billion by 2033, up from USD 33.9 billion in 2023. This growth represents a 4.8% CAGR from 2024 to 2033. The increasing demand for high-precision testing across industries like electronics, automotive, aerospace, and telecommunications is driving market expansion. With rapid advancements in 5G technology, IoT devices, and semiconductor testing, companies are investing more in accurate and reliable measurement tools to ensure performance and compliance with strict regulations.

The Test and Measurement Equipment Market is a critical component of various industries, including telecommunications, electronics manufacturing, automotive, and aerospace, among others. The demand in this market is primarily driven by the need for quality assurance, regulatory compliance, and the ongoing advancement in networking and communication technologies.

Significant factors propelling the growth of the test and measurement equipment market include the rising emphasis on electronics and electrical testing across various end-user industries and technological advancements in wireless communications and connectivity. Furthermore, the integration of connected devices and the expansion of network infrastructures globally have bolstered the need for effective TME to ensure high performance and operational efficiency.

The market is experiencing robust demand driven by developments in sectors such as automotive, healthcare, and consumer electronics, where precision, safety, and quality are paramount. Additionally, the increasing deployment of IoT technology and smart devices has surged the demand for testing solutions that ensure devices perform reliably in varied environments.

There are substantial opportunities in the automation of test processes, development of more integrated systems, and expansion into emerging markets where industries are just beginning to adopt advanced testing methodologies. Additionally, the growing focus on renewable energy sources and the evolving automotive sector toward electric vehicles are creating new avenues for the application of testing equipment.

Technological innovations are continually shaping the TME landscape. Advances such as the development of modular instrumentation, increased use of software-defined testing, and remote testing capabilities are enhancing the flexibility and efficiency of test processes. Moreover, the integration of AI and machine learning technologies is beginning to transform how testing is conducted, leading to smarter, faster, and more accurate testing solutions.

Key Takeaways

- The Test and Measurement Equipment market is expected to grow steadily, reaching USD 54.2 billion by 2033, driven by increasing demand across various industries. The market is set to expand at a CAGR of 4.8% from 2024 to 2033, fueled by advancements in digital technology and rising automation in industrial processes.

- Oscilloscopes hold a strong position, accounting for over 21% of the market in 2023. Their critical role in electronic device development, maintenance, and troubleshooting makes them indispensable across industries.

- The increasing adoption of digital systems has propelled Digital Test Equipment to dominate the market with over 40% share. Its accuracy and repeatability are crucial for modern electronics and communication systems.

- The Manufacturing & Installation segment leads with more than 30% share. This dominance is due to the need for precise testing during production to ensure product reliability, efficiency, and safety.

- Large enterprises controlled over 65% of the market in 2023, benefiting from vast resources, robust R&D investments, and strong global networks. Their ability to scale and innovate keeps them ahead of the competition.

- Direct Sales led the market with a 38% share, as manufacturers prefer to maintain direct relationships with customers. This approach allows for better after-sales support and higher customer satisfaction.

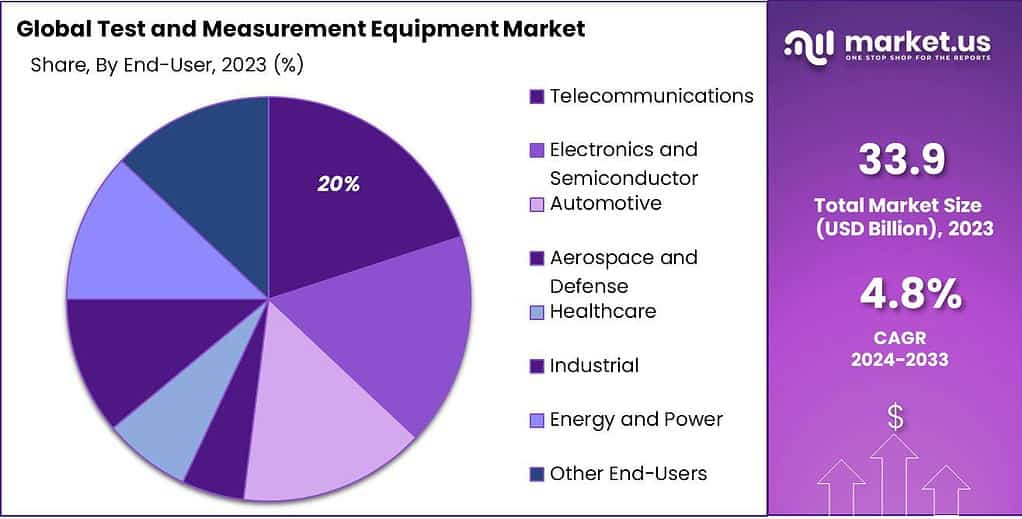

- The Electronics & Semiconductor sector accounted for over 20% of the market. The continuous evolution of consumer electronics and high production volumes are driving the demand for advanced testing solutions.

- The Asia-Pacific region led the market with over 36% share in 2023. The region’s booming electronics manufacturing industry, coupled with growing investments in R&D, is fueling this dominance.

Report Segmentation

Product Type Analysis

In 2023, the test and measurement equipment market saw significant developments across various segments, reflecting trends driven by advances in technology and changing market demands. The Oscilloscopes segment, critical for its precision in visualizing electronic signals, commanded a leading position by capturing over 21% of the market. This dominance indicates the segment’s essential role in applications requiring detailed electronic signal analysis.

Technology Analysis

Further emphasizing the shift towards modernization, the Digital Test Equipment segment secured a dominant stance, holding more than 40% of the market. This substantial share underscores the growing reliance on digital solutions within the test and measurement landscape, catering to increasingly complex electronic environments.

Application Analysis

Manufacturing and installation applications, which often require robust and accurate testing to ensure quality and safety, also led the application segments with more than 30% market share. This reflects the sector’s critical need for precision equipment in both production and field settings.

Organization Size Analysis

In terms of organizational adoption, large enterprises showed a strong preference for high-quality, scalable testing solutions, accounting for over 65% of the market. This trend highlights the importance of advanced test and measurement tools in maintaining operational excellence in larger scale operations.

Sales Channel Analysis

The sales channel analysis revealed that direct sales were the most preferred route, making up more than 38% of the market. This preference indicates that customers value direct interactions for purchasing technical and high-value equipment, likely due to the need for customized solutions and technical support.

End-User Analysis

Lastly, the Electronics and Semiconductor segment emerged as a significant end-user, holding over 20% of the market. The demand in this segment is driven by the continuous need for miniaturization and integration of electronic components, which require precise and reliable testing methodologies.

Driver

Integration of Emerging Technologies

The integration of emerging technologies such as the Internet of Things (IoT), 5G, and Artificial Intelligence (AI) serves as a significant driver for the Test and Measurement Equipment (TME) market. As industries adopt these advanced technologies, the complexity and requirements for testing also escalate.

For example, 5G technology demands precise and rigorous testing of its network equipment and devices to ensure optimal performance and compliance with international standards. Similarly, IoT devices, which are becoming ubiquitous across various sectors including automotive, healthcare, and consumer electronics, require robust testing to ensure they function seamlessly within interconnected environments.

The demand for TME in these high-tech fields is not merely about compliance but also about ensuring reliability, efficiency, and safety of the technologies deployed. As these technologies evolve, the TME market is expected to grow, driven by the need for more sophisticated testing solutions that can handle higher frequencies, more complex data inputs, and increased automation of testing processes.

Restraint

High Cost of Advanced Testing Equipment

One significant restraint in the TME market is the high cost associated with advanced testing equipment. The development and manufacturing of high-precision instruments that can meet the testing demands of modern technologies are inherently expensive. These costs are often passed down to the end-users, making it challenging for small and medium-sized enterprises (SMEs) to afford such advanced equipment.

Additionally, the rapid pace of technological innovation means equipment can quickly become obsolete, necessitating further investment in newer technologies. This financial burden can limit the accessibility of advanced TME for all but the largest corporations or those with substantial investment capabilities.

Opportunity

Expansion into Emerging Markets

Emerging markets present significant opportunities for the TME industry. Countries like China, India, and Brazil are rapidly industrializing and investing heavily in infrastructure, telecommunications, and manufacturing sectors. This development escalates the demand for reliable and efficient test and measurement equipment to ensure the quality and safety of newly developed infrastructures and technologies.

Furthermore, as these economies grow, local companies are also beginning to invest in research and development, further expanding the market for TME. The potential for growth in these regions is enhanced by the increasing adoption of advanced technologies requiring sophisticated testing solutions.

Challenge

Evolving Industry Standards

A major challenge in the TME market is keeping pace with continuously evolving industry standards. As new technologies like 5G and autonomous vehicles are developed, industry standards that govern their safety, efficiency, and reliability also evolve. For TME manufacturers, this means a constant need to adapt and update their products to comply with new regulations and standards.

Staying ahead of these changes requires ongoing research and development efforts, which can be resource-intensive. Additionally, the global nature of technology markets means that TME manufacturers must ensure their products meet the standards of multiple countries, which can vary significantly.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 33.9 Bn |

| Forecast Revenue (2033) | USD 54.2 Bn |

| CAGR (2024-2033) | 4.8% |

| Base Year for Estimation | 2023 |

| Historic Period | 2018-2022 |

| Forecast Period | 2024-2033 |

Key Market Segments

Product Type

- Oscilloscopes

- Spectrum Analyzers

- Multimeters

- Signal Generators

- Network Analyzers

- Power Meters

- Electronic Counters

- Other Product Types

By Technology

- Analog Test Equipment

- Digital Test Equipment

- Wireless Test Equipment

- Other Technologies

By Application

- Research and Development

- Manufacturing and Installation

- Maintenance and Service

- Quality Control and Assurance

- Other Applications

Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Sales Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retail

- Other Sales Channels

End-User

- Telecommunications

- Electronics and Semiconductor

- Automotive

- Aerospace and Defense

- Healthcare

- Industrial

- Energy and Power

- Other End-Users

Top Market Leaders

- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & Co. KG

- Tektronix Inc.

- Anritsu Corporation

- National Instruments Corporation

- Fluke Corporation

- Advantest Corporation

- EXFO Inc.

- Viavi Solutions Inc.

- Yokogawa Electric Corporation

- TestEquity LLC

- GW Instek

- Other Key Players