Table of Contents

Report Overview

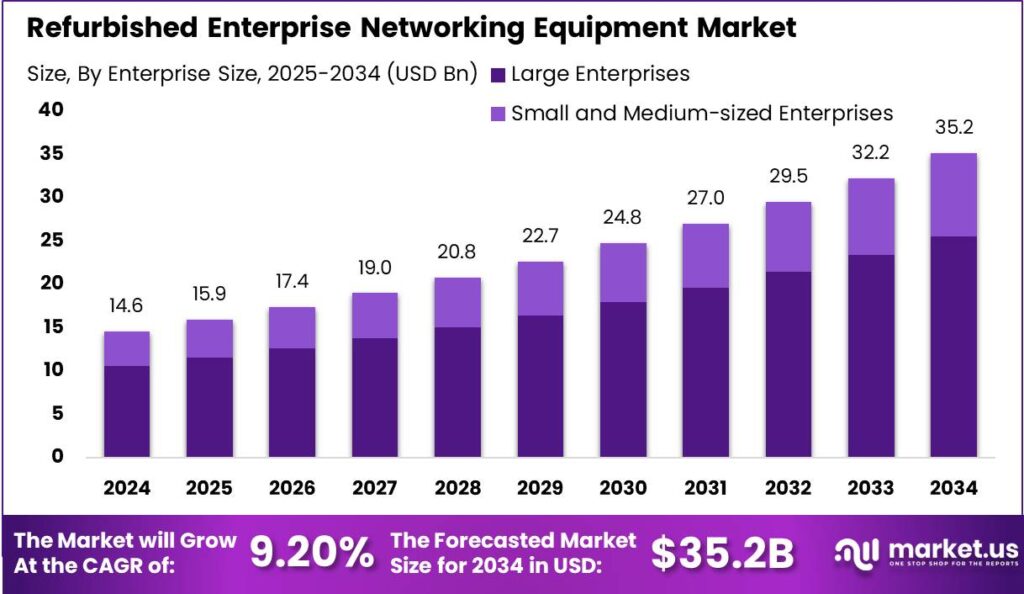

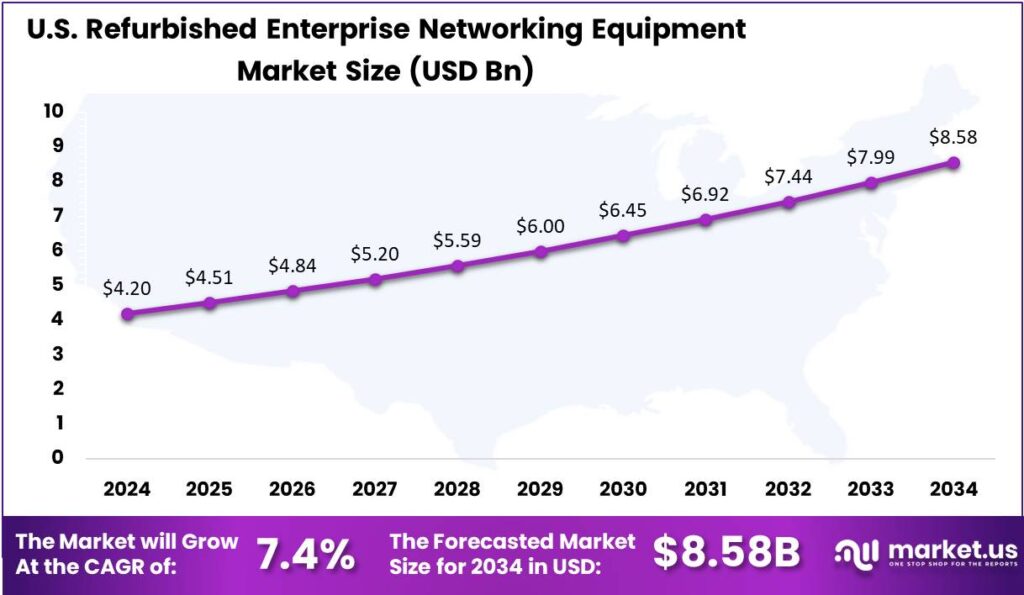

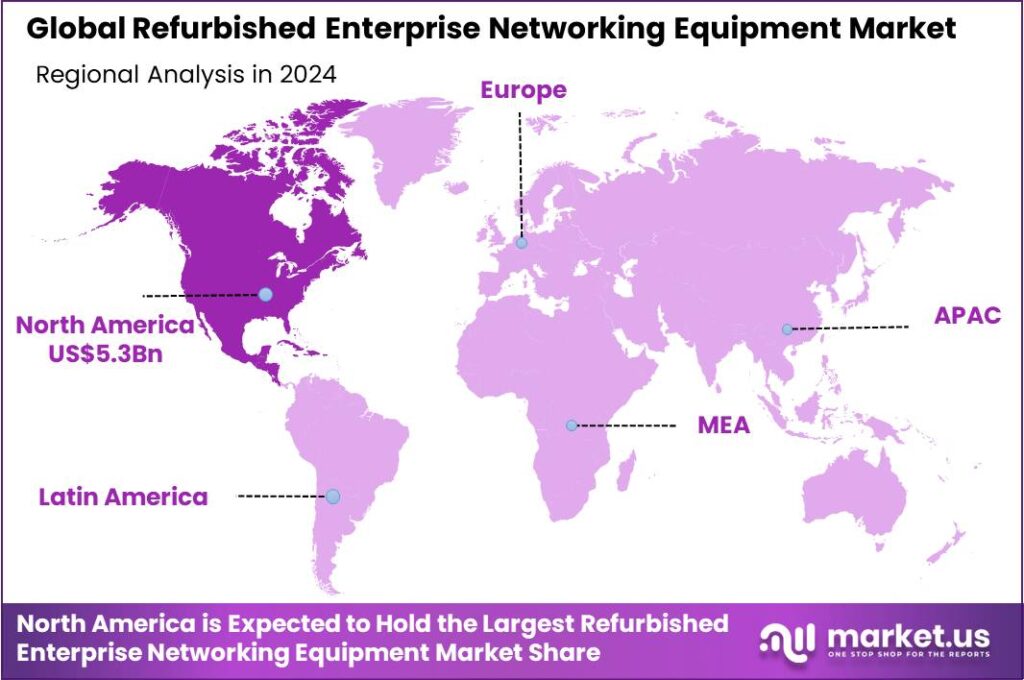

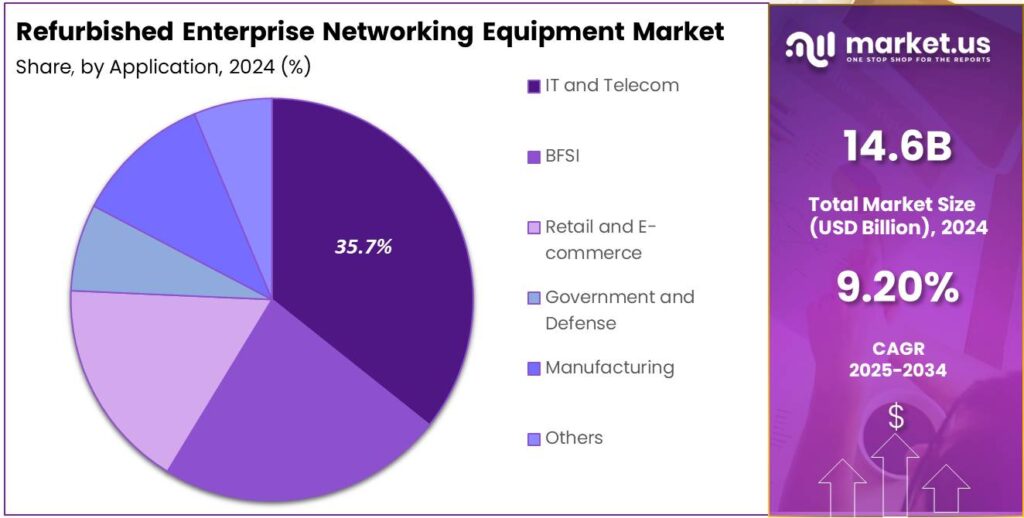

According to the research conducted by Market.us, the Global Refurbished Enterprise Networking Equipment Market is projected to reach USD 35.2 billion by 2034, up from USD 14.6 billion in 2024, growing at a CAGR of 9.2%. North America led the market in 2024, accounting for 36.7% of the share and generating approximately USD 5.3 billion, with the U.S. alone valued at USD 4.2 billion and expected to grow at 7.4% CAGR.

The growth in the market for refurbished enterprise networking equipment is primarily driven by the increasing need for cost-effective network solutions among small and medium-sized enterprises (SMEs). As businesses aim to enhance their tech capabilities, the high cost of new networking equipment is a barrier. Refurbished equipment provides a cost-effective alternative and supports sustainability efforts by reducing electronic waste, aligning with green IT policies.

One notable trend in the refurbished networking equipment market is the increasing integration of advanced technologies such as artificial intelligence (AI) and the Internet of Things (IoT). These technologies boost networking hardware capabilities, offering better management and security, especially in refurbished models. Additionally, the rise of vendor certification programs ensures refurbished equipment meets quality and performance standards, increasing trust and reliability for buyers.

The market presents several key opportunities, particularly in developing regions where the demand for affordable networking solutions is growing rapidly. Businesses in these regions can leverage refurbished equipment to build robust IT infrastructures at a lower initial investment. Another opportunity lies in partnerships between original equipment manufacturers (OEMs) and refurbishing companies to officially endorse and support refurbished products, thus enhancing customer confidence and expanding the market reach.

While there are significant benefits, there are also risks involved in purchasing refurbished networking equipment. The primary concern is the potential for shorter lifespans and higher maintenance costs compared to new equipment. There may also be issues with compatibility and lack of support for older hardware. Buyers need to be cautious and select reputable suppliers who offer warranties and support to mitigate these risks.

The market for refurbished enterprise networking equipment is set to expand as awareness of its benefits grows. Efforts to educate businesses about the economic and environmental advantages of refurbished equipment can drive market expansion. Additionally, the development of global standards for the refurbishing process could further boost consumer confidence and help the market grow.

Key Takeaways

- The Global Refurbished Enterprise Networking Equipment Market is projected to reach USD 35.2 Billion by 2034, growing from USD 14.6 Billion in 2024, with a CAGR of 9.20% from 2025 to 2034.

- In 2024, the routers segment dominated the market, holding over 30.7% of the market share.

- Large Enterprises captured the largest share in 2024, making up more than 72.7% of the market.

- The IT & Telecom segment led the industry in 2024, accounting for 35.7% of the total market share.

- North America held the largest market share in 2024, with 36.7%, generating USD 5.3 billion in revenue.

- The United States contributed USD 4.2 billion to the market in 2024 and is expected to grow at a CAGR of 7.4%.

U.S. Market Growth

In 2024, the United States market for refurbished enterprise networking equipment was estimated to have a value of USD 4.2 billion. It is forecasted to grow at a compound annual growth rate (CAGR) of 7.4%.

The growth in the market can be attributed to several factors, including the increasing demand for cost-effective networking solutions among small and medium-sized enterprises (SMEs). As companies seek to optimize their IT budgets, refurbished equipment offers a viable alternative that reduces expenditure while still providing the necessary technological capabilities. Additionally, the push towards sustainable practices in IT operations is driving the adoption of refurbished networking gear, which aligns with corporate sustainability goals by reducing electronic waste.

In 2024, North America maintained a dominant position in the refurbished enterprise networking equipment sector, securing over 36.7% of the market share. The region generated revenues estimated at approximately USD 5.3 billion.

This substantial market share can be attributed to a robust technological infrastructure and a high adoption rate of cost-efficient solutions by businesses across various sectors. North American companies, particularly those in the United States and Canada, are increasingly recognizing the value of refurbished networking equipment as a means to reduce IT expenses while maintaining high operational standards. The presence of established refurbishing firms in the region, alongside stringent quality control standards, ensures that businesses have access to reliable and high-performance equipment.

Market Segmentation

Type Analysis

In 2024, the routers segment played a pivotal role in the refurbished enterprise networking equipment market, securing more than 30.7% of the total market share. Routers are integral to enterprise networks, enabling efficient data traffic management and connectivity. As businesses continue to prioritize cost-effective solutions, refurbished routers have become increasingly popular, providing enterprises with the opportunity to access high-quality equipment at a fraction of the cost of new models.

Enterprise Size Analysis

The large enterprises segment dominated the refurbished enterprise networking equipment market in 2024, commanding over 72.7% of the market share. Large enterprises typically require robust and scalable networking solutions to support their expansive operations and high data traffic demands. These organizations often invest in refurbished networking equipment as a means of reducing capital expenditures without sacrificing performance or reliability.

Application Analysis

The IT & Telecom sector emerged as the leader in the refurbished enterprise networking equipment industry in 2024, holding more than 35.7% of the market share. This sector’s dominance can be attributed to the ever-increasing need for reliable and cost-efficient networking equipment that supports large-scale communication infrastructure. Companies in the IT & Telecom industry face constant technological advancements and upgrades, making refurbished networking equipment a practical solution to keep operations running smoothly without excessive capital expenditure.

Emerging Trends

- Access to High-Quality Equipment at Reduced Costs: Enterprises can acquire top-tier networking devices, such as routers and switches, at substantially lower prices compared to new models. This affordability enables the deployment of robust network solutions within constrained budgets.

- Alignment with Circular Economy Practices: The refurbished equipment market supports circular economy principles by promoting the reuse and recycling of technology resources. This approach not only conserves materials but also fosters sustainable business practices across the industry.

- Immediate Availability Amid Supply Chain Constraints: Refurbished equipment offers a viable alternative amid global supply chain disruptions, providing organizations with immediate access to necessary networking hardware. This ensures continuity in operations without delays associated with new equipment procurement.

- Enhanced Performance through Rigorous Testing: Advancements in refurbishment processes ensure that pre-owned equipment undergoes comprehensive testing and updates, resulting in performance levels comparable to new devices. This reliability makes refurbished options attractive for critical enterprise applications.

Top Use Cases

- Cost-Effective Network Expansion: Organizations can broaden their network infrastructure affordably by integrating refurbished equipment, achieving desired performance without overspending.

- Support for Legacy Systems: Refurbished devices are invaluable for maintaining and expanding older networks, ensuring compatibility and prolonging the life of existing systems.

- Immediate Availability: Unlike new equipment that may have long lead times, refurbished gear is often readily available, allowing for swift deployment to meet urgent networking needs.

- Environmental Sustainability: Utilizing refurbished equipment reduces electronic waste, contributing to eco-friendly practices by promoting the reuse of functional hardware.

- Enhanced Reliability: Refurbished equipment undergoes rigorous testing and refurbishment processes, ensuring reliable performance comparable to new devices.

Major Challenges

- Quality Assurance: Ensuring consistent quality in refurbished equipment can be difficult. Without proper refurbishment processes, equipment may not meet performance expectations, leading to potential network issues.

- Warranty and Support Limitations: Refurbished equipment often lacks manufacturer warranties and official support. This absence can result in higher maintenance costs and limited access to critical updates or technical assistance.

- Licensing Complications: Software licenses are typically non-transferable, making it challenging to obtain necessary licenses for refurbished equipment. This limitation can hinder functionality and compliance.

- Compatibility Issues: Integrating refurbished equipment with existing or newer systems may lead to compatibility problems. These issues can disrupt network performance and require additional resources to resolve.

- Perception and Trust: Customers often associate refurbished equipment with lower quality, affecting trust and satisfaction. Overcoming this perception requires transparency about the refurbishment process and assurance of reliability.

Market Opportunities for Key Players

- Sustainability Initiatives: As businesses increasingly adopt eco-friendly IT solutions, the demand for refurbished network equipment is growing. Companies can capitalize on this trend by offering products that help businesses meet their sustainability goals and reduce e-waste.

- Technological Advancements: While rapid technological changes present a challenge, they also create opportunities for refurbished equipment providers to innovate. Offering up-to-date technologies such as 5G and edge computing in refurbished models can meet customer demands for modern capabilities at a reduced cost.

- Cost-Effective Solutions for SMEs: Small and medium-sized enterprises (SMEs) are particularly attracted to refurbished networking equipment due to the significant cost savings it offers. This segment provides a robust market opportunity, especially as SMEs look to expand their network infrastructure affordably.

- Global Market Expansion: The global market for refurbished networking equipment is expanding, with significant growth opportunities in regions like North America and Asia Pacific. Companies can leverage these opportunities by enhancing their distribution networks and tailoring their offerings to meet regional demands.

- Support for Legacy Systems: Many businesses continue to rely on legacy systems that may not be compatible with newer technologies. Refurbished network equipment can serve this niche market by providing compatible equipment that supports these older systems, thereby extending their operational life and securing a customer base in industries resistant to frequent upgrades.

Report Scope

| Report Features | Description |

| Market Value (2024) | USD 14.6 Bn |

| Forecast Revenue (2034) | USD 35.2 Bn |

| CAGR (2025-2034) | 9.20% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Conclusion

In summary, the refurbished enterprise networking equipment market has seen significant growth, driven by the increasing demand for cost-effective, reliable, and sustainable solutions. Businesses are increasingly turning to refurbished equipment as a viable alternative to new hardware, especially with the rapid advancements in technology that often render equipment obsolete quickly. This shift is further fueled by the focus on reducing electronic waste and the rising preference for environmentally conscious purchasing decisions.

The market is expected to continue expanding as companies look to optimize their budgets while maintaining high performance in their IT infrastructure. However, ensuring the quality, reliability, and proper certification of refurbished equipment remains a key challenge for the industry. As long as these concerns are addressed, the refurbished networking equipment market is poised for continued success in the coming years.