Table of Contents

Report Overview

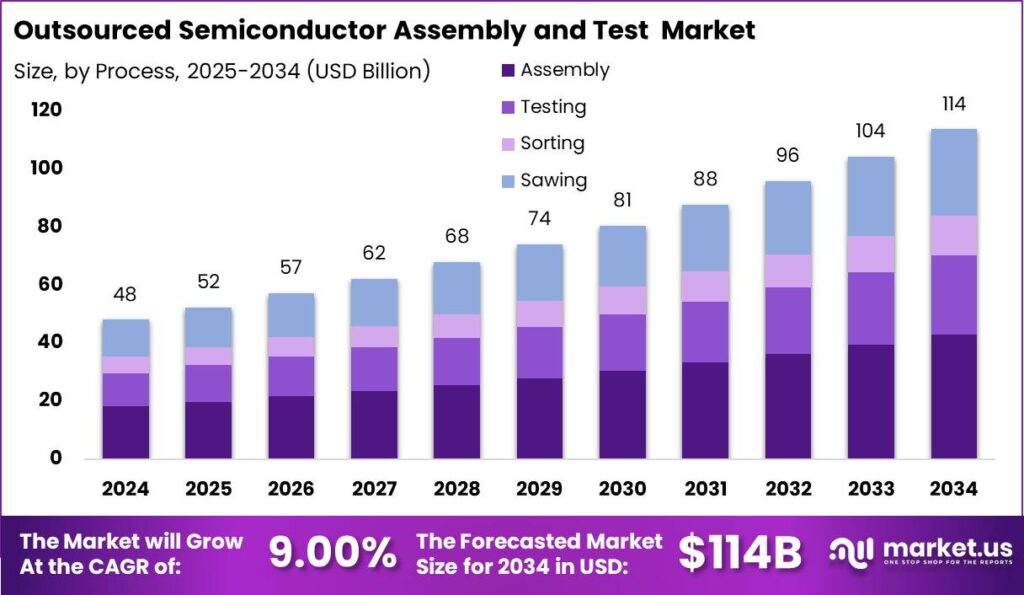

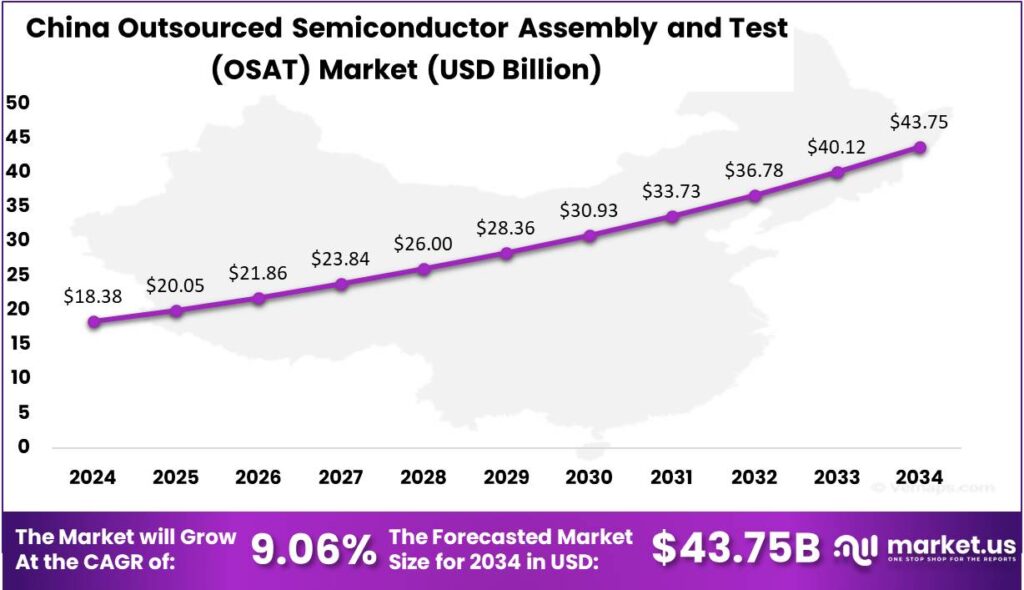

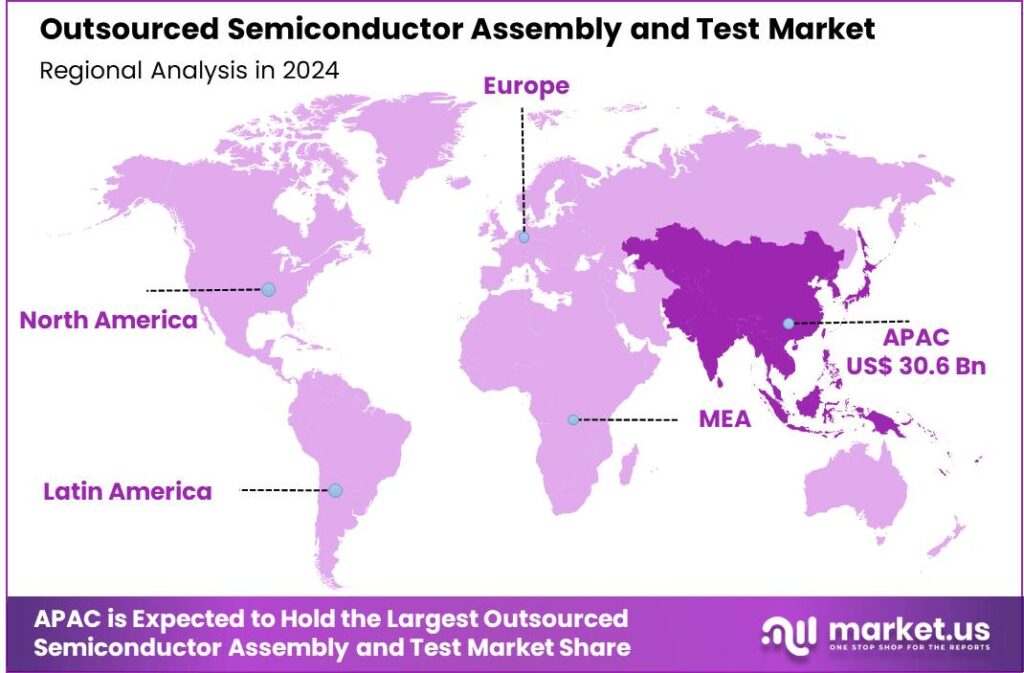

The Global Outsourced Semiconductor Assembly and Test (OSAT) Market is set to reach an impressive USD 114 billion by 2034, up from USD 48.1 billion in 2024. This growth is projected at a robust CAGR of 9.00% between 2025 and 2034. In 2024, the Asia-Pacific region led the OSAT market, holding a dominant share of 63.7%, generating revenue of USD 30.6 billion. China’s OSAT sector, valued at USD 18.38 billion, is expected to grow at an annual rate of 9.06%.

Continuous innovation in semiconductor technology, including developments in 3D packaging and System-on-Chip (SoC) designs, drives the need for sophisticated OSAT services. As devices become smaller and more complex, the expertise of OSAT providers becomes indispensable in handling these advanced products. Outsourcing non-core activities allows chip manufacturers to concentrate on research and development. This strategic focus is crucial in a highly competitive market where technological leadership can determine market success.

Emerging trends in the OSAT sector include the integration of Artificial Intelligence (AI) to enhance testing and packaging precision, using machine learning to detect defects and improve yield rates. Additionally, there is a shift towards environmental sustainability, with a focus on reducing waste and adopting energy-efficient technologies to align with global sustainability goals.

The OSAT market is expanding geographically and in service scope. Emerging markets in Asia, particularly Southeast Asia, are witnessing rapid growth due to the region’s favorable manufacturing policies and growing local demand for electronic products. Additionally, the expansion of services to include design and prototype support is creating new opportunities for OSAT providers to deliver more comprehensive solutions to their clients.

Key Takeaways

- The Global OSAT Market is set to reach USD 114 billion by 2034, growing from USD 48.1 billion in 2024, with a CAGR of 9.00% from 2025 to 2034.

- In 2024, the Assembly segment dominated the market, capturing over 37.8% of the share.

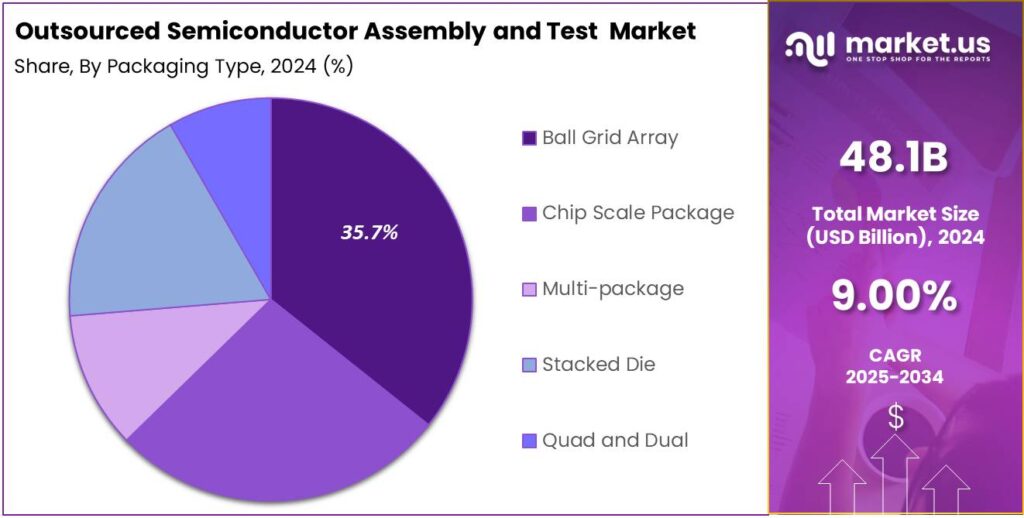

- The Ball Grid Array (BGA) segment led the OSAT market in 2024, holding 35.7% of the market share.

- The Consumer Electronics segment was the top contributor to the OSAT market in 2024, securing more than 41.5% of the market share.

- The Asia-Pacific region held a strong lead in the OSAT market in 2024, commanding more than 63.7% of the global share, with USD 30.6 billion in revenues.

- In China, the OSAT market was valued at USD 18.38 billion in 2024, with a projected CAGR of 9.06%.

Analyst’s Viewpoint

The OSAT market is well-positioned to capitalize on significant growth opportunities, particularly from the automotive and electric vehicle sectors. As industries innovate with advanced electronic systems for enhanced connectivity, safety, and efficiency, the demand for sophisticated semiconductor assembly and testing services is expected to grow. This trend is amplified by the rise of 5G technology and the Internet of Things (IoT), driving a surge in electronic devices and creating a strong demand for OSAT services.

One of the major challenges facing the OSAT market is the supply chain vulnerability. The global nature of semiconductor production involves complex logistics that are susceptible to disruptions from geopolitical tensions, trade policies, and global health crises, impacting the delivery of necessary components and materials. Another significant challenge is the shortage of skilled labor.

Technological advancements are a pivotal area of development within the OSAT market. Companies are increasingly investing in new packaging technologies such as System-in-Package (SiP) and 3D packaging to meet the needs for miniaturization and enhanced performance of semiconductor devices.These innovations enable denser chip packaging, essential for modern applications like smart devices and high-performance computing platforms.

China Market Overview

In 2024, the Chinese market for Outsourced Semiconductor Assembly and Test (OSAT) was estimated to be worth USD 18.38 billion. It is forecasted to expand at a compound annual growth rate (CAGR) of 9.06%. The growth of the OSAT market in China can be attributed to several key factors. Increased demand for semiconductor devices across various sectors, including consumer electronics, automotive, and telecommunications, drives this expansion. The trend toward miniaturization and integration of electronic components drives the demand for advanced assembly and testing services, essential to the semiconductor manufacturing process.

In 2024, the Asia-Pacific region secured a dominant position in the Outsourced Semiconductor Assembly and Test (OSAT) market, accounting for over 63.7% of the global market share with revenues totaling USD 30.6 billion. Asia-Pacific holds a significant market share due to its strong semiconductor manufacturing, major industry players, and advanced infrastructure. Countries like China, Taiwan, South Korea, and Japan provide skilled labor and technological expertise, boosting high-volume production and cost-effective, sophisticated OSAT services.

The focus on expanding technological capabilities and increasing R&D investments by governments and private firms in Asia-Pacific supports the OSAT market’s growth. These efforts ensure the region’s leadership in the global OSAT industry, meeting the rising demand for complex semiconductor solutions in areas like 5G, AI, and IoT.

You May Also Like To Read

- Edge AI ICs Market

- Voice Directed Warehousing Solutions Market

- Synthetic Data Generation Market

- Machine Learning in Supply Chain Management Market

Market Segmentation

Process Analysis

In 2024, the Assembly segment of the Outsourced Semiconductor Assembly and Test (OSAT) market held a dominant position, capturing over 37.8% of the market share. This dominance can be attributed to the increasing demand for semiconductor assembly services across various industries. As semiconductor technology evolves, the need for advanced packaging and testing solutions has surged, leading to a higher reliance on OSAT providers for efficient and cost-effective assembly processes.

Packaging Type Analysis

The Ball Grid Array (BGA) segment also held a significant share of over 35.7% in the OSAT market in 2024. BGA packaging is highly valued for its ability to support high-performance components in modern electronics. As demand for compact, powerful devices rises, BGA technology plays a key role. Its benefits, like better thermal management, electrical performance, and smaller footprint, make it essential in consumer electronics, automotive, and communications.

Application Analysis

In 2024, the Consumer Electronics segment was the leading sector in the OSAT market, capturing more than 41.5% of the overall market share. The surge in demand for advanced consumer electronics, such as smartphones, wearables, and smart home devices, drove this dominance. As devices become more advanced, their semiconductor components require complex assembly and testing. The OSAT industry ensures device performance and reliability, focusing on miniaturization and efficiency.

Key Market Segments

By Process

- Sawing

- Sorting

- Testing

- Assembly

By Packaging Type

- Ball Grid Array

- Chip Scale Package

- Multi-package

- Stacked Die

- Quad and Dual

By Application

- Automotive

- Consumer Electronics

- Industrial

- Telecommunication

- Aerospace and Defense

- Medical and Healthcare

- Logistics and Transportation

- Others

Emerging Trends

- Advanced Packaging Technologies: OSAT providers are increasingly adopting advanced packaging methods like System-in-Package (SiP) and 3D packaging. These techniques integrate multiple functionalities into a single chip, enhancing performance while reducing size.

- Automation and Efficiency: To counter rising labor costs, OSAT companies are implementing automation, including robotics and artificial intelligence, to streamline assembly and testing processes. This shift reduces human error and accelerates production.

- Sustainability Initiatives: There’s a growing emphasis on environmental sustainability within the OSAT sector. Companies are adopting energy-efficient technologies and waste reduction practices to meet regulatory standards and enhance their corporate image.

- Geographical Diversification: Traditionally concentrated in Asia, OSAT services are expanding to regions like North America and Europe. This geographical shift aims to strengthen supply chain resilience amid changing geopolitical landscapes.

- Automotive Semiconductor Growth: The rise of autonomous vehicles and advanced driver-assistance systems (ADAS) has led to increased demand for automotive semiconductors. OSAT providers are scaling up to meet the specific requirements of this burgeoning market.

Top Use Cases

- Consumer Electronics: OSAT providers assemble and test integrated circuits (ICs) used in devices like smartphones, tablets, and wearables, ensuring high performance and reliability.

- Automotive Electronics: In vehicles, advanced driver-assistance systems (ADAS) and electric powertrains rely on semiconductors. OSAT services ensure these components meet stringent quality and safety standards.

- Telecommunications: For 5G infrastructure and networking equipment, OSAT providers handle the packaging and testing of high-frequency semiconductor devices, supporting faster data transmission.

- Industrial Applications: Semiconductors used in industrial automation and control systems are assembled and tested by OSAT companies to withstand harsh operating conditions.

- Computing and Networking: OSAT services are vital for packaging and testing processors and memory chips used in servers and data centers, ensuring efficient data processing and storage.

Major Challenges

- Rising R&D Costs and Margin Pressures: Developing advanced packaging technologies demands substantial investment in research and development. This escalation in costs, coupled with competitive pricing pressures, has led to reduced profit margins for OSAT companies.

- Talent Development: Building a skilled workforce to support rapid growth poses a significant challenge. Countries like Vietnam are investing in training programs to develop semiconductor engineers, aiming to train 50,000 by 2030.

- Technological Complexity and Integration: The shift towards heterogeneous integration and chiplet architectures requires OSAT providers to manage increased technological complexity. Integrating multiple dies into a single package necessitates advanced packaging solutions and poses challenges in maintaining performance and yield.

- Automation and Efficiency Enhancements: To remain competitive, OSAT companies must adopt automation and process efficiencies. Implementing technologies like IoT solutions for real-time data analytics can enhance production monitoring and maintenance, but integrating these systems presents challenges.

- Supply Chain Complexity: The reliance on offshore OSAT facilities introduces security concerns in the advanced packaging supply chain. Ensuring a secure and efficient semiconductor supply chain requires addressing potential bottlenecks and vulnerabilities in the current ecosystem.

Market Opportunities for Key Players

- Increased Demand in Automotive Applications: The automotive sector’s shift towards more electronic and autonomous systems, including advanced driver-assistance systems (ADAS) and electric vehicles (EVs), is significantly increasing the demand for semiconductors. OSAT companies can capitalize on this trend by providing specialized packaging and testing services that are crucial for the performance and reliability of automotive semiconductors.

- Growth of 5G Technology: The rollout of 5G networks and the associated technologies require advanced semiconductor devices that can handle higher frequencies and increased data rates. OSAT companies are crucial in developing and testing these next-generation chips, making this a key area for growth.

- Expansion in Consumer Electronics: As consumer electronics continue to advance in sophistication, the need for high-performance semiconductors grows. OSAT companies play a vital role in meeting this demand through their services in packaging and testing, particularly as devices become smaller and require more complex assembly solutions.

- Advancements in Semiconductor Packaging Technologies: The semiconductor industry is moving towards more sophisticated packaging solutions like 3D packaging, chip-scale packaging, and multi-chip packaging. These technologies improve semiconductor performance by enabling more components in smaller spaces. OSAT companies lead these innovations, offering critical services for advanced packaging adoption.

- Strategic Expansion in the Asia-Pacific Region: The Asia-Pacific region remains a key growth area for the OSAT market, driven by the strong semiconductor manufacturing capabilities of countries like Taiwan, South Korea, and China. The region’s large consumer base and expanding telecommunications infrastructure make it an attractive market for OSAT companies looking to expand their operations and increase their market share.

Report Scope

| Report Features | Description |

| Market Value (2024) | USD 48.1 Bn |

| Forecast Revenue (2034) | USD 114 Bn |

| CAGR (2025-2034) | 9.00% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Conclusion

In summary, the Outsourced Semiconductor Assembly and Test (OSAT) market has seen substantial growth driven by the increasing demand for advanced semiconductor packaging, particularly in consumer electronics, automotive, and communication sectors. As semiconductor companies increasingly focus on core competencies such as design and research, outsourcing assembly and testing services to OSAT providers offers cost-effective and efficient solutions. This trend is expected to continue, with OSAT companies innovating in technologies like system-in-package (SiP) and wafer-level packaging (WLP) to meet evolving industry needs.

Furthermore, the market’s expansion is being fueled by the growing complexity of semiconductor components and the shift toward smaller, more powerful devices. Geographically, Asia-Pacific remains the dominant region for OSAT services due to the concentration of semiconductor manufacturing in countries like China, Taiwan, and South Korea. As demand for high-performance semiconductors rises, OSAT companies will continue to play a pivotal role in ensuring the reliable testing and packaging of these critical components.