Table of Contents

Report Overview

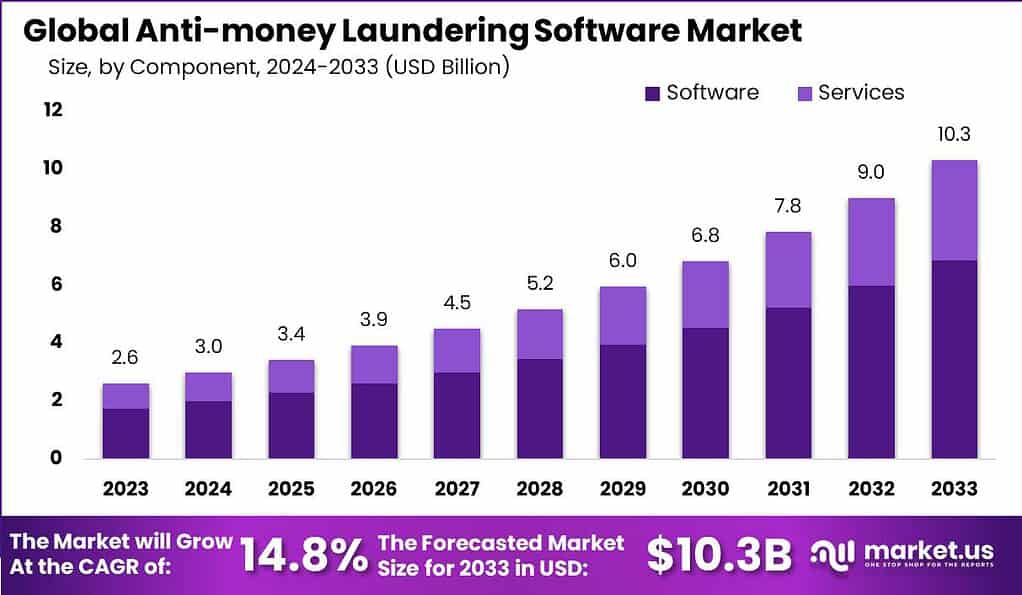

The Global Anti-Money Laundering (AML) Software Market has demonstrated notable progress, achieving a market valuation of approximately USD 2.6 Billion in 2023. Driven by increasing regulatory scrutiny and the rising complexity of financial crimes, the market is expected to grow significantly over the next decade.

By 2033, the AML software market is projected to reach approximately USD 10.3 Billion, expanding at a robust Compound Annual Growth Rate (CAGR) of 14.8% between 2024 and 2033. This sustained growth reflects heightened enforcement of anti-financial crime regulations globally, particularly within banking, insurance, fintech, and cryptocurrency sectors.

Key drivers include the growing need for real-time transaction monitoring, Know Your Customer (KYC) compliance, and the integration of AI and machine learning to enhance fraud detection accuracy. Institutions are increasingly investing in AML platforms not only to meet compliance requirements but also to reduce reputational and operational risks.

The Anti-Money Laundering (AML) landscape in 2022 revealed significant operational and regulatory complexities, reflecting both the scale of illicit financial flows and the evolving challenges in detection and enforcement. It is estimated that USD 800 Billion, equivalent to nearly 5% of global GDP, is laundered each year, emphasizing the vastness of the problem. Alarmingly, according to the United Nations, approximately 90% of global money laundering activities remain undetected, underscoring systemic inefficiencies in current global compliance mechanisms.

A key operational challenge identified was the high incidence of false-positive alerts, reported by 41% of financial organizations, based on Deloitte’s analysis. These alerts often strain compliance teams by diverting critical resources toward non-threatening cases, delaying responses to actual financial crime. Compounding this issue, 48% of banks reportedly continue to rely on outdated AML technology, hindering their ability to meet modern compliance expectations effectively.

Despite these challenges, there are some positive outcomes. Data from the UK’s National Crime Agency shows that 31% of illicit financial flows are intercepted annually via Suspicious Activity Reports (SARs). Yet, the impact is considerably muted when contrasted with findings from the University of Melbourne, which show that only 0.1% of laundered funds are eventually recovered post-investigation, highlighting the limited success of asset recovery efforts.

US Tariff Impact Analysis

At first glance, Anti-Money Laundering (AML) systems may appear to be primarily software-driven solutions. However, their operational effectiveness is fundamentally supported by a sophisticated hardware infrastructure. This includes high-performance servers, large-scale data storage systems, and specialized processing units such as Graphics Processing Units (GPUs) and Application-Specific Integrated Circuits (ASICs). These components enable real-time analytics, high-volume transaction monitoring, and the deployment of AI/ML models for pattern detection.

A significant portion of this critical hardware is sourced internationally, with China being a major supplier of advanced chips and server components. As a result, the imposition of tariffs ranging from 15% to 25% on these imports has placed considerable cost pressures on AML technology providers. These elevated input costs are being absorbed either through higher pricing for financial institutions or by reducing profit margins across the solution lifecycle.

The ripple effects are particularly acute for smaller compliance technology vendors, many of whom operate on tighter margins. Moreover, banks and financial service providers seeking to modernize outdated systems now face increased capital expenditure. In parallel, the rising costs associated with infrastructure are slowing innovation in the AML space, especially in the development and deployment of advanced analytics engines and cloud-integrated monitoring tools.

The imposition of tariffs by the U.S. in 2025 has significantly impacted the Anti-Money Laundering (AML) market, particularly concerning the cost and availability of necessary technologies. Here are five key points detailing these effects:

- Increased Costs of AML Technologies: U.S. tariffs on imported goods have led to increased costs for AML technologies that rely on foreign-manufactured components, such as servers and specialized chips. These costs have forced AML vendors to either absorb increased expenses or pass them onto their clients, which has made sustaining competitive pricing a challenge.

- Strategic Adjustments to Mitigate Impact: Many AML technology providers are adopting strategic measures to counteract tariff impacts. These include forming partnerships with domestic manufacturers to secure a stable and cost-effective supply of necessary components and shifting towards cloud-native architectures. Such strategies help mitigate dependencies on imported hardware and buffer against fluctuating costs.

- Advocacy for Tariff Exemptions: AML stakeholders, including financial institutions and technology providers, are increasingly engaged in policy advocacy. Collaborative efforts with trade associations aim to secure tariff exemptions for critical AML technologies, which are essential for compliance with regulatory standards.

- Technological Innovation as a Response: In response to tariff-induced cost pressures, AML technology vendors are increasingly investing in innovations such as AI, blockchain, and advanced analytics. These technologies not only enhance the capabilities of AML solutions but also improve cost-efficiency by reducing reliance on expensive, tariff-affected hardware.

- Long-term Implications on Supply Chain and Compliance Costs: The broader implications of U.S. tariffs are reshaping the supply chain strategies of AML technology providers. Companies are re-evaluating their supply chains to minimize exposure to tariff impacts, which could lead to a longer-term shift towards more localized manufacturing and service provision.

Key Takeaways

- The AML software market is projected to grow to USD 10.3 billion by 2033, accelerating at a strong CAGR of 14.8% from 2024.

- Globally, nearly USD 800 billion, or around 5% of GDP, is laundered every year—yet 90% of these activities go undetected, exposing serious enforcement limitations.

- In 2023, the Software segment led with a commanding 66.5% market share, driven by increasing demand for automated compliance tools.

- Transaction Monitoring remained the top functional application, capturing over 42.9% share, due to its critical role in identifying suspicious financial behavior.

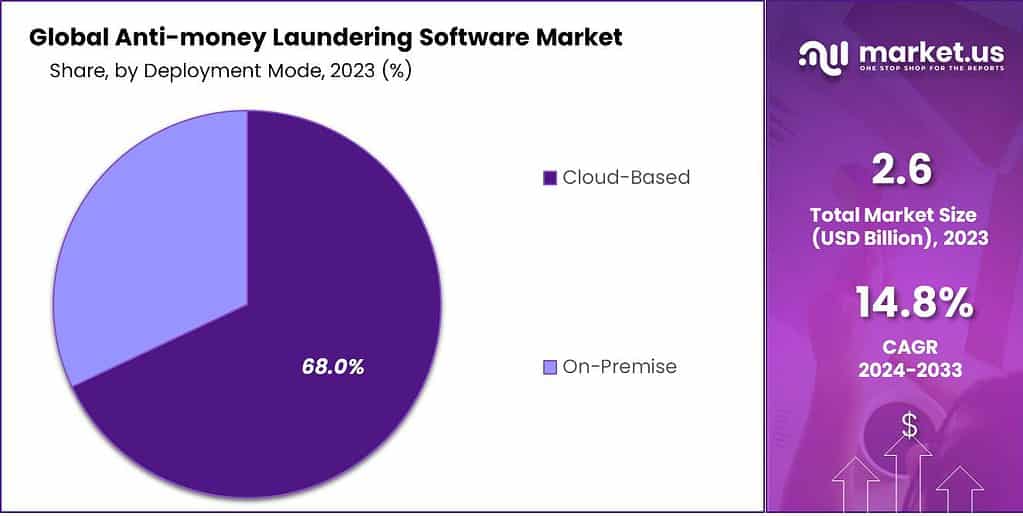

- On-premise deployments dominated with 68.0% share, reflecting the continued preference among institutions for secure, in-house compliance infrastructure.

- BFSI sector emerged as the largest end-user, accounting for 54.5% share in 2023, due to stringent regulations and higher risk exposure.

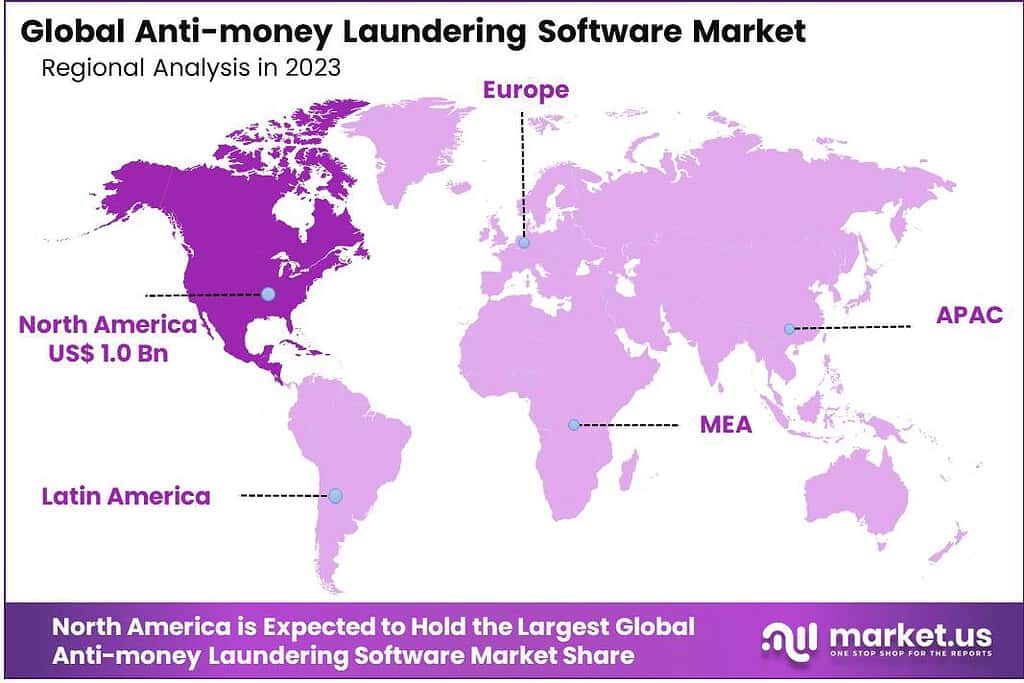

- North America retained leadership with a 38.4% market share, driven by advanced financial systems and strict regulatory frameworks.

Report Segmentation

Component Analysis

In 2023, the Software segment maintained a commanding presence in the Anti-money laundering (AML) software market, securing over 66.5% of the market share. This significant portion reflects the essential role that software solutions play in enabling institutions to effectively detect and report suspicious financial activities.

Product Type Analysis

The Transaction Monitoring segment occupied a leading position in the Anti-money laundering (AML) software market in 2023, with a market share exceeding 42.9%. Transaction monitoring is pivotal in the continuous scrutiny of customer transactions for signs of money laundering and other financial crimes, underscoring its critical importance in AML efforts.

Deployment Mode Analysis

In 2023, the On-premise deployment mode dominated the Anti-money laundering (AML) software market, comprising more than 68.0% of the market. This preference is driven by the enhanced security and control over sensitive financial data that on-premise solutions offer to financial institutions.

End-Use Analysis

Within the Anti-money laundering (AML) software market, the BFSI (Banking, Financial Services, and Insurance) segment held a predominant position in 2023, capturing over 54.5% of the market. This dominance is due to the critical need for robust AML solutions in the sector, which faces stringent regulatory requirements and the highest risks of financial crimes.

Regional Analysis

In 2023, North America was the leading region in the Anti-money laundering (AML) software market, holding more than 38.4% of the market share. The significant market share can be attributed to the stringent regulatory environment in the United States and Canada, where adherence to AML regulations is rigorously enforced, necessitating robust software solutions to comply with legal standards.

Emerging Trends

- AI-Driven Transaction Monitoring: The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing transaction monitoring by enabling proactive detection of suspicious activities. These technologies allow for dynamic risk profiling and real-time monitoring, greatly enhancing the speed and accuracy of AML processes.

- Enhanced Regulatory Compliance with Real-Time Data: As regulatory environments toughen, AML software is increasingly capable of real-time data analysis and compliance checks against global sanctions and politically exposed persons, directly from transaction flows.

- Cloud-Based Solutions: The shift towards cloud-based AML solutions is notable for its cost-effectiveness and scalability, supporting real-time transaction analysis and compliance across geographical boundaries.

- Sophisticated Cybersecurity Integration: With the rise of financial cybercrimes like ransomware, AML software is integrating more deeply with cybersecurity measures to provide a comprehensive defense against both money laundering and cyber threat.

- Global Regulatory Adaptations: The AML landscape is rapidly adapting to global regulatory changes with improved cooperation and sharing of financial intelligence across borders, enhancing the ability to tackle sophisticated international money laundering schemes.

Top Use Cases

- Banking and Financial Services: AML software is extensively used in the BFSI sector to monitor and report suspicious transactions, ensuring compliance with global financial regulations.

- Healthcare Fraud Detection: In healthcare, AML tools are crucial for detecting and preventing fraudulent billing and insurance scams, which can amount to significant financial losses annually.

- Government and Defense: These sectors employ AML software to prevent and trace financial crimes and terrorism financing, aligning with national security measures.

- Retail and E-commerce: To combat fraud in high-volume transactions, retail businesses implement AML solutions to monitor and analyze payment activities, safeguarding against money laundering through digital payments.

- Telecommunications: AML software helps telecom companies monitor and secure mobile and digital payment services, which are susceptible to fraudulent activities due to the high volume of transactions.

Attractive Opportunities

- Expansion in Developing Markets: As financial markets in Asia-Pacific and Africa grow, there is increasing demand for AML solutions to support new financial institutions and expanding digital payment systems.

- Integration with Fintech Innovations: Collaborations between AML software providers and fintech companies are creating more robust solutions for emerging financial products, including cryptocurrencies and digital wallets.

- Regulatory Technology (RegTech) Development: There is significant opportunity in the development of RegTech that automates compliance and enhances the efficiency of AML processes, particularly in adapting to new regulations.

- Advancements in Identity Verification Technologies: The ongoing improvement of biometric and digital identity verification technologies offers substantial opportunities for AML software to enhance KYC processes and reduce identity fraud.

- Training and Consultancy Services: As AML regulations become more complex, there is a growing market for professional training and consultancy services to help institutions implement and manage effective AML strategies.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | US$ 2.6 Bn |

| Forecast Revenue (2033) | US$ 10.3 Bn |

| CAGR (2024-2033) | 14.8% |

| Base Year for Estimation | 2023 |

| Historic Period | 2018-2022 |

| Forecast Period | 2024-2033 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

| Segments Covered | By Component (Software, Services), By Product Type (Compliance Management, Currency Transaction Reporting, Customer Identity Management, and Transaction Monitoring), By Deployment Mode (Cloud and On-premise), By End-Use (BFSI, Government, Healthcare, IT & Telecom, and Other End-Uses) |

Key Market Segments

By Component

- Software

- Services

By Product Type

- Compliance Management

- Currency Transaction Reporting

- Customer Identity Management

- Transaction Monitoring

By Deployment

- Cloud

- On-premise

By End-Use

- BFSI

- Government

- Healthcare

- IT & Telecom

- Other End-Uses

Top Market Leaders

- SAS Institute Inc.

- Oracle Corporation

- NICE Actimize

- BAE Systems plc

- Thomson Reuters Corporation

- Tata Consultancy Services Limited

- ACI Worldwide

- Fiserv, Inc.

- FICO

- Temenos AG

- LexisNexis Risk Solutions

- Other Key Players