Table of Contents

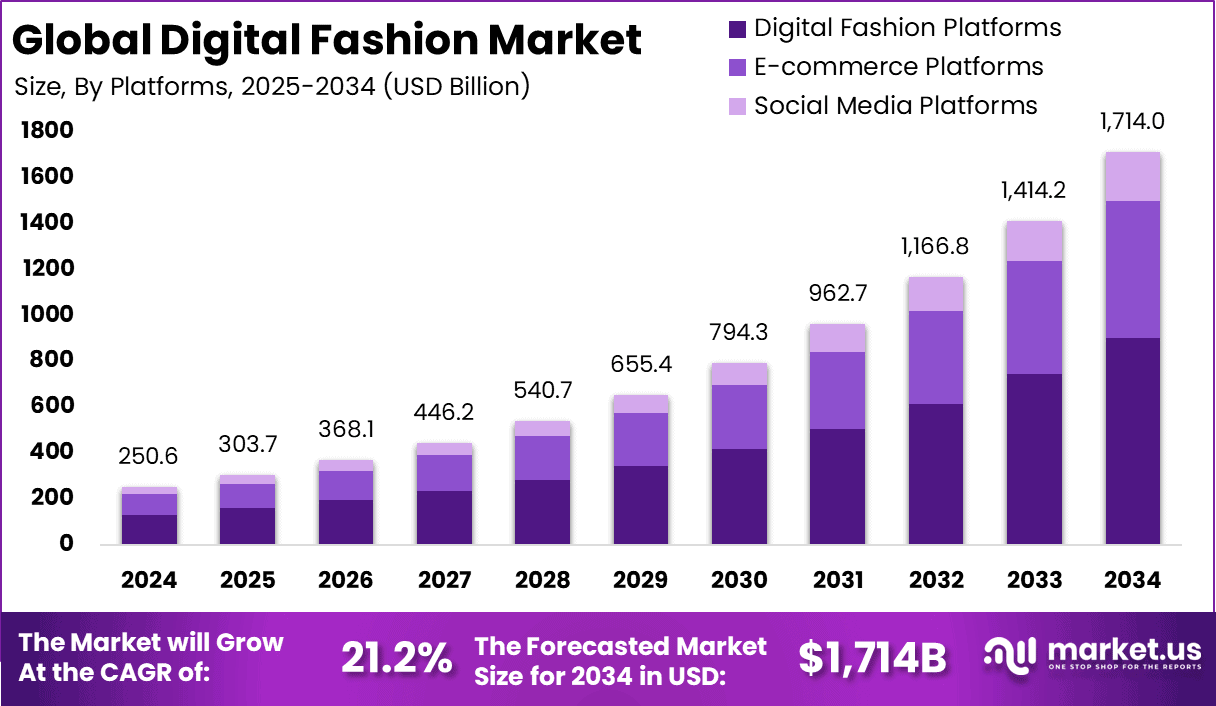

The global digital fashion market is on a rapid growth trajectory, expected to reach USD 1,714 billion by 2034, up from USD 250.6 billion in 2024, growing at a compound annual growth rate (CAGR) of 21.2%. North America holds a dominant share of 37.4% in 2024, with USD 93.7 billion in revenue.

The digital fashion platform segment leads the market with 52.6% share, followed by virtual try-on technology with 48.9%. The subscription-based segment captures 45.7% of the market, while the consumer segment holds 35.8%. The U.S. digital fashion market alone is valued at USD 74.9 billion, with strong future growth projections.

US Tariff Impact on Market

U.S. tariffs on digital fashion components, including software, virtual try-on technology, and digital assets used virtually, have impacted the market. The increased costs associated with importing these technological elements raise operational expenses for U.S.-based companies.

As many fashion companies depend on foreign suppliers for digital infrastructure and content creation, the tariffs have led to price hikes, which could reduce consumer adoption of digital fashion products, especially in the U.S.

In response, some companies may seek to localize production or adjust their supply chain strategies to mitigate tariff-related impacts. However, despite these challenges, the overall growth of the digital fashion market remains robust due to increasing consumer demand for immersive fashion experiences.

➤➤➤ Get More Insights about US Tariff Impact Analysis @ https://market.us/report/digital-fashion-market/free-sample/

- Economic Impact: U.S. tariffs raise costs for digital fashion platforms and virtual try-on technology, potentially leading to higher prices for consumers and slowing growth in the short term.

- Geographical Impact: U.S. companies face higher production costs due to reliance on foreign technology, which could dampen growth in North America and influence global market dynamics.

- Business Impact: Companies may experience margin compression or increased operational costs due to tariffs, affecting profitability, especially for U.S.-based digital fashion businesses.

Impact Percentage on Sectors

- Software and Virtual Try-On Technologies: +8-10%

- Digital Content and Design Assets: +5-7%

Key Takeaways

- The digital fashion market is expected to grow at a CAGR of 21.2%, reaching USD 1,714 billion by 2034.

- North America, particularly the U.S., leads the market with USD 93.7 billion in 2024.

- Digital fashion platforms, virtual try-ons, and subscription models dominate the market, with consumer demand driving adoption.

- U.S. tariffs on technology and digital content raise costs, potentially limiting short-term market growth.

- The demand for immersive fashion experiences remains a key driver of long-term market expansion.

Analyst Viewpoint

The digital fashion market is growing rapidly, with strong adoption driven by technological advancements like virtual try-ons and digital fashion platforms. Although U.S. tariffs have increased costs for some sectors, the long-term outlook remains positive due to continued consumer demand for digital fashion experiences.

As companies adapt to higher operational costs, the market will continue to benefit from innovations in technology and content delivery. Subscription models and online fashion design platforms are expected to sustain growth, while the virtual try-on segment will play an important role in shaping the future of digital fashion. The market is on track for robust expansion.

Regional Analysis

North America holds a dominant position in the global digital fashion market, capturing over 37.4% of the share in 2024 with USD 93.7 billion in revenue. The U.S. is a key contributor to this growth, driven by the increasing adoption of digital fashion platforms and virtual try-on technologies.

Consumer engagement with digital fashion experiences is high, particularly within the e-commerce and subscription-based model segments. Europe and Asia-Pacific are also experiencing growth digitally, although they trail North America in terms of market share. These regions are poised for increased growth as consumer demand for immersive fashion experiences continues to rise globally.

➤ Tariff effects on listed markets?

- G. Fast Chipset Market

- AI in FP&A Market

- Blockchain for Cold Chain Logistics Market

- Deepfake Detection Market

Business Opportunities

The digital fashion market presents several business opportunities, particularly in the subscription-based and virtual try-on technology segments. Companies in fashion retail, e-commerce, and tech can capitalize on the growing demand for personalized, immersive fashion experiences.

As consumers increasingly seek to interact with digital representations of fashion, companies can innovate by offering virtual try-ons, customizable avatars, and online fashion design platforms. Additionally, with the rise of digital fashion platforms, content creation and licensing offer lucrative opportunities for fashion brands to engage with global audiences. U.S. companies, in response to tariffs, may also explore local production solutions and technology development to mitigate costs.

Key Segmentation

The global digital fashion market is segmented into the following:

- Product Type: Digital Fashion Platform, Virtual Try-On, Online Fashion Design

- End-User: Consumers, Commercial (Retailers, E-commerce, Subscription Providers)

- Technology: Augmented Reality (AR), Virtual Reality (VR), AI-based Design Tools

- Business Model: B2C (Business-to-Consumer), Subscription-based, Direct-to-Consumer (DTC)

- Region: North America, Europe, Asia-Pacific, Rest of the World

Digital fashion platforms and virtual try-on technologies dominate the market, with growing adoption of AR and VR in online shopping experiences. The consumer segment leads with 35.8% market share, driven by the increasing shift toward e-commerce and digital interaction.

Key Player Analysis

Key players in the digital fashion market focus on developing advanced digital fashion platforms and virtual try-on technologies. These companies are leveraging augmented reality (AR) and virtual reality (VR) to create immersive shopping experiences that enable consumers to try on clothes digitally. They are also expanding their subscription-based business models to capture a broader consumer base.

As U.S. tariffs increase the cost of imported technology, companies are looking for innovative ways to overcome these challenges, including increasing investment in domestic technology development. Furthermore, partnerships with major fashion retailers and e-commerce platforms are essential for capturing market share.

Top Key Players in the Market

- Shopify

- Klarna

- Stripe

- NCR Corporation

- PayPal

- Snap Inc.

- Global Payments

- Tencent

- Meta Platforms

- Amazon.com

- Alibaba Group

- Adyen

- Worldpay

- ByteDance

- Square

- Others

Recent Developments

Recent developments in the digital fashion market include the widespread adoption of augmented reality (AR) and virtual try-on technologies by major fashion retailers.

Digital platforms are enhancing customer engagement through personalized fashion experiences, with improvements in AI and machine learning to offer more tailored clothing recommendations. These innovations continue to drive the market forward, despite challenges such as tariffs.

Conclusion

In conclusion, the digital fashion market is growing rapidly, driven by technological advancements and increasing consumer demand for immersive fashion experiences. While U.S. tariffs on technology products may affect short-term growth, the long-term outlook remains positive as digital fashion platforms and virtual try-on technologies continue to innovate.

The increasing adoption of subscription models and online fashion design platforms ensures the market’s continued expansion, with opportunities in various regions, especially North America and Europe. As companies adapt to changing market dynamics, digital fashion is poised for a strong future.