Table of Contents

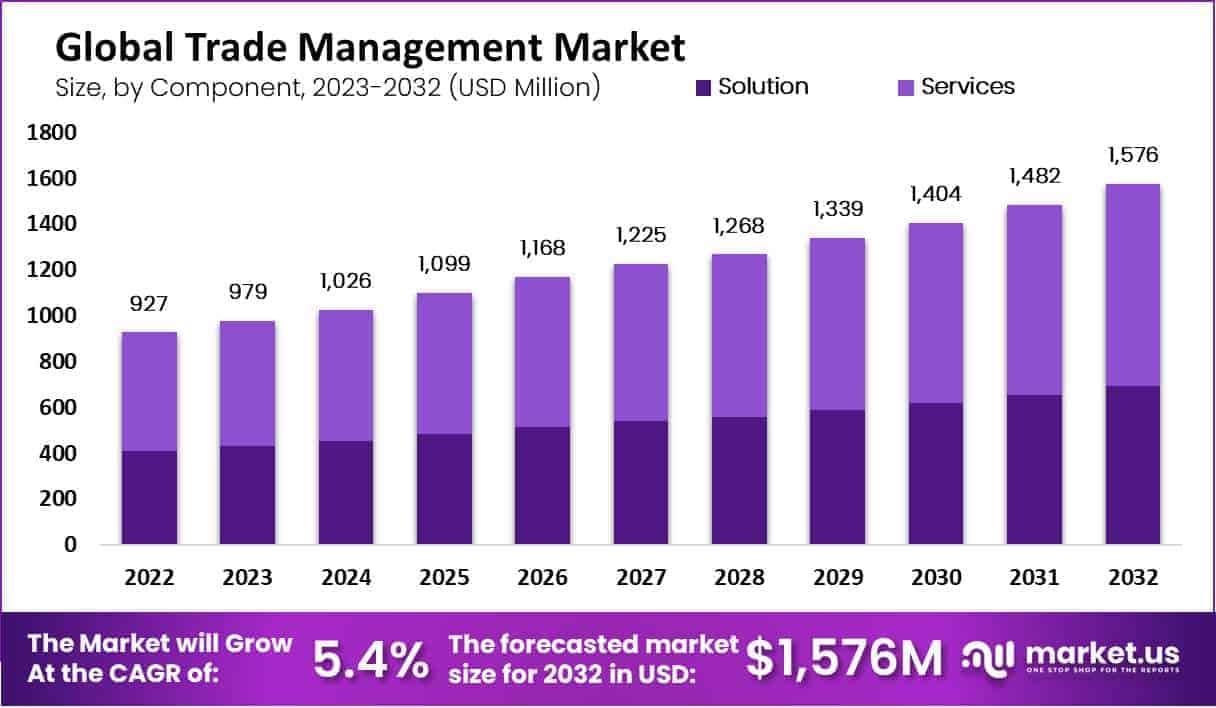

The global trade management market, valued at USD 927 million in 2022, is projected to grow at a compound annual growth rate (CAGR) of 5.4%, reaching USD 1,576 million by 2032. Factors driving this growth include the increasing volume of international trade and the rising need for more efficient global logistics.

The market benefits from technological advancements, including artificial intelligence (AI), automation, and blockchain. However, challenges such as limited resources for technology implementation and the lack of skilled professionals may restrain growth in certain regions. Retail and large enterprises are the most prominent players in this sector.

US Tariff Impact on Market

The US tariff policies have significantly impacted the global trade management market, leading to both opportunities and challenges for businesses. In particular, tariffs on imported goods have increased the complexity of managing cross-border trade, requiring businesses to implement more sophisticated trade management solutions.

As companies face rising costs due to tariffs, the demand for trade management systems that help optimize customs compliance, minimize duties, and streamline logistics has surged. Furthermore, sectors such as manufacturing, retail, and transportation have felt the brunt of these tariffs, with industries directly impacted by increased trade barriers.

➤➤➤ Get More Insights about US Tariff Impact Analysis @ https://market.us/report/trade-management-market/free-sample/

For example, the retail sector has seen a rise in goods costs, ultimately affecting margins. The US tariff impact on sectors like manufacturing and retail is approximately 10-15% as they deal with higher raw material costs and inventory disruptions. Companies now look for more automation and integrated solutions to mitigate these costs and streamline operations.

➤ Economic Impact

The US tariffs have led to an increased cost of imports, pushing businesses to adopt more efficient trade management systems. As tariffs increase, businesses are forced to reevaluate their supply chain strategies, leading to higher operational costs. In the long term, this could prompt global shifts in trade flows.

➤ Geographical Impact

US tariffs have disproportionately affected countries with high trade volumes with the US, especially China, Mexico, and Canada. As tariffs increase, businesses in these regions must adapt to higher costs and potential disruptions. This shift influences regional trade agreements and the movement of goods, altering global trade dynamics.

➤ Business Impact

US tariffs have forced businesses to invest in advanced trade management technologies to mitigate the effects of increased import duties and logistical delays. Companies are now focusing on automation, compliance optimization, and cost-effective solutions to navigate the growing complexities of international trade. Small and medium-sized enterprises face considerable challenges.

Key Takeaways

- The global trade management market is expected to reach USD 1,576 million by 2032.

- US tariffs have increased the complexity and cost of cross-border trade.

- Sectors such as manufacturing and retail are most impacted by the tariff hike.

- Technological advancements, including AI and blockchain, are driving market growth.

- Cloud-based trade management solutions are increasingly preferred by enterprises.

Analyst Viewpoint

Presently, the global trade management market faces growth challenges due to the complexities introduced by US tariffs. However, this is offset by a greater adoption of automated solutions, helping businesses optimize their operations in the face of rising duties.

The market is projected to witness a positive outlook as companies invest in smarter technologies to streamline customs compliance, logistics, and international trade processes. Looking ahead, the implementation of AI, automation, and blockchain technologies will reduce operational costs, driving market growth in the coming years. The future is positive as technological advancements enable businesses to tackle emerging challenges effectively.

➤ How are these markets hit by U.S. tariffs?

- Electron Microscope Market

- Microfluidic Devices Market

- Smartphone Screen Protector Market

- Intelligent Traffic Management System Market

Regional Analysis

The North American region currently dominates the global trade management market due to the presence of large enterprises and the region’s strong trade volume. However, the Asia-Pacific market is expected to witness the highest growth rate, driven by rapid industrialization, increasing international trade, and the adoption of digital technologies in countries like China and India.

The growth in this region is also fueled by the demand for trade management solutions to tackle challenges like complex customs procedures and compliance requirements. Europe is expected to follow closely, with increasing cross-border trade and regulatory compliance driving market demand.

Business Opportunities

The global trade management market presents significant business opportunities, especially for companies offering advanced solutions in automation, AI, and blockchain. As businesses face challenges posed by tariffs and trade barriers, there is a growing demand for integrated solutions to optimize customs clearance, logistics, and overall trade operations.

Cloud-based deployment models, which offer flexibility and scalability, are becoming increasingly popular. Service providers that focus on offering cost-effective solutions tailored to industries such as retail, healthcare, and manufacturing will have significant growth opportunities. The rising need for regulatory compliance also presents new avenues for businesses specializing in trade management consulting.

Key Segmentation

The global trade management market is segmented into several key areas:

- By Component: Solutions and Services, with Services leading in revenue.

- By Deployment Mode: On-premises and Cloud-based, with Cloud-based solutions witnessing higher growth.

- By Organization Size: SMEs and Large Enterprises, with large enterprises accounting for the majority of the market share.

- By End-User: Retail, Healthcare, Energy & Power, Manufacturing, and Transportation, with retail being the most lucrative sector. These segments highlight the diverse needs and opportunities within the trade management market, influenced by sector-specific requirements and the adoption of cloud technology.

Key Player Analysis

Key players in the global trade management market include leading providers of technology solutions and services. These companies focus on offering integrated trade management platforms that help businesses streamline operations, ensure compliance, and reduce costs. Market players are increasingly integrating AI and blockchain technologies into their solutions to improve transparency, security, and operational efficiency.

Additionally, some players offer cloud-based solutions for easier scalability, appealing to enterprises of various sizes. Their competitive edge lies in their ability to offer customized, automated solutions that help clients navigate global trade complexities, especially amidst rising tariffs and regulatory changes.

Recent Developments

Recently, several companies in the trade management sector have rolled out AI-driven solutions to help businesses cope with rising tariffs and complex trade regulations. Additionally, there has been a growing focus on cloud-based platforms to improve the efficiency of cross-border trade management, allowing businesses to scale operations globally.

Conclusion

The global trade management market is poised for substantial growth despite challenges like US tariffs. Technological advancements, particularly in AI and blockchain, will continue to drive innovation, improving the efficiency and effectiveness of international trade operations. As businesses increasingly adopt these solutions, the market will remain resilient and dynamic.