Table of Contents

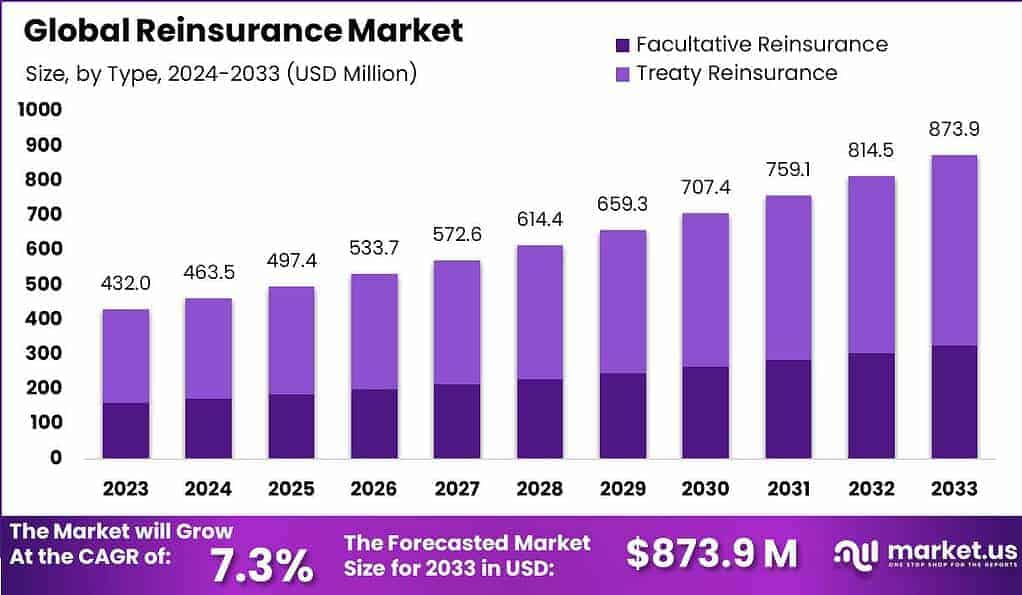

The global reinsurance market was valued at USD 432.0 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.3%, reaching USD 873.9 billion by 2033. Treaty reinsurance leads the market with a 62.5% share, followed by the property and casualty reinsurance segment, which holds 54.6% of the market.

Brokers are the dominant distribution channel, accounting for 52.1% of the market. North America holds the largest market share, with over 41.2%, driven by strong demand for reinsurance in sectors like property, casualty, and life insurance.

US Tariff Impact on Market

US tariffs on reinsurance-related services, particularly those affecting global reinsurers, could increase operational costs for companies relying on international markets for risk mitigation. Tariffs could raise the cost of certain reinsurance services and contracts by 5-10%, particularly for those involving cross-border transactions.

The cost of services for property and casualty reinsurance may increase as reinsurers face higher premiums for cross-border agreements. This could lead to higher costs for insurance providers and, in turn, increase premiums for end consumers. Additionally, higher tariffs may disrupt the flow of capital and data between reinsurers and brokers, further complicating the market landscape.

➤➤➤ Get More Insights about US Tariff Impact Analysis @ https://market.us/report/reinsurance-market/free-sample/

- Economic Impact: Tariffs may increase costs for reinsurers, leading to higher premiums for insurance policies, which could reduce demand in price-sensitive markets.

- Geographical Impact: North America, particularly the US, could face slower market growth as tariffs on reinsurance services raise costs for businesses and insurance providers, reducing competitiveness.

- Business Impact: Reinsurers may need to adjust pricing models, absorb the increased costs, or explore new markets to maintain profitability, which could disrupt the global reinsurance supply chain.

Key Takeaways

- The global reinsurance market is projected to grow at a CAGR of 7.3%, reaching USD 873.9 billion by 2033.

- Treaty reinsurance holds the largest share at 62.5%, with property and casualty reinsurance accounting for 54.6%.

- North America dominates the market with over 41.2% share.

- US tariffs could increase costs by 5-10%, impacting market growth.

- Brokers are the dominant distribution channel, holding 52.1% of the market.

Analyst Viewpoint

Present View: The reinsurance market is seeing steady growth, driven by treaty reinsurance and the increasing need for property and casualty coverage. However, the introduction of tariffs may increase costs and slow market expansion, particularly in North America, where most global reinsurers are based.

Future Positive View: Despite the challenges posed by tariffs, the long-term outlook for the reinsurance market remains positive. As demand for coverage increases, particularly in emerging markets, reinsurance companies are likely to adapt by finding more cost-efficient solutions and expanding into new regions.

Regional Analysis

North America leads the global reinsurance market, accounting for over 41.2% of the share in 2023. This is driven by the large number of reinsurers based in the US and the high demand for reinsurance services in property, casualty, and life insurance sectors. Europe follows with significant market growth, driven by increased reinsurance demand across various sectors and regulatory advancements.

Asia-Pacific is expected to see the highest growth, with increasing demand for reinsurance in countries like China and India, due to growing insurance needs and economic expansion. The region will likely witness strong adoption of treaty and property reinsurance in the coming years.

➤ Impact of U.S. tariffs on these sectors?

- IoT Sensors Market

- Mass Flow Controller Market

- Auto-boxing Technology Market

- Hyperloop Technology Market

Business Opportunities

The growing demand for reinsurance, especially in property and casualty insurance, presents significant opportunities for reinsurers and brokers. Companies can capitalize on the rise of emerging markets, where insurance penetration is still low but increasing rapidly.

Additionally, innovations in digital platforms for distributing reinsurance products and services will enable providers to reach a wider audience and improve efficiency. By offering customized products tailored to specific industries, such as cyber insurance, reinsurers can diversify their offerings and meet the evolving needs of businesses in a digital world.

Key Segmentation

The global reinsurance market is segmented as follows:

- Type: Treaty reinsurance leads with a 62.5% market share, offering long-term contracts that help insurers share risk. Facultative reinsurance, while important, captures a smaller share.

- Application: Property and casualty reinsurance holds the largest share at 54.6%, driven by increasing demand for coverage in sectors like real estate and automotive.

- Distribution Channel: Brokers dominate with 52.1% market share, serving as intermediaries between reinsurers and insurance companies.

- Region: North America leads the market with over 41.2% share, followed by Europe and the Asia-Pacific region, where growth is rapidly accelerating.

Key Player Analysis

Key players in the reinsurance market focus on providing tailored risk management solutions for insurers in various sectors, including property, casualty, and life insurance. These companies are expanding their portfolios by incorporating innovative technologies and enhancing their digital platforms.

As competition increases, reinsurers are also strengthening their relationships with brokers to expand distribution channels. Additionally, many reinsurers are focusing on new geographies to capitalize on growing markets, particularly in Asia-Pacific and emerging economies. Strategic partnerships and acquisitions are also part of the market dynamics, helping companies increase their global presence and diversify offerings.

Top Key Players in the Market

- Barents Re Reinsurance Company, Inc.

- Munich RE

- Everest Re Group, Ltd.

- The Canada Life Assurance Company

- Swiss Re

- Berkshire Hathaway Inc.

- Markel Corporation

- China Reinsurance (Group) Corporation

- SCORE

- Hannover Re

- Tokio Marine HCC

- MAPFRE

- Lloyd’s

- RGA Reinsurance Company

- AXA XL

- Next Insurance, Inc.

- BMS Group

- Other Key Players

Recent Developments

Recent developments in the reinsurance market include increased investment in digital tools and platforms to streamline risk assessment and improve customer experience. Reinsurers are also focusing on sustainability and incorporating environmental, social, and governance (ESG) factors into their offerings to address growing concerns about climate risk.

Conclusion

The global reinsurance market is poised for steady growth, driven by increasing demand for property, casualty, and treaty reinsurance. While US tariffs may pose short-term challenges, particularly in terms of higher costs, the long-term outlook remains positive. By embracing digital transformation and expanding into emerging markets, reinsurers are well-positioned to meet the evolving needs of the global insurance industry.