Table of Contents

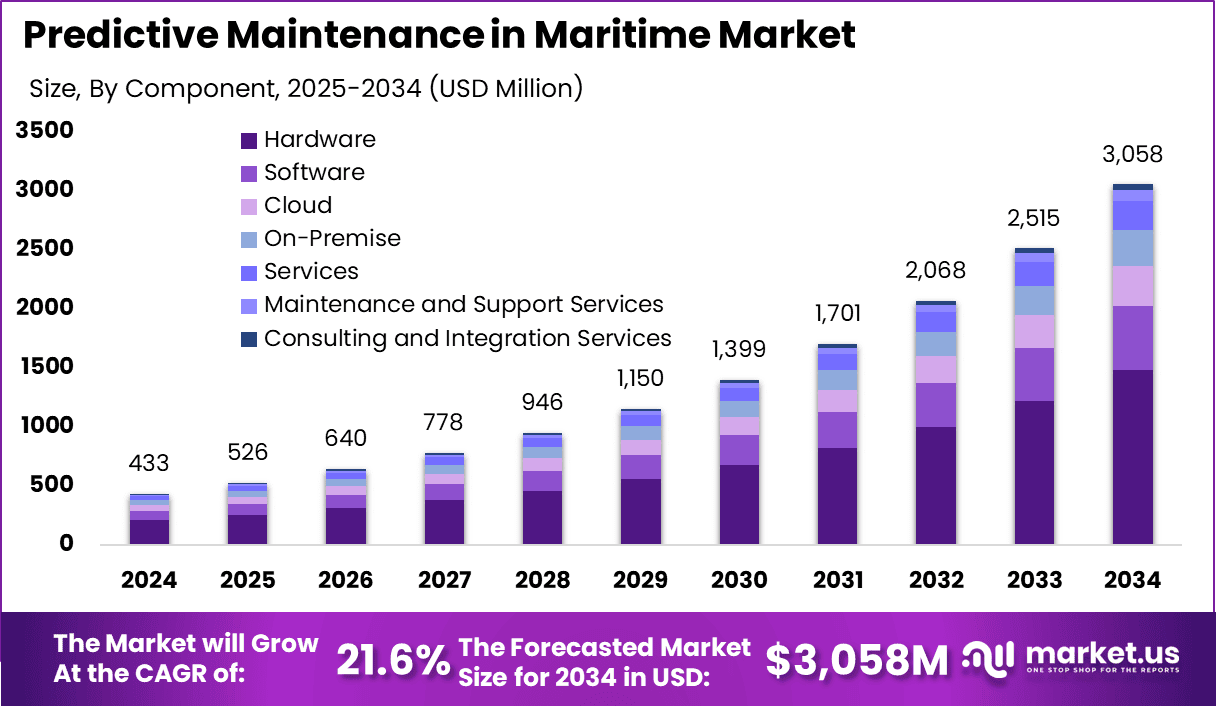

The Predictive Maintenance in Maritime market is experiencing robust growth, expected to expand from USD 433 million in 2024 to USD 3,058 million by 2034, at a CAGR of 21.6%. North America holds a dominant position, with over 39.2% market share and generating USD 169.73 million in 2024.

The U.S. alone contributed USD 152.60 million in 2024, with a forecasted growth to USD 898.66 million by 2034. The hardware segment leads, accounting for 48.4% of the market, driven by IoT sensors and real-time monitoring systems. The commercial shipping sector dominates with a 52.84% share, reflecting strong demand for predictive maintenance solutions.

US Tariff Impact on Market

The imposition of tariffs on maritime equipment and IoT-related hardware, including sensors, has impacted the predictive maintenance market in the U.S. As many components crucial for predictive maintenance systems are sourced globally, tariffs on these imports have increased costs by approximately 10-12%.

These tariffs affect the hardware segment, which captured 48.4% of the market in 2024, as IoT devices and sensors are critical for real-time monitoring in maritime applications. The additional costs of imported components, such as sensors and processing units, have led to higher prices for end-users, particularly smaller shipping companies.

➤➤➤ Experience the power of actionable insights – get a sample here @ https://market.us/report/predictive-maintenance-in-maritime-market/free-sample/

Larger players have been able to absorb these costs, but smaller enterprises face profit margin compression. The long-term effect could also hinder the adoption of advanced predictive maintenance systems among cost-sensitive stakeholders. However, companies are responding by exploring domestic production options and diversifying their supply chains to mitigate the effects of tariffs.

Tariff Impact Percentage: 10-12% increase in costs for IoT and sensor hardware components.

Economic Impact

The tariffs have raised operational costs for U.S. maritime businesses relying on imported sensors and IoT devices. Larger enterprises can absorb these costs, but smaller businesses may face financial strain. This could slow the adoption of predictive maintenance technologies in the short term, particularly for cost-sensitive sectors like commercial shipping.

Geographical Impact

North American markets, especially the U.S., have felt the impact of tariffs on imported maritime equipment, leading to higher costs for predictive maintenance systems. Conversely, regions with more localized manufacturing, like Europe and Asia-Pacific, are less affected, which could lead to faster growth and cost-effective adoption of predictive maintenance in those regions.

Business Impact

The tariffs have forced U.S.-based businesses to explore alternative supply chain solutions, including reshoring manufacturing or partnering with domestic suppliers. While larger companies can absorb the costs, smaller businesses may experience tighter margins and slower technology adoption. Long-term, companies are expected to diversify sourcing strategies to reduce tariff risks.

Key Takeaways

- Predictive Maintenance in Maritime market to grow from USD 433 million in 2024 to USD 3,058 million by 2034 at a CAGR of 21.6%.

- North America holds a 39.2% market share, generating USD 169.73 million in 2024.

- Hardware segment leads with 48.4% of market share.

- U.S. tariffs impact hardware, increasing costs by 10-12%.

- Commercial shipping holds 52.84% of the market share.

Analyst Viewpoint

While tariffs have temporarily increased costs for predictive maintenance systems, the market remains strong, driven by growing demand for enhanced vessel performance and reduced downtime in the commercial shipping sector. In the long term, investments in domestic manufacturing and diversification of supply chains are expected to mitigate these challenges.

Furthermore, the rising adoption of IoT and real-time monitoring solutions is accelerating the growth of predictive maintenance, particularly in high-demand industries like cargo shipping. As the technology matures and becomes more affordable, smaller players will also benefit, ensuring robust market expansion and growth over the coming years.

➤➤➤ Attention!!! Grab Limited Period Offer Now @ https://market.us/purchase-report/?report_id=143850

Regional Analysis

North America remains the largest market for predictive maintenance in maritime, holding a 39.2% share in 2024. The U.S. is particularly influential, contributing a significant portion of this share. The European market is growing steadily, with strong adoption driven by technological advancements and regulatory requirements.

In Asia-Pacific, rapid industrialization and the expansion of the shipping industry are fueling demand for predictive maintenance solutions, particularly in China and Japan. Latin America and the Middle East are expected to see slower adoption rates, but increasing focus on improving port and shipping operations will drive future demand for predictive maintenance technologies.

Business Opportunities

The growing demand for predictive maintenance in maritime presents significant business opportunities, particularly in the hardware and IoT sensor sectors. Companies can capitalize on the need for real-time monitoring to reduce vessel downtime, optimize performance, and improve fuel efficiency. Startups focusing on developing cost-effective, easy-to-integrate solutions will find opportunities in emerging markets.

Additionally, the rising demand for automation and digitalization in the commercial shipping sector creates a large customer base for predictive maintenance solutions. There is also potential for strategic partnerships with global shipping firms, logistics providers, and port authorities to offer integrated predictive maintenance services.

➤ How do U.S. tariffs affect these markets?

- Financial Predictive Analytics Market

- Digital Manufacturing Market

- Humanoid Robots for Customer Service Market

- Game Publisher Market

Key Segmentation

The Predictive Maintenance in the Maritime market is segmented by hardware, application, end-use, and region.

- Hardware: The IoT sensors segment dominates with 48.4%, driven by the need for real-time monitoring and predictive analytics.

- Application: Engine and propulsion system maintenance leads with 31.3%, highlighting its role in improving vessel performance and minimizing downtime.

- End-Use: Commercial shipping dominates with 52.84% market share, reflecting the importance of predictive maintenance in the global freight and cargo sectors.

- Region: North America holds a dominant share, followed by Europe and Asia-Pacific, where maritime operations are growing rapidly.

Key Player Analysis

Key players in the predictive maintenance in the maritime market focus on integrating advanced IoT technologies, machine learning, and data analytics to enhance real-time monitoring and decision-making. These companies are investing in R&D to develop highly accurate, cost-effective predictive maintenance solutions that can reduce downtime and operational costs for shipping companies.

Strategic partnerships with commercial shipping firms and port authorities are central to market expansion. Players are also focusing on expanding their offerings to cover various types of vessels, from cargo ships to cruise liners. Additionally, firms are increasingly adopting cloud-based solutions to enable seamless data integration and remote monitoring.

Top Key Players in the Market

- Siemens AG

- General Electric (GE)

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric

- DNV GL

- Kongsberg Gruppen

- Caterpillar Inc.

- Trimble Inc.

- Emerson Electric Co.

- Other Major Players

Recent Developments

Recent developments include the launch of AI-powered predictive maintenance tools that integrate machine learning algorithms to enhance the accuracy of maintenance predictions. Companies are also introducing more affordable IoT sensors for smaller vessels, broadening the adoption of predictive maintenance across different vessel sizes and types. Additionally, more companies are adopting cloud-based solutions for easier data access.

Conclusion

The Predictive Maintenance in Maritime market is on a strong growth path, driven by technological advancements and the growing need for efficiency in the shipping industry. Despite challenges like tariffs, the long-term outlook is positive, with increasing adoption of IoT, machine learning, and cloud-based solutions ensuring continued market expansion.