Table of Contents

The global WiFi 6, WiFi 6E, and WiFi 7 chipset market is set for substantial growth, with an expected market value of approximately USD 101.0 billion by 2033, up from USD 25.8 billion in 2023. This represents a CAGR of 14.6% during the forecast period from 2024 to 2033.

WiFi 6 chipsets dominate the market, holding over 73% of the share due to their improvements in speed, capacity, and efficiency. The WLAN infrastructure devices segment, including routers and access points, also holds a significant market share, while the commercial segment is the largest end-user. Asia-Pacific leads the market with over 42% of the share in 2023.

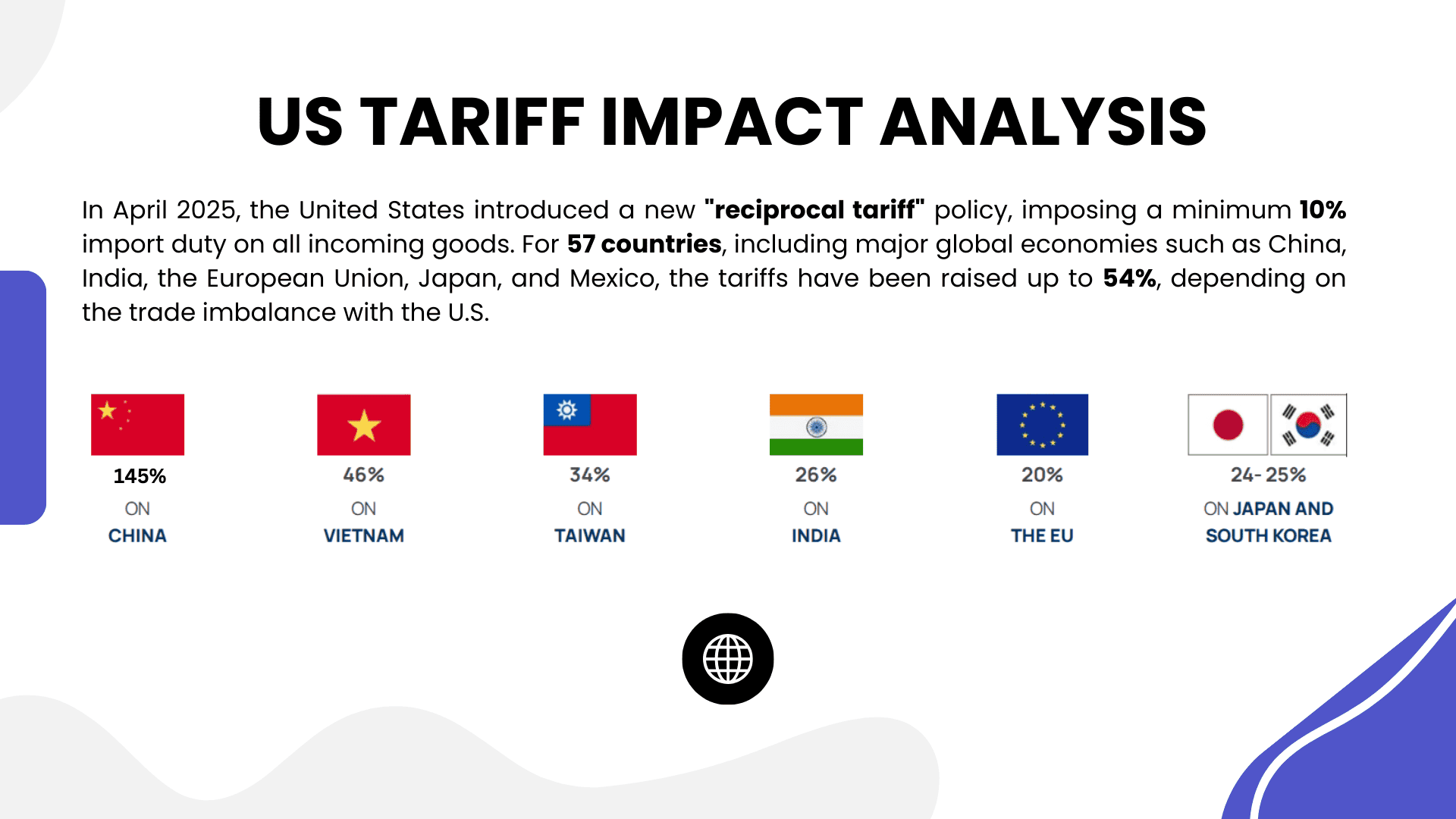

US Tariff Impact on Market

US tariffs on imported technology components, including Wi-Fi chipsets, routers, and access points, could impact the WiFi 6, WiFi 6E, and WiFi 7 chipset market. Tariffs on components such as semiconductors, integrated circuits, and networking hardware could lead to increased production costs for manufacturers in the US.

This could raise prices for consumers, especially in commercial and residential sectors where affordability is crucial. Smaller businesses and consumers might be deterred from upgrading to newer Wi-Fi standards due to higher prices.

The tariffs could also disrupt global supply chains, delaying product availability and impacting the timely release of WiFi 6, 6E, and 7 technologies. Although the market will continue to grow, US tariffs could slow adoption in the short term and affect manufacturers’ profit margins.

➤➤➤ Experience the power of insights here @ https://market.us/purchase-report/?report_id=112989

Impact on Sectors (Tariff Percentage Impact)

- Wi-Fi Chipsets (5-7%)

- WLAN Infrastructure (3-5%)

- Commercial Equipment (4-6%)

Economic Impact

US tariffs on Wi-Fi chipset components could raise production costs, leading to higher retail prices for Wi-Fi equipment. This may slow market growth, particularly among small businesses and price-sensitive consumers. Additionally, increased tariffs may reduce profit margins for companies, impacting overall industry revenue and slowing technological adoption.

Geographical Impact

US tariffs on critical components used in Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 chipsets could reduce the competitiveness of US-based manufacturers. This could slow growth in North America, while regions like Asia-Pacific and Europe, with fewer tariff barriers, may continue to experience faster adoption and growth in these technologies.

Business Impact

The tariffs could force Wi-Fi chipset manufacturers to adjust pricing strategies, potentially raising the cost of Wi-Fi 6, 6E, and 7 chipsets. Companies may struggle to absorb the higher costs, which could lead to reduced demand, particularly in the commercial sector. Supply chain disruptions could also delay product releases.

Key Takeaways

- Wi-Fi 6 chipset segment dominates with a 73% market share in 2023.

- Wi-Fi 6, 6E, and 7 chipset market to grow at a CAGR of 14.6%, reaching USD 101.0 billion by 2033.

- US tariffs on components could increase prices, slowing adoption in North America.

- Asia-Pacific holds over 42% of the market share in 2023.

- The commercial segment leads with over 37.5% market share.

Analyst Viewpoint

The Wi-Fi chipset market is currently seeing robust growth, driven by technological advancements and the widespread demand for high-speed, reliable connectivity. Despite the short-term challenges posed by US tariffs, particularly impacting component costs, the long-term outlook remains positive.

With increasing demand for faster internet, smart homes, and business connectivity, Wi-Fi 6, 6E, and Wi-Fi 7 chipsets will continue to play a pivotal role. As manufacturers adapt to tariff-related challenges by exploring alternative sourcing and supply chain strategies, the market will likely see sustained growth, especially in emerging markets in Asia-Pacific, Europe, and Latin America.

➤➤➤ Attention!!! Grab Limited Period Offer Now @ https://market.us/purchase-report/?report_id=112989

Regional Analysis

Asia-Pacific dominates the Wi-Fi chipset market, capturing over 42% of the market share in 2023. This region benefits from rapid technological advancements, lower production costs, and high demand for Wi-Fi 6, 6E, and 7 chipsets, particularly in countries like China, Japan, and South Korea.

North America follows closely, with the US leading the demand for advanced Wi-Fi solutions in commercial applications. However, US tariffs on key components could hinder growth in this region. Europe and Latin America are experiencing steady growth, driven by the increasing adoption of high-speed internet and Wi-Fi infrastructure in both commercial and residential sectors.

Business Opportunities

The Wi-Fi 6, 6E, and 7 chipset market presents several business opportunities, particularly in the development of advanced networking solutions. Companies can capitalize on the increasing demand for high-speed connectivity in commercial settings like offices, hotels, and retail spaces.

The growing adoption of smart homes and IoT devices creates additional demand for high-performance Wi-Fi networks. Moreover, businesses can focus on developing cost-effective solutions to address the impact of tariffs and reduce product prices. There is also an opportunity to expand into emerging markets in Asia-Pacific and Latin America, where the adoption of high-speed internet is rising steadily.

➤ Tariff impact overview by market?

- Legal Process Outsourcing Market

- Fraud Detection and Prevention (FDP) Market

- Big data as a Service Market

- Augmented Reality and Virtual Reality Market

Key Segmentation

The Wi-Fi 6, 6E, and 7 chipset market is segmented by technology, end-use, and region. In terms of technology, Wi-Fi 6 chipsets dominate, with a 73% market share in 2023, followed by the newer Wi-Fi 6E and Wi-Fi 7 chipsets.

The commercial segment holds the largest share, driven by demand from businesses, including offices, retail, and hospitality sectors. Regionally, Asia-Pacific leads, accounting for over 42% of the market, followed by North America and Europe. WLAN infrastructure devices like routers and access points also contribute significantly to market revenue, with a strong focus on improving connectivity in urban areas.

Key Player Analysis

Leading players in the Wi-Fi 6, 6E, and 7 chipset market are focusing on advancing their chipsets to meet the growing demand for faster, more reliable internet connections. These companies are investing in R&D to enhance the performance, capacity, and energy efficiency of their products.

Strategic partnerships with telecom providers, device manufacturers, and cloud service providers are also pivotal to expanding market reach. In addition, companies are working on optimizing production to mitigate the effects of tariffs on pricing, ensuring that their solutions remain affordable for both commercial and residential customers while maintaining high performance and security standards.

Market Company Players

- Qualcomm Technologies, Inc.

- Broadcom Inc

- ON Semiconductor Connectivity Solutions, Inc.

- Intel Corporation

- Celeno

- MediaTek Inc.

- Texas Instruments Incorporated

- Cypress Semiconductor Corporation

- STMICROELECTRONICS N.V.

- NXP SEMICONDUCTORS N.V.

- Other key players

Recent Developments

Recent developments in the Wi-Fi chipset market include the ongoing rollout of Wi-Fi 6 and Wi-Fi 6E solutions, with increased focus on improving coverage and speed. Companies are also accelerating the adoption of Wi-Fi 7 chipsets, promising even faster speeds and better performance, particularly for high-density networks and advanced applications.

Conclusion

The Wi-Fi 6, 6E, and 7 chipset market is poised for robust growth, driven by increasing demand for high-speed connectivity. While US tariffs may introduce short-term challenges, the market’s long-term outlook remains positive, with significant opportunities in commercial and residential applications, especially in emerging regions like Asia-Pacific and Latin America.