Table of Contents

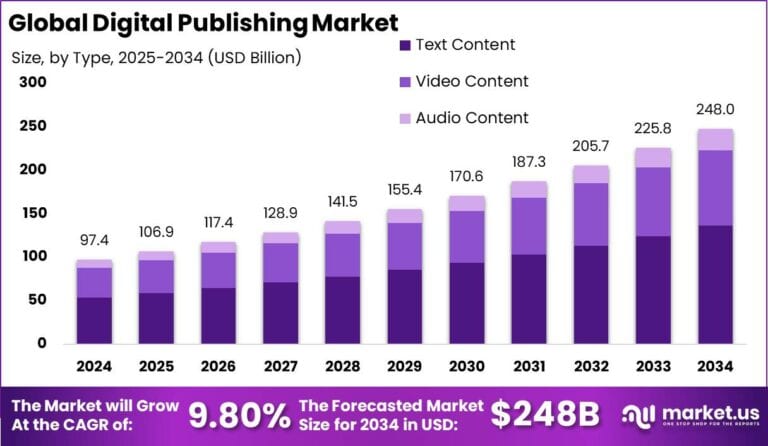

The global Digital Publishing Market is poised for strong growth, expected to rise from USD 97.36 billion in 2024 to approximately USD 248 billion by 2034, registering a CAGR of 9.8% during 2025–2034. In 2024, North America dominated with a 35.7% share, generating USD 34.7 billion, while the U.S. alone contributed USD 32.8 billion, driven by demand for digital-first content across news, education, and entertainment. Key market segments such as Text Content (55%), E-books (20%), and Subscription-Based Models (61%) underscore a shift toward accessible and personalized content, with smartphones emerging as the primary consumption device (53% share).

How Tariffs Are Impacting the Economy

Tariffs, particularly those implemented by the U.S. on China and other trading partners, are exerting pressure on global economic flows. Increased import duties on paper, printing equipment, and digital devices have directly impacted production costs in digital publishing.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/global-digital-publishing-market/free-sample/

According to the U.S. International Trade Commission, tariffs on Chinese goods, valued at over USD 300 billion, have strained supply chains, elevating costs for digital infrastructure and devices essential for content delivery. As companies pass these costs on to consumers, inflationary pressures rise, dampening purchasing power and slowing digital service subscriptions. Moreover, retaliatory tariffs hinder global collaboration, especially for firms reliant on international editorial and publishing ecosystems.

Impact on Global Businesses

Tariffs have pushed operational costs upward, particularly in regions where digital publishing is reliant on imported tech infrastructure. This is forcing businesses to restructure supply chains, shifting sourcing to tariff-exempt regions like Southeast Asia.

- Rising Costs: Tariffs on semiconductors, screens, and smart devices raise hardware costs, impacting e-readers and mobile-based digital publishing.

- Supply Chain Shifts: Many firms are now looking to nearshore suppliers or domestic manufacturing to avoid unpredictable trade barriers.

- Sector-Specific Impacts: Education and STM publishing sectors are hit hardest due to the need for frequent updates and high-tech content platforms, pushing businesses toward SaaS models to mitigate risk.

Strategies for Businesses

- Diversify suppliers and production hubs to minimize tariff exposure.

- Invest in cloud infrastructure and digital assets to reduce physical hardware dependency.

- Adopt subscription and bundled pricing models to secure recurring revenue amid cost pressures.

- Leverage localization strategies to bypass cross-border tariff complications.

Key Takeaways

- Digital publishing to grow at 9.8% CAGR, reaching USD 248 Bn by 2034.

- Tariffs increase input and tech infrastructure costs.

- Supply chains are shifting to reduce tariff exposure.

- North America leads the market with a 35.7% share in 2024.

- Subscription models (61% share) are mitigating pricing instability.

- Text and STM content remain dominant and resilient.

➤ Get full access now @ https://market.us/purchase-report/?report_id=147870

Analyst Viewpoint

Despite tariff-related disruptions, the digital publishing industry is adapting rapidly. Currently, businesses are navigating pricing volatility and logistical uncertainty. However, long-term prospects remain robust, fueled by digital transformation in education, expanding smartphone penetration, and innovation in immersive content formats. Looking ahead, the focus will shift from volume to value, with AI-driven personalization and regional content strategies unlocking new consumer segments.

Regional Analysis

North America leads the global digital publishing space with a market share exceeding 35.7%, followed by Europe and Asia-Pacific. The U.S., driven by high internet penetration and tech innovation, dominates regional revenue. Meanwhile, Asia-Pacific is emerging as a high-growth zone due to rapid urbanization and mobile internet adoption. Europe, with its strict data laws, is seeing moderate but stable expansion led by education publishing and language learning platforms.

➤ Discover More Trending Research

- Predictive Policing in Smart Cities Market

- Solar Powered UAVs Market

- AI in ESG and Sustainability Market

- NeuroMarketing Market

Business Opportunities

- EdTech integration with K-12 and university curricula opens vast opportunities for educational content creators.

- Localized publishing in regional languages is gaining traction in emerging markets.

- AI-powered content recommendation systems are driving higher user engagement.

- AR/VR-based digital magazines and e-books offer new monetization models.

- Independent publishing platforms are enabling direct creator-to-consumer models, bypassing traditional channels.

Key Segmentation

- By Content Type: Text, Video, Audio, Graphics

- By Format: E-books, Digital Magazines, Online Journals, Blogs

- By Revenue Model: Subscription-based, Ad-supported, Pay-per-download

- By Device: Smartphones, Tablets, Laptops, E-readers

- By Application: Education, Entertainment, STM (Scientific, Technical, Medical), Marketing

- In 2024, Text Content held a dominant 55% market share, followed by E-books (20%). Subscription-based models are favored for stability and user convenience, while smartphones led consumption at 53%.

Key Player Analysis

Industry leaders are leveraging AI, analytics, and cloud publishing platforms to scale operations and personalize content. They are investing heavily in mobile-first design, subscription bundles, and DRM tools. Innovation remains high, especially in language personalization, audio formats, and interactive publishing. These firms are also increasingly partnering with educational institutions and media houses to diversify offerings and strengthen user bases.

Top Key Players in the Market

- Adobe Inc.

- Amazon.com Inc.

- Apple Inc.

- Thomson Reuters Corp.

- Netflix Inc.

- Comcast Corp.

- RELX Group plc

- Xerox Corporation

- BuzzFeed, Inc.

- 1854 Media Limited

- 911Media

- 24Media, Inc.

- Others

Recent Developments

Leading digital publishing platforms are investing in AI-powered content generation and NFT-based digital asset monetization, signaling a shift toward value-based and decentralized models.

Conclusion

Digital publishing is entering a transformative phase. Despite trade tensions and tariff pressures, technological advancements and evolving consumer behaviors are driving sustainable long-term growth. Adaptive strategies will be the key to thriving in this dynamic environment.