Table of Contents

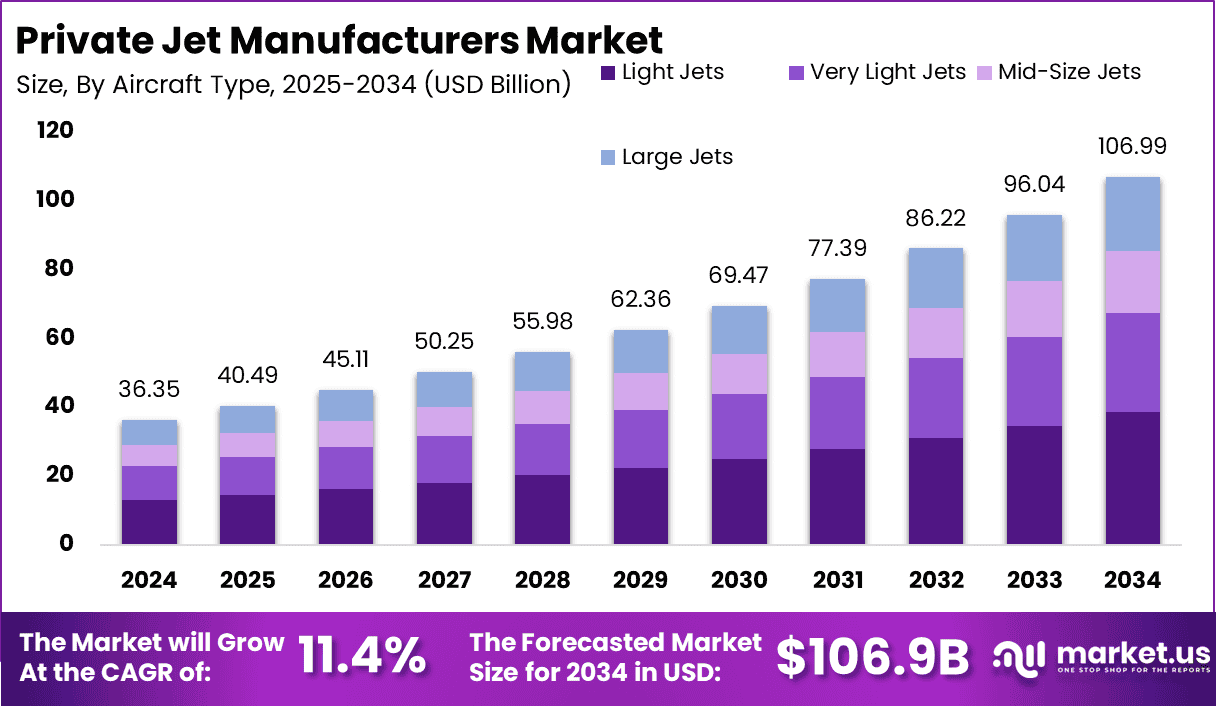

The Global Private Jet Manufacturers Market is set for robust expansion, projected to grow from USD 36.35 billion in 2024 to USD 106.99 billion by 2034, registering a CAGR of 11.4% during the forecast period (2025–2034). In 2024, North America held a dominant 48.5% share, contributing USD 17.6 billion in revenue.

Growth is driven by increased demand for business aviation, rising ultra-high-net-worth individuals (UHNWIs), and post-pandemic preferences for private air travel. Technological advancements in fuel efficiency, hybrid-electric propulsion, and customized cabin interiors further accelerate market adoption.

How Tariffs Are Impacting the Economy

Tariffs on aerospace materials such as aluminum, titanium, and avionics have raised input costs for jet manufacturers. According to the U.S. International Trade Commission, tariffs on Chinese and European aluminum imports have elevated material expenses by up to 10%. These increases are passed down through the supply chain, inflating production costs and final aircraft prices.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/private-jet-manufacturers-market/free-sample/

As U.S. exports face retaliatory duties in Asia and Europe, international demand has weakened, particularly from price-sensitive institutional buyers. The broader impact includes reduced capital spending, hindered innovation pipelines, and slowed job creation within aerospace manufacturing hubs. Tariffs not only disrupt pricing equilibrium but also hinder strategic global trade relationships that the private aviation sector depends on.

Impact on Global Businesses

Rising Costs: Tariff-induced inflation on raw materials and imported systems has forced manufacturers to revise pricing strategies, affecting affordability and customer acquisition.

Supply Chain Shifts: Companies are realigning sourcing operations toward lower-tariff nations such as Brazil, Mexico, and select Southeast Asian countries to maintain profitability.

Sector-Specific Impacts:

- Luxury Jet Segments: Impacted by costlier imported materials used in high-end interiors and cockpit systems.

- Mid-sized OEMs: Facing margin pressures due to dependency on global supply chains.

- Aftermarket Services: Higher tariffs on parts affect MRO operations, driving up maintenance costs.

Strategies for Businesses

- Localize production and component sourcing to minimize tariff exposure.

- Form strategic alliances within tariff-free zones to stabilize supply chains.

- Invest in 3D printing and advanced materials to reduce reliance on taxed imports.

- Develop fuel-efficient and low-emission aircraft to meet environmental regulations and appeal to sustainability-focused clients.

Key Takeaways

- Private Jet Manufacturers Market to reach USD 106.99 billion by 2034

- CAGR of 11.4% from 2025 to 2034

- Tariffs increase production costs by up to 10%

- North America leads with 48.5% market share

- The sector is adapting through tech innovation, strategic partnerships, and regional expansion

- Demand driven by UHNWIs, corporate mobility, and sustainability priorities

➤ Get full access now @ https://market.us/purchase-report/?report_id=148028

Analyst Viewpoint

Currently, the industry is undergoing recalibration due to supply chain disruptions and rising input costs. However, the outlook remains optimistic. Increasing demand for long-range and eco-friendly jets, along with digital cockpit integration, is expected to drive profitability. Private jet manufacturers embracing smart manufacturing, green technologies, and modular design will lead the future of personalized air mobility, especially in developing economies and rising luxury markets.

Regional Analysis

North America leads with over 48.5% market share in 2024 due to strong domestic demand, advanced aerospace infrastructure, and a high concentration of manufacturers. Europe follows with a growing market for light and mid-size jets, supported by tourism and business aviation recovery. Asia-Pacific is expected to be the fastest-growing region, driven by increasing disposable incomes, expanding infrastructure, and new charter service entrants in China and India. The Middle East also presents opportunities due to rising VIP and government fleet demand.

➤ Discover More Trending Research

- Digital Publishing Market

- Sustainable Finance Market

- Precision Guided Munitions Market

- AI in Quick Service Restaurants Market

Business Opportunities

There is a surge in demand for eco-efficient aircraft with hybrid or electric propulsion. Smart cabin systems and autonomous flight technology are becoming selling points. Opportunities are emerging in fleet modernization programs across the government and corporate sectors.

Fractional ownership models and digital booking platforms are creating new access points for consumers. Companies entering emerging economies with localized production and customized offerings can significantly capitalize on first-mover advantages. There is also rising interest in connectivity-driven interiors, particularly in business-class configurations.

Key Segmentation

The market is segmented based on:

- Aircraft Type: Light, Mid-size, Large

- End-Use: Private, Commercial, Government, Charter Services

- System Components: Avionics, Propulsion, Cabin Interiors, Airframe

- Range: Short-range, Mid-range, Long-range

- In 2024, mid-size and long-range jets saw the most traction due to increasing international business travel. Charter and private use segments dominate demand, driven by customization needs and reduced commercial flight preferences. Avionics and propulsion systems remain the core areas for innovation and investment.

Key Player Analysis

Major manufacturers are heavily investing in next-generation avionics, lightweight composite materials, and hybrid-electric propulsion. Focus areas include enhancing fuel efficiency, reducing carbon footprints, and developing modular cabin solutions tailored to individual customers.

Companies are expanding globally through strategic alliances, joint ventures, and acquisitions to access new customer bases and strengthen regional presence. A strong emphasis is placed on R&D, with leading firms building dedicated innovation centers for sustainability and digital integration. Flexibility and scalability remain key differentiators in a competitive environment.

Recent Developments

Several manufacturers unveiled hybrid-electric prototypes and next-gen avionics platforms in 2024, signaling a pivot toward environmentally sustainable and AI-integrated aircraft systems.

Conclusion

The private jet manufacturing industry is on a strong upward trajectory, driven by shifting consumer expectations, sustainability trends, and innovation. Despite the economic drag of tariffs, proactive strategies and technology adoption are positioning the market for long-term success.