Table of Contents

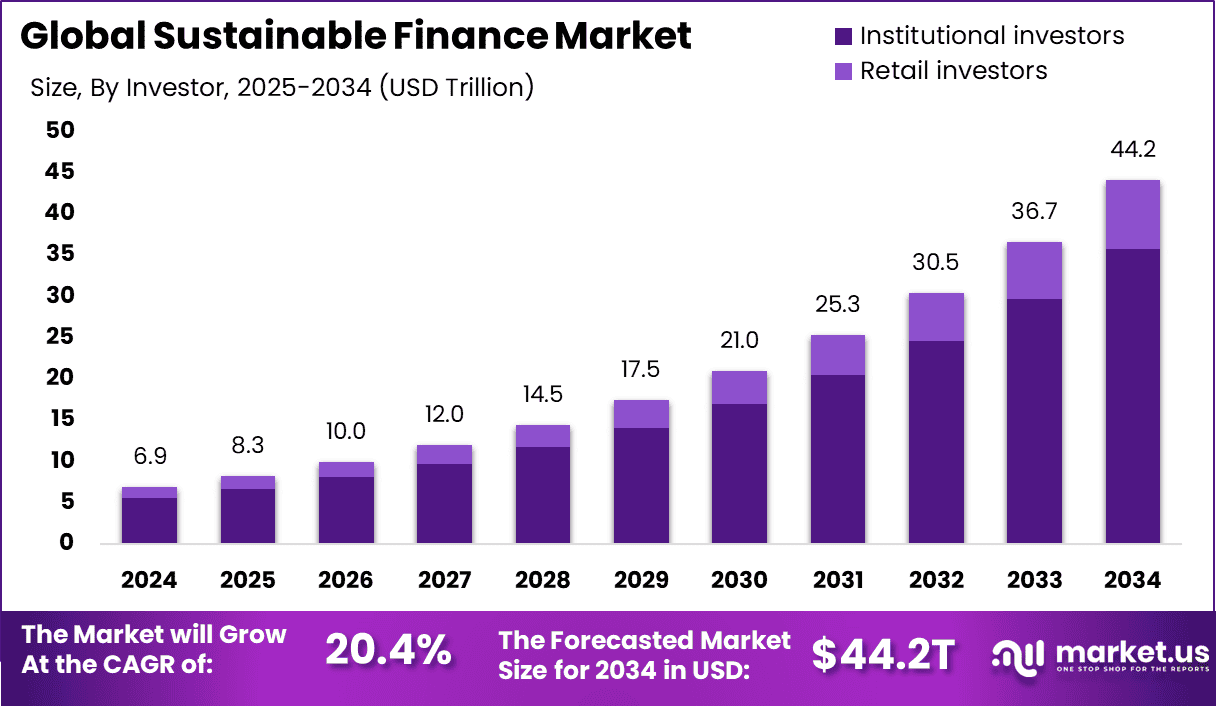

The Global Sustainable Finance Market is set for exponential growth, projected to rise from USD 6.9 trillion in 2024 to USD 44.2 trillion by 2034, expanding at a CAGR of 20.4% from 2025 to 2034. In 2024, Europe dominated the market, accounting for over 43.1% of the global share and generating USD 2.9 trillion in revenue.

This surge is driven by rising climate-conscious investments, ESG regulations, and increased demand for green bonds and social impact funds. Financial institutions worldwide are shifting capital toward low-carbon, socially responsible, and ethically governed projects, aligning profit with long-term environmental and social value.

How Tariffs Are Impacting the Economy

Tariffs, particularly on renewable technologies and green infrastructure components, have slowed sustainable project implementation and increased the cost of capital. U.S. tariffs on imported solar panels, batteries, and electric vehicle parts—originally aimed at protecting domestic manufacturers—have led to price hikes of 10–15% on green energy projects, delaying infrastructure deployment.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/sustainable-finance-market/free-sample/

According to the U.S. International Trade Commission, these tariffs have resulted in billions in lost potential investments in climate projects. Additionally, higher import costs undermine investor confidence in large-scale sustainability ventures, discouraging cross-border capital flows and increasing project risks. Tariff-driven inflation and uncertainty have become major headwinds, particularly in emerging markets that rely on foreign tech and capital to build green economies.

Impact on Global Businesses

Rising Costs: Tariffs have escalated costs for green technologies, including solar modules, wind turbines, and clean transport components, leading to reduced ROI for sustainability-linked projects.

Supply Chain Shifts: Many companies are reshoring or diversifying their supply chains to tariff-exempt countries, driving up short-term logistics and compliance costs.

Sector-Specific Impacts:

- Renewable Energy: Higher hardware costs delay project timelines.

- Green Construction: Tariffs on eco-friendly building materials stall LEED-certified developments.

- EV and Battery Manufacturing: Increased reliance on regional partnerships to circumvent tariffed imports.

Strategies for Businesses

- Establish supplier networks in tariff-free regions to reduce input volatility.

- Leverage local materials and manufacturing to ensure supply chain continuity.

- Adopt modular project designs to enhance scalability and cost efficiency.

- Form public-private partnerships to unlock regulatory incentives and green financing.

- Invest in technology that qualifies for domestic tax credits and subsidies.

Key Takeaways

- Sustainable finance to reach USD 44.2 trillion by 2034

- CAGR of 20.4% reflects increasing ESG mandates and investor demand

- Europe dominates with a 43.1% share

- Tariffs slow project rollout and raise financing risks

- Green bonds, ESG funds, and sustainability-linked loans are key growth drivers

- Businesses are adapting by reshoring supply chains and investing in local solutions

➤ Get full access now @ https://market.us/purchase-report/?report_id=148041

Analyst Viewpoint

Currently, the sustainable finance market is evolving from a niche ethical initiative to a mainstream investment mandate. While tariffs and global trade tensions pose structural challenges, the long-term trajectory remains highly positive.

With mounting regulatory pressures, investor activism, and corporate ESG goals, the market will continue to expand rapidly. Future growth will be driven by the digitization of green disclosures, the tokenization of sustainable assets, and increased climate risk assessments. Firms that integrate sustainability into their core strategy will emerge as market leaders in the decade ahead.

Regional Analysis

Europe leads the sustainable finance market with over 43.1% of global revenue, backed by strong regulatory frameworks like the EU Taxonomy and SFDR (Sustainable Finance Disclosure Regulation). North America is seeing accelerated adoption, with green bond issuance and ESG compliance on the rise. Asia-Pacific, particularly China and Japan, is making significant strides through public infrastructure spending and green finance pilot zones. Middle Eastern and African markets are showing potential, supported by climate-focused sovereign funds and multilateral financing programs aimed at decarbonization and inclusive growth.

➤ Discover More Trending Research

- Renewable Drone Market

- Digital Education Content Market

- K-12 Game-Based Learning Market

- Digital Publishing Market

Business Opportunities

The transition to sustainable finance opens up diverse opportunities, including green bonds, climate-resilient infrastructure investments, sustainable insurance, and ESG-focused asset management. There is growing investor appetite for social bonds targeting affordable housing, health, and education. SMEs offering carbon reduction or circular economy solutions are becoming acquisition targets.

Blockchain-enabled ESG reporting tools present scalability for transparent and traceable sustainability financing. Financial institutions can tap into blended finance models to bridge funding gaps in high-risk but high-impact green projects, particularly in developing nations.

Key Segmentation

The sustainable finance market can be segmented into:

- By Product Type: Green Bonds, Social Bonds, Sustainability-Linked Loans, ESG Funds, Green Equity

- By End Use: Energy, Infrastructure, Transportation, Agriculture, Healthcare, Real Estate

- By Financial Institutions: Banks, Asset Managers, Insurance Firms, Development Finance Institutions

- By Investment Mode: Public, Private, Public-Private Partnerships

In 2024, Green Bonds and ESG Funds held the largest share, driven by high demand from institutional investors and regulatory-backed guidelines. Energy and infrastructure projects remain the primary beneficiaries, while agriculture and healthcare are gaining relevance in climate adaptation investments.

Key Player Analysis

Leading firms in the sustainable finance space are prioritizing transparency, ESG analytics integration, and impact measurement frameworks. These players are deploying AI tools to assess environmental risks, leveraging satellite and IoT data for due diligence. Strategic focus remains on cross-border collaborations, green fund launches, and regulatory compliance automation.

Many firms are also investing in carbon credit trading platforms, real-time ESG scoring engines, and fintech partnerships to scale sustainable investment offerings. By aligning with global climate goals, these entities are enhancing stakeholder trust and ensuring long-term competitiveness.

Sustainable Finance Market Companies

- BlackRock, Inc.

- State Street Corporation

- Morgan Stanley

- UBS

- JPMorgan Chase & Co.

- Franklin Templeton Investments

- Amundi US

- The Bank of New York Mellon Corporation

- Deutsche Bank AG

- Goldman Sachs

Recent Developments

In 2024, several major institutions launched blockchain-based green bond platforms to improve transparency and investor trust, while new ESG rating tools powered by AI began gaining traction among asset managers.

Conclusion

The sustainable finance market is rapidly scaling, offering powerful opportunities to align capital with climate and social priorities. Despite short-term friction from tariffs, long-term momentum remains strong due to regulatory push and stakeholder demand for ethical investing.