Table of Contents

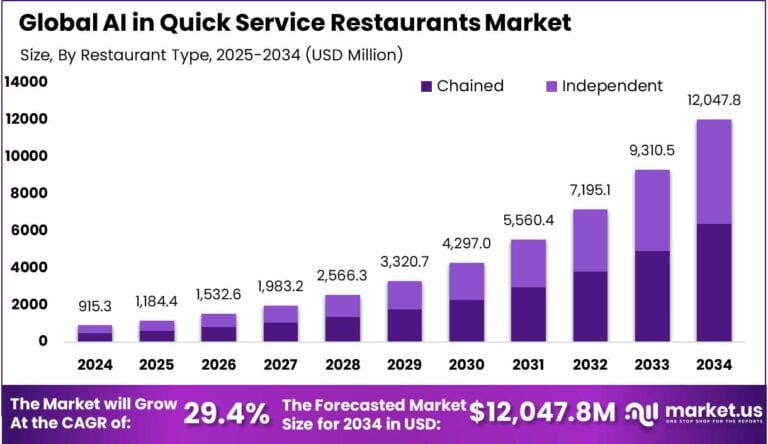

The AI in Quick Service Restaurants (QSR) Market is witnessing unprecedented growth, projected to surge from USD 915.3 million in 2024 to approximately USD 12,047.8 million by 2034, expanding at a CAGR of 29.4% during the forecast period (2025–2034).

In 2024, North America led the global market with a 32.4% share, generating USD 296 million, while the U.S. market alone contributed USD 266.9 million, expected to grow at a CAGR of 27.1%. The sector is being fueled by the rising demand for automation, personalized customer experiences, and operational efficiency in the fast-food industry, driven by AI integration.

How Tariffs Are Impacting the Economy

Tariffs on imported hardware components, such as sensors, processors, and touchscreen systems, have increased the cost of deploying AI solutions in QSRs. According to the U.S. International Trade Commission, tariffs on Chinese electronics and AI-enabling hardware have added 8–12% to the overall system integration costs.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/ai-in-quick-service-restaurants-market/free-sample/

This has slowed deployment rates, especially for small and mid-sized QSR chains that depend on affordable technology to automate ordering, inventory, and customer interaction. Higher import duties also limit innovation by discouraging experimentation with emerging tech due to budget constraints.

These economic pressures contribute to pricing instability in an already cost-sensitive industry, forcing QSRs to either absorb the costs or pass them on to consumers, ultimately impacting competitiveness and growth.

Impact on Global Businesses

Rising Costs: Hardware tariffs have driven up the price of AI-powered kiosks, robotic kitchen equipment, and cloud-based POS systems, affecting AI adoption rates.

Supply Chain Shifts: Many companies are relocating sourcing to regions like Vietnam, Taiwan, and Mexico to reduce tariff impact, though this involves restructuring logistics and vendor partnerships.

Sector-Specific Impacts:

- Fast Food Chains: Struggle with ROI on AI investments due to equipment cost spikes.

- Tech Vendors: Delay innovation cycles to manage increased sourcing and production expenses.

- Franchise Owners: Face difficulties justifying costlier upgrades under standardized operating budgets.

Strategies for Businesses

- Restructure supplier networks to focus on low-tariff countries or domestic options.

- Invest in software-driven AI enhancements to reduce dependency on imported hardware.

- Leverage tax incentives and local government support for automation.

- Adopt cloud-based AI solutions to minimize on-premise hardware investments.

- Enhance vendor collaboration for shared R&D costs and flexible pricing models.

Key Takeaways

- Market to reach USD 12.05 billion by 2034, CAGR of 29.4%

- North America leads with 32.4% market share in 2024

- Tariffs raise hardware integration costs by 8–12%

- Cost inflation affects small and mid-sized QSR tech adoption

- Firms shifting toward software AI and localized sourcing

- U.S. market projected to grow at 27.1% CAGR

➤ Get full access now @ https://market.us/purchase-report/?report_id=148063

Analyst Viewpoint

The current QSR landscape is evolving rapidly, with AI transforming customer engagement, kitchen operations, and business analytics. Although tariff-related cost pressures challenge scalability, the outlook remains highly positive.

Demand for AI-driven personalization, voice ordering, predictive maintenance, and automated inventory will continue to grow. Over the next decade, firms that embrace modular AI platforms and partner-driven ecosystems will dominate the market. As costs normalize and domestic production expands, AI integration will become a core competitive differentiator in the QSR space.

Regional Analysis

North America dominates the AI in the QSR market with over 32.4% share, driven by early tech adoption, robust fast-food infrastructure, and strong vendor partnerships. The U.S. alone contributes USD 266.9 million, with aggressive expansion of AI ordering systems and drive-thru automation. Asia-Pacific is expected to see rapid growth due to population density and mobile ordering culture, led by China, India, and Japan. Europe is witnessing steady adoption, with sustainability and labor efficiency driving AI investment in QSR chains.

➤ Discover More Trending Research

- Earthquake Insurance Market

- Smart Asset Tracking Apps Market

- Blockchain for Supply Chain Traceability Market

- Full-Service Restaurants (FSR) Market

Business Opportunities

The AI revolution in QSRs presents multiple opportunities. Voice-enabled drive-thru systems, dynamic menu boards, and AI-powered kitchen analytics are becoming mainstream. There is also rising interest in personalized loyalty programs, predictive demand planning, and robotic cooking assistants.

Small chains and franchises can adopt cloud-based AI modules with minimal hardware, opening doors to affordable scalability. Vendors offering integrated POS-AI packages and real-time customer insights will find increasing demand. Emerging markets also offer untapped potential for low-cost, scalable AI deployments.

Key Segmentation

The AI in the QSR market is segmented by:

- By Offering: Hardware, Software, Services

- By Application: Order Management, Inventory Management, Predictive Maintenance, Customer Relationship Management, Marketing & Advertising

- By Deployment: On-Premise, Cloud-Based

- By End-User: Large QSR Chains, Independent Outlets, Franchise Owners

In 2024, Order Management and Customer Relationship Management segments led the market, fueled by demand for efficient service and tailored customer experiences. Cloud-based deployments are gaining traction due to cost-effectiveness and scalability.

Key Player Analysis

Leading companies in the AI in Quick Service Restaurants Market are focusing on developing modular, scalable solutions that combine AI with IoT and cloud infrastructure. They are investing in natural language processing for voice ordering, machine vision for kitchen automation, and predictive analytics to optimize staffing and ingredient usage.

Many firms are forming strategic alliances with POS providers and franchise operators to ensure seamless integration. These players are also driving innovation through AI training datasets, customer behavior analysis, and automated quality assurance features to support QSR operations globally.

Top Key Players in the Market

- Presto

- Omilia

- Conversable

- Brightloom

- ClearObject

- Restoke

- Owner.com

- Zebra Medical Vision

- Qube

- DeepVision

- Rex Animal

- Simbe Robotics

- Fritz AI

- Others

Recent Developments

In 2024, several vendors launched AI-integrated self-service kiosks with multilingual voice support and expanded partnerships with global QSR chains to enhance drive-thru analytics and kitchen automation.

Conclusion

AI in QSRs is rapidly redefining the food service experience. Despite cost challenges from tariffs, innovation, cloud adoption, and global demand are powering the sector’s trajectory. Businesses that act early will secure long-term operational and competitive advantages.