Table of Contents

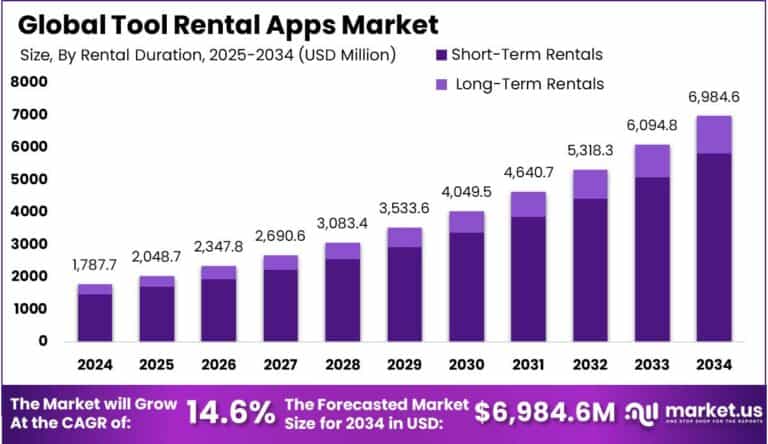

The Global Tool Rental Apps Market is witnessing substantial growth, projected to expand from USD 1.79 billion in 2024 to USD 6.98 billion by 2034, growing at a CAGR of 14.60% during the forecast period from 2025 to 2034. In 2024, North America led the market with a 36.1% share, generating USD 645 million in revenue.

The increasing popularity of do-it-yourself (DIY) projects, along with the rise of construction and industrial equipment rental, is driving the adoption of tool rental apps. These apps offer consumers and businesses easy access to a wide range of tools, reducing the need for long-term purchases and enhancing cost-efficiency.

How Tariffs Are Impacting the Economy

Tariffs on imported tools, machinery parts, and equipment are affecting the cost structure for tool rental app providers. The U.S. International Trade Commission reports that tariffs on imported tools, particularly from China, have increased costs by 8–12%, impacting both tool rental prices and the operational costs for app providers.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/tool-rental-apps-market/free-sample/

This increase in tariffs makes it more expensive for businesses to stock rental equipment, which can lead to higher prices for consumers. Additionally, the ongoing supply chain disruptions due to tariffs and geopolitical tensions are delaying the availability of new tools, thereby hindering market growth.

Businesses are forced to either absorb these costs or pass them on to customers, impacting demand for rental services in price-sensitive regions. Moreover, tariffs have disrupted cross-border trade, particularly for countries that rely on international suppliers for tool procurement, slowing down the expansion of tool rental services in emerging markets.

Impact on Global Businesses

Rising Costs: The increase in tariffs on imported tools, equipment, and machinery components is raising prices for both rental companies and end-users, impacting affordability.

Supply Chain Shifts: Tool rental companies are adjusting their sourcing strategies by moving to tariff-free countries or localizing production to mitigate the effects of import duties.

Sector-Specific Impacts:

- Tool Rental Companies: Higher costs for acquiring and maintaining rental inventory, which can result in reduced profit margins.

- Manufacturers: Facing delays in production and delivery due to tariffs on essential raw materials, impacting product availability.

- Consumers: Price hikes for tool rentals and fewer rental options may deter DIY enthusiasts and businesses from utilizing rental services.

Strategies for Businesses

- Explore local manufacturing partnerships to reduce reliance on international imports and mitigate tariffs.

- Optimize fleet management through data-driven algorithms to ensure high utilization and reduce operational costs.

- Diversify sourcing channels by establishing relationships with suppliers from tariff-free regions.

- Leverage technology to improve rental logistics, such as AI-driven fleet management and cloud-based platforms to streamline operations.

- Engage with policymakers to advocate for tariff exemptions or reductions on rental equipment.

Key Takeaways

- The tool rental market is projected to reach USD 6.98 billion by 2034 with a CAGR of 14.6%

- North America holds 36.1% of the market in 2024, with USD 645 million in revenue

- Tariffs have increased tool costs by 8–12%, impacting both businesses and consumers

- Supply chain disruptions from tariffs hinder new inventory availability and slow market expansion

- Companies adopting local sourcing, technology adoption, and optimized fleet management will lead the market

- Government collaboration is key for reducing tariff impacts on tool rental businesses

➤ Get full access now @ https://market.us/purchase-report/?report_id=143822

Analyst Viewpoint

Despite tariff challenges, the tool rental apps market is poised for significant growth driven by increased demand for short-term rentals in DIY and professional sectors. While tariffs increase operational costs, businesses are adapting by optimizing fleets, streamlining supply chains, and leveraging technology to reduce overall costs.

The market’s long-term growth trajectory remains positive, with technological advancements in app development and logistics, along with increasing consumer preference for rental solutions. The shift toward sustainable practices and affordable options will further propel growth, especially as urbanization and construction activities continue to rise globally.

Regional Analysis

North America leads the global tool rental apps market with a 36.1% market share in 2024, driven by a robust construction sector and high demand for DIY home improvement projects. The U.S. continues to dominate, with an increasing number of consumers using rental apps for both personal and business use.

Europe follows closely, with countries like Germany and the UK driving demand for professional-grade tools. Asia-Pacific is emerging as a fast-growing region, particularly China and India, where urbanization and construction activities are increasing. Latin America and Africa show moderate growth, as the infrastructure and real estate sectors gradually develop.

➤ Discover More Trending Research

- Luxury E-commerce Market

- Home Appliance Rental Apps Market

- Video Commerce Market

- Predictive Maintenance in Maritime Market

Business Opportunities

The increasing demand for sustainable, cost-effective tools creates opportunities for businesses to innovate in battery-powered, energy-efficient equipment and eco-friendly tools. As more people turn to DIY projects, e-commerce-enabled rental services, which provide quick access and delivery, will expand.

Companies can explore partnerships with construction firms and urban developers for long-term rental agreements. The expansion of smart home services and small-scale industrial applications offers growth in niche markets, while cross-border expansion into emerging markets with developing infrastructure and growing construction needs presents further opportunities.

Key Segmentation

The tool rental apps market is segmented by:

- By Application: DIY Projects, Professional/Industrial Use, Construction & Renovation

- By Product Type: Power Tools, Hand Tools, Garden Tools, Construction Equipment

- By Deployment: Cloud-Based, On-Premise

- By End-User: Individual Consumers, Small Enterprises, Large Enterprises

In 2024, the DIY Projects segment holds the largest market share, driven by the popularity of home improvement and renovation activities. The Construction Equipment category is growing rapidly, with companies seeking rental services for heavy machinery and equipment.

Key Player Analysis

Key players in the tool rental apps market are focusing on cloud-based solutions to facilitate seamless rentals, AI-driven logistics for efficient fleet management, and partnerships with large enterprises for long-term contracts.

Additionally, these companies are increasingly integrating smart features into rental tools for better usage monitoring and customer experience. Firms are also investing in user-friendly apps, making it easy for both businesses and consumers to rent tools on demand. The rise of subscription-based models is also gaining traction, ensuring recurring revenue streams and customer retention.

Top Key Players in the Market

- Home Depot Tool Rental

- Lowe’s Tool Rental

- United Rentals

- Herc Rentals

- Sunbelt Rentals

- Acme Tools

- Bunnings

- RentMyTool

- Point of Rental

- EquipmentShare

- Other Major Players

Recent Developments

In 2024, several tool rental companies introduced AI-powered predictive maintenance systems and smart rental options to streamline operations and improve customer satisfaction. New partnerships with hardware stores and construction firms are also increasing tool availability and extending market reach.

Conclusion

The tool rental apps market is poised for significant growth, driven by increasing demand for convenience, cost-efficiency, and eco-friendly solutions. Although tariffs have impacted operational costs, businesses are adapting by optimizing fleets, innovating rental services, and strategically localizing sourcing. The market’s future remains bright, with technological innovation and sustainable practices playing key roles in its evolution.