Table of Contents

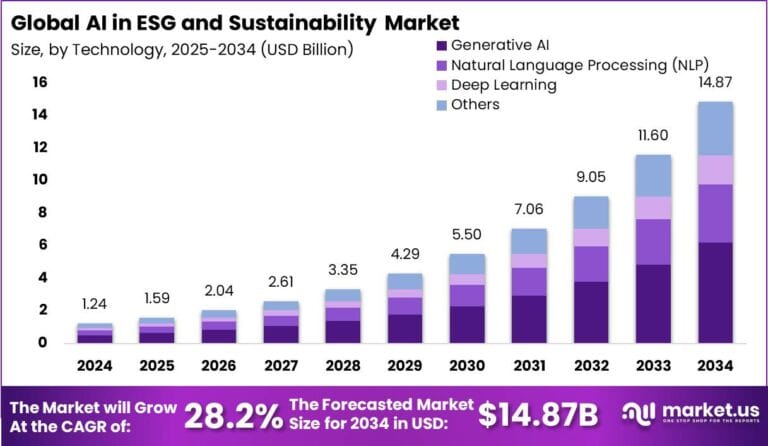

The global AI in ESG and Sustainability market was valued at USD 1.24 billion in 2024 and is projected to reach USD 14.87 billion by 2034, growing at a CAGR of 28.20% from 2025 to 2034. North America leads the market, capturing 43.8% of the share in 2024, generating approximately USD 0.54 billion, with the U.S. market alone valued at USD 0.48 billion.

The increasing integration of AI technologies into Environmental, Social, and Governance (ESG) strategies for sustainable development is a major factor driving the market’s growth. This growth is fueled by the increasing demand for data-driven solutions to address sustainability challenges and regulatory requirements.

How Tariffs Are Impacting the Economy

The imposition of tariffs has had a notable impact on the global economy, particularly in sectors such as AI and sustainability. Increased tariffs on goods, including technology components, have raised production costs for businesses using AI in ESG and sustainability projects.

The higher costs for raw materials, electronics, and components necessary for AI-powered sustainability tools can lead to increased prices for businesses and consumers alike. Additionally, supply chain disruptions due to tariffs have resulted in delays in AI technology production, impacting the availability of advanced solutions in ESG.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/ai-in-esg-and-sustainability-market/free-sample/

These challenges are forcing companies to reassess their supply chains, seek alternative sourcing strategies, and pass on some of the additional costs to customers. Furthermore, the unpredictability of tariffs can affect long-term investment decisions, particularly for companies focused on sustainability and ESG, where the initial capital outlay is already significant.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Tariffs have significantly increased the cost of materials, particularly for businesses involved in AI and sustainability solutions, impacting companies that rely on international supply chains for technology components.

For instance, tariffs on electronic components like semiconductors, which are critical for AI systems, have raised operational costs for businesses. Supply chain shifts are also underway, with many companies looking for cost-effective alternatives or moving production to lower-tariff regions, which can lead to operational inefficiencies and delays in product availability.

Sector-Specific Impacts

- Technology: Increased tariffs on semiconductors and AI hardware have raised costs, slowing the pace of innovation in AI-powered sustainability solutions.

- Sustainability: The additional costs of AI-powered ESG solutions may hinder the adoption of sustainable technologies, particularly for smaller companies with tighter budgets.

- Energy: Companies in renewable energy sectors utilizing AI for energy optimization face increased operational costs, which could slow down the scaling of green technologies.

Strategies for Businesses

- Supply Chain Diversification: Businesses can explore diversifying their supply chains to regions with fewer tariff impositions to mitigate increased costs.

- Investment in Automation: To offset rising operational costs, businesses should consider automating production processes and leveraging AI technologies for greater operational efficiency.

- Long-Term Sustainability Initiatives: Investing in more sustainable technologies now can help mitigate long-term risks posed by tariffs and lead to stronger ESG outcomes.

- Regulatory Compliance: Companies should focus on regulatory compliance and transparency, utilizing AI to ensure adherence to ESG guidelines despite increasing tariffs.

➤ Get full access now @ https://market.us/purchase-report/?report_id=148131

Key Takeaways

- Tariffs have increased production and operational costs, particularly for businesses in the AI and sustainability space.

- Supply chain disruptions have forced companies to find alternative sourcing options, leading to delays and higher operational costs.

- Companies are adapting through strategies like supply chain diversification, automation, and increased investment in sustainable technologies.

- Despite challenges, the AI in the ESG market continues to grow, fueled by increasing demand for sustainable solutions.

Analyst Viewpoint

Present Outlook: The AI in ESG and sustainability market faces short-term challenges due to tariffs impacting production and supply chains. However, businesses are adapting through strategic measures, such as supply chain diversification and investing in automation, to mitigate these effects.

Future Perspective: As companies adopt more AI-driven sustainability solutions and the market for ESG technologies grows, the AI in ESG market is poised for long-term expansion, with North America continuing to lead the charge.

Regional Analysis

North America holds the largest market share for AI in ESG and Sustainability, capturing 43.8% of the global market in 2024, valued at USD 0.54 billion. The U.S. alone accounted for USD 0.48 billion and is projected to grow at a CAGR of 26.7%, indicating strong future growth prospects.

This growth is driven by the increasing adoption of AI technologies in sustainability and ESG strategies by both businesses and government entities. Europe and Asia-Pacific are also showing promising growth, with increasing investment in AI-powered ESG solutions, although they face different regional challenges related to tariffs and regulatory frameworks.

Business Opportunities

The AI in ESG market presents significant opportunities for companies focusing on energy, technology, and sustainability solutions. Businesses can explore AI-based tools for optimizing energy usage, reducing carbon footprints, and improving ESG reporting capabilities.

Furthermore, industries such as renewable energy, waste management, and agriculture are increasingly adopting AI solutions to meet sustainability goals. Additionally, companies offering AI-based ESG consulting and data analysis services are in high demand, providing opportunities for startups and established players to capitalize on the growing trend toward corporate responsibility and environmental sustainability.

➤ Discover More Trending Research

- Predictive Policing in Smart Cities Market

- Solar Powered UAVs Market

- NeuroMarketing Market

- Loitering Munition Market

Key Segmentation

- By Application: Environmental Sustainability, Social Impact, Governance, Risk Management, Reporting & Analytics

- By Industry: Technology, Energy, Financial Services, Manufacturing, Healthcare

- By Technology: AI-Driven Reporting, Machine Learning Algorithms, Data Analytics, Predictive Modeling

Each segment provides growth opportunities, with energy and financial services sectors seeing the highest demand for AI-powered ESG solutions. AI-driven reporting and data analytics are expected to be key growth areas, with machine learning algorithms enhancing predictive capabilities.

Key Player Analysis

Leading players in the AI in ESG and Sustainability market are focusing on expanding their product offerings to include AI-driven solutions for environmental monitoring, social responsibility reporting, and governance risk management.

These companies are integrating machine learning, predictive modeling, and advanced data analytics to create solutions that help businesses achieve their sustainability goals. Strategic partnerships with environmental agencies and sustainability-focused organizations are also key drivers of growth in this space.

Top Key Players in the Market

- Clarity AI

- Workiva

- Briink

- Sweep

- GaiaLens

- GLYNT.AI

- Persefoni

- Kanini

- Dcycle

- Watershed

- Sunairio

- Exowatt

- FactSet

- Others

Recent Developments

Recent advancements in AI technologies have led to more efficient and cost-effective ESG solutions. Companies are now utilizing machine learning algorithms to enhance their ESG reporting and predictive analytics capabilities, while regulatory bodies are increasing their focus on integrating AI into sustainability strategies.

Conclusion

The AI in ESG and Sustainability market is poised for substantial growth despite the short-term challenges posed by tariffs. As businesses adapt to these challenges and continue to innovate, the market is expected to expand significantly. Driven by the increasing demand for sustainable and AI-powered solutions across industries.