Table of Contents

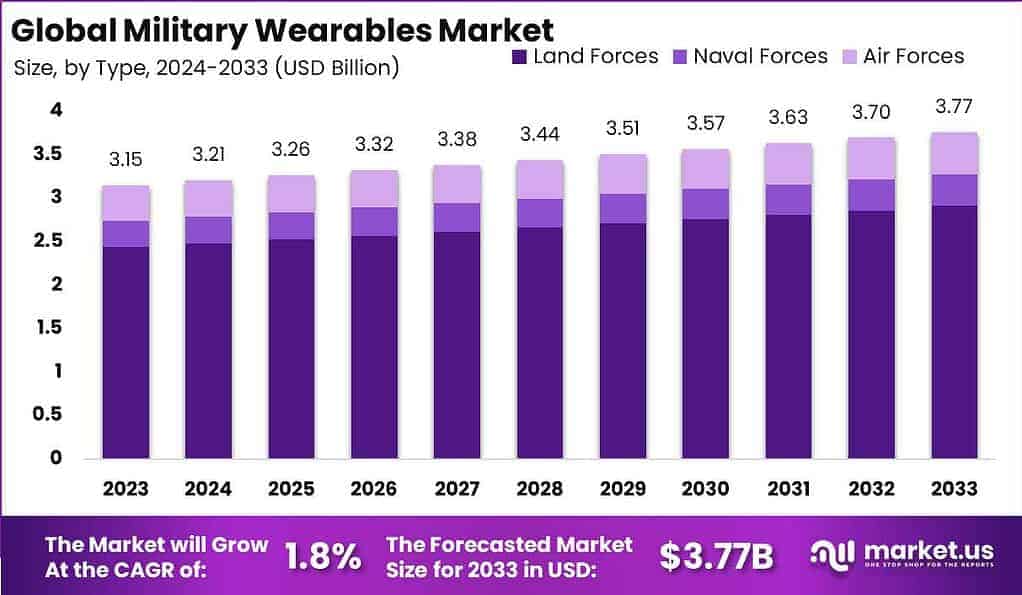

The global military wearables market is expected to grow from USD 3.15 billion in 2023 to USD 3.77 billion by 2033, registering a steady CAGR of 1.8% from 2024 to 2033. This growth is driven by the increasing adoption of advanced wearable technologies in defense applications, including situational awareness, soldier health monitoring, and communication systems. The integration of sensors, augmented reality (AR), and GPS technologies enhances operational efficiency and safety for military personnel, fueling market expansion despite moderate growth rates.

How Tariffs Are Impacting the Economy

Tariffs imposed by the U.S. on imported electronic components and materials essential for military wearables raise production costs and influence broader economic dynamics. Increased tariffs on semiconductors, sensors, and communication devices escalate manufacturing expenses for defense contractors, which can translate into higher government procurement costs.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/military-wearables-market/free-sample/

(Use corporate mail ID for quicker response)

According to Yale Budget Lab, tariffs have contributed to a 1.7% rise in consumer prices and reduced real household income by approximately $1,200 annually. Supply chain disruptions caused by tariffs compel companies to diversify suppliers or shift production domestically, resulting in increased operational costs and delivery delays. The uncertainty surrounding evolving trade policies deters investment in defense technology innovation, potentially slowing advancements in military wearables and impacting national security spending.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Military wearable manufacturers face rising component costs due to tariffs, driving supply chain diversification and increased local sourcing. These changes raise logistical complexity and short-term expenses.

Sector-Specific Impacts

- Defense Contractors: Elevated production costs delay product development and procurement cycles.

- Technology Providers: Tariffs increase R&D costs and limit hardware availability.

- Government Agencies: Higher contract costs strain defense budgets and acquisition timelines.

- Logistics & Distribution: Increased compliance and shipping costs affect supply chain efficiency.

Strategies for Businesses

Businesses counter tariff impacts by diversifying supplier bases, investing in domestic manufacturing capabilities, and adopting cloud and virtualization technologies to reduce hardware reliance. Enhancing automation and streamlining logistics improve operational efficiency. Engaging with policymakers to advocate for stable trade policies and leveraging flexible contract models further mitigate risks.

Key Takeaways

- Tariffs elevate component costs and operational expenses.

- Supply chain diversification enhances resilience.

- Sector-specific impacts affect procurement and innovation.

- Technology adoption and policy engagement are crucial.

➤ Get full access now @ https://market.us/purchase-report/?report_id=73128

Analyst Viewpoint

Despite moderate growth and tariff challenges, the military wearables market benefits from continuous defense modernization and technological integration. Companies that adapt supply chains and innovate in wearable tech will maintain competitiveness. As trade environments stabilize, investment and innovation will accelerate, bolstering military capabilities globally.

Regional Analysis

North America leads the military wearables market with extensive defense budgets and advanced technology adoption. Europe follows, driven by NATO initiatives and modernization efforts. Asia-Pacific shows gradual growth amid rising defense expenditures. Emerging regions remain limited due to budget constraints and infrastructure challenges.

➤ Discover More Trending Research

- Deadhand System Market

- AI in Cellular Networks Market

- Tax Tech Market

- AI-Powered Asset Tracking System Market

Business Opportunities

Opportunities exist in developing lightweight, durable sensors, augmented reality interfaces, and health monitoring systems. Collaborations with defense agencies for customized solutions and investment in cybersecurity for wearables offer growth potential. Expanding into emerging markets through technology transfer and joint ventures also presents avenues for expansion.

Key Segmentation

- By Product Type: Headgear, bodywear, wristwear, footwear.

- By Technology: Sensors, AR/VR, GPS, communication modules.

- By Application: Situational awareness, health monitoring, communication, training.

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Key Player Analysis

Leading players focus on R&D in miniaturization, sensor fusion, and AR capabilities. Strategic alliances with defense agencies and tech firms accelerate innovation. Emphasis on rugged, secure, and interoperable solutions addresses operational needs and regulatory compliance.

Recent Developments

Recent trends include integration of AI-powered analytics for real-time monitoring, enhanced AR displays for soldiers, and increased government funding for next-gen wearable research and development.

Conclusion

The military wearables market is poised for steady growth despite tariff pressures. Strategic supply chain management, technological innovation, and policy collaboration will enable stakeholders to capitalize on evolving defense needs.