Table of Contents

Report Overview

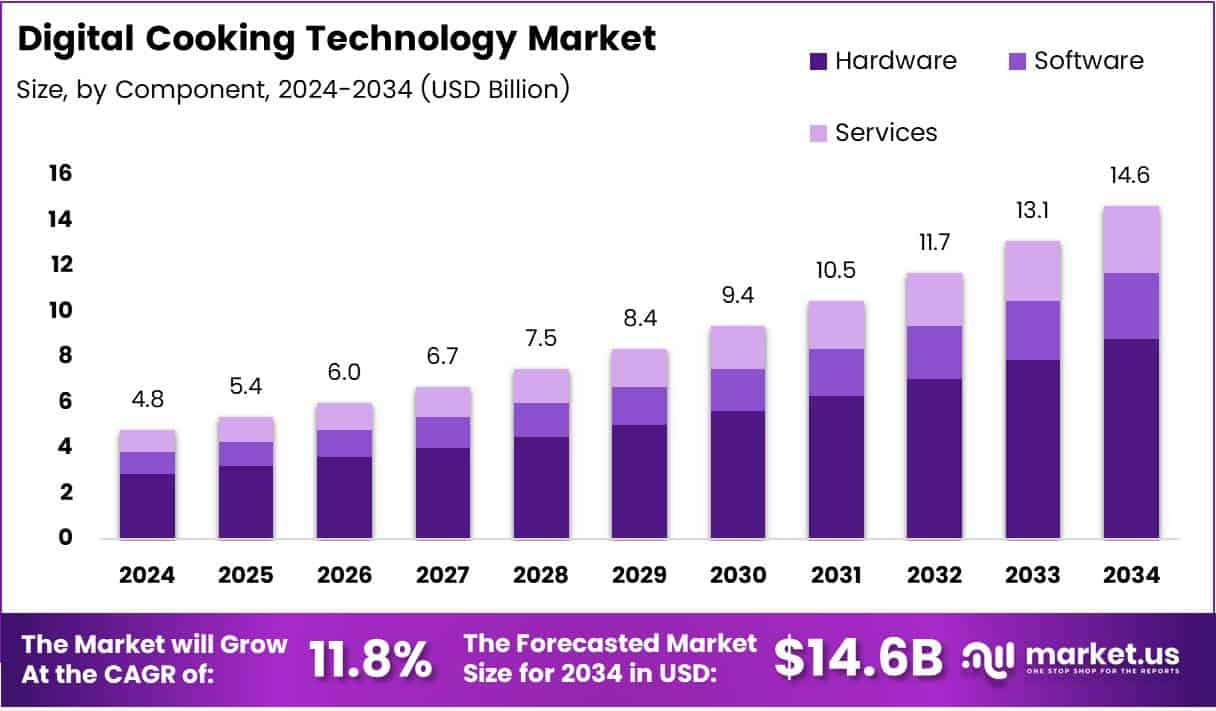

The Global Digital Cooking Technology Market size is expected to be worth around USD 14.6 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 11.8% during the forecast period from 2025 to 2034.

The Digital Cooking Technology Market is witnessing accelerated growth driven by evolving consumer behavior, technological innovation, and increased digital integration in the kitchen.

A major catalyst is the widespread use of smart devices, with 59% of 25- to 34-year-olds reportedly cooking with smartphones or tablets, highlighting the generational shift toward app-enabled cooking. This digital dependency is fueling demand for connected kitchen appliances, AI-based recipe platforms, and IoT-integrated cooking ecosystems.

The market is ripe with opportunities as consumer acceptance of automation in food services continues to rise. According to recent data, 29% of adults are open to ordering meals prepared by robots, and 37% are comfortable receiving food delivered by them—figures that spike even higher among Millennials and Gen Z. This suggests strong potential for robotic cooking solutions, automated delivery systems, and smart restaurant tech adoption.

Governments are also beginning to support digital kitchen technologies through smart home initiatives and funding for foodtech startups, particularly in the U.S., Europe, and parts of Asia-Pacific. However, regulatory clarity is essential for AI-integrated appliances and data-driven cooking solutions. As 89% of consumers now use digital recipes and 43% do so more frequently, ensuring data security, recipe standardization, and appliance interoperability will become regulatory priorities.

Key Takeaways

- Market Size: Expected to reach USD 14.6 Billion by 2034, up from USD 4.8 Billion in 2024, growing at a CAGR of 11.8% (2025–2034)

- By Component: Hardware led in 2024 with a 64% share, driven by demand for smart cooking devices

- By Connectivity: Wi-Fi dominated with a 52% share in 2024 due to real-time control and integration features

- By Application: Residential segment held a 72% share in 2024, driven by smart kitchen adoption

- By Region: North America led with a 36.3% share, valued at USD 1.7 Billion in 2024, supported by strong digital infrastructure and high tech adoption

Top Use Cases

- Smart Recipe Guidance – AI-enabled devices offer step-by-step cooking instructions and auto-adjust temperatures for perfect meals.

- Remote Cooking Control – Users can start, stop, and monitor appliances via mobile apps, enhancing flexibility and time management.

- Personalized Cooking Automation – Appliances learn user preferences to customize cooking settings and suggest tailored recipes.

- Nutritional Tracking and Analysis – Devices calculate calories and nutrients in real time, supporting health-conscious cooking.

- Voice and Gesture Operation – Hands-free control through voice assistants or gestures improves safety and ease during cooking.

Market Segmentation

Component Analysis

In 2024, hardware dominated the digital cooking technology market by capturing 64% of the share, as it forms the core of the cooking process. Devices like smart stoves, cookers, and sensors are crucial because they deliver accurate and real-time cooking performance. While software adds value through user-friendly interfaces and automation, and services like installation and support are gradually growing, it’s the hardware that continues to be the backbone of the industry thanks to its reliability and necessity in every digital kitchen setup.

Connectivity Technology Analysis

Wi-Fi led the connectivity technology segment in 2024 with a 52% market share. This is because consumers prefer features like remote control, automatic updates, and smooth integration with other smart devices in the kitchen. Bluetooth is still widely used for its simplicity and energy efficiency in close-range connections, especially for smaller setups. Technologies like Zigbee/Z-Wave are gaining attention for their smart home network compatibility, but their use in digital kitchens is still developing. Meanwhile, NFC is used for specific needs like fast pairing and user verification, although it remains a niche option.

Application Analysis

The residential sector held a strong lead in 2024, capturing 72% of the market. This growth comes from rising consumer interest in smart cooking gadgets that make daily life easier, healthier, and more efficient. Products like digital ovens and smart cooktops are especially popular among younger, tech-savvy users. While commercial use in restaurants and catering is slowly increasing, its adoption is more cautious due to higher investment needs and slower decision-making processes.

Key Market Segments

By Component

- Hardware

- Smart Ovens & Microwaves

- Smart Cooktops & Induction Hobs

- Smart Pressure Cookers & Multi-Cookers

- Connected Grills & Smokers

- Smart Thermometers & Probes

- Software

- Cooking Assistant Apps

- Recipe Recommendation Engines (AI-driven)

- Remote Control & Monitoring Platforms

- Services

- Installation & Integration

- Cloud Cooking Data Management

- Maintenance & Technical Support

By Connectivity Technology

- Wi-Fi

- Bluetooth

- Zigbee/Z-Wave

- NFC (Near Field Communication)

By Application

- Residential

- Commercial

Major Challenges

High prices make digital cooking devices hard to afford for many, especially in developing regions. Older users also struggle with using new tech, limiting adoption. Some appliances don’t fit well with existing kitchens, adding upgrade costs. Plus, data privacy concerns make some people hesitant to use connected devices.

Top Opportunities

AI is making cooking smarter by personalizing recipes and suggestions. Eco-friendly devices are gaining popularity as more users care about sustainability. Rising incomes in emerging markets are boosting demand. Also, partnerships with meal kit services are adding value and convenience for users.

Emerging Trends

Voice and gesture controls are making cooking easier and hands-free. IoT lets users control devices remotely through apps. All-in-one cookers are saving time and space. Health-focused tools that track nutrition are attracting users who want to eat better.

Regional Analysis

In 2024, North America emerged as the top region in the digital cooking technology market, capturing 36.3% of the share, worth USD 1.7 billion. This growth is powered by the widespread use of smart kitchen appliances and strong digital infrastructure. Consumers in the U.S. are quick to adopt innovative, energy-efficient cooking solutions, thanks to high internet access and a strong preference for tech-driven convenience in daily life.

Conclusion

The digital cooking technology market is rapidly transforming kitchens into smart, connected spaces, driven by rising demand for convenience, health, and personalization. With strong growth seen in regions like North America and increasing adoption of AI, IoT, and voice-controlled systems, the market is well-positioned for expansion. As more consumers seek efficient and intuitive cooking solutions, supported by eco-friendly features and smart integrations, digital cooking is evolving from a luxury to a mainstream necessity across both residential and commercial settings.