Table of Contents

Introduction

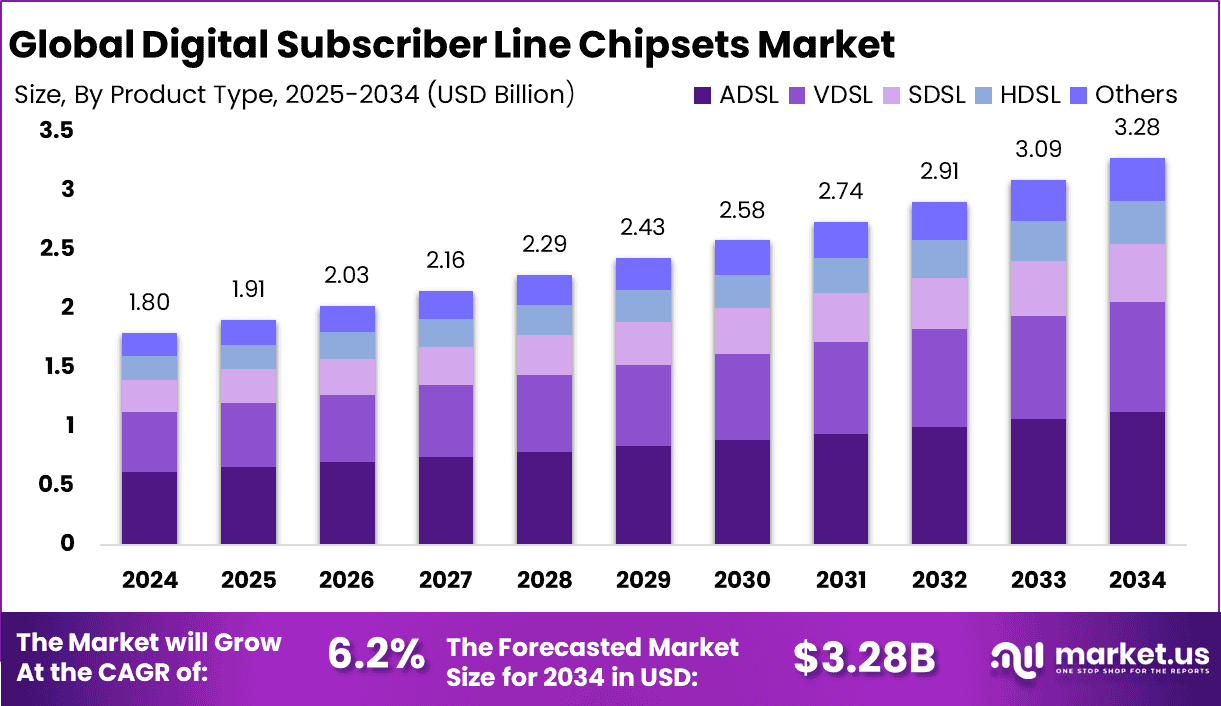

The global Digital Subscriber Line (DSL) chipsets market is projected to grow from USD 1.8 billion in 2024 to approximately USD 3.28 billion by 2034, reflecting a CAGR of 6.2%. In 2024, Asia Pacific dominated the market with a 35.8% share, generating USD 0.6 billion in revenue. This growth is driven by expanding broadband infrastructure, rising internet penetration, and demand for high-speed connectivity in emerging economies. The evolution of DSL technology and increasing investments in telecom infrastructure further propel market expansion across regions.

How Tariffs Are Impacting the Economy

Tariffs imposed on semiconductor components, including DSL chipsets, have introduced considerable economic challenges. Increased import duties elevate the cost of raw materials and finished products, driving up prices for manufacturers and consumers alike. These cost pressures contribute to inflation, reducing disposable income and slowing consumer spending, which negatively impacts economic growth.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/digital-subscriber-line-chipsets-market/free-sample/

(Use corporate mail ID for quicker response)

Tariffs also disrupt global supply chains by forcing companies to seek alternative sourcing, often at higher costs or longer lead times. Additionally, retaliatory trade measures escalate geopolitical tensions, creating uncertainty that hinders investment and innovation. These factors collectively affect sectors reliant on semiconductor technologies, slowing infrastructure development and technological advancement.

Impact on Global Businesses

Global businesses in the semiconductor and telecommunications sectors face increased costs and supply chain disruptions due to tariffs. Manufacturers of DSL chipsets experience higher expenses for imported components, pressuring profit margins. Supply chain shifts toward diversification or nearshoring add operational complexity and capital expenditure.

Telecommunications providers may face delayed deployments and elevated infrastructure costs, impacting service expansion. These challenges necessitate cautious investment approaches and force companies to enhance operational flexibility. Sector-specific impacts vary, with emerging markets particularly vulnerable to cost fluctuations and supply instability, while mature markets focus on optimizing existing infrastructure amid tariff-related uncertainties.

Strategies for Businesses

To mitigate tariff impacts, businesses are diversifying supply chains, sourcing from tariff-exempt countries, and increasing local manufacturing capabilities. Investments in automation reduce reliance on imported labor-intensive processes. Companies leverage predictive analytics to forecast tariff changes and optimize inventory management. Strategic partnerships and supplier collaborations help share risks and negotiate better terms. Digital transformation initiatives enable agility in responding to market disruptions. Additionally, engaging with policymakers to influence trade regulations complements operational strategies. These approaches enhance resilience and support sustained growth in a tariff-sensitive environment.

Key Takeaways

- DSL chipsets market expected to grow at a 6.2% CAGR through 2034

- Tariffs increase costs and disrupt semiconductor supply chains globally

- Telecommunications sector faces infrastructure deployment delays and cost hikes

- Businesses respond with supply chain diversification and local manufacturing

- Predictive analytics aid in navigating tariff-related uncertainties

➤ Get full access now @ https://market.us/purchase-report/?report_id=148810

Analyst Viewpoint

The DSL chipsets market continues steady growth, propelled by broadband expansion and technological advancements. Although tariffs present challenges, they incentivize supply chain optimization and local production investments. Market players are adopting innovative solutions to mitigate cost pressures, sustaining long-term growth. The increasing demand for high-speed connectivity and infrastructure modernization supports a positive outlook. Continued regional investments and evolving technologies are expected to drive market expansion globally despite tariff-related obstacles.

Regional Analysis

Asia Pacific dominates the DSL chipsets market with a 35.8% revenue share in 2024, driven by rapid urbanization, expanding broadband networks, and strong government initiatives promoting digital connectivity. Countries like China, India, and Southeast Asia lead infrastructure investments. North America and Europe maintain stable growth supported by technological innovation and mature telecom markets. Regional disparities arise from varying levels of infrastructure development, regulatory environments, and market demand for high-speed internet services.

➤ Discover More Trending Research

Business Opportunities

Growing demand for DSL chipsets in emerging markets offers significant opportunities as governments invest in broadband expansion. Upgrading legacy DSL infrastructure with advanced chipsets to support higher speeds creates further growth avenues. Integration with IoT and smart city initiatives increases chipset applicability. Cloud-based and AI-driven network management solutions complement hardware growth. Collaborations between chipset manufacturers and telecom operators facilitate tailored solutions. Additionally, research into energy-efficient and cost-effective chipsets addresses evolving market needs.

Key Segmentation

Component

- DSL Chipsets

- Modems

Technology

- ADSL (Asymmetric DSL)

- VDSL (Very-high-bit-rate DSL)

- G.fast

Application

- Residential

- Commercial

End-User

- Telecom Service Providers

- Enterprises

Key Player Analysis

Leading companies in the DSL chipset market emphasize innovation in high-speed and energy-efficient technologies. They invest in R&D to enhance chipset performance and compatibility with evolving broadband standards. Strategic collaborations with telecom operators enable customized solutions. Market leaders focus on expanding presence in emerging regions through partnerships and local manufacturing. Scalability, reliability, and cost-effectiveness remain critical competitive factors. Their comprehensive product portfolios and service offerings drive customer loyalty and market penetration.

Top Key Players in the Market

- Broadcom Corporation

- MediaTek Inc.

- Intel Corporation

- Qualcomm Incorporated

- Infineon Technologies AG

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- Texas Instruments Incorporated

- Marvell Technology Group Ltd.

- Lantiq (acquired by Intel)

- Sckipio Technologies

- Ikanos Communications (acquired by Qualcomm)

- ZTE Corporation

- Huawei Technologies Co., Ltd.

- Alcatel-Lucent (now part of Nokia)

- Realtek Semiconductor Corp.

- Analog Devices, Inc.

- Microchip Technology Inc.

- Vitesse Semiconductor Corporation

- Cavium, Inc.

- Others

Recent Developments

In 2025, several chipset providers launched next-generation VDSL and G.fast solutions, boosting broadband speeds. Strategic partnerships with telecom firms accelerated rollout in Asia Pacific. Increased focus on energy-efficient chipsets aligns with sustainability goals.

Conclusion

The Digital Subscriber Line Chipsets Market is set for steady growth, supported by broadband infrastructure expansion and technological advances. While tariffs pose challenges, strategic adaptations and regional investments ensure continued market momentum. Innovations in chipset technology will drive future opportunities and global connectivity.