Table of Contents

Introduction

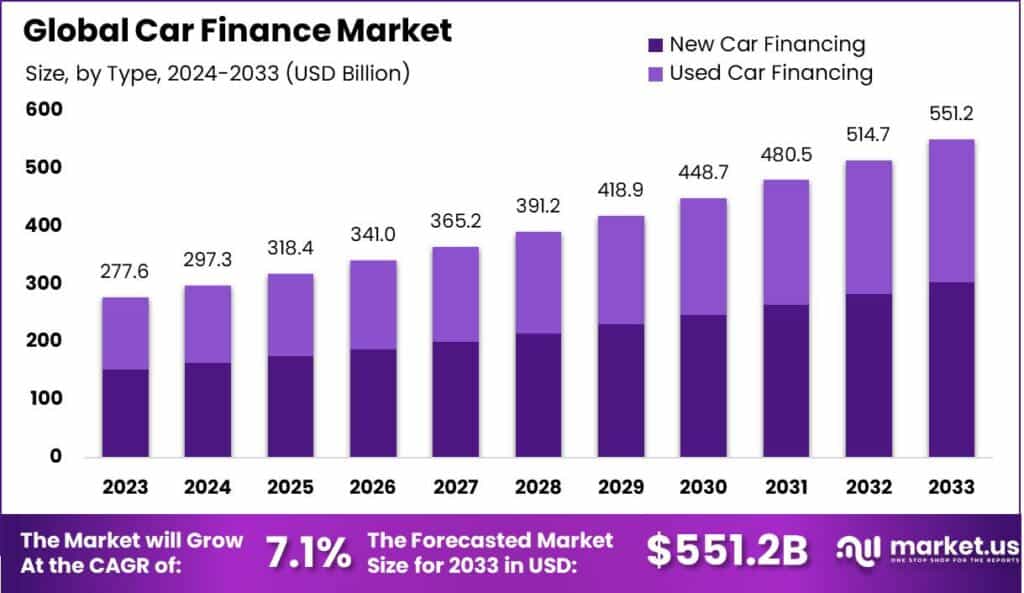

The global Car Finance Market is projected to grow significantly, reaching USD 551.2 billion by 2033, up from USD 297.3 billion in 2024, with a CAGR of 7.1% during the forecast period from 2024 to 2033. In 2023, North America held a dominant position, capturing over 35.8% of the market share, generating USD 0.9 billion in revenue. This growth is driven by increasing consumer demand for vehicles, greater access to financing options, and the rise of digital car finance solutions, allowing for more flexible and convenient financing experiences for both individuals and businesses.

How Growth is Impacting the Economy

The growth of the Car Finance Market is playing a crucial role in shaping the global economy, particularly within the automotive and financial sectors. With more consumers opting for vehicle financing, the demand for cars has surged, fueling production and sales within the automotive industry. The rise of innovative financing solutions, including digital platforms, has made vehicle ownership more accessible to a broader demographic, stimulating consumer spending and contributing to economic growth.

Additionally, the market is driving job creation in finance, automotive, and technology sectors, as new products and services emerge to meet evolving consumer preferences. The expansion of car finance also promotes competition, fostering better financing options and competitive interest rates, benefiting consumers and businesses alike. Furthermore, this market’s growth supports economic stability by enabling people to access mobility, a key component of workforce participation and access to services, further contributing to GDP growth in various regions.

➤ To Elevate Your Business – Request Sample Here @ https://market.us/report/global-car-finance-market/free-sample/

Impact on Global Businesses

The rapid growth of the Car Finance Market presents both opportunities and challenges for global businesses. Rising demand for car financing is encouraging automotive manufacturers to increase vehicle production, while financial institutions are expanding their loan offerings to meet consumer demand. However, rising interest rates and inflationary pressures are driving up the cost of financing, which could affect both consumers’ purchasing decisions and businesses’ profitability.

Supply chain shifts also impact the automotive sector, leading to increased production costs for vehicles and components, which may influence car pricing and financing terms. In sector-specific impacts, technology and digital platforms are revolutionizing car financing processes, offering more streamlined and transparent options to consumers. However, businesses must also address the risks associated with rising default rates on car loans, which may be exacerbated by economic instability. Companies must develop strategies to mitigate risks while continuing to meet the growing demand for car financing solutions.

Strategies for Businesses

To capitalize on the growth of the Car Finance Market, businesses must focus on offering flexible and customer-centric financing solutions that cater to a wide range of consumer needs. This includes expanding digital and online financing platforms, which provide ease of access and transparency for customers.

Companies should also explore strategic partnerships with automotive manufacturers to offer tailored financing packages, such as zero-interest or low-interest payment plans, to enhance customer acquisition. Additionally, businesses should invest in data analytics to understand consumer preferences and provide personalized financing options. Strengthening risk management strategies and ensuring compliance with regulatory standards will also be critical in maintaining profitability and long-term success in the evolving car finance landscape.

Key Takeaways

- The Car Finance Market is expected to grow at a CAGR of 7.1% from 2024 to 2033.

- North America holds a dominant position, capturing 35.8% of the market share in 2023.

- Rising consumer demand for vehicles and flexible financing solutions is driving market growth.

- Businesses should focus on digital platforms, flexible financing options, and risk management to stay competitive.

Analyst Viewpoint

The Car Finance Market is witnessing robust growth, driven by consumer demand for vehicles and the expansion of digital financing solutions. Currently, North America leads the market, but global growth is expected as emerging economies increasingly adopt car financing options. The future outlook remains positive, with digitalization continuing to play a key role in expanding market reach and improving accessibility. As businesses adapt to changing consumer behavior and economic conditions, there will be further opportunities to enhance offerings, optimize loan terms, and capitalize on digital platforms to drive growth in the car finance sector.

Regional Analysis

In 2023, North America led the global Car Finance Market, holding a 35.8% market share with USD 0.9 billion in revenue. The region benefits from a mature automotive market, high demand for vehicle ownership, and advanced financial infrastructure. Europe follows with steady growth, driven by demand for personal vehicles and rising consumer preference for flexible financing options. The Asia Pacific region is expected to witness rapid growth, particularly in countries like China and India, where increasing disposable incomes and a growing middle class are driving demand for cars. Other regions, including Latin America and the Middle East, are also showing potential for growth, driven by economic development and rising consumer access to financing.

Business Opportunities

The Car Finance Market presents numerous business opportunities, particularly for companies offering digital financing platforms, auto lenders, and financial institutions. As consumers increasingly seek flexibility, businesses can capitalize on offering tailored financing solutions such as low-interest loans, extended payment plans, and leasing options. The rise of digital platforms also offers opportunities for tech companies to develop innovative tools that streamline the financing process. Additionally, partnerships with car manufacturers to provide integrated financing options will help businesses expand their customer base. With the increasing focus on electric vehicles (EVs), companies specializing in financing solutions for EVs are likely to benefit from the growing adoption of sustainable automotive technologies.

Key Segmentation

- By Financing Type: Loan Financing – 50%, Leasing – 30%, Hire Purchase – 20%

- By Region: North America – 35.8%, Europe – 30%, Asia Pacific – 25%, Rest of the World – 9%

- By Vehicle Type: New Cars – 60%, Used Cars – 40%

Key Player Analysis

Leading players in the Car Finance Market are focusing on expanding their digital offerings and partnerships with automotive manufacturers to provide tailored financing options for consumers. These companies are investing in technology to improve the car finance process, offering transparent terms, flexible payment plans, and real-time decision-making capabilities. Strategic collaborations with dealerships and car manufacturers are helping to increase their market presence and improve customer access to financing. Additionally, players are leveraging data analytics and AI to enhance credit assessment, personalize financing options, and manage risks effectively, positioning themselves for long-term success in this rapidly growing market.

- Toyota Financial Services

- Ford Credit

- Volkswagen Financial Services

- GM Financial

- Santander Consumer USA

- Ally Financial

- Bank of America

- Capital One Auto Finance

- BNP Paribas

- Daimler Financial Services

- Other Key Players

Recent Developments

- January 2024: A leading financial institution launched a new digital platform offering real-time car financing approvals and competitive rates.

- December 2023: A major car manufacturer partnered with a fintech company to introduce an integrated financing solution for electric vehicles.

- November 2023: A key player in the market expanded its leasing options, offering flexible terms for both new and used cars.

- October 2023: A prominent auto lender introduced a customer loyalty program that rewards repeat car buyers with reduced interest rates on financing.

- September 2023: A major player partnered with an automotive marketplace to offer on-site financing options for customers purchasing vehicles online.

Conclusion

The Car Finance Market is on a strong growth path, driven by rising demand for vehicles and flexible financing solutions. As digital platforms gain prominence, businesses that invest in innovation, flexible financing options, and risk management will be well-positioned to capitalize on future opportunities in the evolving car finance landscape.