Table of Contents

Market Overview

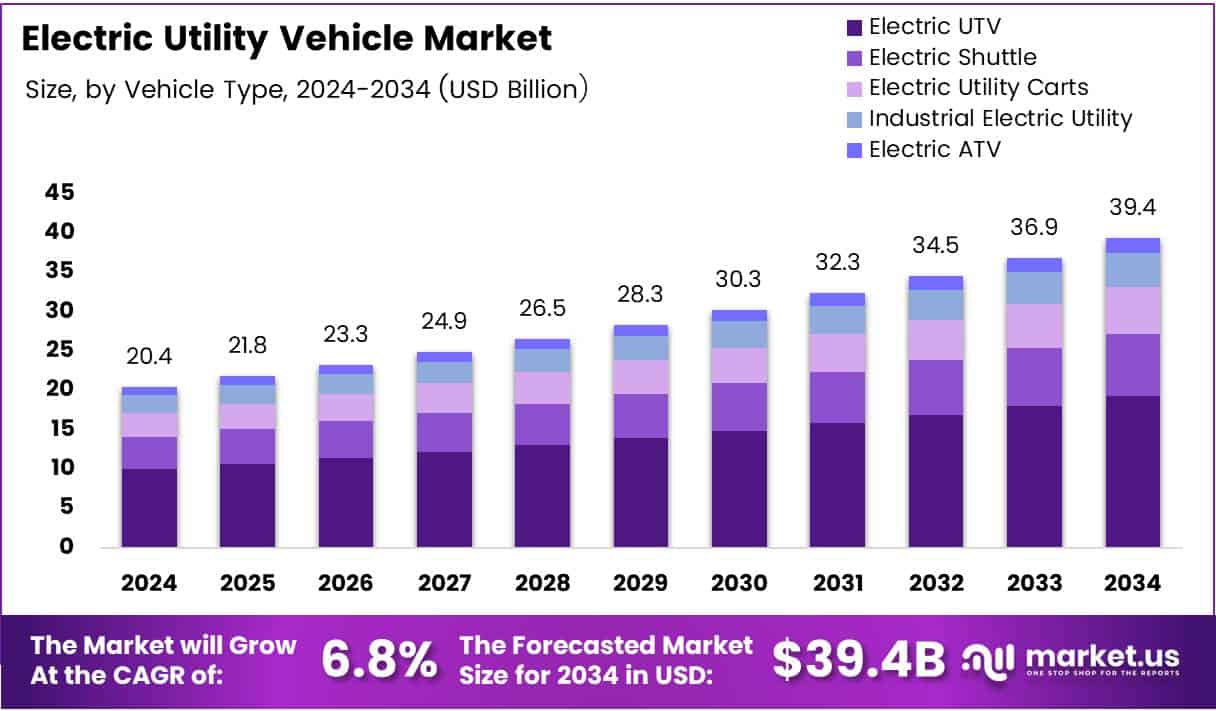

The Global Electric Utility Vehicle Market size is expected to be worth around USD 39.4 Billion by 2034, from USD 20.4 Billion in 2024, growing at a CAGR of 6.8% during the forecast period.

The Electric Utility Vehicle (EUV) market is witnessing a strong growth trajectory fueled by the global transition toward cleaner mobility solutions. With 2.79 million units of SUVs and MPVs accounting for 65% of the 4.30 million passenger vehicle dispatches, the demand for versatile and utility-driven vehicles has seen a remarkable shift from just 21% a decade ago. This change signals a favorable environment for electric utility models, which blend practicality with sustainability. In India, for instance, electric vehicle (EV) sales rose by 27%, crossing 2 million units in 2024, highlighting a robust consumer shift and increased adoption rate in emerging markets.

Opportunities are further expanding with government backing in the form of EV subsidies, infrastructure investments, and stricter emissions regulations. As the transportation sector is responsible for approximately 23% of global CO2 emissions, regulatory frameworks are now mandating zero-emission alternatives across multiple regions.

Innovations from companies like Navya, with its 100% electric autonomous vehicle, and Endera’s electric B4 shuttle bus scoring 90.1 in the Altoona durability test are reshaping fleet and utility transportation. Furthermore, with global energy use hitting 183,230 terawatt-hours in 2023, the emphasis on energy-efficient mobility solutions presents a high-growth, high-opportunity landscape for electric utility vehicle stakeholders.

Segmentation Analysis

Vehicle Type Analysis

Electric UTVs led the market in 2024 with a 34.2% share due to their strong performance in agriculture, construction, and recreation. Their durability and eco-friendly design make them a top choice, while other types like shuttles and ATVs are growing in niche areas.

Application Analysis

Commercial Transport dominated with a 36.8% share, driven by demand in logistics and delivery. Electric vehicles cut fuel costs and emissions, making them ideal for last-mile and public transport. Industrial and recreational uses are also rising steadily.

Drive Type Analysis

Rear Wheel Drive held a 49.6% market share in 2024. It’s preferred for its strength, control, and off-road performance, especially in UTVs. AWD and FWD are still used but less dominant.

Battery Type Analysis

Lithium-Ion batteries led with a 58.3% share thanks to fast charging, long life, and high efficiency. They’re widely used in commercial and industrial EVs, while lead-acid batteries remain in use for low-cost needs.

Key Drivers

- Environmental Regulations: Stringent emission norms and government incentives are encouraging companies and individuals to shift toward electric vehicles.

- Cost Efficiency: Lower maintenance and operating costs make EUVs an attractive long-term investment.

- Technological Innovation: Developments in lithium-ion batteries and EV infrastructure are significantly enhancing vehicle performance and range.

- Diverse Applications: The flexibility of EUVs across sectors like tourism, logistics, security, and agriculture fuels their adoption.

Restraints

- High Initial Cost: Upfront costs for electric utility vehicles can be a deterrent, especially for small businesses.

- Charging Infrastructure: Inadequate EV charging stations in several regions limits the seamless integration of EUVs.

- Limited Load Capacity: Electric utility vehicles may not be suitable for heavy-duty operations compared to traditional alternatives.

- Battery Concerns: Limited battery life and long charging times can impact operational efficiency.

Opportunities

- Fleet Electrification: Corporations and government agencies are increasingly electrifying their fleets, offering a major boost to this market.

- Smart Integration: Incorporating IoT and telematics into EUVs is enabling smart operations, predictive maintenance, and route optimization.

- Urban Mobility Solutions: As cities become smarter and more sustainable, the use of EUVs for last-mile deliveries and intra-city transportation is expected to increase.

- Emerging Markets: Developing countries offer untapped potential for EUV manufacturers due to rising industrialization and supportive government policies.

Competitive Landscape

The market features both established and emerging players. Leading companies are focusing on mergers, acquisitions, and strategic collaborations to enhance their global presence and technological capabilities. Key strategies include investing in R&D to develop longer-range vehicles, expanding product lines to cater to niche applications, and leveraging digital platforms for marketing and customer engagement.

In addition, customization and aftersales services are being emphasized to strengthen customer retention. The ability to provide tailored solutions for specific commercial and industrial use cases is a key differentiator among leading manufacturers.

Market Trends

- Rise in Electric ATVs/UTVs: There is growing interest in electric recreational and off-road vehicles, especially in eco-tourism and farming.

- Battery-as-a-Service (BaaS): Subscription-based battery models are emerging as a solution to reduce upfront costs.

- Compact Urban Designs: Manufacturers are introducing smaller, modular electric vehicles to cater to congested urban environments.

- Sustainability Focus: EUV companies are integrating recycled materials and renewable energy solutions in production processes.

Recent Development

- In Aug 2024, Fresh Bus, a Bengaluru-based intercity electric bus startup, has secured ₹875 million in funding, according to Mercom India. This funding boost aims to accelerate its expansion plans and strengthen its position in the growing Indian electric mobility sector. The move reflects investor confidence in sustainable urban transport solutions.

- In September 2024, Meanwhile, the Asian Development Bank (ADB) and JBM Group have entered a strategic partnership through a ₹3.6 billion ($43.2 million) non-convertible debenture loan. This collaboration seeks to enhance electric bus infrastructure in Haryana and Odisha. The funding underscores regional efforts to reduce carbon emissions and modernize public transport systems.

- In Jan 2024, In another development, Phoenix Motor Inc. has finalized the acquisition of the Proterra Transit business from Proterra Inc. and Proterra Operating Company. This acquisition is set to strengthen Phoenix Motor’s capabilities in the electric transit segment. It also marks a strategic expansion of its footprint in the U.S. electric vehicle market.

Conclusion

The electric utility vehicle market is on a path of consistent expansion, supported by environmental concerns, technological evolution, and multi-sector demand. While challenges like cost and infrastructure need to be addressed, the market holds significant potential due to its adaptability and eco-friendly nature. Stakeholders across the value chain—from manufacturers to end-users—stand to benefit from the continued innovation and growth within this industry.