Table of Contents

Market Overview

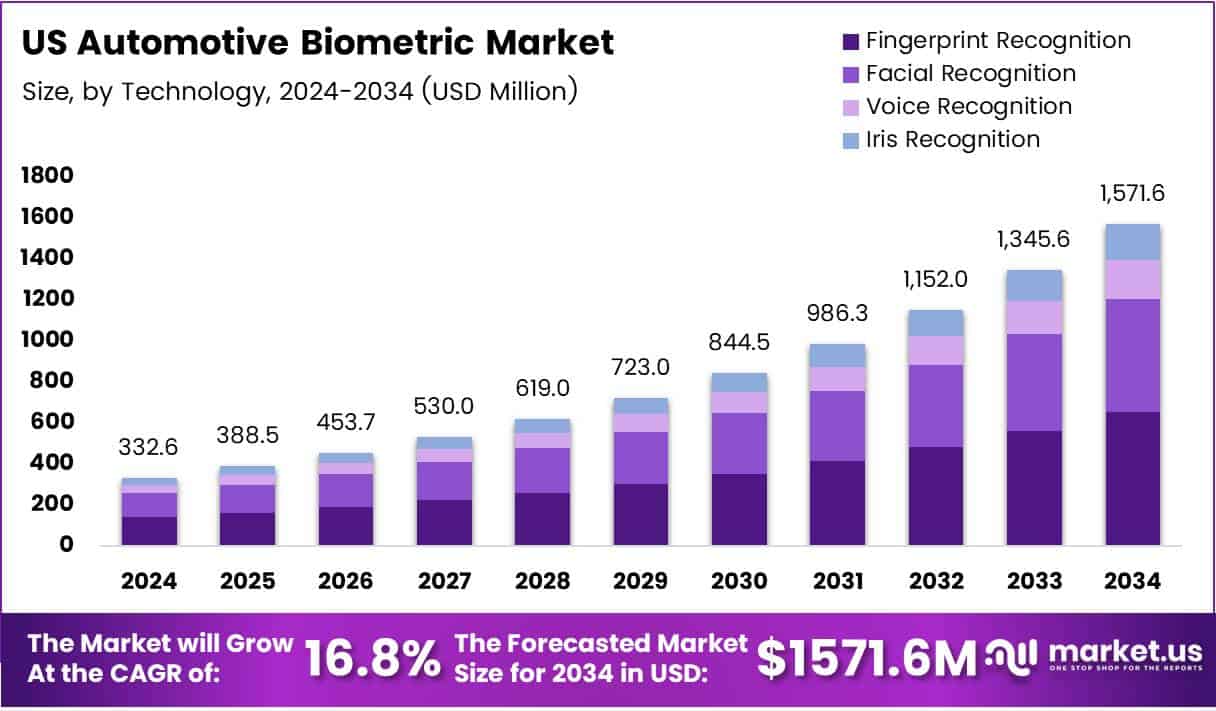

The US Automotive Biometric Market size is expected to be worth around USD 1571.6 Million by 2034, from USD 332.6 Million in 2024, growing at a CAGR of 16.8% during the forecast period.

The U.S. Automotive Biometric Market is accelerating towards a transformative future driven by rising consumer demand for seamless, secure, and personalized mobility experiences. As 72% of consumers in the U.S. prefer facial recognition over traditional login systems, automotive OEMs and Tier-1 suppliers are swiftly integrating biometric-enabled identity and access management (IAM) solutions into next-gen vehicles. From ignition control to driver monitoring systems, biometrics is redefining how drivers interact with their vehicles.

This market presents substantial growth opportunities as automotive players tap into multimodal biometric systems, including facial, voice, and fingerprint recognition. Notably, the Next Generation Identification (NGI) System in the U.S. holds over 161 million fingerprint records, highlighting the nation’s advanced biometric infrastructure. This paves the way for government-backed innovations and cross-industry collaborations in automotive safety and security. Moreover, as 41% of U.S. adults use voice search daily, integration of voice biometrics in infotainment and navigation systems is becoming a strategic focus area.

Government investments in intelligent transportation and digital identity, coupled with strict data privacy regulations, are fueling innovation while maintaining consumer trust. With 99.7% accuracy in maskless facial recognition, AI-powered biometric systems are becoming indispensable to automotive OEMs aiming to lead in the connected car revolution.

Key Takeaways

- The US Automotive Biometric Market is projected to reach USD 1571.6 Million by 2034, growing at a CAGR of 16.8% from 2025 to 2034.

- Fingerprint Recognition led the Technology segment with a 35.9% share in 2024.

- Vehicle Access Control dominated the Application segment in 2024, driven by its role in enhancing vehicle security.

- Passenger Cars held the highest share in the Vehicle Type segment in 2024 due to high biometric adoption rates.

- Hardware accounted for the largest share in the Offering segment in 2024, underlining the demand for biometric sensors and devices.

Key Market Drivers

- Enhanced Vehicle Security: With the rise in car theft and unauthorized access incidents, biometric systems offer a more secure alternative to traditional key-based or even smart card-based entry systems. Facial and fingerprint recognition systems are increasingly being adopted for driver authentication.

- Personalization and Convenience: Biometrics allows vehicles to recognize individual drivers and automatically adjust seating, mirror positions, infotainment preferences, and climate controls. This not only enhances user comfort but also provides a personalized driving experience.

- Integration with Connected Vehicles: As vehicles become more connected through IoT, integrating biometrics with telematics and mobile applications is creating new possibilities. For instance, remote vehicle access and monitoring through biometric validation are gaining traction.

- Growth of Autonomous Vehicles: With the development of self-driving technology, driver monitoring systems (DMS) are crucial. These often use eye tracking, facial expression analysis, and other biometric methods to ensure that drivers remain alert or take control when needed.

Restraints and Challenges

- Privacy Concerns: Collecting and storing biometric data raises significant data privacy and cybersecurity issues. Consumers are increasingly cautious about how their personal information is used and stored by automakers.

- High Implementation Costs: Developing and integrating biometric systems into vehicles requires significant investment. These costs can be prohibitive, especially for economy vehicle segments.

- Standardization Issues: The lack of uniform regulatory frameworks and technical standards hinders seamless integration and scalability of biometric solutions across different manufacturers and vehicle models.

Market Segmentation

Technology Analysis

In 2024, Fingerprint Recognition led with 35.9% market share due to its accuracy and easy integration. Facial Recognition is rising fast, offering contactless access with AI support. Voice Recognition is popular for hands-free control, while Iris Recognition is gaining interest for its high precision and future growth potential.

Application Analysis

Vehicle Access Control dominates, as it’s key to preventing unauthorized entry. Driver Personalization is growing, especially in premium cars, for customized settings. Driver Monitoring Systems help detect fatigue and boost safety. Biometric HMI enhances infotainment access, and In-Car Payments bring secure, smart vehicle transactions.

Vehicle Type Analysis

Passenger Cars lead adoption thanks to strong consumer demand for safety and personalization. Commercial Vehicles are slowly catching up, using biometrics for driver monitoring and secure access, especially in fleets.

Offering Analysis

Hardware leads the market, as sensors and cameras are critical for accurate data capture. Software enables system integration, and Services ensure smooth operation through installation and support.

Trends and Opportunities

- Electric and Autonomous Vehicles: Biometric systems are expected to be key components in the emerging landscape of electric and self-driving vehicles. These technologies will help regulate access, monitor driver health, and manage passenger preferences.

- Cloud-Based Biometric Systems: Automakers are exploring cloud-based platforms to store and manage biometric data securely, allowing for cross-platform integration and easier software updates.

- Collaborations and Strategic Partnerships: Tech companies and OEMs are increasingly partnering to co-develop biometric modules tailored for automotive needs. These collaborations are expected to accelerate innovation and deployment.

Competitive Landscape

The U.S. market is moderately fragmented, with several prominent players competing through innovation, strategic alliances, and product differentiation. Companies are investing in R&D to develop compact, cost-effective, and multi-functional biometric modules.

The report highlights that competition is intensifying as automakers race to offer biometric features as a part of their premium and safety-focused packages. Startups and established tech firms alike are finding footholds through novel applications such as health monitoring and behavioral biometrics.

Recent Development

January 2025: UVeye, a global leader in AI-based vehicle inspection, secured $191 million in new funding, raising its total capital to $380.5 million. This investment underscores growing confidence in automated inspection systems and positions UVeye for rapid global expansion across automotive service and manufacturing sectors.

March 2025: Hyundai Motor Group announced a major investment of $21 billion in the United States. This move reflects the company’s commitment to expanding electric vehicle production and innovation hubs in North America, and strengthens its presence in one of the world’s most competitive automotive markets.

Conclusion

The U.S. automotive biometric market is poised for sustained growth, driven by technological innovation, heightened consumer expectations, and increasing demand for smart and secure mobility solutions. As the automotive landscape continues to evolve with electric, connected, and autonomous vehicles, biometric systems will play an integral role in shaping the next generation of user experiences. However, addressing data privacy, regulatory, and cost challenges will be key to achieving long-term market penetration and consumer trust.