Table of Contents

Market Overview

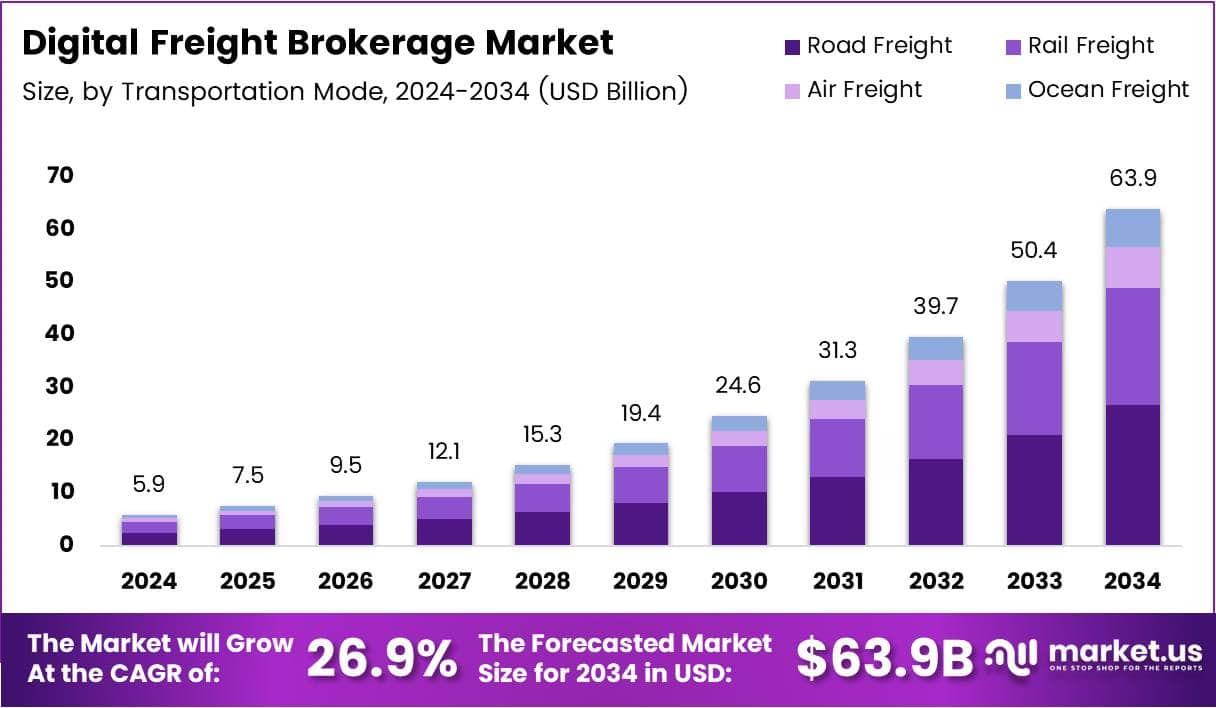

The Global Digital Freight Brokerage Market size is expected to be worth around USD 63.9 Billion by 2034, from USD 5.9 Billion in 2024, growing at a CAGR of 26.9% during the forecast period.

The Digital Freight Brokerage Market, valued at $17.58 billion in 2024-25, is undergoing a transformative shift fueled by automation, real-time visibility, and artificial intelligence. This evolution is streamlining freight operations across continents and boosting efficiencies in the supply chain. As 72.6% of U.S. freight nearly 12 billion tons is transported via over-the-road fleets, digital solutions are increasingly being adopted to optimize truck utilization, reduce deadhead miles, and improve carrier-shipper connectivity.

There is substantial opportunity in cross-border freight movement. In March 2024 alone, freight between the U.S. and Canada rose to $67.5 billion (up 3.7%), while trade with Mexico surged to $77.3 billion (up 13.0%). Trucks played a major role in this trade, moving $94.2 billion worth of goods a 9.5% increase. This upward trend amplifies demand for digital brokerage platforms capable of managing complex, multimodal logistics efficiently.

Government efforts in modernizing transportation infrastructure, investing in 5G connectivity, and supporting sustainable logistics systems are bolstering digital transformation. However, evolving regulations around cross-border logistics, cybersecurity, and environmental compliance will require brokers to adopt flexible, regulation-ready platforms. With rising air cargo demand up 5.8%, multimodal digital brokerage platforms stand to capture even broader market share.

Key Takeaways

- The global digital freight brokerage market is projected to reach USD 63.9 billion by 2034, growing at a CAGR of 26.9% from 2025 to 2034.

- Road Freight dominated the Transportation Mode segment in 2024 with a 75.1% market share due to cost efficiency and strong logistics networks.

- The Retail & E-commerce segment led the End-User category in 2024, driven by demand for fast and trackable deliveries.

- Full-truckload (FTL) Brokerage held the largest share in the Service Type segment in 2024 due to direct routing and better cargo security.

- The Business-to-Business (B2B) segment was the leading Customer Type in 2024, supported by high-volume freight operations.

- North America held 42.6% of the global market share in 2024, valued at USD 2.5 billion.

Key Market Drivers

- Technology Integration

The core engine behind digital freight brokerage is technology. Platforms use cloud-based infrastructure, machine learning, and data analytics to provide real-time freight matching and route optimization. This leads to higher truckload utilization, reduced empty miles, and better fuel efficiency. - E-commerce Boom

With global e-commerce sales rising sharply, there’s increasing pressure on logistics to deliver faster and cheaper. This has propelled demand for digital brokerage services that offer on-demand freight capacity and improved delivery timelines. - Cost Reduction and Efficiency

Manual freight processes are time-consuming and prone to errors. Digital platforms reduce the need for human intervention, lower administrative overhead, and enable dynamic pricing models, making freight movement more economical and agile. - Changing Consumer Expectations

Shippers today demand transparency, real-time tracking, and flexible delivery options. Digital brokers meet these expectations with intelligent dashboards, automated alerts, and predictive analytics, enhancing customer satisfaction.

Market Challenges

- Resistance to Change: Many carriers and traditional brokers still rely on phone calls and emails. Convincing them to adopt digital platforms can be challenging.

- Cybersecurity Concerns: With data playing a vital role, safeguarding systems from cyber threats is critical.

- Regulatory Compliance: Varying logistics and transportation regulations across countries complicate cross-border brokerage operations.

Market Segmentation

Transportation Mode Analysis

Road Freight led with 75.1% share in 2024 due to its low cost, wide reach, and last-mile delivery ability. Rail is used for bulk goods but limited by infrastructure. Air Freight serves urgent, high-value items. Ocean Freight supports large, global shipments despite slower speeds.

End-User Analysis

Retail & E-commerce dominated, driven by rising online orders and demand for fast delivery. Manufacturing, Automotive, and Food sectors rely on freight brokers for efficiency and speed. Healthcare and Oil & Gas need specialized transport, while other industries use brokerage to cut costs and optimize logistics.

Service Type Analysis

Full-Truckload (FTL) leads due to its speed and security for large loads. LTL helps smaller businesses save costs. Intermodal blends rail and road for efficiency. Expedited and Refrigerated Freight support urgent and sensitive goods. Cross-border and specialized freight expand market flexibility.

Customer Type Analysis

B2B dominates with frequent, high-volume shipping needs and a focus on efficiency. B2C is growing fast with e-commerce, though shipments are smaller. Digital platforms are helping both segments improve speed, visibility, and cost control in freight management.

Regional Insights

North America

North America leads the digital freight brokerage market, holding 42.6% of the global share, valued at USD 2.5 billion. This strong position is thanks to early use of digital logistics platforms, a highly developed transportation system, and a mature logistics sector. Ongoing investments in digital transformation and a strong push for efficiency continue to support the region’s leadership in this space.

Europe

Europe is quickly advancing in the digital freight brokerage market, driven by efforts to improve supply chain efficiency and reduce emissions. Government support for freight digitalization and seamless cross-border trade within the EU make it a strong contender. The region’s shift toward automation and sustainability is pushing more companies to adopt tech-based freight solutions.

Asia Pacific

Asia Pacific is growing rapidly in this market due to rising e-commerce, urban growth, and industrial expansion. Countries like China and India are investing in logistics infrastructure, creating demand for efficient and cost-effective digital freight services. The region’s huge population and fast-paced trade activity present big opportunities for market players.

Middle East and Africa

The digital freight market in the Middle East and Africa is still developing but gaining momentum. Growth is supported by large infrastructure projects and efforts to diversify economies beyond oil. Gulf countries, in particular, are adopting smart transport technologies, although the market is still at an early stage compared to others.

Latin America

Latin America is making steady progress in digital freight brokerage, with growing cross-border trade and a push toward logistics digitalization. While infrastructure and regulatory issues remain challenges, mobile access and startup activity are driving innovation. The region has untapped potential, especially in boosting supply chain efficiency and transparency.

Key Players and Competitive Landscape

- Established logistics companies integrating digital features into their operations.

- Tech-first freight startups offering end-to-end digital brokerage services.

- Platform-as-a-Service (PaaS) models that enable small brokers and carriers to digitalize quickly.

- AI-based routing and predictive analytics

- Dynamic pricing tools

- Blockchain for secure documentation

- Automated payments and invoicing

Future Outlook

- Integration with Autonomous Vehicles and Internet of Things (IoT) for real-time data gathering.

- Expansion of green logistics through route optimization and carbon tracking tools.

- Use of AI and machine learning to refine freight matching and price predictions.

Recent Development

In June 2024, NFI strategically expanded its capabilities by acquiring Transfix’s freight brokerage operations. This move strengthens NFI’s position in digital freight and enhances its service offerings across North America, signaling a growing trend of consolidation within the tech-enabled logistics sector.

By April 2025, Nuvocargo advanced its market footprint by acquiring Merge Transportation, a South Carolina-based intra-US 3PL. This acquisition allows Nuvocargo to deepen its domestic logistics capabilities while complementing its strong cross-border expertise, aligning with its goal of becoming a full-service freight provider.

Also in June 2024, RXO took a significant step by announcing the acquisition of Coyote Logistics from UPS. This acquisition is set to bolster RXO’s market share and service capacity, offering clients a broader carrier network and more robust freight solutions amid increasing competition in the logistics space.

In November 2024, Parade entered a transformative partnership with Uber Freight. This collaboration integrates Uber Freight’s expansive carrier network with Parade’s AI-driven capacity management tools, aiming to optimize freight matching, reduce empty miles, and elevate overall operational efficiency for shippers and brokers alike.

Conclusion

The Digital Freight Brokerage Market is transforming traditional logistics through automation, transparency, and efficiency. Driven by the digitization of supply chains and the growing demand for flexible logistics solutions, this market is set to grow exponentially. Companies that embrace digital innovation and invest in customer-centric technologies are best positioned to lead in this evolving space.