Table of Contents

Market Overview

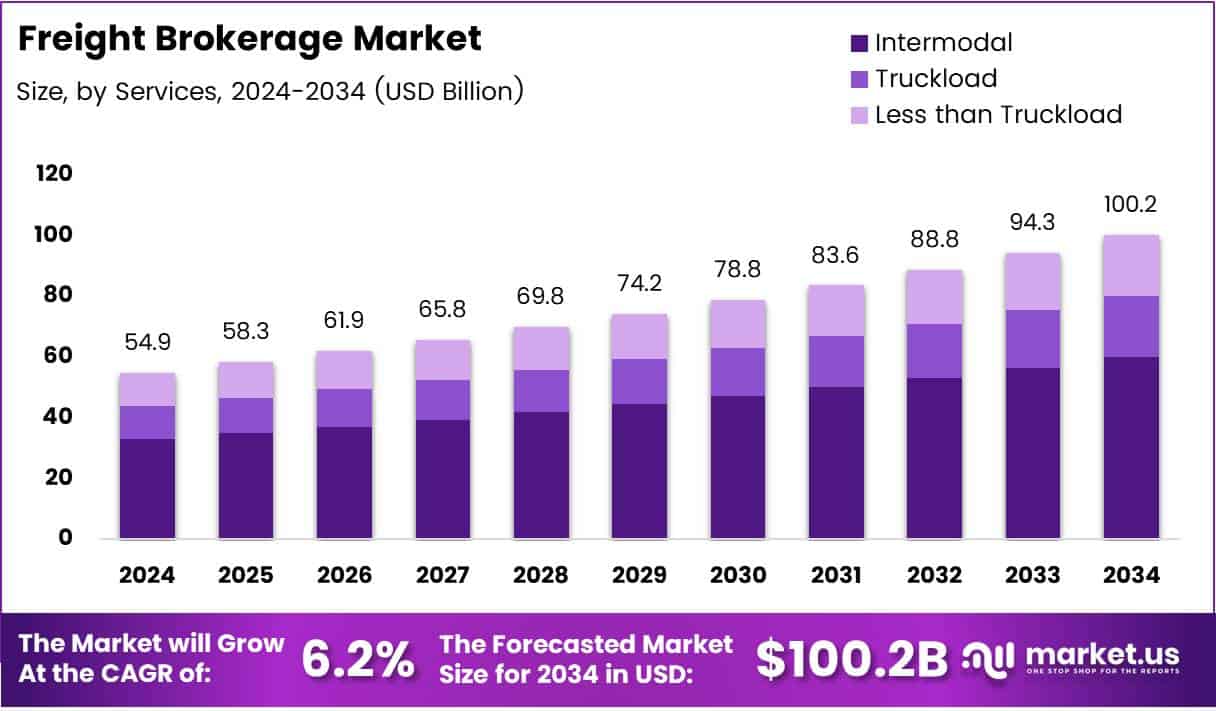

The Global Freight Brokerage Market size is expected to be worth around USD 100.2 Billion by 2034, from USD 54.9 Billion in 2024, growing at a CAGR of 6.2% during the forecast period.

The Global Freight Brokerage Market, valued at $17.58 billion in 2024–25, plays a critical role in the global logistics ecosystem by streamlining the flow of goods across cities and continents. As supply chain digitization accelerates, brokers are becoming key facilitators of operational efficiency, especially in the trucking sector, where they now manage over 20% of all freight. This rapid shift toward digital platforms and real-time load matching is fueling both growth and competitiveness across the industry.

From a growth perspective, rising e-commerce activity, demand for faster deliveries, and capacity optimization are opening new avenues for freight brokers. However, sales engagement remains a challenge, with 44% of salespeople giving up after one follow-up—despite 80% of conversions requiring at least five. This creates an opportunity for tech-enabled brokerages to automate lead nurturing, improve client retention, and gain market share through CRM and AI tools.

Governments worldwide are recognizing the importance of freight efficiency in economic development. Investments in infrastructure, such as smart highways and cross-border trade facilitation, are creating a favorable policy environment. Meanwhile, evolving regulations around carbon emissions and freight transparency are pushing brokers to innovate with sustainable practices and compliance-ready platforms. These forces together set the stage for steady, tech-driven growth.

Key Takeaways

- The Global Freight Brokerage Market is expected to reach USD 100.2 Billion by 2034, growing from USD 54.9 Billion in 2024 at a 6.2% CAGR.

- In 2024, Intermodal services led the By Services segment due to flexibility, cost efficiency, and optimized delivery.

- B2B transactions held a 59.2% share in 2024 under By Customer Type, driven by industrial and wholesale demand.

- Waterways dominated the By Mode of Transport segment in 2024, offering economical bulk transport over long distances.

- The Manufacturing sector led the By Industry Vertical segment in 2024 with a 30.2% share, reliant on efficient logistics.

- North America held the top regional position in 2024 with a 34.2% share valued at USD 18.6 Billion, backed by robust infrastructure and trade.

Key Market Drivers

- E-commerce Boom: The rise in online shopping has resulted in increased shipments, particularly smaller and frequent deliveries, boosting the need for dynamic freight matching services.

- Digital Transformation: Technology is reshaping the brokerage landscape. Real-time tracking, digital load boards, automation, and AI-driven analytics are helping brokers provide more efficient and transparent services.

- Outsourcing Trends: Shippers are increasingly outsourcing logistics to third-party providers to focus on core business operations, fueling the demand for freight brokers.

- Cost Optimization: Freight brokers help businesses find the most cost-efficient transportation routes and carriers, which is especially critical amid fluctuating fuel prices and global inflation.

Market Challenges

- High Competition: The market is fragmented, with numerous traditional and digital-first players competing for market share.

- Regulatory Compliance: International shipments are subject to complex regulations, customs rules, and environmental policies that require brokers to remain constantly updated.

- Margin Pressures: Because brokers often compete on price, profit margins can be slim, especially in commoditized freight lanes.

- Technological Adaptation: Smaller or traditional brokers may struggle to adopt or afford the latest technologies, risking obsolescence.

Segmentation Analysis

Services Analysis:

In 2024, Intermodal led the market due to its cost savings and flexible transport combinations. Truckload followed, ideal for large, single shipments with minimal handling. LTL grew with e-commerce, offering a cost-effective option for small, frequent deliveries.

Customer Type Analysis:

B2B dominated with 59.2% share, driven by strong demand from industries like manufacturing and wholesale. B2C is growing steadily, boosted by e-commerce and rising consumer expectations for fast delivery.

Mode of Transport Analysis:

Waterways led due to low-cost bulk transport over long distances. Roadways remained vital for short hauls and door-to-door service. Rail and air offered niche benefits rail for heavy inland loads, air for urgent and high-value goods.

Industry Vertical Analysis:

Manufacturing topped the market with 30.2% share, needing complex logistics. Automotive followed, relying on timely part deliveries. Healthcare required secure, compliant transport. Retail & e-commerce grew fast, demanding quicker and more flexible delivery options.

Regional Insights

- North America:

North America leads the market with 34.2% share (USD 18.6 Billion), driven by strong logistics infrastructure, digital freight platforms, and active cross-border trade. - Europe:

Europe has a mature market supported by strong road and rail networks, EU regulations, and rising demand from e-commerce and sustainability efforts. - Asia Pacific:

Asia Pacific is growing fast due to strong manufacturing, rising trade, urbanization, and government investment in transport infrastructure. - Middle East & Africa:

The region sees steady growth backed by logistics hubs in the UAE and Saudi Arabia, digital adoption, and expanding trade routes. - Latin America:

Growth in Latin America is supported by trade agreements, economic reforms, and infrastructure upgrades in countries like Brazil and Mexico.

Competitive Landscape

- Digital Freight Brokers: These companies leverage advanced algorithms, AI, and digital interfaces to provide real-time freight matching, reducing manual intervention and delays.

- Established Logistics Firms: Many traditional players are expanding their brokerage services through acquisitions or digital platform launches to keep pace with technology-driven disruption.

Future Outlook

- Increased cross-border trade and economic globalization.

- Greater adoption of digital logistics solutions.

- Growing demand for multimodal freight options.

- Continued expansion of e-commerce and direct-to-consumer shipping models.

Recent Development

In May 2025, Flock Freight secured $60 million in Series E funding, strengthening its financial position. This investment aims to boost the company’s shared truckload platform and expand its service capabilities. The funding round demonstrates investor confidence in Flock Freight’s innovative approach to freight efficiency and sustainability.

In April 2025, OIA Global acquired JF Moran, a strategic move to enhance its global logistics and customs brokerage capabilities. This acquisition strengthens OIA’s position in international trade services and broadens its operational reach, especially in key U.S. entry points and international supply chain management.

In December 2024, FreightVana announced the acquisition of Loadsmith’s brokerage operations. This deal intends to expand FreightVana’s digital freight matching capabilities and integrate Loadsmith’s network into its platform. The move marks a significant step in FreightVana’s growth strategy within the competitive digital freight space.

In May 2025, Cambridge Capital merged Everest Transportation Systems with Simple Logistics to create a new freight brokerage leader. This merger combines their operational strengths, technology platforms, and carrier networks. The consolidation reflects Cambridge Capital’s vision to build scalable, tech-driven logistics solutions and drive efficiency across the freight brokerage industry.

Conclusion

In conclusion, the global freight brokerage market is undergoing a significant transformation driven by digitalization, rising e-commerce demand, and the need for cost-efficient, flexible logistics solutions. While the industry faces challenges such as regulatory complexities, intense competition, and technological disparities, it continues to offer strong growth potential across regions and sectors. Freight brokers both traditional and digital are increasingly vital in optimizing supply chain operations, providing end-to-end visibility, and facilitating seamless cargo movement. As businesses prioritize agility and efficiency in their logistics strategies, the role of freight brokerage is expected to expand further, making it a crucial component of global trade and transportation networks.