Table of Contents

Introduction

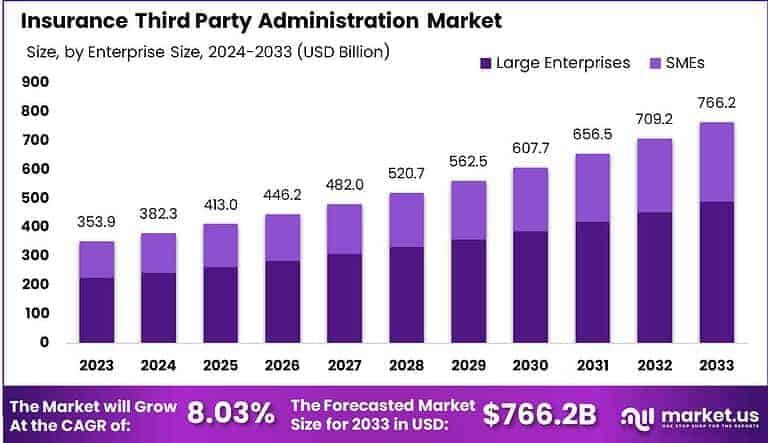

The Global Insurance Third-Party Administration (TPA) Market is experiencing significant growth, expected to reach USD 766.2 billion by 2033, up from USD 353.93 billion in 2023, growing at a compound annual growth rate (CAGR) of 8.03%. This growth is driven by the increasing complexity of the insurance industry, with businesses seeking efficient outsourcing solutions for claims processing, policy administration, and risk management. North America holds a dominant market position, capturing over 42.5% of the global share in 2023, generating USD 150.4 billion in revenue. TPAs help insurers streamline operations and improve cost efficiency, thus fueling demand for these services.

How Growth is Impacting the Economy

The growth of the insurance third-party administration market is having a substantial impact on the global economy, particularly by improving operational efficiency and reducing costs in the insurance sector. TPAs enable insurance companies to outsource claims processing, policy administration, and customer service, leading to significant cost savings. This helps insurance providers maintain profitability while ensuring compliance with regulatory requirements.

Additionally, as more companies adopt third-party administration services, the market is creating new jobs in claims management, customer service, and data processing. The TPA sector also contributes to innovation in the insurance industry by improving operational workflows through technology integration, such as AI and automation. This results in faster claims resolution, enhanced customer satisfaction, and a more streamlined insurance process. The growing demand for TPAs also benefits service providers in areas like IT, customer support, and risk management, further stimulating economic growth. Additionally, TPAs contribute to greater financial stability within the insurance industry by reducing operational risks and enhancing profitability.

➤ Research uncovers business opportunities here @ https://market.us/report/insurance-third-party-administration-market/free-sample/

Impact on Global Businesses

The expansion of the TPA market is reshaping the landscape for global businesses, particularly in the insurance sector. Rising demand for efficient and cost-effective claims management has led businesses to increasingly adopt TPA services. However, this shift has resulted in rising costs for both service providers and insurers, as TPAs must continually invest in technology and talent to meet growing demand. Additionally, supply chain shifts are occurring as companies seek to integrate third-party services seamlessly with their internal operations, requiring enhanced collaboration and data exchange.

Sector-specific impacts are particularly noticeable in the healthcare, life insurance, and property & casualty sectors, where TPAs are helping companies manage claims, policyholders, and risk with greater efficiency. The growth of the TPA market is also fostering innovations in digital tools and platforms for managing claims and policyholder services. This has prompted many businesses to reevaluate their operational strategies, embracing digitalization and outsourcing as key components of their growth strategies.

Strategies for Businesses

To stay competitive in the growing insurance third-party administration (TPA) market, businesses should implement several strategies. First, investing in advanced technologies like AI, automation, and data analytics will help companies streamline operations, reduce costs, and improve accuracy in claims processing and risk management. Second, forming partnerships with established TPA service providers can enhance operational efficiency, as outsourcing non-core functions allows businesses to focus on their core competencies.

Third, businesses should prioritize improving customer experience by adopting digital platforms that enable faster claims resolution and enhanced customer support. Additionally, integrating blockchain technology to improve transparency and reduce fraud risks is becoming increasingly important in the insurance industry. Expanding into emerging markets, where insurance penetration is increasing, provides a significant opportunity for TPA providers to grow their customer base. Finally, businesses should prioritize employee training and reskilling initiatives to adapt to the evolving landscape of TPA services, ensuring the workforce is prepared for the future.

Key Takeaways

- The global TPA market is expected to reach USD 766.2 billion by 2033, growing at a CAGR of 8.03%.

- North America holds over 42.5% of the market share, generating USD 150.4 billion in revenue in 2023.

- TPAs offer insurers cost-effective solutions for claims processing, policy administration, and customer service.

- Technological innovations like AI, automation, and blockchain are transforming the TPA landscape.

- The demand for TPAs is growing in sectors like healthcare, life insurance, and property & casualty.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=133592

Analyst Viewpoint

Currently, the TPA market is seeing significant growth, driven by the increasing demand for cost-effective and efficient insurance administration services. The future outlook for the market is highly positive, with technological advancements in AI, automation, and blockchain continuing to improve operational efficiency. TPAs will play a pivotal role in helping insurance companies manage costs, ensure compliance, and enhance customer satisfaction. As the insurance industry becomes more competitive, businesses that integrate TPA services will be able to streamline operations and improve service delivery. The continued growth of the TPA market will foster innovation and create new business opportunities for both providers and insurers.

Regional Analysis

In 2023, North America was the largest market for insurance third-party administration, capturing over 42.5% of the global share with USD 150.4 billion in revenue. The region’s dominance is driven by its well-established insurance market and the growing need for cost-effective claims management solutions. Europe follows closely behind, with increasing demand for TPA services driven by regulatory compliance and operational efficiency. The Asia Pacific region is expected to witness rapid growth as insurance penetration increases and businesses seek to optimize their operations through outsourcing. Emerging markets in Latin America and the Middle East are also experiencing growth in TPA adoption, driven by expanding insurance industries and rising demand for efficient claims processing.

Business Opportunities

The growing insurance third-party administration market presents numerous business opportunities, particularly for TPA providers, technology developers, and consulting firms. As more insurers seek to outsource their claims management and policy administration, TPA providers have the opportunity to develop customized solutions for various sectors, including healthcare, life insurance, and property & casualty.

Financial technology companies can capitalize on this growth by developing AI-powered tools and platforms for claims automation, risk management, and data analytics. Additionally, consulting firms that specialize in operational efficiency and compliance can help insurers implement TPA services effectively. Expanding into emerging markets, especially in Asia Pacific, offers new growth opportunities for businesses looking to capitalize on the increasing demand for insurance services and outsourcing.

➤ Discover More Trending Research

- Torque Sensor Market

- Moving Services Market

- Electronic Warfare Market

- Online Alternative Finance Market

Key Segmentation

The TPA market can be segmented by type of service, end-user industry, and region. Service types include claims processing, policy administration, customer service, and risk management. By end-user industry, the market includes healthcare, life insurance, property & casualty, and other insurance sectors. North America, Europe, and Asia Pacific are the key regional markets, with North America currently holding the largest share. In terms of service demand, claims processing and policy administration are the most prominent segments, driven by the need for efficient and cost-effective management. The healthcare and property & casualty sectors represent the largest demand for TPA services due to their complexity and large customer bases.

Key Player Analysis

Key players in the TPA market are focusing on developing innovative, cost-effective solutions that streamline insurance operations. These players are increasingly integrating advanced technologies such as AI, machine learning, and automation into their services to enhance efficiency and reduce processing times. Many TPA providers are expanding their offerings by including risk management and data analytics services to help insurers better manage claims and improve customer experiences. Strategic partnerships with insurance companies and technology providers are key for growth, enabling TPA providers to expand their reach and develop more comprehensive service offerings. As the market evolves, key players are expected to invest heavily in digital transformation and process automation.

- Sedgwick

- UMR Inc.

- Crawford & Company

- Gallagher Bassett Services Inc.

- CorVel Corporation

- ESIS Inc.

- Healthscope Benefits

- Maritain Health

- ExlService Holdings, Inc.

- Charles Taylor

- Other Key Players

Recent Developments

- Increased integration of AI and automation into TPA services to improve claims processing and policy management.

- Expansion of TPA offerings to include risk management and data analytics to help insurers optimize operations.

- Rising adoption of blockchain technology by TPAs to enhance transparency and reduce fraud in claims management.

- Partnerships between TPA providers and insurance companies to streamline operations and enhance customer satisfaction.

- Increased focus on compliance and regulatory standards, driving demand for TPA services in healthcare and property & casualty sectors.

Conclusion

The insurance third-party administration market is growing rapidly, driven by the increasing demand for efficient, cost-effective solutions in claims processing, policy administration, and risk management. With significant technological advancements and growing industry adoption, TPAs will continue to play a crucial role in helping insurance companies streamline operations and improve customer satisfaction.