Table of Contents

Market Overview

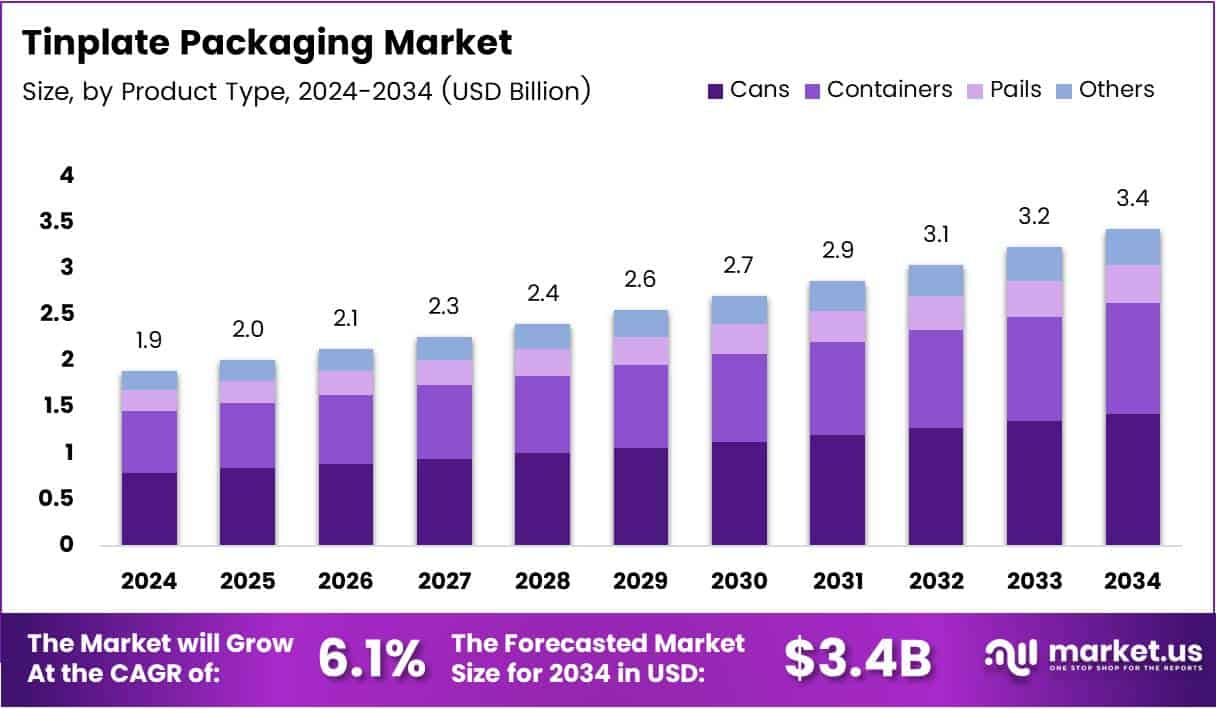

The Global Tinplate Packaging Market size is expected to be worth around USD 3.4 Billion by 2034, from USD 1.9 Billion in 2024, growing at a CAGR of 6.1% during the forecast period.

The Tinplate Packaging Market is experiencing robust growth, driven by rising sustainability awareness and increasing demand for circular economy practices. With 74% of consumers willing to pay a premium for eco-friendly packaging, brands are under pressure to adopt recyclable materials like tinplate. Tinplate’s edge lies in its near-infinite recyclability and its energy-efficient production the production of one ton of recycled steel uses only 25% of the energy compared to virgin steel. This significantly reduces carbon footprint, making tinplate a preferred material for environmentally conscious companies.

In terms of opportunity, the sector benefits from a well-established recycling infrastructure. The UK, for instance, recorded the recycling of 10.7 billion cans in 2023, showcasing the potential for large-scale recovery and reuse. Cost is another critical factor: metal packaging recycling costs between £140 to £180 per ton, which is notably more economical than plastic (£225 per ton). This cost advantage adds to tinplate’s attractiveness for both manufacturers and regulators.

Governments are also stepping in. Regulatory frameworks increasingly promote sustainable materials through subsidies, recycling mandates, and carbon credits. These initiatives, combined with growing investor interest in green packaging, position the tinplate packaging market for sustained expansion in the years ahead.

Key Takeaways

- The Global Tinplate Packaging Market is expected to reach USD 948.9 Billion by 2034, growing from USD 605.2 Billion in 2024 at a CAGR of 4.6% (2025–2034).

- Cans dominated the product segment in 2024 with a 56.4% market share due to their durability, affordability, and versatility.

- The 0.15 to 0.30mm thickness range led in 2024 for offering optimal strength and cost-efficiency, ideal for cans and general packaging.

- The Food and Beverage industry was the largest end-use segment in 2024, driven by demand for hygienic, corrosion-resistant packaging.

- Asia Pacific held the largest regional share in 2024 at 50.3%, valued at USD 0.9 Billion, supported by industrial growth and sustainable packaging trends.

Market Drivers

- Rising Demand for Packaged Foods and Beverages: Urbanization and changes in consumer lifestyles have led to a surge in demand for ready-to-eat and canned food products. Tinplate offers the required durability and preservation qualities, making it the material of choice in this segment.

- Environmental Sustainability: The recyclable nature of tinplate aligns with stringent environmental regulations and consumer preferences for eco-friendly packaging. This characteristic is encouraging manufacturers to adopt tinplate over plastic and other non-recyclable materials.

- Growing Cosmetics and Personal Care Industry: The demand for visually attractive and corrosion-resistant packaging is rising in the cosmetics sector, which is contributing to increased usage of tinplate containers.

- Advancements in Printing Technology: Tinplate allows for high-quality printing, which is beneficial for branding and product appeal. As a result, it is preferred for premium packaging applications.

Market Challenges

- High Cost of Raw Materials: Fluctuations in the prices of steel and tin can impact production costs, thereby affecting pricing strategies and profit margins.

- Competition from Alternatives: Plastic, aluminum, and composite materials offer lower costs and lighter weight, posing competition to tinplate in certain applications.

- Stringent Regulations: Regulatory compliance concerning food safety and packaging standards can create entry barriers for new players and complicate operations for existing ones.

Segmentation Insights

Product Type:

Cans lead the market with 56.4% share due to their wide use in food, beverage, and chemical packaging. Containers follow for bulk needs, pails serve thick liquids like paints, and specialty tins fill niche roles.

Thickness:

0.15 to 0.30mm is the top choice for its strength and cost balance. Thinner plates are cheaper but less durable, while thicker ones offer more protection but cost more.

End-Use Industry:

Food & Beverage is the biggest user thanks to hygiene and shelf-life needs. Consumer goods use tinplate for looks and protection. Pharma values safety, while industrial sectors like paints and chemicals use it for corrosion resistance.

Regional Insights

- Asia Pacific leads the market with 50.3% share (USD 0.9 Billion), driven by industrial growth, rising food & beverage demand, and sustainability focus in China and India.

- North America shows strong performance due to advanced packaging tech, high regulatory standards, and strong demand in food and pharma sectors.

- Europe grows steadily, supported by eco-friendly laws, recycling policies, and demand from cosmetics and gourmet food industries.

- Middle East & Africa is an emerging market, with urbanization and packaged goods driving demand, though growth is slowed by economic challenges.

- Latin America is expanding gradually, backed by rising incomes, sustainable packaging trends, and food sector development.

Competitive Landscape

The tinplate packaging market is moderately fragmented with the presence of several key players who compete based on price, product quality, innovation, and distribution. Companies are investing in advanced manufacturing technologies and exploring partnerships to expand market share. Mergers and acquisitions are also prominent as firms aim to consolidate operations and broaden their product portfolios.

The report outlines profiles of leading companies, highlighting their strategic moves such as facility expansions, product launches, and sustainability initiatives.

Recent Trends and Opportunities

- Sustainable Packaging Innovations: Increasing investment in circular economy practices is encouraging the development of lightweight and eco-friendly tinplate packaging solutions.

- Smart Packaging: Integration of QR codes and interactive labels in tinplate packaging is a growing trend to enhance consumer engagement and brand storytelling.

- Growth in E-commerce: With the rise of online retail, there is a growing need for robust and tamper-proof packaging, which tinplate can fulfill effectively.

- Government Incentives: Policies promoting metal recycling and eco-friendly packaging support the market growth and encourage R&D in tinplate technologies.

Future Outlook

The tinplate packaging market is expected to continue its growth trajectory, buoyed by the intersection of environmental concerns and consumer demand for high-performance packaging. Technological advancements, coupled with strong demand from food, beverage, and cosmetics sectors, will likely shape the future of the industry. However, the pace of innovation and adaptation to changing regulatory landscapes will be key in determining long-term success.

Recent Developments

In June 2024, Sonoco strategically acquired a European metal packaging platform for $3.9 billion, marking a major expansion of its global footprint. This move enhances Sonoco’s capabilities in sustainable packaging and positions the company to meet growing demand across various sectors, particularly in food and consumer goods industries.

By November 2024, Italian service centre San Polo Lamiere further strengthened its market position by gaining full ownership of Italpak, a company specialising in tinplate and food packaging solutions. This acquisition aligns with San Polo Lamiere’s growth objectives and broadens its service offerings within the European metal packaging industry.

Conclusion

In conclusion, the tinplate packaging market is poised for sustained growth, driven by its unique combination of durability, recyclability, and aesthetic appeal. As industries increasingly prioritize sustainable and high-performance packaging solutions, tinplate stands out as a versatile material that aligns with both regulatory demands and consumer preferences. While challenges such as raw material costs and competition from alternative packaging materials persist, ongoing innovations, particularly in eco-friendly and smart packaging, are expected to open new avenues for market expansion. With strong demand from sectors like food and beverages, personal care, and industrial goods, the future of tinplate packaging appears resilient and promising.