Table of Contents

Introduction

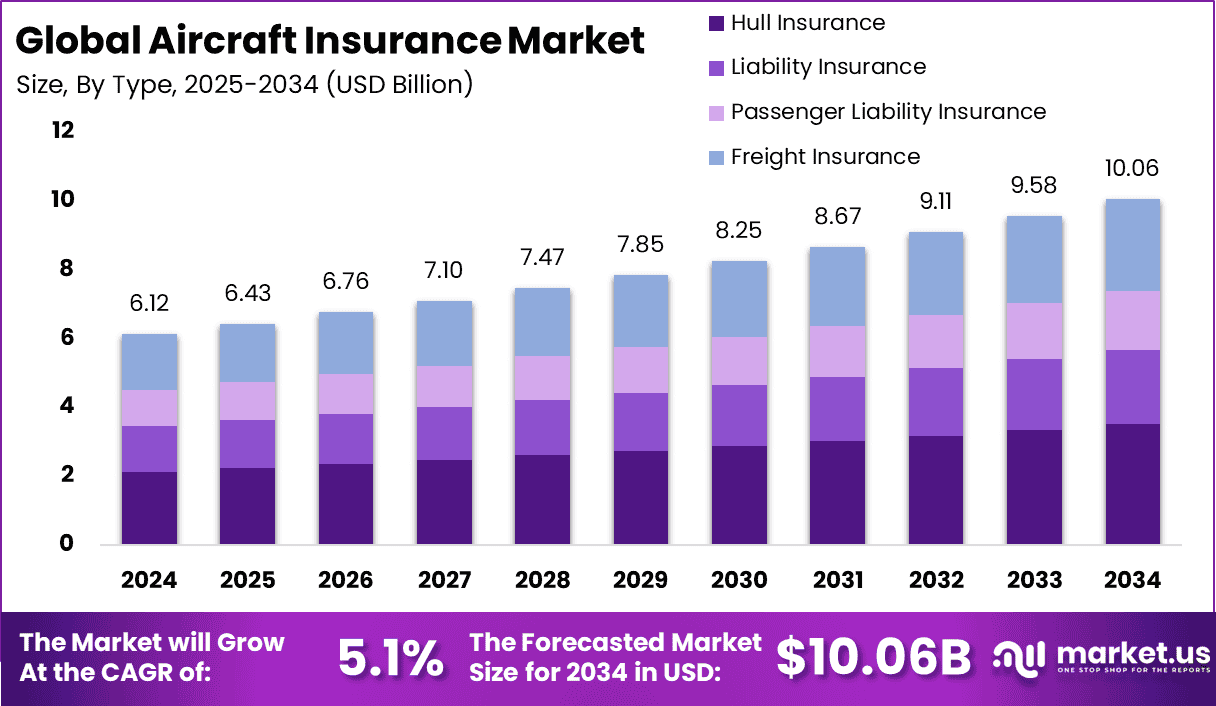

The global aircraft insurance market is projected to grow from USD 6.12 billion in 2024 to USD 10.06 billion by 2034, with a CAGR of 5.1% during the forecast period. In 2024, North America holds the largest market share at 41.7%, contributing USD 2.55 billion in revenue. This market expansion is driven by increasing air traffic, advancements in aviation technology, and the growing need for comprehensive risk management solutions to address potential aircraft-related losses.

How Growth is Impacting the Economy

The growth of the aircraft insurance market is contributing significantly to the global economy by providing essential coverage for the expanding aviation industry. As the number of aircraft and air travel increases, the demand for insurance solutions grows, driving investments in risk management technologies and services.

This sector’s growth supports job creation across the aviation and insurance industries, stimulating economic activity in various regions. Additionally, the development of new insurance products tailored to emerging risks such as cybersecurity in aviation enhances market depth and supports the financial stability of the aviation industry. Economic recovery in the post-pandemic era is also contributing to the steady demand for insurance, particularly as airlines and private aircraft owners seek to mitigate risks in a recovering travel market.

➤ Research uncovers business opportunities here @ https://market.us/report/aircraft-insurance-market/free-sample/

Impact on Global Businesses

Rising costs in the aircraft insurance market, particularly driven by increasing premiums and claims, are affecting both large and small airlines, particularly those in regions with volatile economic conditions. Supply chain disruptions, such as delays in aircraft parts and fuel supply, are also contributing to higher operational costs, indirectly influencing the demand for insurance coverage.

Furthermore, sector-specific impacts such as the introduction of new aircraft technologies or stricter regulatory requirements for safety are reshaping insurance policies. Airlines are now adjusting their insurance strategies to account for newer risks related to cybersecurity and environmental regulations, which require more comprehensive coverage solutions. This results in higher premiums and more tailored offerings to meet the evolving needs of the industry.

Strategies for Businesses

To effectively navigate the growing aircraft insurance market, businesses must adopt strategies that include diversifying their insurance portfolios and incorporating technology-driven risk management solutions. Airlines and aircraft owners should explore tailored policies that consider new emerging risks, such as those related to autonomous flight and cybersecurity threats.

Collaboration between insurers and aviation technology providers to develop customized solutions can provide better coverage while reducing costs. Moreover, insurers should leverage data analytics to assess risk more accurately and offer competitive pricing, while maintaining profitability and mitigating claims-related losses.

Key Takeaways

- The global aircraft insurance market is expected to grow at a CAGR of 5.1% from 2025 to 2034.

- North America is the leading region, contributing 41.7% of the total revenue in 2024.

- The rise in air travel and aircraft numbers is driving the demand for comprehensive risk management solutions.

- Emerging risks, such as cybersecurity threats, are influencing policy structures and premium rates.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=151693

Analyst Viewpoint

Currently, the aircraft insurance market is on a steady growth trajectory due to the continued expansion of air travel and technological advancements in aviation. In the future, the market is expected to benefit from innovations in risk management and the emergence of new risks, leading to more dynamic insurance products. Insurers will likely enhance their offerings with advanced data analytics and AI, allowing for more personalized policies and competitive premiums. This trend will help boost market growth and offer better financial protection for the aviation sector in the long term.

Regional Analysis

North America remains the dominant region in the aircraft insurance market, with 41.7% of the market share in 2024. The region’s robust aviation industry, combined with a large number of both commercial and private aircraft, underpins its market leadership. Europe and Asia-Pacific are expected to grow steadily, driven by increasing air traffic and a surge in private aircraft ownership. These regions are seeing a rise in demand for specialized insurance products, particularly in response to new regulatory requirements and heightened security risks in the aviation sector.

➤ Discover More Trending Research

- MEP Software Market

- Digital Marketing Outsourcing Market

- Call Center Outsourcing Market

- Military Rotorcraft Market

Business Opportunities

The aircraft insurance market presents numerous opportunities for insurers to develop specialized products targeting new and emerging risks. Insurers can expand their offerings by focusing on niche segments like unmanned aerial vehicles (UAVs) or green aircraft technologies. Additionally, the rise in private jet ownership, along with the demand for enhanced cybersecurity coverage, opens up opportunities for bespoke insurance policies. There is also growth potential in offering coverage for emerging markets where air travel is expanding rapidly, providing insurers with the chance to tap into new and untapped regions.

Key Segmentation

- By Insurance Type

- Hull Insurance – 40.0%

- Liability Insurance – 30.0%

- Passenger Liability Insurance – 20.0%

- Others – 10.0%

- By End-User

- Commercial Airlines – 50.0%

- Private Aircraft Owners – 30.0%

- Cargo Airlines – 10.0%

- Others – 10.0%

Key Player Analysis

The aircraft insurance market is driven by the presence of multiple global insurers offering a variety of insurance products tailored to the needs of the aviation industry. Key players leverage data analytics, risk management expertise, and innovative technologies to create more comprehensive and cost-effective policies. Strategic partnerships with airlines and aircraft manufacturers also play a significant role in ensuring the relevance of their offerings, catering to the evolving risks faced by the aviation industry, including those associated with emerging technologies and cybersecurity threats.

- AXA XL

- Allianz Global Corporate & Specialty SE

- Swiss Re Corporate Solutions Ltd

- QBE Aviation

- Willis Towers Watson

- Aon plc

- AIG (American International Group Inc.)

- Starr Aviation (Starr Indemnity & Liability Company)

- Great American Insurance Company

- Global Aerospace Inc.

- Tokio Marine HCC

- Munich Reinsurance Company

- Hallmark Financial Services Inc.

- Old Republic Aerospace Inc.

- Chubb Limited

- Others

Recent Developments

- In March 2025, a leading aircraft insurer launched a new insurance policy focused on covering the risks associated with cybersecurity in aviation.

- In May 2025, a major player introduced a more cost-effective insurance package for small private aircraft owners, aiming to expand its market share.

- In June 2025, a collaboration between an insurance company and an aircraft manufacturer led to the creation of a specialized policy for the new generation of electric aircraft.

- In July 2025, a new regulatory framework in Europe prompted insurers to develop customized insurance solutions for compliance with safety and environmental regulations.

- In September 2025, an insurer partnered with a global aviation technology firm to develop AI-driven insurance products tailored to high-tech aircraft.

Conclusion

The aircraft insurance market is expected to grow steadily in the coming years, driven by rising air traffic, the introduction of new technologies, and the evolving risk landscape. This growth presents opportunities for insurers to develop innovative, tailored insurance products that address both traditional and emerging risks.