Table of Contents

Market Overview

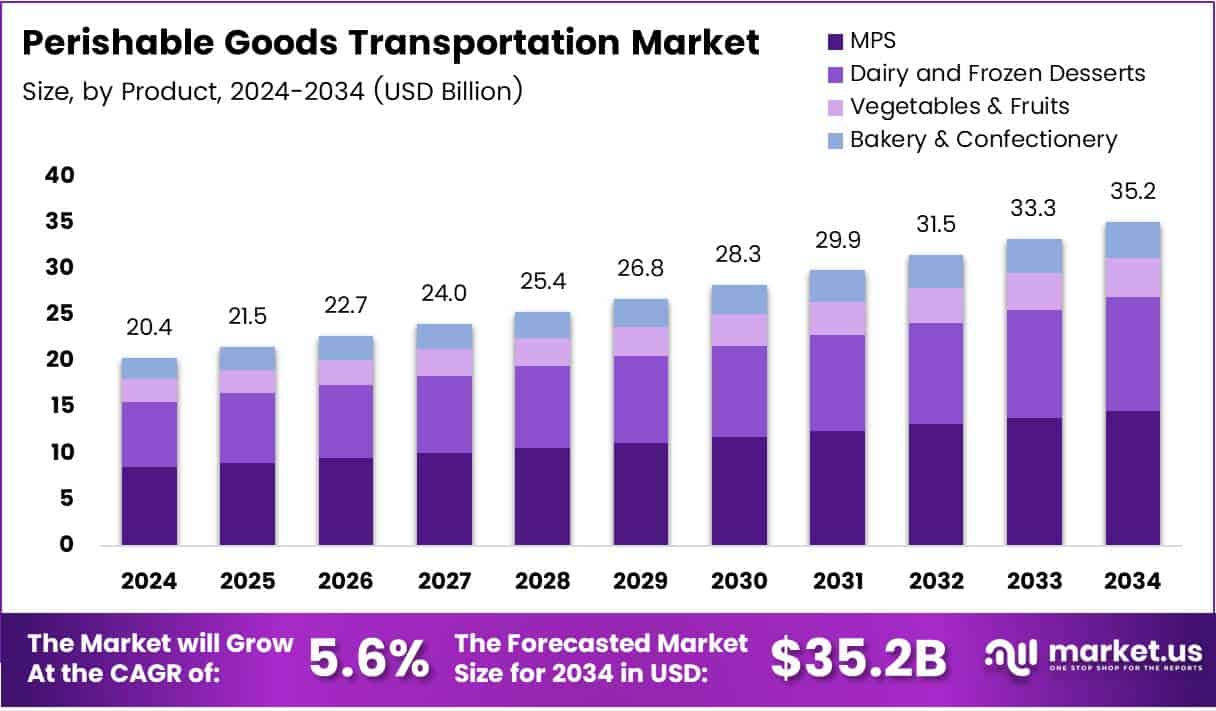

The Global Perishable Goods Transportation Market size is expected to be worth around USD 35.2 Billion by 2034, from USD 20.4 Billion in 2024, growing at a CAGR of 5.6% during the forecast period.

The Perishable Goods Transportation Market is undergoing a notable transformation, driven by growing global demand for fresh, high-quality food and strict regulations around food safety and carbon emissions. With rising consumption of perishable items especially in emerging markets the market is witnessing strong year-on-year growth, particularly across air and cold-chain logistics. A striking example is air cargo, where over 80,000 flowers are transported every 24 hours, underlining the trust in fast and controlled transportation modes.

Opportunities in this sector are massive, especially in countries like India, which produces over 400 million metric tonnes of perishable food annually. However, 30–40% of fruits and vegetables and up to 16% of marine products are lost before reaching consumers, due to gaps in temperature-controlled logistics. This presents a clear investment case for cold-chain infrastructure, last-mile delivery tech, and smarter routing solutions.

The Indian government is actively addressing these inefficiencies with greater funding in agri-infrastructure and logistics parks. Exports also highlight potential, with fruit and vegetable exports growing 11% to $1.8 billion in FY 2023–24. Moreover, as transporting food contributes 109 million tonnes of CO2e annually (26% of national GHG emissions), the regulatory push for greener logistics solutions will define market leadership.

Key Takeaways

- The Global Perishable Goods Transportation Market is projected to reach USD 35.2 Billion by 2034, growing at a CAGR of 5.6% from 2025 to 2034.

- MPS leads the By Type Analysis segment with a 38.6% market share, supported by advanced infrastructure and cold chain capabilities.

- Roadways dominate the Mode of Transportation segment with a 49.3% market share, reflecting cost-effectiveness and flexibility.

- Asia-Pacific holds the largest regional share at 35.2%, valued at USD 7.14 Billion, fueled by industrialization, rising processed food demand, and e-commerce expansion.

Market Drivers

- Growth in International Trade: As globalization expands, the movement of perishable items across borders has grown, requiring more robust and reliable transportation solutions.

- Changing Lifestyles and Urbanization: Urban consumers are increasingly demanding fresh and ready-to-eat products, boosting the need for quick and secure transportation methods.

- Advancements in Cold Chain Logistics: Innovations such as GPS tracking, real-time temperature monitoring, and AI-based logistics solutions are improving the quality and efficiency of perishable goods transport.

- E-commerce and Online Grocery Sales: Online platforms offering fresh produce and perishable food items are contributing significantly to the growth of temperature-sensitive logistics services.

Market Challenges

- High Operating Costs: Maintaining cold storage and temperature-controlled transportation is capital-intensive, especially in developing regions with limited infrastructure.

- Stringent Regulations: The industry must adhere to a variety of global and regional standards to ensure food safety and pharmaceutical integrity, which can be complex and costly.

- Infrastructure Gaps in Emerging Markets: Inadequate cold storage facilities, poor road connectivity, and lack of skilled labor remain barriers in many regions.

Segmentation Analysis

- Type Analysis

In 2024, MPS led with 38.6% market share due to strong cold chain systems and infrastructure. Dairy & Frozen Desserts followed, needing precise temperature control. Vegetables & Fruits grew steadily with rising demand for fresh produce. Bakery & Confectionery also performed well, driven by consumer preference for fresh baked goods requiring specialized transport. - Mode of Transportation Analysis

Roadways led with 49.3% share in 2024, offering flexible, door-to-door delivery. Seaways handled bulk international shipments cost-effectively. Air and rail transport served niche needs but had smaller shares due to higher costs.

Regional Analysis

Asia-Pacific

Asia-Pacific is leading the global perishable goods transportation market with a 35.2% share, valued at USD 7.14 billion. This growth is powered by fast industrial development, rising demand for packaged and processed food, and the rapid expansion of online shopping. More people moving to cities and a growing population are also increasing the need for reliable, temperature-controlled transport services in the region.

North America

North America plays a major role in the perishable goods transport market due to its strong infrastructure and high demand for quality food products in the U.S. and Canada. The region benefits from efficient supply chains and the presence of large logistics companies, ensuring smooth and safe delivery of temperature-sensitive goods across long distances.

Europe

Europe’s market is growing steadily, supported by its large farming industry and strong preference for fresh, top-quality food items. Countries like Germany, France, and the UK are also focusing on eco-friendly transportation and strict temperature control regulations, which are shaping how goods are moved across the region.

Middle East and Africa

In the Middle East and Africa, the perishable goods transport market is gaining pace due to the rising demand for imported food like fruits and vegetables. Infrastructure improvements, especially in GCC countries, are helping reduce transport costs and improve connections, making it easier to deliver perishable items across the region.

Latin America

Latin America is showing good potential in this market, with countries like Brazil and Argentina exporting more fresh food. Better logistics and increasing cross-border trade are helping the market grow, although some regions still face challenges due to weaker infrastructure. As transport networks improve, the region’s role in the global market is set to rise.

Competitive Landscape

The global market is competitive and fragmented, with several key players operating across regions. Companies focus on expanding their fleet, adopting advanced cold chain technologies, and forming strategic partnerships to gain a competitive edge.

Some companies specialize in specific transportation modes or regions, while others offer end-to-end cold chain solutions. Innovations like AI-driven logistics, autonomous refrigerated trucks, and blockchain-based tracking systems are being explored to enhance transparency and operational efficiency.

Emerging Trends

- Sustainability and Eco-Friendly Solutions: Companies are investing in electric refrigerated trucks and environmentally friendly refrigerants.

- Automation and IoT Integration: Real-time monitoring, predictive maintenance, and route optimization through AI and IoT technologies are improving efficiency.

- Customized Logistics Solutions: Tailored transport services for niche markets like organic produce or biotech products are on the rise.

- Blockchain for Transparency: Increasing adoption of blockchain to provide visibility and traceability across the cold supply chain.

Recent Developments

In May 2024, Celcius Logistics secured ₹40 crore in a pre-Series B funding round. The investment was led by existing backer IvyCap Ventures, reinforcing investor confidence in the company’s temperature-controlled logistics services. This funding is expected to support Celcius’s expansion in cold chain infrastructure and boost operational efficiency across India.

By September 2024, 2HM Logistics attracted strategic interest and was partially acquired by logistics major Neele Vat. This move strengthened Neele Vat’s European footprint while integrating 2HM’s niche capabilities. The acquisition also signaled ongoing consolidation in the sector as companies seek scale and synergies in international logistics operations.

In February 2025, Hellmann Worldwide Logistics completed the full acquisition of HPL Apollo by acquiring the remaining shares. This strategic step deepened Hellmann’s presence in the Asian logistics market and aligned with its long-term expansion goals. The acquisition also unified operations under one leadership, streamlining services for global clients.

Conclusion

The global perishable goods transportation market is poised for robust growth, driven by evolving consumer preferences, technological advancements, and rising global trade. While there are challenges related to cost and infrastructure, the integration of smart logistics and sustainable practices is creating new opportunities for stakeholders. The industry’s future will be shaped by how effectively it can balance speed, safety, efficiency, and environmental impact.