Table of Contents

Market Overview

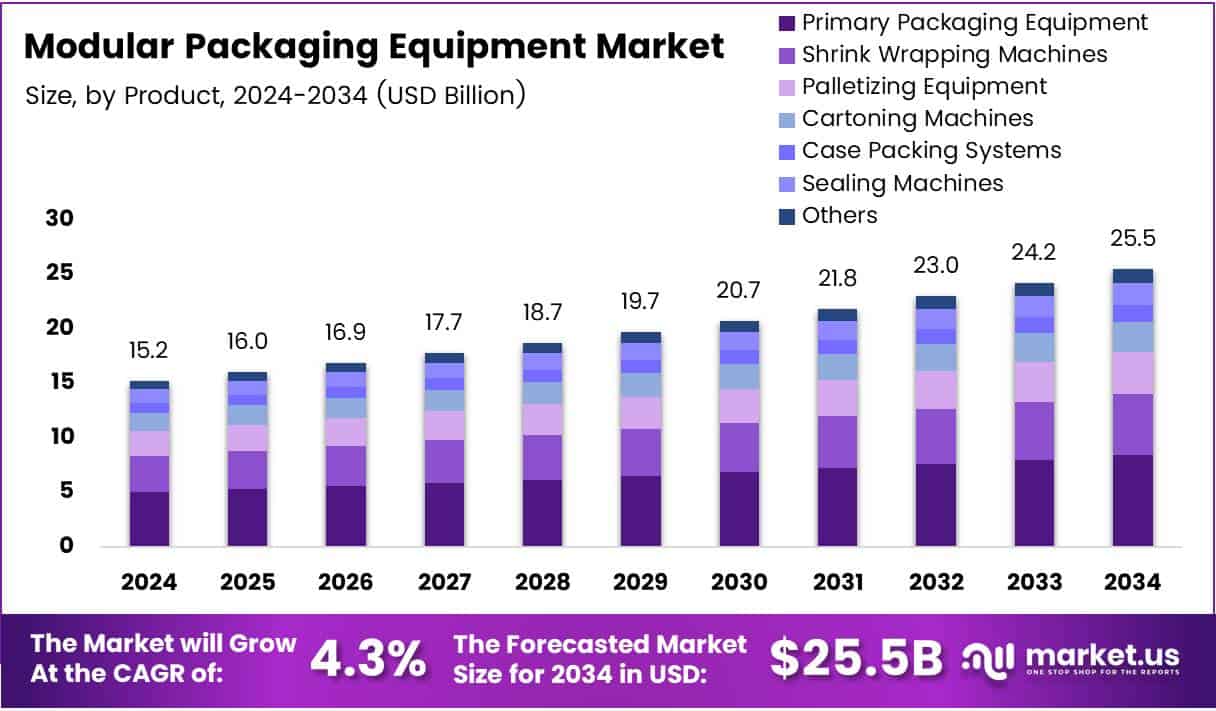

The Global Modular Packaging Equipment Market size is expected to be worth around USD 25.5 Billion by 2034, from USD 15.2 Billion in 2024, growing at a CAGR of 5.3% during the forecast period.

The Modular Packaging Equipment Market is witnessing significant momentum, driven by the increasing demand for flexible, scalable, and cost-effective packaging solutions across various industries. As businesses aim to streamline operations and reduce production downtime, modular systems are becoming an ideal choice due to their adaptability and ease of integration into existing production lines. The rising consumer preference for customized packaging formats is also pushing manufacturers to invest in modular designs that can be quickly adjusted to meet changing needs.

From an opportunity standpoint, technological advancements such as automation, IoT integration, and smart control systems are opening new doors for manufacturers. As industries continue to transition toward Industry 4.0, there is a growing appetite for intelligent packaging equipment that enhances productivity and data-driven decision-making. Notably, the total exports of packaging machinery exceeded 2.2 billion US dollars, accounting for more than 57 percent of total exports of food and packaging machinery highlighting the global competitiveness and demand for modular systems.

Government initiatives are further accelerating market growth. Many countries are supporting the packaging sector through subsidies, infrastructure development, and policies favoring automation. Simultaneously, strict regulations concerning packaging waste and sustainability are compelling companies to adopt modular equipment that supports eco-friendly and efficient packaging practices ensuring compliance and long-term cost savings.

Key Takeaways

- The global Modular Packaging Equipment Market is expected to reach USD 25.5 billion by 2034, growing at a CAGR of 5.3% from 2025 to 2034.

- Primary Packaging Equipment leads the market by type with a 60.5% share in 2024.

- Automatic Systems dominate the automation level segment with a 46.3% share in 2024.

- The Asia Pacific region holds the largest regional share at 32.5%, valued at USD 4.9 billion in 2024.

Market Drivers

Several factors are propelling the growth of the modular packaging equipment market. One of the most significant drivers is the growing need for operational flexibility. As consumer product cycles become shorter and more diverse, companies are under pressure to deliver high-mix, low-volume production runs. Modular equipment provides the flexibility to accommodate this demand without investing in separate lines for each product variation.

In addition, the rise in e-commerce and online retailing has led to an increase in demand for personalized packaging. This has necessitated the use of machines that can adapt to custom sizes and styles quickly. Modular equipment meets this need effectively.

Another major factor is the emphasis on automation and Industry 4.0. The integration of robotics, sensors, and AI within modular systems enhances process control, data monitoring, and predictive maintenance. Companies are increasingly investing in smart packaging lines that reduce human intervention, optimize throughput, and minimize errors.

The focus on sustainability is also contributing to the market’s expansion. With stricter environmental regulations and increased consumer awareness, manufacturers are turning to modular systems that reduce material waste and energy consumption. These systems support eco-friendly operations without compromising on performance or packaging quality.

Market Challenges

Despite its advantages, the modular packaging equipment market faces certain challenges. High initial investment costs and complex installation processes may deter small and mid-sized companies. Additionally, training and upskilling of operators and maintenance personnel are essential to fully leverage the benefits of modular systems.

Another challenge lies in integration compatibility. While modular systems are designed to be flexible, integrating them with existing legacy systems can be difficult, requiring additional customization and investment.

Market Segments

Primary Packaging Equipment (60.5%)

Primary Packaging Equipment leads the market due to its essential role in protecting products at the first packaging stage. It ensures safety, hygiene, and quality, especially in food, pharma, and cosmetics sectors.

Shrink Wrapping Machines

These machines are gaining popularity for offering tight, tamper-evident, and space-saving packaging, suitable across multiple industries.

Palletizing Equipment

Palletizing systems automate stacking for shipping, reducing labor and increasing efficiency in bulk handling operations.

Cartoning Machines

Cartoning equipment simplifies box folding, filling, and sealing, offering flexibility and speed for varied product sizes.

Case Packing Systems

Used in secondary packaging, these machines provide strong outer protection, ideal for storage and transportation.

Sealing Machines

Sealing machines help extend product shelf life by ensuring airtight closures, critical for food and pharma industries.

Filling Machines

These machines provide accurate, fast filling for liquid and semi-liquid products, enhancing productivity and reducing waste.

Labeling & Coding Machines

These systems ensure proper branding, traceability, and regulatory compliance by applying labels and essential information.

Secondary Packaging Equipment

Though smaller in share, secondary packaging equipment is key for bundling and final product presentation.

Automatic Systems (46.3%)

Automatic systems dominate due to their speed, precision, and ability to reduce human error in high-volume production lines.

Semi-Automatic Systems

These are ideal for mid-sized businesses seeking cost-effective partial automation with operational flexibility.

Manual Modular Equipment

Used in low-volume or specialized settings, manual systems are affordable and offer customization where automation isn’t viable.

Industry Applications

- Food and Beverage: This is one of the largest consumers of modular packaging solutions. These systems are used for bottling, sealing, labeling, and cartoning products with varying shelf lives and packaging formats.

- Pharmaceuticals: In this highly regulated industry, modular machines support precise filling, labeling, and serialization of drugs and medical supplies, ensuring compliance with stringent safety standards.

- Cosmetics and Personal Care: As this industry often deals with frequent product launches and packaging updates, modular equipment offers the needed agility.

- Consumer Goods and Electronics: These industries benefit from the adaptability and efficiency that modular packaging equipment offers, especially in managing high-mix product batches.

Regional Trends

Asia Pacific:

Asia Pacific leads the modular packaging equipment market with 32.5% share, valued at USD 4.9 billion. Growth is driven by strong demand in food, pharma, and consumer goods, along with rapid industrialization and urbanization.

North America:

North America sees strong growth due to advanced packaging tech, strict sustainability regulations, and a mature retail sector. The U.S. dominates with high adoption of automated modular systems.

Europe:

Europe holds a solid market share, driven by eco-friendly packaging demand and strict waste management rules. Growth is supported by strong manufacturing and food industries.

Middle East & Africa:

MEA region shows steady growth, fueled by expanding food & beverage industries, rising investments in manufacturing, and growing demand for packaged goods.

Latin America:

Latin America’s market is growing due to urbanization, rising middle class, and demand for cost-effective packaging. Increased foreign investment and tech adoption also support growth.

Competitive Landscape

The modular packaging equipment market is moderately fragmented, with the presence of both established players and emerging companies. Leading manufacturers are focusing on product innovation, expanding their portfolios, and offering end-to-end solutions that include not only machinery but also maintenance, support, and training services.

Strategic collaborations, mergers, and acquisitions are also prevalent, as companies seek to strengthen their technological capabilities and expand their global footprint.

Future Outlook

The future of the modular packaging equipment market looks promising. As industries increasingly prioritize flexibility, customization, and sustainability, the demand for modular solutions is expected to continue growing. The integration of IoT, AI, and machine learning will further revolutionize the way these systems are operated, monitored, and maintained.

In conclusion, modular packaging equipment represents the next step in packaging innovation, enabling manufacturers to remain competitive in an ever-changing global market landscape. Its ability to offer tailored, efficient, and scalable solutions makes it a vital component of modern production lines.

Recent Developments

In December 2024, Movopack secured £2 million ($2.5 million) in seed funding to boost its circular and sustainable packaging solutions for e-commerce platforms. This investment strengthens its mission to replace single-use packaging and scale its operations across environmentally conscious markets.

By March 2025, BENZ Packaging committed Rs 150 crore to modernize its facilities and expand globally. This strategic investment aims to enhance production capabilities, align with international quality standards, and meet growing demand in global markets.

In June 2025, ALPLA Group acquired KM Packaging to bolster its injection-moulding unit, ALPLAinject. This move reinforces ALPLA’s position in advanced moulding technologies and expands its product offering across sectors like food, cosmetics, and healthcare packaging.

Also in June 2024, Pacteon Group acquired Descon Integrated Conveyor Solutions, expanding its end-of-line packaging equipment portfolio. The acquisition enhances its automation solutions, strengthens its North American footprint, and deepens its integration capabilities for diverse packaging systems.

Conclusion

In conclusion, the modular packaging equipment market is poised for substantial growth, driven by the increasing demand for flexibility, automation, and sustainability across diverse industries. As companies strive to stay competitive in fast-paced, consumer-driven markets, modular systems offer the adaptability and efficiency needed to manage varied product lines, reduce downtime, and optimize production processes. With the integration of smart technologies and ongoing innovations, modular packaging equipment is set to become an essential component of modern manufacturing, enabling businesses to respond swiftly to evolving packaging needs while maintaining high standards of quality and performance.