Table of Contents

Market Overview

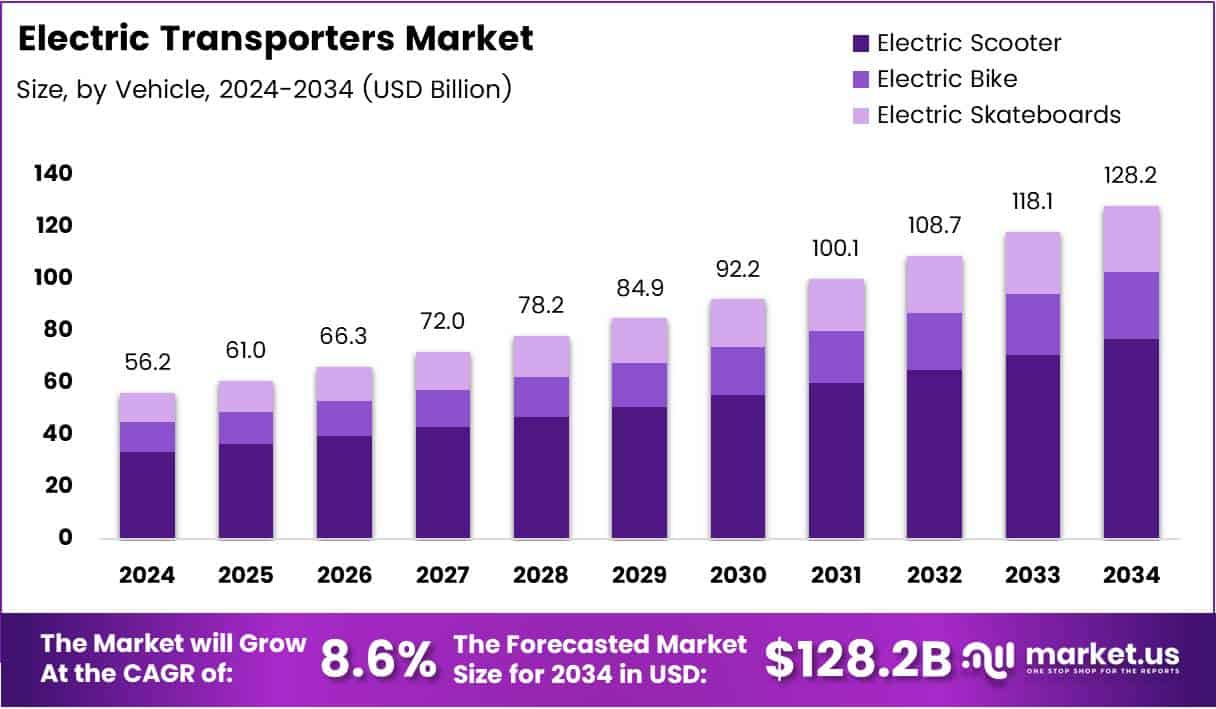

The Global Electric Transporters Market size is expected to be worth around USD 128.2 Billion by 2034, from USD 48.9 Billion in 2024, growing at a CAGR of 8.6% during the forecast period.

The Electric Transporters Market is at a pivotal stage, driven by a confluence of technological advancements, sustainability imperatives, and government initiatives. Global electric vehicle (EV) ownership has surged by 53% year-over-year since 2011, signaling robust consumer demand and a shift in mobility preferences. One of the most compelling growth factors is the environmental advantage EV buses reduce greenhouse gas emissions by 70% compared to compressed natural gas (CNG) alternatives, positioning electric transporters as a vital tool in meeting global climate targets.

Governments across major economies are accelerating the transition through targeted investments, subsidies, and infrastructure development. For example, dedicated EV policies, tax incentives, and funding for battery manufacturing plants are creating fertile ground for market expansion. Regulatory frameworks are also evolving mandates on emission reductions and fleet electrification are pushing both public and private transport providers to adopt electric solutions.

There is substantial opportunity in emerging markets where urbanization and air pollution are rising concerns. Fleet electrification in logistics, last-mile delivery, and public transit is unlocking new revenue channels. With declining battery costs and improved charging infrastructure, the market is expected to maintain strong momentum. Strategic collaboration and policy alignment will be key to capitalizing on this growth trajectory.

Key Takeaways

- The Global Electric Transporters Market is projected to reach USD 128.2 Billion by 2034, growing from USD 48.9 Billion in 2024 at a CAGR of 8.6%.

- In 2024, Electric Scooters led the vehicle segment with a 56.2% market share, fueled by urban congestion and short-distance commuting demand.

- Li-Ion batteries dominated the battery segment in 2024 due to high energy density, lighter weight, and longer lifecycle.

- The 48V voltage category held a top position in 2024 with a 51.4% share, balancing power, safety, and cost effectively.

- Asia Pacific was the largest regional market in 2024, accounting for 44.2% share valued at USD 21.5 Billion, driven by urbanization, incentives, and environmental focus.

Key Market Drivers

- Sustainability Initiatives and Green Policies: Increasing environmental regulations and zero-emission targets by governments globally are propelling the demand for electric transporters. Policies supporting EVs, including tax rebates and subsidies, are incentivizing both manufacturers and consumers.

- Urbanization and Traffic Congestion: Rapid urban growth has led to increased traffic congestion. Electric transporters provide an efficient, low-cost solution for short-distance travel, helping ease urban mobility challenges.

- Fuel Price Volatility: Rising and unpredictable fossil fuel prices have led consumers to seek alternatives. Electric transporters offer a more economical, stable-cost transportation option.

- Growing Demand for Micro-Mobility: The global shift toward micro-mobility short trips under 5 kilometers is creating strong demand for lightweight and compact electric vehicles like e-scooters and e-bikes.

- Technological Advancements: Innovations in battery technology, energy efficiency, and lightweight materials are making electric transporters more viable, attractive, and accessible for mass adoption.

- Supportive Infrastructure Development: Investments in EV charging networks, especially in urban centers, are reducing range anxiety and enabling widespread usage of electric transporters.

- Increased E-Commerce and Last-Mile Delivery Demand: The booming online retail sector is driving demand for electric transporters in the commercial segment, especially for last-mile delivery operations in cities.

Market Segmentation

Vehicle Analysis

Electric scooters lead the market with 56.2% share in 2024 due to their affordability and convenience in cities. E-bikes are rising in demand for longer rides and fitness use, while electric skateboards attract younger users looking for fun and portability.

Battery Analysis

Li-Ion batteries dominate for their high efficiency, light weight, and long life. Lead acid batteries are cheaper but bulky and outdated. NiMH batteries are better than lead acid but still lag behind Li-Ion in performance.

Voltage Analysis

48V systems lead with 51.4% share, offering a good mix of power and cost. 24V is for basic, low-cost vehicles. 36V suits mid-range models. Above 48V systems give top performance but are mainly used in premium vehicles due to higher costs.

Regional Insights

Asia Pacific

Asia Pacific leads the electric transporters market with a 44.2% share, valued at USD 21.5 billion. This is mainly due to rapid urban growth, strong government support, and rising demand for eco-friendly travel. The region’s large population and need for personal transport options also boost its dominance.

North America

North America is seeing steady growth in electric transporters, thanks to increasing awareness about green mobility, strong investment in charging stations, and helpful government incentives. The shift toward electric vehicles for last-mile delivery also supports market expansion.

Europe

Europe remains a major player in this market due to strict emission rules and strong policies for clean transportation. Innovation in battery tech and a focus on cutting carbon emissions are pushing both personal and commercial adoption of electric transporters.

Middle East and Africa

In the Middle East and Africa, electric transporters are slowly catching on, mainly in cities focused on smart infrastructure. Governments are working to move away from oil dependency, creating new chances for electric mobility.

Latin America

Latin America’s market is growing moderately, driven by environmental concerns and urban transport needs. Incentives, global partnerships, and city-level pilot programs are helping increase the use of electric transporters in the region.

Key Market Trends

- Micro-Mobility Boom: There is a surge in demand for micro-mobility solutions in urban settings. Electric scooters and bikes are being widely adopted for short-distance travel to avoid traffic congestion and reduce commuting time.

- Technological Innovations: Continuous advancements in battery technology, charging infrastructure, and vehicle design are making electric transporters more efficient and appealing. Lightweight materials, enhanced range, and fast-charging capabilities are improving user experience.

- Shared Mobility Services: The growth of app-based electric scooter and bike rentals has made electric transporters more accessible. Companies are introducing shared fleets in cities, reducing the need for personal ownership and promoting sustainability.

- Focus on Safety and Regulation: As electric transporters grow in popularity, governments are introducing safety regulations and guidelines to manage traffic integration, ensure rider safety, and standardize manufacturing practices.

Challenges and Restraints

- High Initial Costs: Although electric transporters offer low operational costs, the initial purchase price is still high compared to traditional alternatives, which may deter some consumers.

- Limited Charging Infrastructure: Inadequate availability of public charging stations, especially in developing regions, hampers the adoption rate.

- Battery Issues: Battery life, charging time, and replacement costs remain major concerns. Innovations are ongoing, but these factors still affect consumer confidence.

- Regulatory Hurdles: In some regions, the lack of clear regulatory frameworks for electric micro-mobility solutions hinders market penetration. This includes issues related to road safety, parking, and rider behavior.

Competitive Landscape

- Introducing foldable, lightweight designs for enhanced portability.

- Developing apps for real-time tracking, battery management, and fleet sharing.

- Investing in R&D to extend range and improve performance.

- Collaborating with urban mobility platforms and municipal authorities.

Future Outlook

- Improved battery technology (solid-state batteries, extended range).

- Integration of AI and IoT for smart mobility solutions.

- Expansion of charging infrastructure.

- Greater adoption in emerging markets.

Recent Developments

- In Nov 2024, the U.S. allocated $46.5M to boost EV charging reliability and performance, aiming to strengthen the national infrastructure.

- By May 2024, electric school buses qualified for over $9B in funding, promoting cleaner student transportation and reducing emissions.

- In Sept 2024, ATC invested £19M in a new EV fleet, advancing its shift toward sustainable logistics and green mobility.

- In Apr 2024, the DOE invested $54M to expand transport options, supporting clean mobility in underserved U.S. communities.

- In Jan 2025, MoEVing acquired EVonGO to scale operations and enhance its EV fleet and logistics capabilities.

Conclusion

In conclusion, the electric transporters market is rapidly evolving as a crucial component of the global shift toward sustainable and efficient urban mobility. Driven by supportive government policies, rising environmental consciousness, and ongoing technological innovations, the market is set for significant expansion across both personal and commercial segments. While challenges such as high initial costs, infrastructure limitations, and regulatory uncertainties persist, continuous investment in battery technology, smart mobility solutions, and charging infrastructure is expected to overcome these barriers. With increasing adoption in emerging markets and growing applications in last-mile delivery and shared mobility, electric transporters are well-positioned to redefine the future of short-distance transportation.