Table of Contents

Introduction

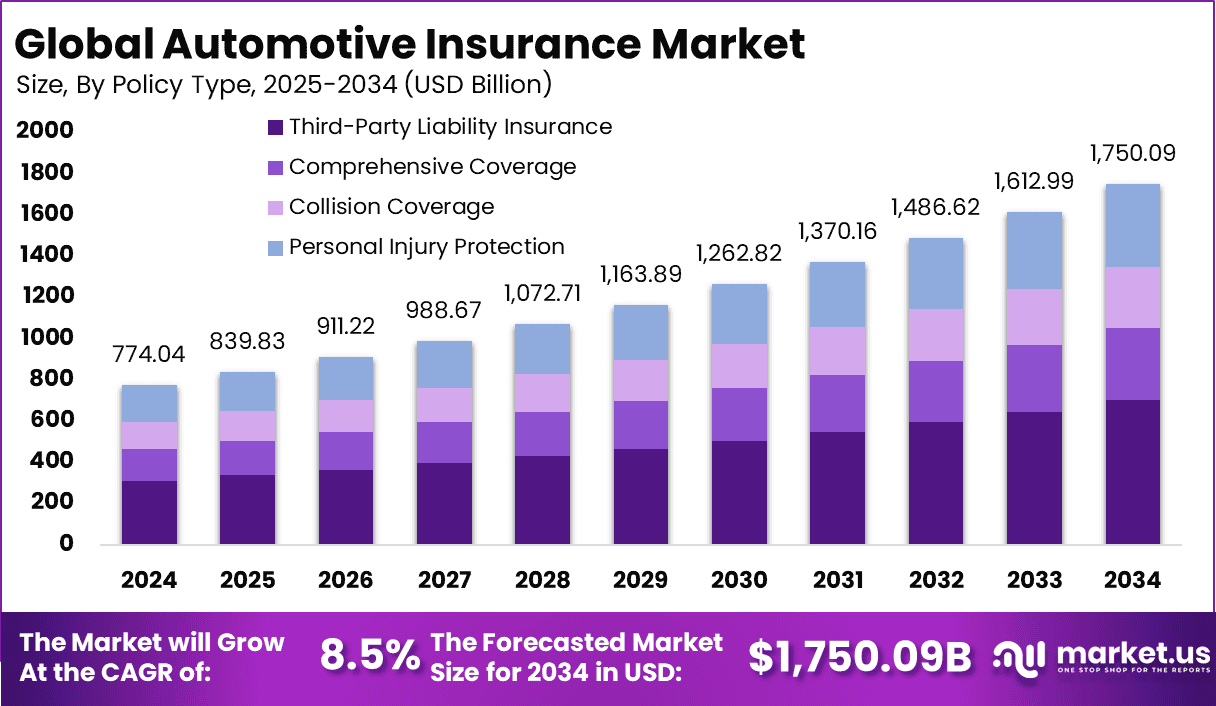

The global automotive insurance market is poised for substantial growth, with a projected market value of USD 1,750.09 billion by 2034, up from USD 774.04 billion in 2024, reflecting a CAGR of 8.5% during the forecast period from 2025 to 2034.

As the automotive industry evolves with increasing vehicle sales, advanced technologies, and regulatory changes, automotive insurance remains a critical component of the sector. The growing adoption of electric vehicles (EVs), autonomous vehicles, and digital technologies is also influencing insurance models. The market is driven by the increasing demand for comprehensive coverage, technological advancements, and a growing awareness of risk management.

How Growth is Impacting the Economy

The growth of the automotive insurance market is contributing significantly to the global economy, particularly in the financial services and automotive sectors. The increasing number of vehicles on the road, driven by rising urbanization and income levels, is directly fueling the demand for automotive insurance products. As the market expands, it is also creating new job opportunities in underwriting, claims management, and customer service.

Technological innovations, such as the integration of telematics and AI in insurance policies, are enabling businesses to offer more personalized and dynamic insurance plans, driving revenue growth. Furthermore, the rise of electric vehicles and connected cars is prompting new insurance models, impacting how coverage is structured.

The market’s growth also has a broader economic impact by improving consumer protection and financial security, driving growth in related industries such as auto repair, spare parts, and technology development. The continued expansion of this market is expected to create a positive economic ripple effect across multiple sectors.

➤ Research uncovers business opportunities here @ https://market.us/report/automotive-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

The increasing demand for automotive insurance is driving up operational costs, as insurers need to adopt new technologies and enhance customer service to stay competitive. Companies are investing heavily in AI, telematics, and data analytics to improve risk assessment and claims processing, which incurs additional costs.

The need for better data and analytics has led to shifts in the supply chain, with more collaboration between insurance companies, technology providers, and automotive manufacturers to create innovative solutions tailored to emerging trends, such as EVs and autonomous driving.

Sector-Specific Impacts

- Automotive: The rising number of vehicles on the road, particularly electric and autonomous vehicles, is significantly boosting demand for specialized insurance products.

- Insurance Providers: The shift toward personalized insurance policies powered by data and telematics is changing how providers assess risk and calculate premiums.

- Technology: With the integration of telematics and AI, tech companies that provide data analytics and AI solutions are benefiting from increased demand in the automotive insurance sector.

- Consumer Behavior: Consumers are increasingly looking for more flexible, customized insurance options, prompting insurers to innovate with dynamic pricing models.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=152136

Strategies for Businesses

To capitalize on the growing automotive insurance market, businesses should focus on embracing digital transformation. This includes investing in AI, machine learning, and telematics to offer more personalized and flexible policies. Insurers should also prioritize improving customer experience through digital platforms that streamline the claims process and provide real-time updates.

Partnerships with automakers to offer bundled insurance solutions or customized coverage for electric and autonomous vehicles could further expand market share. Additionally, expanding into emerging markets with high vehicle growth potential will help insurers tap into new revenue streams. Businesses should also focus on enhancing their data security measures to protect sensitive customer information, which will help build consumer trust and comply with regulations.

Key Takeaways

- The global automotive insurance market is expected to reach USD 1,750.09 billion by 2034.

- CAGR of 8.5% reflects robust growth in vehicle insurance demand.

- The rise of electric vehicles, autonomous driving, and telematics is reshaping insurance models.

- Businesses must embrace digital transformation, focusing on personalized solutions and AI-driven models.

- New opportunities lie in emerging markets and innovative coverage options for EVs and connected vehicles.

Analyst Viewpoint

Currently, the automotive insurance market is driven by the increasing number of vehicles on the road and the rise of connected, electric, and autonomous vehicles. The present focus is on enhancing risk assessment through technology, allowing insurers to offer more tailored policies. In the future, the integration of AI, data analytics, and telematics will continue to transform the market, providing more dynamic pricing and personalized coverage. As the automotive landscape evolves with new technology and regulatory changes, the market will continue to expand, creating numerous opportunities for innovation and growth.

Regional Analysis

North America currently holds a dominant position in the automotive insurance market, capturing 32% of the market share in 2024, with USD 247.6 billion in revenue. This is driven by a high vehicle ownership rate, advanced insurance models, and regulatory frameworks. Europe is following closely, with increasing demand for both traditional and specialized insurance products, particularly for electric vehicles.

Asia-Pacific is expected to see the highest growth rate, driven by the rapid increase in vehicle sales and infrastructure development in countries like China and India. Latin America and the Middle East & Africa are emerging regions with a growing middle class, leading to rising vehicle ownership and increasing demand for insurance solutions.

Business Opportunities

The automotive insurance market presents numerous business opportunities, especially for insurers who can adapt to the needs of electric and autonomous vehicle owners. Companies can explore partnerships with automakers to offer bundled products or develop tailored policies for emerging technologies.

Data analytics and AI solutions providers also have significant opportunities in this market, helping insurers improve risk assessment, pricing models, and claims processing. Insurers entering emerging markets with expanding vehicle sales can tap into new revenue streams, offering basic to premium coverage. Additionally, opportunities exist in offering flexible, on-demand insurance policies for customers looking for customizable options.

Key Segmentation

Product Type:

- Comprehensive Insurance

- Third-Party Liability Insurance

- Collision Insurance

- Uninsured Motorist Coverage

Technology:

- Telematics-Based Insurance

- AI-Driven Risk Assessment

- Blockchain for Claims Processing

End-User:

- Individual Vehicle Owners

- Fleet Owners

- Insurance Providers

Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Key Player Analysis

The automotive insurance market is highly competitive, with insurers focusing on providing innovative and flexible solutions to meet the growing demand for customized coverage. Key players are integrating telematics, AI, and blockchain into their offerings to improve risk assessment, claims processing, and fraud detection.

Companies are also forming strategic partnerships with automakers, data analytics providers, and technology firms to offer comprehensive, bundled insurance products. As the market grows, those who can integrate technology seamlessly into their business models and offer dynamic, customer-centric solutions will have a significant competitive advantage.

- Allianz SE Company Profile

- AXA SA

- State Farm Mutual

- Progressive Corporation

- GEICO (Berkshire Hathaway)

- Liberty Mutual Insurance

- Zurich Insurance Group

- Tokio Marine Group

- Mapfre S.A.

- Admiral Group

- Allstate Corporation

- Bajaj Allianz General Insurance

- ICICI Lombard General Insurance

- Others

Recent Developments

- A major insurer launched an AI-driven platform for real-time claims processing and dynamic pricing based on telematics data.

- Several automakers have partnered with insurers to offer bundled insurance products for electric vehicles, including coverage for charging infrastructure.

- A prominent insurer introduced a blockchain-based solution for improving transparency and security in claims management.

- The adoption of pay-per-mile insurance policies has gained traction, offering flexible options for consumers with low annual mileage.

- Governments in key markets are introducing regulatory frameworks that require insurers to offer coverage for autonomous vehicles, fueling market growth.

Conclusion

The global automotive insurance market is poised for significant growth, driven by the increasing demand for customized coverage and advancements in technology. With a projected market value of USD 1,750.09 billion by 2034, businesses that invest in AI, telematics, and blockchain will be well-positioned to capitalize on emerging opportunities.