Table of Contents

Market Overview

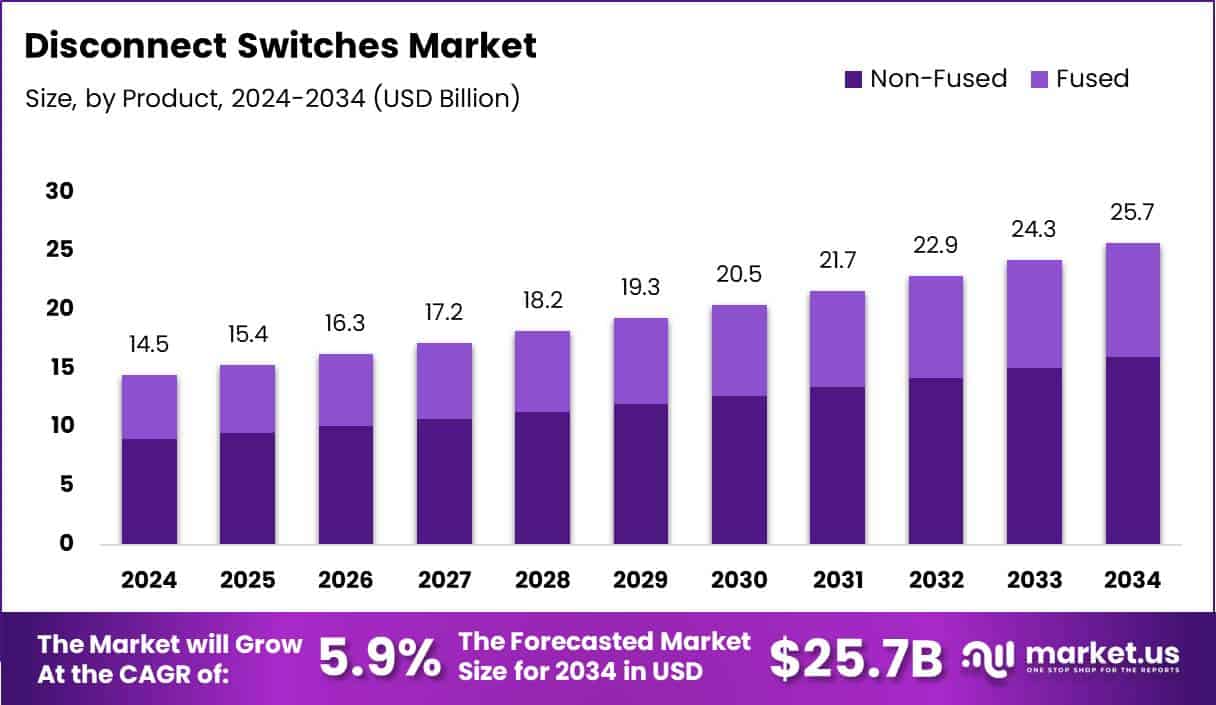

The Disconnect Switches Market will grow from USD 14.5B in 2024 to USD 25.7B by 2034 at a 5.9% CAGR.

The Disconnect Switches Market is experiencing robust growth due to rising investments in power infrastructure, renewable energy projects, and industrial automation. With the global market expected to grow at a CAGR of over 5.2% through 2033, key sectors such as utilities, manufacturing, and transportation are significantly driving demand for reliable electrical isolation solutions. The shift toward grid modernization, smart substations, and solar energy integration is creating new revenue streams for manufacturers and suppliers of disconnect switches.

Significant growth opportunities are emerging across developing economies where governments are heavily investing in high-voltage transmission and distribution networks. Markets like India, China, and Southeast Asia are expanding their energy access goals, prompting the adoption of advanced electrical safety systems. Furthermore, government investments exceeding billions of dollars in grid resilience and renewable energy particularly in the U.S., Europe, and the Middle East are accelerating the deployment of medium and high-voltage disconnect switches.

Regulatory compliance is another strong driver. Strict standards such as IEC 60947 and IEEE C37 are encouraging the adoption of high-efficiency and environment-friendly switches. In conclusion, the Disconnect Switches Market presents a lucrative landscape for OEMs, EPC players, and energy solution providers looking to capitalize on the global shift toward safer, smarter, and more sustainable electrical networks.

Key Takeaways

- The Global Disconnect Switches Market will grow from USD 14.5 Billion in 2024 to USD 25.7 Billion by 2034, at a 5.9% CAGR.

- Non-Fused disconnect switches dominated the product segment in 2024 with a 62.1% market share due to their cost-efficiency and simple design.

- Panel Mounted disconnect switches led the mounting type segment in 2024 with a 57.2% share, driven by ease of installation and integration.

- Disconnect switches rated Up to 1 kV held a 52.2% market share in the voltage segment in 2024, popular in low-voltage applications.

- The Below 200 A current rating segment accounted for a 46.2% market share in 2024, due to its affordability and circuit compatibility.

- North America was the leading regional market in 2024 with a 41.1% share, valued at USD 5.9 Billion, supported by smart grid upgrades and industrial safety regulations.

Market Drivers

- Rising demand for electrical safety and system reliability: As modern infrastructure relies more heavily on electrical systems, there is a growing need for components that ensure safe operation and maintenance.

- Industrial and commercial infrastructure development: Emerging economies are seeing significant industrial growth, especially in manufacturing and energy sectors, which require robust electrical safety systems.

- Smart grid implementation and modernization of power systems: The ongoing upgrades of electrical grids are increasing the deployment of disconnect switches as part of automation and control solutions.

- Renewable energy integration: The rising penetration of solar and wind energy systems necessitates efficient power isolation solutions, boosting demand for disconnect switches in renewable installations.

Key Market Segmentation

Product Analysis

Non-Fused disconnect switches held a 62.1% share in 2024 due to their simple, low-cost design and easy installation.

Mounting Analysis

Panel Mounted switches dominated with 57.2% share for their easy fit in control panels. DIN Rail types suit compact systems; custom mounts meet niche needs.

Voltage Analysis

Switches up to 1 kV led with 52.2% share, widely used in homes and low-voltage industries. Medium (1–15 kV) and high (>15 kV) types serve larger setups but see less demand due to cost.

Current Rating Analysis

Switches below 200 A led with 46.2% share due to affordability and standard circuit use.

Regional Analysis

North America

Leads the market with 41.1% share (USD 5.9 Billion) due to smart grid investments, strong safety rules, and a mature industrial base.

Europe

Growing steadily with focus on energy efficiency, industrial automation, and renewable energy upgrades.

Asia Pacific

Fastest growth driven by industrialization, urban expansion, and high electricity demand in countries like China and India.

Middle East & Africa

Growth supported by infrastructure projects, grid upgrades, and strong demand from oil, gas, and utility sectors.

Latin America

Steady progress due to grid modernization, industrial recovery, and rising focus on renewable energy.

Competitive Landscape

The disconnect switches market is competitive with both global and regional players offering a broad range of solutions. Leading companies focus on strategic collaborations, product innovation, and mergers to strengthen their positions. Product reliability, cost efficiency, and safety compliance are key differentiators in this space.

Vendors are also increasingly focusing on integrating digital monitoring and automation features into disconnect switches to align with Industry 4.0 trends. These smart switches enable predictive maintenance, reduce downtime, and enhance operational visibility.

Recent Trends and Innovations

- Smart Disconnect Switches: Feature IoT and remote monitoring for better control.

- Eco-friendly and Compact Designs: Designed to be smaller and more energy-efficient.

- Integration with Renewable Systems: Built to work with solar inverters and battery storage.

Challenges and Restraints

- High initial costs of advanced or customized switches.

- Lack of awareness in underdeveloped regions.

- Supply chain disruptions affecting raw material availability and product delivery timelines.

Recent Developments

- Apr 2025: Sécheron acquired LoPro high-voltage circuit breaker tech from TE Connectivity to expand its power system solutions.

- Feb 2024: Pioneer Safety Group took over Petrel Limited to strengthen its hazardous lighting offerings.

- Oct 2024: Power Grid Components acquired Vizimax to enhance grid reliability with advanced control tech.

- Nov 2024: TE Connectivity bought Harger to boost its portfolio in lightning protection and grounding solutions.

Conclusion

The global disconnect switches market is growing due to expanding infrastructure, energy transition, and stricter safety norms. Tech advances and rising investments in smart grids and renewables will drive strong growth. Makers focused on innovation, low cost, and compliance will benefit most.