Table of Contents

Market Overview

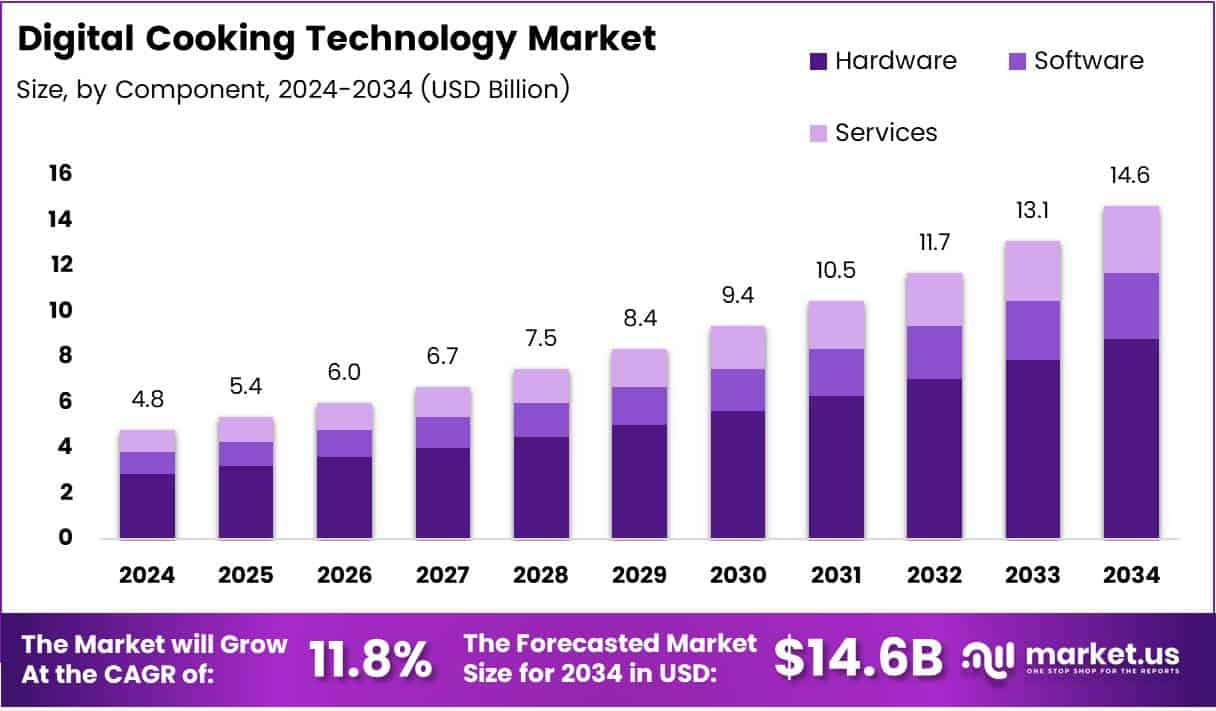

The Global Digital Cooking Technology Market size is expected to be worth around USD 14.6 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 11.8% during the forecast period.

Opportunities are strong in smart homes. Users want app-based, voice-controlled, and personalized cooking. Brands offering energy-saving, user-friendly products can lead. Cloud platforms and remote cooking features add extra value for tech-savvy buyers.

Governments are boosting investment in clean and digital kitchens. Incentives support smart and green appliances. Public programs push companies to innovate and cut emissions.

Regulations focus on safety, data privacy, and standards. Firms must follow rules on emissions and product safety. Adapting to these laws while innovating is key for growth and trust.

Key Takeaways

- The Global Digital Cooking Technology Market will reach USD 14.6 Billion by 2034, up from USD 4.8 Billion in 2024, at a CAGR of 11.8% (2025–2034).

- Hardware led the By Component segment in 2024 with a 64% share.

- Wi-Fi dominated Connectivity Technology in 2024, holding a 52% market share.

- The Residential sector captured a 72% share in Application in 2024.

- North America held a 36.3% market share in 2024, valued at USD 1.7 Billion.

Key Market Drivers

- Smart Kitchen Demand

Consumers are upgrading to smart kitchens. Devices like smart ovens and cooktops offer automation and app control. Voice-enabled features add convenience. - Urban Lifestyle

Busy city life increases demand for quick, efficient cooking. Smart appliances help save time and effort. - Energy Efficiency

Digital devices use less power. They reduce energy bills and support eco-friendly goals. - Health Focus

Users want healthy meals. Smart cookers suggest recipes, count calories, and monitor nutrition. - Tech Innovation

AI and IoT boost cooking accuracy. Apps offer remote monitoring, timers, and smart alerts.

Market Challenges

- High Cost

Smart cooking appliances are expensive. Cost limits adoption in budget-sensitive areas. - Connectivity Issues

Devices may not work with all smart home systems. Integration problems affect performance. - Privacy Concerns

Connected devices collect data. Users worry about security and data misuse. - Low Awareness

Many people in emerging markets don’t know about digital cooking tech. Adoption is slower.

Product Types

Smart Ovens

Offer temperature control, cooking presets, and app features.

Smart Cooktops

Use touch controls, timers, and auto-shutoff.

Connected Microwaves

Adjust cooking time based on weight and moisture.

Digital Sous Vide

Ideal for precision cooking at fixed temperatures.

Multifunction Smart Cookers

Combine pressure, steam, and slow cooking in one unit.

End-User Trends

More consumers cook at home using digital tools. Features like app-guided cooking and voice commands are popular. Diet tracking and meal suggestions support healthy living.

The DIY cooking trend is rising. Bloggers and online recipes boost interest in smart devices. Integration with content makes cooking more interactive.

Segmentation Insights

Component Analysis:

Hardware holds 64% share in 2024. Smart stoves and sensors are key to digital cooking. They ensure real-time, accurate performance. Software boosts features with AI, recipes, and UI but lags in share. Services grow slowly, covering setup, support, and content.

Connectivity Technology Analysis:

Wi-Fi leads with 52% due to smart home use, updates, and remote control. Bluetooth fits short-range, low-energy needs. Zigbee/Z-Wave offers mesh and low power but faces cost, compatibility issues. NFC is niche, used for fast pairing and secure access.

Application Analysis:

Residential dominates with 72% share in 2024. Home users adopt smart ovens, cooktops, and AI tools for easy, healthy cooking. Commercial use rises slowly due to cost and long decision cycles but adds value in speed and consistency.

Regional Insights

North America:

Leads with 36.3% share (USD 1.7B). Strong tech, smart appliance use, and high internet boost growth.

United States:

Drives the region. High mobile use, smart homes, and energy rules push demand.

Europe:

Steady growth. Green tech, smart homes, and rising income support adoption.

Asia Pacific:

Fastest growth. Urban life, e-commerce, and mobile access fuel demand. China, India, Japan lead.

Middle East & Africa:

Early-stage market. Urbanization and smart home investment show future potential.

Latin America:

Moderate growth. Convenience drives demand, but economy and awareness limit pace.

Competitive Landscape

- Product innovation

- Mobile apps

- User-friendly designs

- Smart home integration

- Eco-friendly materials

Future Outlook

- Real-time nutrition tracking

- Smarter automation

- Enhanced voice control

- Cloud-based updates

Recent Developments

In June 2024, Tender Food Inc. raised $11M in Series A funding. The funds will boost plant-based meat tech. The company plans to scale R&D and production. Demand for alt-protein drives investor interest. Tender targets growth in the sustainable food space.

By April 2025, Geek, a Chennai-based kitchen tech brand, raised ₹4 Crore. The funding supports product upgrades and retail reach. Geek focuses on smart appliances for digital homes. Rising demand fuels growth. The brand aims to expand across India.

In March 2025, Wonder Group acquired Tastemade for $90M. The deal enhances Wonder’s content and food delivery play. Tastemade’s media strength adds value to Wonder’s ecosystem. The move blends content and commerce. It marks a shift in food-tech strategy.

Conclusion

The digital cooking technology market is expanding fast. Smart appliances offer ease, control, and health benefits. Urban lifestyles, tech growth, and sustainability trends are shaping demand.

With AI and IoT, kitchens are becoming smarter. Users enjoy time savings, better food, and connected experiences. Brands that innovate and stay eco-friendly will lead this market.