Table of Contents

Introduction

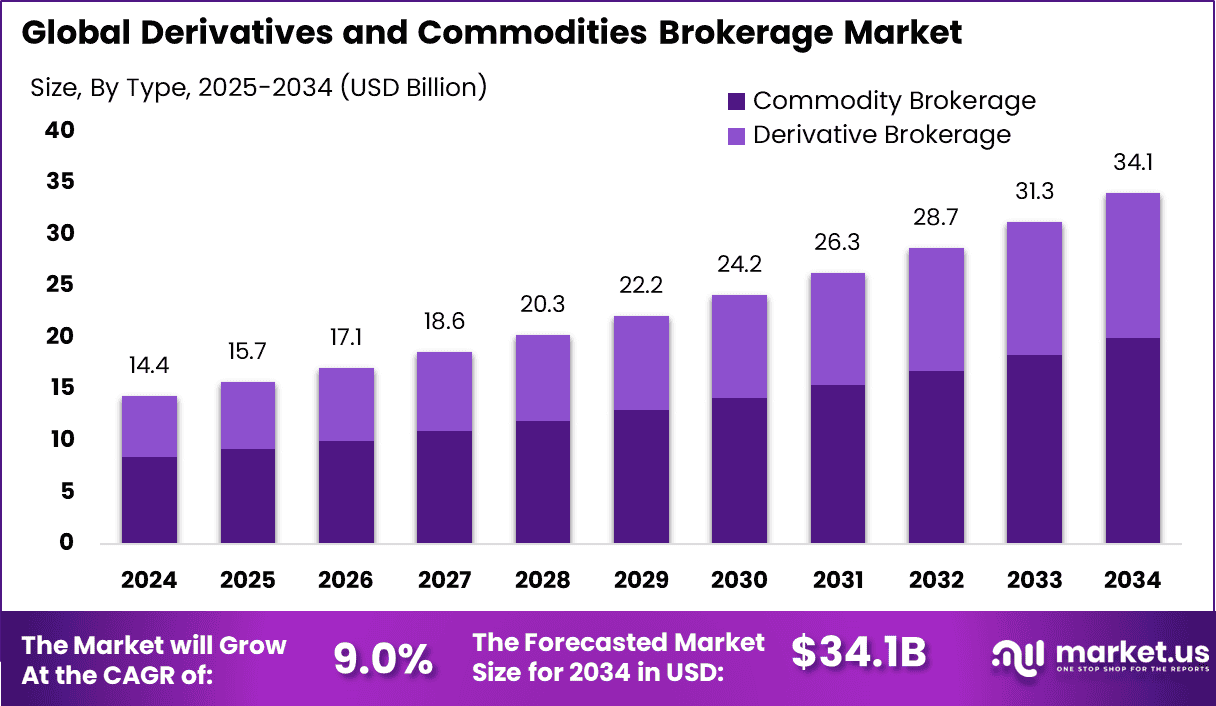

The Global Derivatives and Commodities Brokerage Market is set to experience substantial growth, projected to reach USD 34.1 billion by 2034, up from USD 14.4 billion in 2024. This reflects a compound annual growth rate (CAGR) of 9.0% from 2025 to 2034.

North America currently leads the market with a 34.2% share, generating USD 4.9 billion in revenue in 2024. The increasing demand for financial instruments such as derivatives and commodities, driven by market volatility and hedging needs, is fueling this growth. Key factors include rising global trade activities and the growing popularity of online trading platforms.

How Growth is Impacting the Economy

The rapid growth of the Derivatives and Commodities Brokerage Market is significantly impacting the global economy by enhancing financial market liquidity and offering new investment opportunities. As more investors and institutions participate in derivatives and commodities trading, market efficiency increases, driving economic growth. These markets serve as crucial tools for risk management, allowing businesses to hedge against price fluctuations in raw materials, currencies, and interest rates. The growing size of these markets also contributes to job creation, especially in financial services and technology development sectors.

Additionally, the expansion of this market leads to more sophisticated trading platforms and financial products, encouraging further market participation. As trading volumes rise, the global economy benefits from increased capital flows, fostering business development and economic stability. Moreover, the growth of derivatives and commodities brokerage contributes to strengthening global financial systems, making them more resilient to economic disruptions and shocks.

➤ Uncover best business opportunities here @ https://market.us/report/derivatives-and-commodities-brokerage-market/free-sample/

Impact on Global Businesses

The increasing prominence of the derivatives and commodities brokerage market is reshaping global businesses. As more companies and financial institutions engage in derivatives trading, they gain tools for managing price risks associated with commodities, currencies, and interest rates. However, the rise of these financial instruments is also leading to rising operational costs, particularly related to technology adoption, data analytics, and regulatory compliance.

Shifts in global supply chains are evident as businesses rely on commodity derivatives to hedge against volatile prices of raw materials, which impacts industries such as manufacturing, agriculture, and energy. Sectors like energy and agriculture benefit from the ability to stabilize prices and reduce the risk of supply chain disruptions. On the flip side, the complexity and volatility of these markets can introduce risks, particularly for businesses unprepared for potential market fluctuations.

Strategies for Businesses

Businesses looking to capitalize on the growth of the derivatives and commodities brokerage market should focus on adopting cutting-edge trading platforms and risk management tools. Establishing strategic partnerships with brokerage firms that provide access to global derivatives markets will also be crucial for expanding market reach. Additionally, companies should invest in upskilling their financial teams to better understand and navigate complex financial instruments.

Another key strategy is leveraging technology to automate trading processes, reduce operational costs, and improve trading efficiencies. Companies should also remain vigilant of regulatory changes in global markets and ensure compliance to avoid penalties. By adopting these strategies, businesses can enhance their profitability and secure a competitive edge in the rapidly evolving market.

Key Takeaways

- The Derivatives and Commodities Brokerage Market is expected to grow from USD 14.4 billion in 2024 to USD 34.1 billion by 2034, at a CAGR of 9.0%.

- North America leads the market, holding 34.2% of the share in 2024, with USD 4.9 billion in revenue.

- The growth is driven by rising global trade activities, increased demand for financial instruments, and the need for risk management solutions.

- Businesses should adopt innovative trading platforms, invest in employee training, and stay compliant with evolving regulations to remain competitive.

➤ Buy Report Here @ https://market.us/purchase-report/?report_id=152582

Analyst Viewpoint

The derivatives and commodities brokerage market is experiencing significant growth, with strong demand for risk management tools and trading platforms. In the present, this market is benefiting from the growing sophistication of trading technology and increased investor interest. The future of this market is bright, with continued growth expected as global economic uncertainty drives further adoption of derivatives and commodities trading. The outlook remains positive as businesses seek new ways to manage risk and capitalize on market opportunities.

Regional Analysis

North America is the dominant region in the Derivatives and Commodities Brokerage Market, capturing a 34.2% share and generating USD 4.9 billion in revenue in 2024. This dominance is supported by advanced financial infrastructure, high investor activity, and a well-established regulatory environment. Europe and Asia Pacific are expected to experience strong growth, with businesses in these regions increasingly adopting derivatives and commodities trading solutions. Asia Pacific, in particular, is seeing rising demand from emerging markets, where financial inclusion and investment opportunities are growing rapidly.

➤ Discover More Trending Research

- Data Encryption in ERP Systems Market

- AI Marine Market

- AI for Recreational Boaters Market

- AI Avatar Market

Business Opportunities

The expanding Derivatives and Commodities Brokerage Market offers numerous opportunities for both established and new entrants. Businesses can explore opportunities in financial services by developing innovative trading platforms and products that meet the needs of institutional and retail investors.

Companies can also offer specialized risk management solutions tailored to industries such as agriculture, energy, and manufacturing, which are heavily impacted by commodity price fluctuations. Furthermore, the rise of digital trading platforms presents significant growth potential for technology providers offering cloud-based solutions and AI-driven tools. As global demand for these services increases, opportunities in emerging markets are also expanding.

Key Segmentation

The Derivatives and Commodities Brokerage Market can be segmented by product type, end-user, and region. By product type, the market includes financial derivatives, commodities, and energy products. Financial derivatives, such as futures and options, dominate the market, driven by their use in risk management.

By end-user, the market is segmented into institutional investors, retail investors, and corporations that use derivatives for hedging purposes. Regionally, North America leads the market, followed by Europe and Asia Pacific, where demand is growing due to increasing financial activity in emerging markets.

Key Player Analysis

Key players in the derivatives and commodities brokerage market are focused on enhancing their product offerings, particularly in providing access to diverse asset classes and global markets. Companies are investing in advanced technology, such as AI and blockchain, to improve trading efficiencies and reduce transaction costs.

Additionally, many firms are expanding their service portfolios to include educational resources and risk management tools for their clients. As the market grows, key players are also increasing their geographical reach to tap into emerging markets, where demand for derivatives trading solutions is rising.

- Abans Global Limited

- Bovill Limited

- Northern Trust Corporation

- TP ICAP Group Plc

- Multi Commodity Exchange of India Ltd.

- Japan Exchange Group

- ICICI Securities Limited

- Kotak Securities Ltd.

- Sharekhan

- The Charles Schwab Corporation

- Fidelity Investments

- Interactive Brokers Group Inc.

- TradeStation Group Inc.

- Saxo Bank A/S

- Pepperstone Group Limited

- Others

Recent Developments

- Increased adoption of AI-driven trading platforms that offer predictive analytics and automated trading.

- Integration of blockchain technology to improve transparency and reduce transaction costs in derivatives trading.

- Development of mobile trading apps that cater to retail investors, expanding access to global financial markets.

- Enhanced regulatory frameworks across regions to ensure transparency and stability in derivatives markets.

- Strategic mergers and acquisitions are aimed at expanding service offerings and geographic presence in emerging markets.

Conclusion

The Derivatives and Commodities Brokerage Market is poised for strong growth, driven by increased demand for risk management tools and financial trading solutions. North America continues to lead the market, while growth in Europe and Asia Pacific is accelerating. As the market evolves, businesses that innovate and leverage advanced technology will be well-positioned to capitalize on emerging opportunities.