Table of Contents

Market Overview

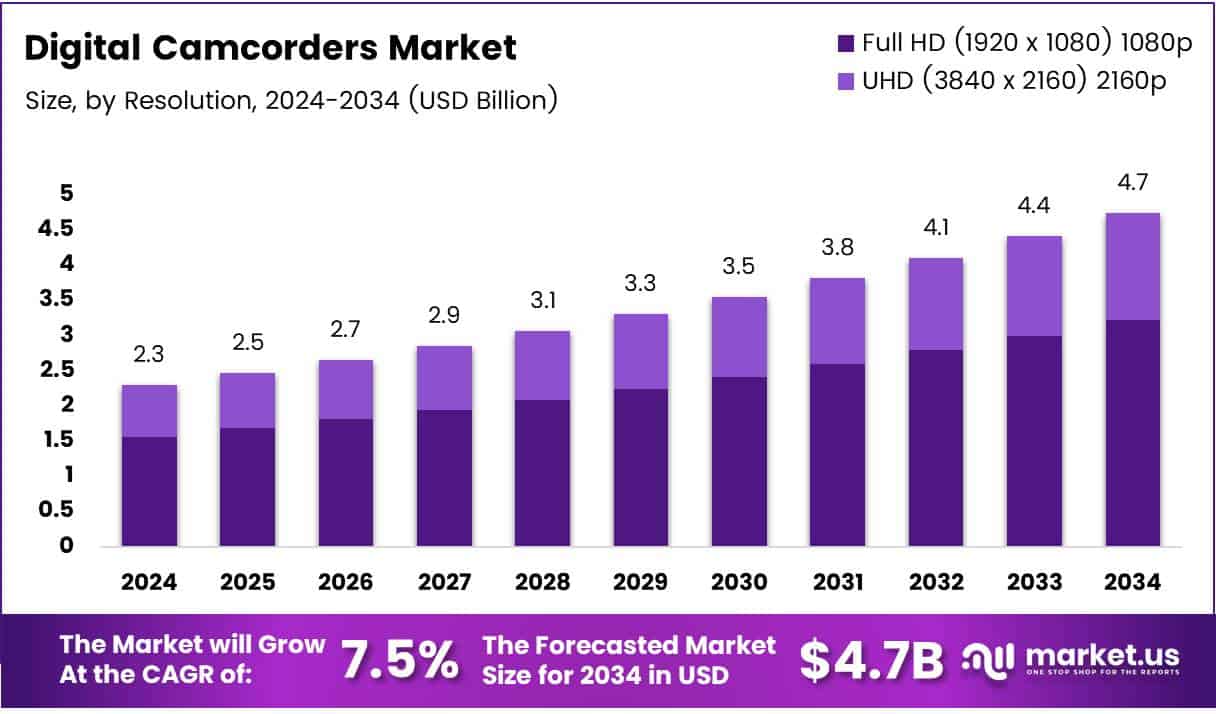

The Global Digital Camcorders Market size is expected to be worth around USD 4.7 Billion by 2034, from USD 2.3 Billion in 2024, growing at a CAGR of 7.5% during the forecast period.

The digital camcorders market is showing strong growth in 2025. Compact camera shipments rose 116.9% in the first five months compared to last year. This signals higher demand for digital camcorders globally. Rising video content creation boosts sales across consumer and pro segments. Features like 4K, 8K, and AI-stabilization are driving upgrades.

Content creators and vloggers are choosing digital camcorders over smartphones. Education and online training also fuel demand. Video quality, zoom range, and low-light performance offer clear advantages. Small businesses are investing in camcorders for marketing and live streaming.

Emerging markets offer high growth potential. Internet access and video platforms are expanding rapidly. Governments are investing in digital infrastructure and creator economy tools. These investments push camcorder sales in

Key Takeaways

- Global Digital Camcorders Market to hit US$ 4.7 Billion by 2034 from US$ 2.3 Billion in 2024.

- Market grows at a CAGR of 7.5% from 2025 to 2034.

- Full HD 1080p held 57.6% share in 2024 resolution market.

- Bridge Cameras led the segment in 2024 for zoom and portability.

- Offline sales channels dominated over online in 2024.

- Consumers prefer in-store buying over digital purchase options.

- Asia Pacific held 52.8% market share in 2024.

- Region valued at US$ 1.2 Billion due to content growth.

- Rising digital infrastructure boosts Asia Pacific demand.

Growth Drivers

- Demand for High-Quality Content Creation: With the surge in platforms like YouTube, TikTok, and Twitch, there’s increasing demand for devices capable of producing professional-grade video content. Digital camcorders offer superior optics and audio recording capabilities that remain attractive to content creators.

- Technological Advancements: Manufacturers are constantly introducing improvements, including 4K and 8K resolution, better sensors, AI-assisted autofocus, and real-time editing features. These innovations continue to differentiate camcorders from standard smartphone cameras.

- Professional and Industrial Use: Sectors like media, education, sports, and surveillance rely on digital camcorders for their robustness and quality output. These applications ensure a consistent demand even as casual users gravitate towards mobile alternatives.

- Increased Demand in Developing Economies: As economies in Asia-Pacific, Latin America, and Africa continue to grow, there is a rising adoption of digital recording equipment for education, news reporting, and event documentation.

Challenges and Restraints

- Smartphone Cannibalization: The growing quality of smartphone cameras, including support for 4K recording, has significantly eaten into the consumer camcorder market.

- Price Sensitivity: High-end camcorders can be expensive, especially when compared to multifunctional smartphones, discouraging average consumers from investing in standalone devices.

- Rapid Obsolescence: Fast technological shifts can make older models obsolete quickly, putting pressure on manufacturers to innovate rapidly while managing inventory and R&D costs.

- Shift to Mirrorless and DSLR Cameras: Hybrid cameras that offer both high-quality stills and professional-grade video have become popular among enthusiasts and professionals, competing directly with camcorders.

Market Segmentation

Resolution Analysis

Full HD 1080p holds 57.6% market share in 2024. It offers good quality at low cost. UHD 2160p is rising but still behind. Full HD remains the top choice.

Bridge Camera Analysis

Bridge cameras lead the market in 2024. They offer zoom and portability in one. Preferred by hobbyists and semi-pro users. Demand stays strong due to versatility.

Distribution Channel Analysis

Offline stores dominate camcorder sales in 2024. Buyers prefer testing products in person. Online sales grow but lag behind. Offline offers trust and instant purchase.

Regional Outlook

Asia Pacific

Asia Pacific leads with 52.8% share. Market value is USD 1.2 billion. Growth from creators, influencers, and tech adoption.

North America

North America stays strong. High demand for 4K/8K camcorders. Driven by tech users and pro studios.

Europe

Europe shows steady growth. Demand from film and media. Mid-range camcorders are popular.

Latin America

Latin America grows slowly. Social video demand rises. Budget models see good sales.

Middle East & Africa

MEA is emerging. Digital use is rising. Urban demand is increasing.

Recent Trends

- AI and Smart Features: Features like object tracking, facial recognition, and automated lighting adjustments are becoming standard.

- Cloud and Wireless Integration: Real-time video sharing, cloud backups, and wireless control via smartphone apps are increasingly common.

- Miniaturization and Portability: Compact camcorders with foldable designs and modular components are gaining popularity, especially for travel and vlogging use cases.

- Sustainability Initiatives: Companies are focusing on eco-friendly packaging, energy-efficient designs, and recyclable materials in production.

Recent Developments

In July 2025, Jessops raised funding in one round. The goal is to expand digital retail. The brand focuses on online sales growth. Jessops plans to modernize its tech stack. This investment boosts its retail strategy. The brand aims to regain market share. Funding supports new consumer tech launches.

In May 2024, Nikon acquired RED for $85 million. RED is known for cinema-grade cameras. This deal expands Nikon’s product range. Nikon enters the professional filmmaking space. The acquisition boosts Nikon’s innovation capabilities. RED’s tech will enhance Nikon cameras. Nikon aims to lead in cinema imaging.

Conclusion

The digital camcorders market, though facing headwinds from the smartphone revolution, continues to maintain its relevance through technological innovation, professional demand, and niche applications. While casual usage may have declined, segments such as broadcasting, filmmaking, education, and surveillance continue to drive steady demand. Manufacturers who adapt to changing user expectations and technological trends are best positioned to capitalize on emerging opportunities in this evolving landscape.