Table of Contents

Market Overview

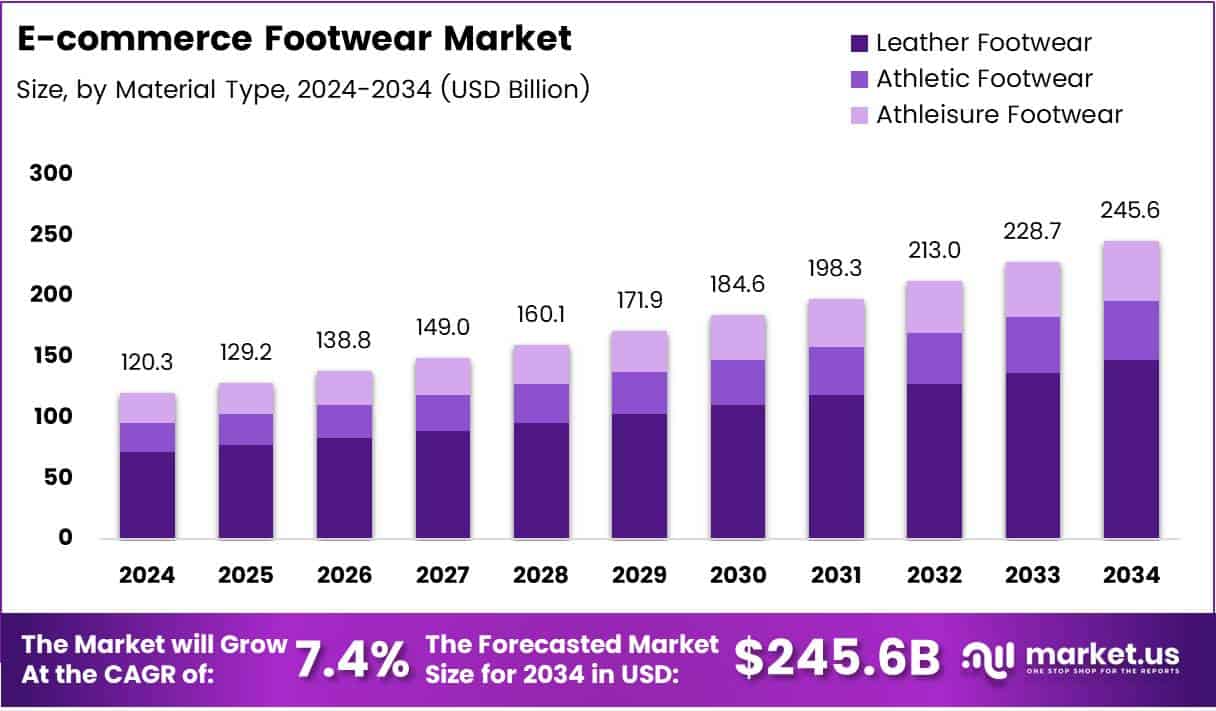

The Global E-commerce Footwear Market size is expected to be worth around USD 245.6 Billion by 2034, from USD 120.3 Billion in 2024, growing at a CAGR of 7.4% during the forecast period.

The e-commerce footwear market is growing fast. In India, digital adoption is rising. The add-to-cart rate is 11.5% in 2024. The cart abandonment rate is 78.1%. The conversion rate is just 2.5%. This shows strong interest but low final purchase. Brands must fix checkout gaps.

Casual footwear leads India’s market with 67% share. Consumers prefer comfort and affordable options. Digital sales are rising fast. 32% of global apparel and footwear sales are now online. This shift boosts online brand visibility and global access.

Footwear consumption may grow by 7.6% in 2025 worldwide. This creates big e-commerce potential. Rising income and youth trends drive demand. Brands must offer variety and faster delivery. Price competition is also key to growth.

India supports digital retail expansion. ONDC and BharatNet are improving access. These programs help small sellers join e-commerce. Government support adds trust and speed. It also enables rural market penetration.

Data rules and product policies are strict now. These ensure better buyer protection. Long-term trust depends on clear return rules and quality checks. E-commerce players must adapt fast. Regulation is not a barrier it is a base for growth.

Key Takeaways

- The global E-commerce Footwear Market is projected to reach USD 245.6 billion by 2034, growing at a CAGR of 7.4% from 2025 to 2034.

- In 2024, Leather Footwear held a dominant market share of 71.2% in the Material Type segment.

- Online Retailers led the Distribution Channel segment in 2024, highlighting the e-commerce boom.

- Men’s Footwear captured the largest End-User market share in 2024.

- North America was the top regional market in 2024, holding 32.6% share, valued at USD 39.6 billion.

Key Market Drivers

- Changing Consumer Preferences: Increasing preference for hassle-free online shopping experiences, combined with access to diverse footwear styles, brands, and sizes, is propelling market growth. Younger demographics, particularly Gen Z and millennials, are key contributors due to their comfort with digital platforms.

- Technological Integration: The integration of technology into online retail such as virtual try-on features, AI-based recommendations, and chatbots enhances user engagement and conversion rates. Real-time inventory updates, secure payment systems, and improved mobile app experiences further support sales.

- Urbanization and Lifestyle Changes: Rapid urbanization, rising disposable incomes, and a growing emphasis on fashion and self-expression have driven demand for a variety of footwear, especially in emerging economies. Online platforms provide an ideal channel for fulfilling these fashion-forward demands.

- COVID-19 Acceleration: The pandemic reshaped consumer behavior by encouraging online shopping across all categories, including footwear. Many brands strengthened their digital channels, and e-commerce became the primary mode of footwear retail during lockdowns, accelerating the sector’s long-term shift.

Market Segmentation

Material Type Analysis – Leather Footwear Leads

In 2024, leather footwear held a 71.2% share. It is durable, stylish, and comfortable. Eco-friendly leather boosts demand. Leather stays the top choice for quality shoes.

Distribution Channel Analysis – Online Retailers Dominate

Online retailers led sales in 2024. Buyers prefer easy access, more variety, and better prices. Mobile shopping and fast delivery fuel growth.

End-User Analysis – Men’s Footwear Leads

Men’s footwear held the top share in 2024. Demand grows for sneakers, formals, and athleisure. Online stores offer more styles and convenience.

Trends and Opportunities

- Sustainability Demand: A rising demand for eco-friendly and vegan footwear is reshaping product offerings. Consumers are becoming more environmentally conscious, and brands are responding with sustainable materials and ethical production practices.

- Customization and Personalization: Brands are offering customizable shoes, allowing consumers to choose colors, materials, and designs. Personalized recommendations based on user behavior are increasing conversion and customer satisfaction.

- D2C Expansion: Footwear brands are shifting towards direct-to-consumer (D2C) models, bypassing intermediaries to control branding, customer data, and margins. This also allows for greater pricing flexibility and tailored marketing.

- Social Commerce: The integration of shopping with social media platforms like Instagram, Facebook, and TikTok is growing. Influencer marketing and shoppable posts are driving brand visibility and direct traffic to product pages.

Regional Insights

North America

North America leads the e-commerce footwear market. It holds a 32.6% share, valued at USD 39.6 billion. Growth is driven by high online spending. Strong internet use supports market expansion. Advanced logistics boost online footwear sales.

Europe

Europe sees high online footwear demand. Consumers prefer digital platforms for shoes. Strong e-commerce systems aid growth. Eco-friendly footwear trends drive sales. Logistics networks support smooth delivery.

Asia Pacific

Asia Pacific is a fast-growing footwear market. Rising incomes fuel online shopping. Smartphone use boosts digital sales. India and China lead regional growth. Youth population drives e-commerce demand.

Middle East & Africa

This region sees rising online footwear sales. Internet use is increasing steadily. More buyers trust online platforms. Fashion trends attract digital consumers. E-commerce access continues to grow.

Latin America

Latin America’s footwear market is growing online. Brazil and Mexico lead this shift. Mobile use drives e-commerce growth. Payment issues still slow progress. Digital adoption boosts future potential.

Challenges and Restraints

- High Return Rates: Footwear, being size-sensitive, has high return rates in online sales, which affects profitability.

- Counterfeit Products: Online platforms can sometimes serve as channels for fake or low-quality products, harming brand reputation.

- Logistics and Fulfillment: Inconsistent delivery timelines, especially in remote areas, can impact customer experience and repeat business.

- Data Privacy Concerns: As more brands collect consumer data for personalization, ensuring data security is critical to maintain trust.

Future Outlook

The e-commerce footwear market is expected to continue expanding due to digital innovation, broader internet access, and shifts in consumer shopping habits. Technological advancements and improvements in virtual shopping experiences will further blur the line between physical and digital retail. Companies that invest in customer experience, fulfillment, and innovation will likely lead the next phase of growth.

The industry is moving toward seamless, mobile-first experiences, emphasizing sustainability and personalization. The rising influence of digital-first branding, cross-border e-commerce, and fast fashion trends will shape the future of online footwear retail.

Recent Developments

Mar 2025: KNS International acquired Birdies to expand its premium e-commerce footwear range and boost DTC growth.

May 2025: Nina Footwear merged into Kidpik’s subsidiary to enhance children’s fashion offerings and expand market reach.

May 2025: 3G Capital acquired Skechers for $9 billion, aiming to accelerate global expansion and retail growth.

Jun 2025: Mytheresa rebranded to LuxExperience after the planned YNAP acquisition, targeting luxury e-commerce leadership.

Conclusion

The e-commerce footwear market is growing fast. Online shopping for shoes is more popular now. Mobile apps help increase footwear sales. Digital tools improve the shopping experience. Sustainable and eco-friendly shoes are in high demand. Brands are shifting to direct-to-consumer models. Social media boosts online shoe sales. Fast delivery improves customer satisfaction. Tech innovation drives market expansion. The future of footwear retail is fully digital.