Table of Contents

Market Overview

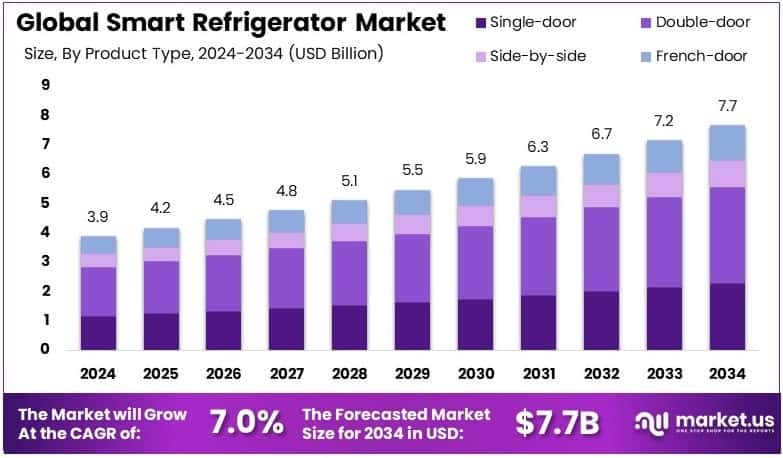

The Global Smart Refrigerator Market size is expected to be worth around USD 7.7 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 7.0% during the forecast period.

The Smart Refrigerator Market is growing fast due to rising demand for smart home tech. Consumers want connected kitchen appliances with more features. Smart refrigerators use between 100 – 800 watts, making them energy-efficient. They help manage groceries, reduce waste, and track temperature in real-time. These devices also connect with other smart home systems easily.

More households are upgrading to smart appliances globally. This shift supports the growth of the smart fridge segment. Manufacturers now focus on AI-powered features and voice control functions. These innovations improve user convenience and system efficiency. People prefer remote control and diagnostics in daily appliance use.

Governments support energy-efficient appliances with strict rules and rebates. Regions like North America and Europe offer tax benefits and green incentives. These policies help boost smart refrigerator adoption rates. Energy labeling laws push brands to follow eco-friendly practices. Rising power bills also drive consumers to smarter choices.

There is high market opportunity in emerging economies. Consumers seek tech-rich but low-energy devices. Brands can offer subscription services and app updates with these models. Cloud integration allows for smart inventory and shopping lists. The smart refrigerator market promises long-term growth and recurring revenue potential.

Key Takeaways

- Smart Refrigerator Market size was USD 3.9 billion in 2024 and will reach USD 7.7 billion by 2034, growing at 7.0% CAGR.

- Double-door smart refrigerators held 42.6% share in 2024, due to more storage and high demand.

- Wi-Fi Enabled refrigerators dominated with 58.2% share in 2024, offering smart home features.

- Residential users led with 70.4% market share in 2024, driven by rising home appliance adoption.

- Offline channels held 61.8% share in 2024, as buyers prefer in-store experience.

- North America led with 34.2% share in 2024, worth USD 1.33 billion, due to smart home growth.

Product Segmentation

Product Type Analysis Double-door smart refrigerators hold 42.6% share. They offer more space and smart features. Urban users prefer them for daily use. Side-by-side and French-door models grow in premium homes. Single-door units stay popular in small homes.

Technology Analysis Wi-Fi enabled models lead with 58.2% share. They connect easily to smart home systems. Mobile app control boosts demand. Bluetooth models are basic and cheap. RFID use is niche and mostly commercial.

End-User Analysis Residential segment leads with 70.4% share. Smart fridges save time and reduce waste. Urban homes adopt smart tech fast. Commercial use grows in hotels and restaurants. High cost slows adoption for small businesses.

Distribution Channel Analysis Offline channels dominate with 61.8% share. Buyers prefer seeing products in-store. Stores offer support and financing. Online sales grow via discounts and convenience. E-commerce rising post-COVID but offline still strong.

Technological Innovations

The integration of AI and machine learning is revolutionizing the market. Modern smart refrigerators can suggest recipes based on available ingredients, track expiration dates, and even automate grocery orders. This level of convenience not only saves time but also aligns with a growing preference for personalized and intuitive kitchen experiences.

Voice assistant integration is another important innovation. Many smart refrigerators now support Amazon Alexa, Google Assistant, or proprietary systems that allow users to set timers, search recipes, or adjust settings through voice commands. This hands-free interaction is especially valuable in a busy kitchen environment.

Smart diagnostics and remote monitoring are also increasingly becoming standard. These features help users identify potential problems before they escalate, thereby reducing repair costs and downtime. Manufacturers benefit from these capabilities by providing better customer service and gathering usage data to improve future product designs.

Regional Insights

North America leads with 34.2% market share. High income and smart home adoption drive demand. U.S. homes use Alexa, boosting integration. Brands like Whirlpool and Samsung dominate. Retailers and incentives support strong growth.

Europe sees steady smart fridge growth. Germany and UK focus on energy savings. Eco-friendly homes drive adoption. Smart kitchen upgrades are rising fast.

Asia Pacific

Asia Pacific grows rapidly in this market. China, Japan, and Korea lead adoption. Urbanization and local tech brands drive sales. Manufacturing strength boosts regional supply.

Middle East & Africa adoption is rising slowly in this region. UAE and Saudi invest in smart homes. Urban growth supports demand. Market still small but expanding.

Latin America shows growing interest. Brazil and Mexico lead adoption. Internet use and smart living trends help growth. Market potential is rising steadily.

Consumer Behavior and Buying Patterns

Modern consumers are increasingly influenced by the convenience and functionality of smart appliances. Millennials and Gen Z buyers, in particular, prioritize connectivity, automation, and tech-enabled features when purchasing home appliances. These consumers are also likely to read online reviews, compare features, and opt for devices that are compatible with their existing smart ecosystems.

Moreover, the pandemic has changed how people interact with their kitchens. With more people cooking at home, demand has surged for appliances that make meal planning, grocery management, and storage more efficient.

Competitive Landscape

The smart refrigerator market is highly competitive, with numerous global and regional players focusing on innovation, design, and energy efficiency. Companies are investing heavily in R&D to enhance functionality and develop new use cases, while also striving to reduce costs to appeal to broader markets.

Leading manufacturers are also exploring partnerships with tech companies to strengthen their IoT capabilities. This has led to ecosystems where smart refrigerators seamlessly integrate with other devices, such as ovens, dishwashers, and home automation systems.

Challenges and Opportunities

Despite strong growth, the market faces several challenges. High cost remains a barrier for widespread adoption, especially in price-sensitive markets. Additionally, concerns about data privacy and cybersecurity are growing as more appliances become connected to the internet.

However, these challenges are also opportunities. Manufacturers that can offer secure, affordable, and user-friendly products will gain a competitive edge. Sustainability is another key area of opportunity. Smart refrigerators that help reduce food waste and energy usage will likely benefit from regulatory support and eco-conscious consumer preferences.

Recent Developments

- In April 2025, Husky Intelligent Fridges, the innovation arm of Husky Refrigerators, acquired Selfly Store, a specialist in RFID-enabled smart retail solutions. This acquisition strengthens Husky’s position in automated retail and intelligent appliance ecosystems.

- In July 2024, LG Electronics acquired an 80% stake in Athom, a Netherlands-based smart home automation company. This move enhances LG’s connected home ecosystem by integrating Athom’s Homey platform with LG’s ThinQ technology.

Conclusion

The smart refrigerator market is on an upward trajectory, supported by innovation, lifestyle changes, and the expanding smart home ecosystem. As technology becomes more accessible and consumers demand more from their kitchen appliances, smart refrigerators are set to play a pivotal role in the future of home automation. Manufacturers that focus on AI integration, energy efficiency, and user experience will be best positioned to lead in this dynamic and competitive market.