Table of Contents

Market Overview

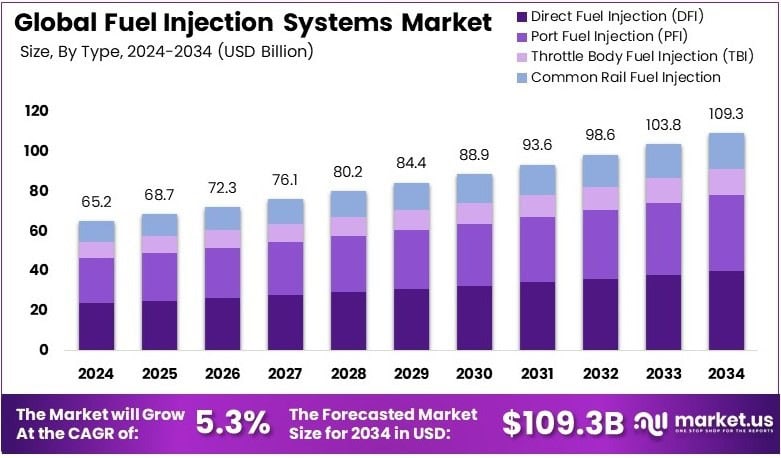

The Global Fuel Injection Systems Market size is expected to be worth around USD 109.3 Billion by 2034, from USD 65.2 Billion in 2024, growing at a CAGR of 5.3% during the forecast period.

The Fuel Injection Systems Market is growing steadily. Rising demand for fuel-efficient engines drives this growth. Cleaner emission norms also boost market demand. Ethanol injection systems show strong promise. Tests show 8.89% SFC reduction at 1 bar ethanol pressure. This means better fuel economy and engine efficiency. Automakers are adopting ethanol tech to meet green targets.

Urban pollution is a big concern. Vehicles emit 70% of total NOx and PM in cities. Fuel injection systems can reduce these emissions. They help engines burn fuel more cleanly. Governments support this with green investments. Strong policies back cleaner transport tech. Euro 6 and CAFÉ norms push system upgrades.

Asia-Pacific shows high growth potential. Developing countries need clean vehicle tech. Electric and hybrid vehicle demand supports this market. Fuel injection systems are key for performance. They are essential for hybrid engine design. OEMs invest in advanced injection systems.

The market sees high R&D activity. Suppliers focus on compact and precise injectors. Retrofit solutions also gain traction. Demand will rise in the next few years. Clean fuel focus and regulations will drive growth. Businesses must adapt fast to stay competitive.

Key Takeaways

- The Fuel Injection Systems Market was valued at USD 65.2 billion in 2024 and is projected to reach USD 109.3 billion by 2034, growing at a CAGR of 5.3%.

- Direct Fuel Injection (DFI) held the largest market share in 2024 at 36.7%, due to its enhanced fuel efficiency and performance.

- Gasoline fuel type dominated the market in 2024 with a share of 58.4%, driven by consumer demand for fuel-efficient vehicles.

- Passenger Cars accounted for the highest segment share at 63.2% in 2024, supported by adoption of advanced injection systems.

- Asia Pacific led the regional market in 2024 with 38.6% share and valuation of USD 25.17 billion, fueled by automotive industry growth and strict emission laws.

Growth Drivers

One of the most significant drivers of the fuel injection systems market is the tightening of global emission regulations. Governments across key automotive-producing regions are implementing stringent standards to reduce air pollution, leading automakers to adopt more efficient fuel delivery mechanisms. Fuel injection systems are crucial for meeting these targets, as they optimize fuel combustion and minimize pollutant output.

Additionally, the demand for fuel-efficient vehicles is pushing manufacturers to integrate advanced injection technologies, such as direct and common rail fuel injection. These systems offer improved mileage without compromising power, thereby aligning with consumer and environmental demands.

Technological innovations, such as the rise of electronic fuel injection (EFI) systems, have further catalyzed market growth. EFI allows better control over engine functions, real-time monitoring, and adaptive performance adjustments all of which are aligned with modern automotive requirements.

Market Challenges

Despite its promising growth, the fuel injection systems market faces several challenges. One of the primary concerns is the rising adoption of electric vehicles (EVs), which do not require fuel injection systems. As EV penetration increases globally, particularly in developed regions, it is expected to put downward pressure on the market for traditional fuel systems.

Moreover, the high cost of advanced injection components, especially for direct and common rail systems, can act as a deterrent for price-sensitive markets. Maintenance complexities and the need for high-quality fuel to prevent injector clogging also pose concerns for consumers and manufacturers alike.

Market Segmentation

Type Analysis

DFI leads with 36.7% share. It gives high efficiency. It boosts performance. DFI cuts emissions. PFI is cheap and reliable. It fits budget cars. TBI is simple and low-cost. Good for light use. Common Rail suits diesel engines. It gives high pressure. Best for trucks.

Fuel Type Analysis

Gasoline leads with 58.4% share. Widely used in cars. Easy to find fuel. Diesel suits heavy vehicles. It is efficient and strong. Meets emission rules. CNG, LPG, ethanol are rising. Eco-friendly and cost-saving. Policy push supports growth.

Vehicle Type Analysis

Passenger cars lead with 63.2% share. High global demand. Buyers want fuel savings. LCVs grow with e-commerce. Need flexible injection. HCVs use strong systems. Handle heavy loads. Off-road vehicles need tough tech. Used in farming and construction.

Regional Insights

Asia Pacific leads with 38.6% market share (USD 25.17 B). Growth driven by rising vehicle production, strict emission rules, and fuel-efficient tech in China, Japan, and South Korea.

North America holds 28.4% share, backed by tech advancements and tough emission laws. Strong R&D and modern auto manufacturing drive the market.

Europe captures 26.1% share. Focus on fuel efficiency, clean mobility, and innovation fuels demand for advanced injection systems.

Middle East & Africa own 3.7% share. Market grows with tech adoption and better economic conditions.

Latin America holds 3.2%. Growth is slow but steady, with modern auto standards boosting system adoption.

Competitive Landscape

The global fuel injection systems market is moderately consolidated, with several key players competing on the basis of product innovation, strategic collaborations, and regional expansion. Companies are heavily investing in research and development to create compact, cost-effective, and more efficient fuel delivery systems that meet upcoming environmental standards.

Prominent firms are also exploring partnerships with automotive manufacturers to ensure timely integration of cutting-edge technologies. As competition intensifies, market participants are striving to balance performance, cost, and sustainability.

Future Outlook

While the market faces headwinds from the rise of electric mobility, it remains resilient due to the continuing demand for internal combustion engine (ICE) vehicles, especially in emerging markets. Hybrid vehicles, which combine internal combustion with electric power, still rely heavily on efficient fuel injection systems, providing a buffer for market decline.

Ongoing innovation in injection technologies, combined with the gradual electrification of transport, will shape the future trajectory of the fuel injection systems market. Advanced sensors, AI-driven engine management, and eco-friendly fuels are expected to further transform this sector.

Recent Developments

- In Oct 2024, Alliant Power strengthened its market presence by acquiring Oregon Fuel Injection, a trusted name in diesel parts.

This acquisition positioned Alliant Power as a leading diesel parts provider in the U.S. aftermarket segment.

Conclusion

The fuel injection systems market is poised for gradual but steady growth amid evolving automotive trends. Environmental regulations, consumer expectations for better fuel economy, and technological advances will continue to propel demand in the short to medium term. However, long-term success will depend on how effectively manufacturers adapt to the electrification of transportation and integrate intelligent solutions to enhance engine performance and sustainability.