Table of Contents

Market Overview

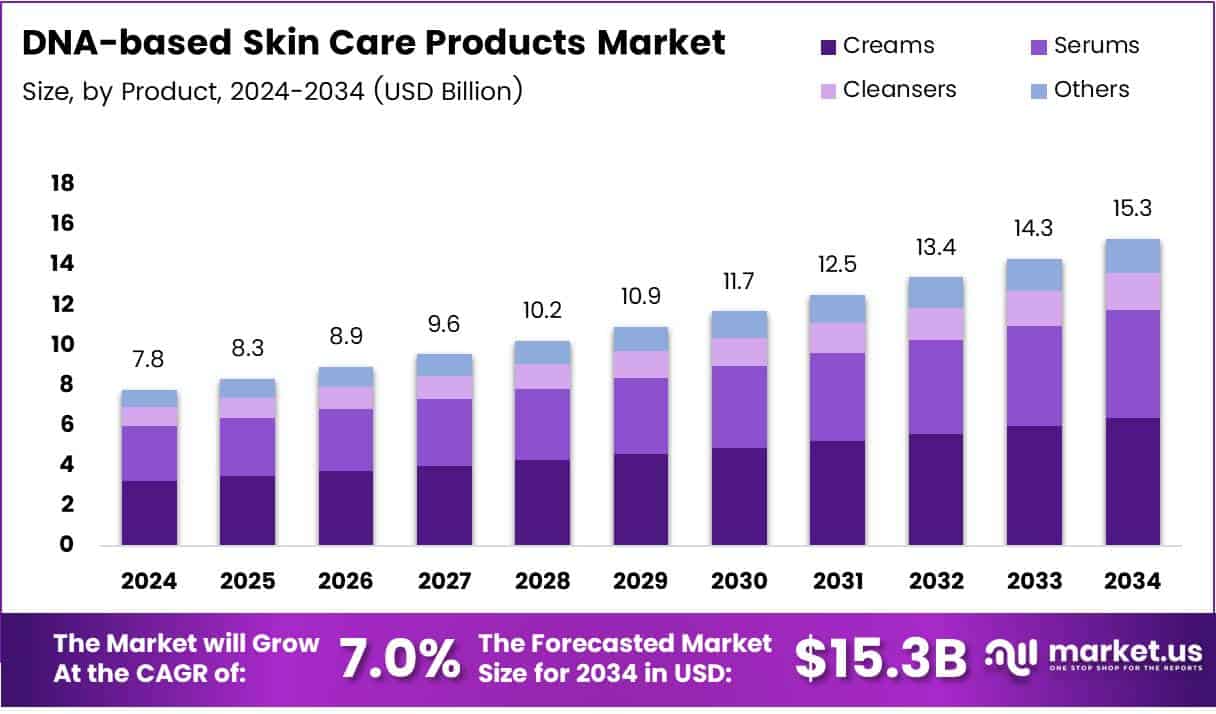

The Global DNA-based Skin Care Products Market size is expected to be worth around USD 15.3 Billion by 2034, from USD 7.8 Billion in 2024, growing at a CAGR of 7% during the forecast period.

The DNA-based skin care market is growing fast with rising demand for personalized beauty. Consumers want products made for their unique genetic profiles. This trend supports innovation in custom skincare solutions. Around 90% of Chinese women follow anti-aging routines using skincare and aesthetic treatments. This shows strong demand for targeted anti-aging products.

The market is fueled by tech advancements in DNA testing and AI analysis. Many brands now offer skin care based on genomic data. This creates new chances for growth and innovation. Asia-Pacific is a key region, with China and South Korea leading in adoption. Consumers in this region prefer premium, science-based products.

Governments support biotech and healthcare innovation, boosting this segment. Investment in personalized medicine also helps this market grow. But there are strict rules on product claims and data use. Brands must follow FDA and EU Cosmetic Regulation for safety and honesty. Also, genetic data laws are getting tighter worldwide. Companies that stay compliant and transparent will gain more trust. The DNA-based skincare market has high potential for those who focus on science, safety, and personalization.

Key Takeaways

- Global DNA-based Skin Care Products Market is expected to reach USD 15.3 billion by 2034, growing at a CAGR of 7% from 2025 to 2034.

- Creams led the product segment with a 47.3% market share in 2024, driven by versatility and acceptance.

- Adults accounted for 52.1% of the market in 2024, due to rising demand for personalized skincare.

- Collagen Production dominated the application segment with a 34.6% share in 2024, fueled by anti-aging needs.

- Wellness Clinics held the top end-user position with 51.1% market share in 2024, offering tailored DNA-based treatments.

- Offline Retail captured 73.4% of the market in 2024, as consumers favor in-person product experiences.

- North America led the regional market with 39.7% share, valued at USD 3.1 billion in 2024, driven by high demand for customized skincare.

Market Drivers

One of the primary drivers of this market is the technological advancement in genetic testing. The ability to obtain and analyze an individual’s DNA at a relatively low cost has made such personalized services more accessible. Additionally, increasing internet penetration and mobile app integrations have allowed brands to offer these services through digital platforms, enhancing convenience and scalability.

There is also a growing awareness among consumers about how lifestyle, diet, and genetics affect skin health. As people become more educated and proactive about health and beauty, the demand for scientifically backed products is rising.

Furthermore, social media influence and celebrity endorsements are accelerating the trend of personalized skincare. Influencers and public figures advocating DNA-based beauty products are playing a significant role in promoting consumer trust and interest.

Market Challenges

Despite its promising potential, the DNA-based skincare market faces certain challenges. One is data privacy concerns. Since these services involve the collection and analysis of personal genetic information, there is growing scrutiny around how data is stored, processed, and used. Regulatory compliance and transparency are essential to gaining and maintaining consumer trust.

Another major challenge is the high cost of DNA-based skincare regimens compared to conventional products. While the prices are expected to decrease as technologies evolve, they currently limit adoption among middle-income groups. Moreover, not all consumers are aware of or trust genetic science, which may slow down market penetration in less-educated or traditionally inclined populations.

Consumer Trends

The modern skincare consumer values transparency, personalization, and efficacy. DNA-based products align perfectly with these values by offering science-based formulations. Millennials and Gen Z are particularly receptive to these innovations, as they prioritize wellness and are more open to adopting advanced technologies in personal care.

In addition, there’s a notable shift toward clean and cruelty-free formulations within the DNA-based skincare niche. Many brands are incorporating eco-friendly packaging and plant-based ingredients to meet the rising demand for sustainable beauty solutions.

Competitive Landscape

The market is moderately fragmented, with both start-ups and established cosmetic brands entering the space. Innovation is a key strategy for players looking to differentiate themselves. Many companies are forming partnerships with biotechnology firms to enhance the quality and credibility of their DNA analysis processes.

Some brands focus solely on offering DNA testing kits and personalized recommendations, while others provide complete product lines based on the genetic analysis. The competition is expected to intensify as more companies enter the space and AI and machine learning tools are integrated to optimize recommendations and improve consumer experience.

Segmentation Insights

Product Analysis:

Creams lead the market with 47.3% share in 2024 due to their everyday use and wide acceptance. Serums and cleansers are growing fast as consumers seek targeted and clean skincare.

Group Analysis:

Adults hold 52.1% of the market, driven by demand for anti-aging and DNA-based products. Teens and seniors are showing steady interest as awareness grows.

Application Analysis:

Collagen production dominates with 34.6% share, fueled by demand for firm and youthful skin. Sun defense and antioxidants are also gaining popularity.

End-User Analysis:

Wellness clinics lead with 51.1% share, offering DNA-based treatments tailored to skin type. Salons and personal use segments are expanding with growing interest in home care.

Distribution Channel Analysis:

Offline sales account for 73.4%, as people prefer testing products in stores. Online sales are rising due to convenience and digital marketing.

Regional Insights

North America

North America leads the DNA-based skincare market with a 39.7% share, valued at USD 3.1 billion. Growth is driven by high awareness, demand for personalized skincare, and strong presence of major brands.

Europe

Europe shows strong demand, led by Germany, France, and the UK. The region benefits from a mature skincare culture and rising interest in premium, innovative products.

Asia Pacific

Asia Pacific is the fastest-growing region. Countries like China, Japan, and South Korea are driving demand with rising income, beauty focus, and interest in targeted skincare.

Middle East & Africa & Latin America

These regions are growing slowly but steadily. As awareness increases, demand for personalized skincare is expected to rise, though market share remains small.

Future Outlook

The DNA-based skin care products market is still in its early growth phase, but it holds considerable potential. As technological barriers lower and consumer awareness rises, more mainstream adoption is expected. Investments in genetic research, biotechnology, and dermatological science will continue to fuel innovation and product diversification.

The future will likely see the integration of real-time skin diagnostics, AI-driven skin assessments, and dynamic product customization. Companies that can combine scientific rigor with user-friendly solutions and maintain ethical data practices will be best positioned for long-term success.

Recent Developments

- In May 2024, Three Ships Beauty raised $2.5 million to accelerate the growth of its clean and natural beauty line. The funding will help expand product development, retail presence, and the brand’s commitment to sustainable skincare innovation.

- In December 2024, Eternis Fine Chemicals Ltd. completed the acquisition of Sharon Personal Care, aiming to expand its footprint in the high-growth personal care ingredients segment. This move strengthens Eternis’s global presence and product portfolio in cosmetic actives and specialty ingredients.

- In February 2025, Level Zero Health secured €6.6 million in funding to develop the world’s first continuous hormone monitoring device. This breakthrough technology is set to revolutionize real-time hormone tracking and personalized health insights.

- In February 2025, a UK-based healthtech start-up raised £5.5 million to advance its next-generation hormone monitoring device. This funding milestone supports its mission to deliver precision-driven, personalized healthcare solutions at scale.

Conclusion

The global DNA-based skin care products market is on a strong growth trajectory, driven by increasing consumer demand for personalized, science-backed beauty solutions. With technological advances, rising consumer awareness, and government support, the market is well-positioned to expand rapidly over the next decade. Despite challenges like data privacy and high costs, companies that prioritize transparency, innovation, and compliance are set to thrive. As AI and real-time diagnostics evolve, DNA-based skincare will move from niche to mainstream, offering new opportunities for brands and better outcomes for consumers.