Table of Contents

Market Overview

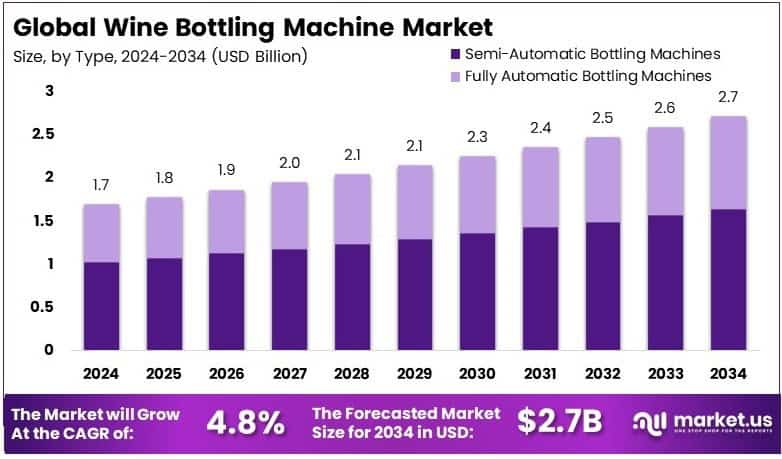

The Global Wine Bottling Machine Market size is expected to be worth around USD 2.7 Billion by 2034, from USD 1.7 Billion in 2024, growing at a CAGR of 4.8% during the forecast period.

The Wine Bottling Machine Market is entering a dynamic growth phase driven by increasing global wine production and the need for faster, more hygienic packaging systems. As wineries aim to scale efficiently, the adoption of advanced bottling technology is rising. A key example is the 100% automated Italian Alfatek bottling line, launched in March 2025, which delivers up to 2,500 bottles per hour a benchmark for modern efficiency. This shift toward automation is reshaping bottling operations in both established and emerging wine regions.

Market opportunities are expanding due to consumer demand for premium, organic, and craft wines. Small and medium producers are upgrading from manual to semi- or fully-automatic systems to meet quality and quantity demands. These systems reduce labor costs, increase output, and improve packaging accuracy, making them essential for competitive growth.

Government initiatives are also influencing market expansion. Investments in food and beverage processing especially in countries like Italy, France, Spain, and India are helping wineries modernize operations. Favorable policies, tax incentives, and relaxed import duties for advanced equipment are encouraging adoption. Additionally, stricter regulations on food safety and packaging are pushing manufacturers to invest in compliant, hygienic machinery. This creates strong demand for smart, efficient, and regulation-ready bottling solutions.

Key Takeaways

- The Wine Bottling Machine Market was valued at USD 1.7 Billion in 2024 and is projected to reach USD 2.7 Billion by 2034, growing at a CAGR of 4.8%.

- Fully Automatic Bottling Machines led the type segment in 2024 with 60.5%, driven by higher output and efficiency.

- Glass Bottles dominated the bottle type segment in 2024 with 55.3%, due to their classic look and preservation benefits.

- Large Scale Wineries accounted for 65.4% of the end-user segment in 2024, showing their reliance on high-capacity machines.

- Europe led the regional market in 2024 with a 36.7% share, valued at USD 0.62 Billion, fueled by established wineries and automation adoption.

Market Drivers

- Increasing Wine Consumption global wine consumption is increasing, especially in developing markets like Asia-Pacific and Latin America, where lifestyle changes and urbanization are contributing to higher demand.

- Automation and Technological Advancements automation in bottling processes enhances efficiency, reduces operational errors, and ensures consistent product quality. Modern machines offer smart features like real-time monitoring, IoT integration, and self-cleaning systems.

- Growth of Small and Mid-Sized Wineries the rise of craft and boutique wineries has increased the demand for compact and semi-automatic bottling equipment that suits low to mid-volume production needs.

- Demand for Sustainable and Eco-Friendly Solutions Wineries are adopting eco-friendly packaging and sustainable machinery that consume less energy, use recyclable materials, and support green initiatives.

- Rising Export of Wine Products as international trade of wine grows, the need for compliant, efficient, and scalable bottling solutions becomes essential for ensuring shelf-life and product integrity across long supply chains.

Market Challenges

- High Initial Investment Advanced wine bottling machines require substantial capital, which can be a barrier for small wineries.

- Maintenance and Technical Expertise Maintaining high-end automated systems requires skilled labor and regular servicing, adding to operational costs.

- Regulatory Compliance Machines must meet stringent hygiene, labeling, and packaging regulations in different countries, increasing complexity for manufacturers and exporters.

Segmentation Analysis

Type Analysis

Fully Automatic Bottling Machines lead with 60.5%. They offer speed, less labor, and suit large wineries. Semi-automatic types are cheaper and used by small wineries.

Bottle Type Analysis

Glass Bottles hold 55.3% share. They keep wine fresh and look premium. PET and cans are cheaper, used for casual or low-cost wines.

End-User Analysis

Large Wineries dominate with 65.4% share. They need fast, large-scale bottling. Small wineries use flexible, low-cost machines for small batches.

Regional Analysis

Europe leads with 36.7% share (USD 0.62 Billion), driven by strong wine production and automation in countries like France, Italy, and Spain.

North America holds 28.5%, led by U.S. wineries adopting fast, automated bottling systems.

Asia Pacific has 18.2%, with China and Japan driving growth through rising wine demand and tech adoption.

Latin America captures 8.7%, with Argentina and Chile modernizing to boost wine exports.

Middle East & Africa hold 7.9%, supported by rising local wine production and bottling needs.

Competitive Landscape

The wine bottling machine market is moderately fragmented with several global and regional players competing on factors like technology, pricing, service offerings, and product customization. Companies are investing in research and development to create energy-efficient, smart, and scalable solutions tailored to various production volumes.

Strategic collaborations, product launches, and mergers and acquisitions are common strategies adopted by key players to strengthen their market presence. Additionally, many companies are offering post-sale services, training, and maintenance support to build long-term relationships with wineries.

Future Outlook

The outlook for the wine bottling machine market remains positive, with growth opportunities emerging from automation, sustainable technology, and the expansion of the global wine trade. Innovation will continue to drive value, particularly through smart bottling solutions, eco-friendly systems, and machines optimized for flexibility in production lines.

Moreover, government support for local wine industries, favorable export policies, and growing awareness of product safety and shelf-life preservation will contribute to increased adoption of modern bottling equipment.

Recent Developments

- In February 2025, Hirsch Wine Group launched a fully automated Alfatek bottling line with a capacity of 2,500 bottles per hour, boosting production efficiency. The company also expanded its infrastructure with 6,000 square meters of temperature-controlled storage to reduce third-party logistics costs.

- In December 2024, Forest Hill Wines secured a $580,000 Value Add Investment grant from the State Government to support a $1.32 million facility upgrade. The project includes an in-house bottling line and cool room, aiming to double production and generate five new jobs.

Conclusion

The Wine Bottling Machine Market is set for steady growth, reaching USD 2.7 Billion by 2034 at a 4.8% CAGR. Rising wine production, automation, and government support are driving demand. Fully automatic machines lead the market due to efficiency gains. Despite high initial costs and technical needs, opportunities from eco-friendly tech, exports, and small winery upgrades will fuel future growth.