Table of Contents

Report Overview

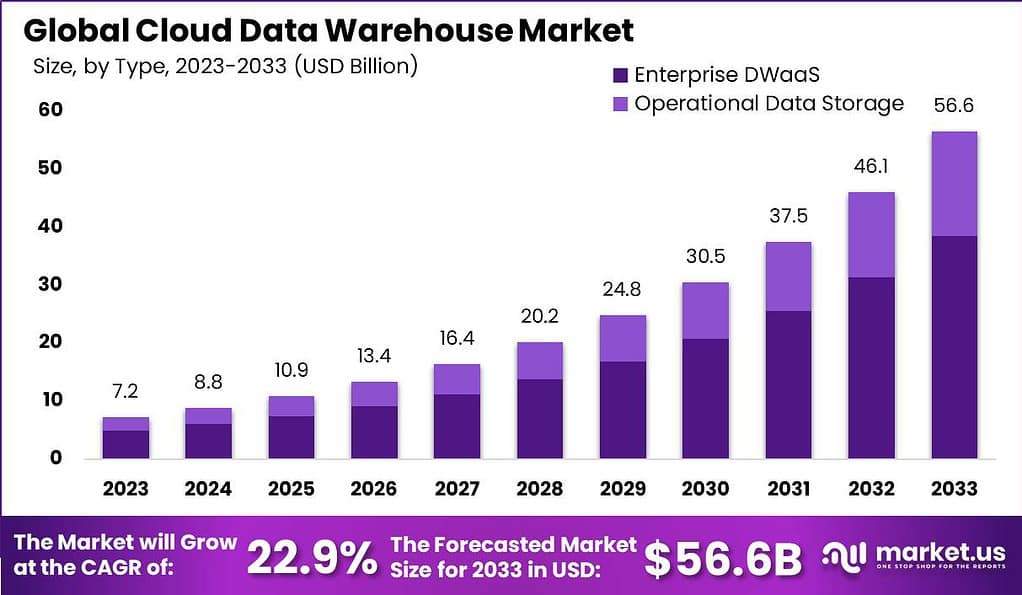

The Global Cloud Data Warehouse Market is expected to grow significantly, reaching USD 56.6 billion by 2033, up from USD 7.2 billion in 2023, registering a strong CAGR of 22.90% from 2024 to 2033. In 2023, North America held a leading market position, accounting for over 34.3% share and generating approximately USD 2.5 billion in revenue. This dominance was driven by widespread cloud adoption, advanced enterprise analytics capabilities, and strong demand for scalable, real-time data processing infrastructure across industries.

The cloud data warehouse market is receiving heightened attention as enterprise data volumes continue to grow rapidly. Its evolution is being shaped by the shift from on‑premises systems to scalable cloud solutions capable of integrating structured, semi‑structured, and unstructured data from diverse sources. These platforms are increasingly providing real‑time query performance and seamless analytics access across geographically distributed teams.

A variety of factors are powering the rise of the cloud data warehouse market. One of the most prominent is the accelerating embrace of big data analytics, where organizations require the agility to process and analyze vast datasets without latency. Firms are rapidly shifting from legacy on-premises storage solutions to scalable cloud-based platforms that promise cost-efficiency, automation, and streamlined compliance. The expansion of hybrid and multi-cloud environments is also bolstering growth, providing the flexibility to harness best-of-breed capabilities from different service providers.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 7.2 Bn |

| Forecast Revenue (2033) | USD 56.6 Bn |

| CAGR (2024-2033) | 22.9% |

| Base Year for Estimation | 2023 |

| Historic Period | 2019-2022 |

| Forecast Period | 2024-2033 |

Key Takeaways

- The market is expected to grow from USD 7.2 billion in 2023 to nearly USD 56.6 billion by 2033, registering a solid CAGR of 22.90% throughout the forecast period.

- North America remained the dominant region in 2023, contributing over 34.3% of the global market and generating around USD 2.5 billion in revenue.

- The Data Warehouse as a Service (DWaaS) segment led with over 68.1% share, as enterprises increasingly shifted toward scalable, managed warehousing solutions.

- The Public Cloud model held a leading 70.5% share, favored for its cost efficiency, broad accessibility, and lower infrastructure overhead.

- Business Intelligence (BI) tools accounted for 34.0% of application usage, reflecting the critical role of real-time analytics and data-driven decision-making.

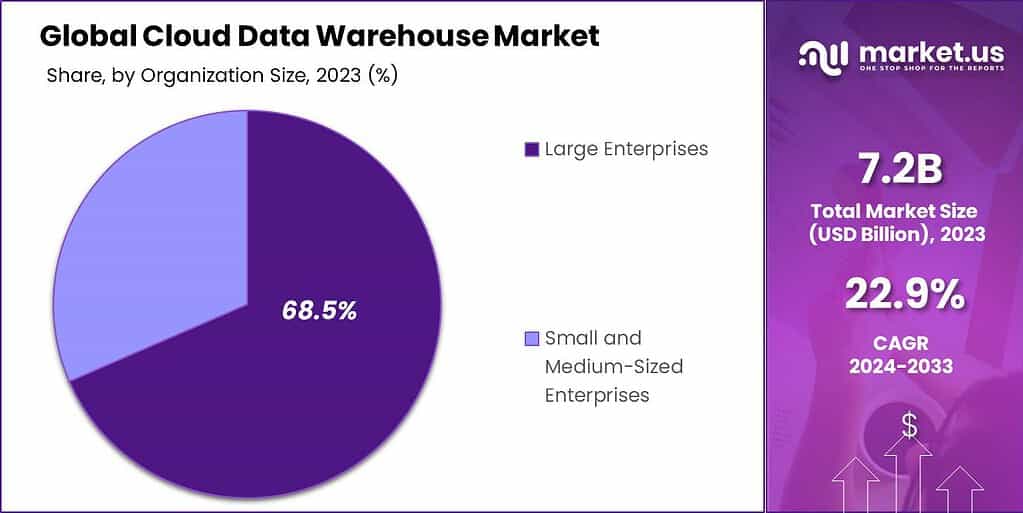

- Large enterprises represented 68.5% of the market, due to their high data volumes and continuous demand for analytics infrastructure.

- The BFSI sector accounted for 23.0%, leveraging cloud data warehouses to enhance fraud detection, customer insights, and regulatory compliance.

Segmental Analysis

By Offering – Data Warehouse as a Service (DWaaS) (68.1%)

Enterprises are rapidly gravitating towards DWaaS, which now leads the market with over 68.1% share. The appeal lies in its managed, scalable nature- organizations benefit from eliminating the burden of on-premises infrastructure and ongoing maintenance. DWaaS providers deliver robust storage, seamless integration with advanced analytics tools, and on-demand scaling, which empowers companies to handle explosive data growth cost-effectively. As businesses face accelerating digital transformation, they increasingly favor DWaaS for its simplicity, agility, and consistent performance, supporting modern use cases from real-time analytics to machine learning.

By Deployment – Public Cloud (70.5%)

Public cloud remains the dominant deployment model, with approximately 70.5% market share. Large and small enterprises alike value the public cloud for its affordability, accessibility, and infrastructure-light approach. The public cloud not only slashes capital expenditure but also helps firms avoid the complexity of building and managing in-house data centers.

Its flexible, subscription-based model lets organizations pay for what they use while leveraging the latest advancements in cloud security, compliance, and data privacy. With leading cloud providers continuously enhancing features and security, adoption is outpacing private and hybrid alternatives – especially for businesses with variable workloads or rapid scaling needs.

By Application – Business Intelligence (34.0%)

Business intelligence (BI) tools have become a cornerstone application within cloud data warehouses, accounting for 34.0% of usage. Real-time analytics, dashboarding, and self-service reporting are now accessible to teams across geographic boundaries and departments. BI facilitates faster, data-driven decisions by aggregating diverse, complex data into actionable insights – crucial for industries navigating fierce competition and evolving customer demand. As organizations strive for a data-literate workforce, investment in cloud-based BI tools is expected to accelerate, further embedding analytics into daily business operations.

By Enterprise Size – Large Enterprises (68.5%)

Large enterprises account for 68.5% of market share, reflecting their vast data volumes and relentless need for high-compute analytics. These organizations typically manage global operations, omnichannel customer interactions, and stringent compliance requirements – needs best met by cloud data warehouses’ scalability and advanced feature sets. While adoption among SMEs is rising steadily due to cloud democratization, the lion’s share remains with large enterprises, who require robust, customizable, and high-availability solutions to stay competitive.

By End-user – BFSI Sector (23.0%)

The Banking, Financial Services, and Insurance (BFSI) sector emerges as a key vertical, commanding 23.0% of market activity. This sector handles billions of transactions daily, relies on advanced fraud detection algorithms, and faces strict regulatory mandates. Cloud data warehouses empower BFSI organizations to consolidate disparate data sources, run real-time risk analytics, and remain agile in adapting to new compliance rules. Enhanced customer profiling and service personalization are further enabled, helping financial institutions deliver seamless, secure, and compliant digital experiences at scale.

Emerging Trend

Real-Time Analytics and Intelligent Automation

One of the most exciting trends shaping cloud data warehouses is the demand for real-time analytics powered by intelligent automation. Organizations today are not content with simply storing vast amounts of data. They want the ability to analyze their data instantly and generate actionable insights on the fly.

Cloud data warehouses are meeting this need with advanced features like automated ETL (extract, transform, load) processes, self-optimizing queries, and integration with AI and machine learning models. These innovations not only cut down manual work for data teams but also allow businesses to respond quickly to market changes and customer needs, making intelligent decision-making a core business capability.

Driver

Scalability and Flexibility

The primary force accelerating cloud data warehouse adoption is their unparalleled scalability and flexibility. Traditional storage solutions often buckle under increasing data loads or require heavy investments for upgrades. With the cloud model, organizations can quickly scale their storage and computing resources up or down based on current demand, paying only for what they use.

This flexibility removes barriers for businesses of all sizes to harness data effectively – allowing for dynamic adaptation as requirements shift – while reducing the need for major upfront infrastructure investments. For many, this translates into significant time and cost savings alongside improved business agility.

Restraint

Security Concerns and Regulatory Compliance

Despite the benefits, data security and compliance remain major restraints for organizations considering the cloud. Sensitive information, such as personal, financial, or health data, presents a meaningful risk when moved to cloud environments. The complexity of global data regulations means firms must carefully navigate where data is stored, how it is protected, and who has access.

High-profile threats like data breaches and cyberattacks, as well as worries about unauthorized access and data sovereignty, further complicate adoption. As a result, businesses must invest in robust security tools and ensure compliance frameworks are in place, which can slow cloud migration projects and add to the workload of IT and compliance teams.

Opportunity

Advanced Analytics with AI and Machine Learning

Cloud data warehouses offer a golden opportunity for businesses to tap into advanced analytics. The integration of AI and machine learning capabilities within cloud data environments enables predictive modeling, anomaly detection, and enhanced business intelligence. These technologies empower organizations not just to store information, but to derive deeper, predictive insights that fuel better strategies and innovation.

As adoption spreads, cloud data warehouses are increasingly viewed as strategic assets that help companies harness automation, optimize data processing, and create smarter, more responsive operations. This opportunity is especially valuable for industries eager to leverage data for competitive advantage and business growth.

Challenge

Migration Complexity

Transitioning from legacy systems to modern cloud data warehouses poses a significant challenge for many organizations. Migrating large volumes of structured and unstructured data is rarely straightforward. Legacy data formats, varying quality, and the risk of data loss or downtime demand careful planning and skilled execution. Businesses need to assess dependencies and ensure data integrity every step of the way.

Without a well-thought-out migration strategy and capable teams, organizations can face project delays and operational disruptions. This hurdle often slows down the move to the cloud and can lead to unexpected resource drains, underlining the need for expert support and robust migration tools.

Top Key Players in the Market

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- IBM Corporation

- SAP SE

- Teradata Corporation

- Snowflake Inc.

- Cloudera, Inc.

- Yellowbrick Data, Inc.

- Other Key Players

Source – https://market.us/report/cloud-data-warehouse-market/