Table of Contents

Market Overview

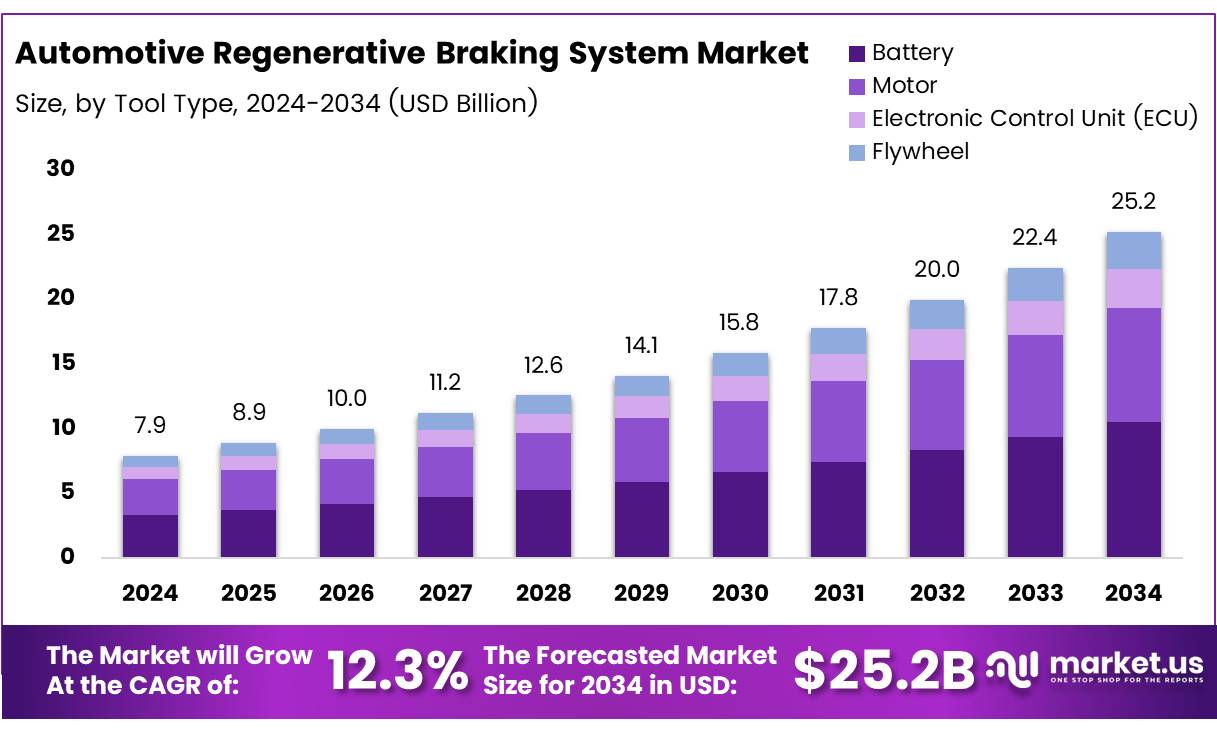

The Global Automotive Regenerative Braking System Market size is expected to be worth around USD 25.2 Billion by 2034, from USD 7.9 Billion in 2024, growing at a CAGR of 12.3% during the forecast period.

The automotive regenerative braking system market is growing fast due to rising EV and hybrid adoption. These systems boost energy efficiency and support green mobility goals. Regenerative braking can recover 60 to 70% of energy lost during braking. This energy is reused to charge the vehicle’s battery. It reduces fuel use and improves overall vehicle performance.

EV batteries typically come with an 8 to 10-year warranty, making energy recovery systems more valuable. Global test cycles like WLTC and CLTC show strong results. Recovery efficiency reaches 21.54% in WLTC and 25.39% in CLTC conditions. These results reflect real-world driving, supporting system adoption.

Government policies worldwide support EV technology. Many nations invest in cleaner mobility and emission controls. In June 2025, plug-in hybrid electric vehicle sales rose by 110% year-over-year. More buyers prefer EVs with advanced braking systems. Meanwhile, hydrogen fuel cell vehicle sales dropped by 91%, shifting focus to battery-powered options.

Regenerative braking offers a big market opportunity. OEMs are adding it to improve range and lower costs. Regulations, demand, and clean tech trends will drive future growth. The market is set for expansion as EV sales rise globally.

Key Takeaways

- Automotive Regenerative Braking System market to reach USD 7.9 billion by 2034.

- Market grows at a strong CAGR of 12.3% during the forecast period.

- In 2024, Battery component held 41.2% market share.

- .BEVs led propulsion type in 2024 due to zero-emission shift.

- Asia Pacific held 53.1% share in 2024.

- Region valued at USD 4.1 billion in 2024.

Market Drivers

- Fuel Efficiency Regulations: Global mandates push automakers to adopt RBS for lower emissions and better mileage.

- EV Adoption: Surge in electric vehicle sales boosts demand, as RBS is standard in EVs.

- Tech Advancements: Innovations in braking, energy storage, and vehicle electronics enhance RBS performance.

- Consumer Awareness: High fuel costs and eco-concerns drive interest in energy-efficient systems like RBS.

Challenges

- High Costs: RBS increases vehicle prices, limiting adoption in cost-sensitive segments.

- System Complexity: Integrating RBS with brakes, motors, and electronics complicates design and production.

- Performance Limits: RBS may need support from friction brakes in certain conditions, adding engineering challenges.

Segmentation Insights

Component Analysis

In 2024, batteries led with 41.2% share due to their key role in storing energy during braking in EVs and hybrids. Motors followed, helping convert energy back to motion. ECUs control the system efficiently, while flywheels, though smaller in use, support high-performance energy storage.

Propulsion Type Analysis

BEVs dominated the market as they rely heavily on regenerative braking for energy recovery. PHEVs also use the system but less extensively. FCEVs are growing slowly, but BEVs will continue leading due to strong demand and zero-emission benefits.

Vehicle Type Analysis

Passenger cars held the top spot in 2024, driven by rising demand for fuel-efficient and eco-friendly vehicles. Regenerative braking is widely adopted here. Light and heavy commercial vehicles are growing users, but their share remains smaller for now.

Regional Insights

Asia Pacific leads the market with 53.1% share worth USD 4.1 billion in 2024. Growth is driven by high EV production in China, Japan, and South Korea, along with strong government support and investment in EV infrastructure.

North America is growing steadily, led by the U.S., where strict emission laws and rising EV adoption support regenerative braking system demand.

Europe shows strong growth due to EU sustainability rules and high consumer demand for fuel-efficient cars. EV expansion by automakers also boosts the market.

Latin America is still in early stages, but growth is expected as awareness and EV infrastructure improve, especially in Brazil and Mexico.

Middle East & Africa may see moderate growth, with rising EV interest in the UAE and Saudi Arabia, though market size remains small for now.

Recent Developments

- In July 2025, the UK government announced a £4.5 billion funding package dedicated to accelerating electric vehicle (EV) adoption. This includes investments in charging infrastructure, EV manufacturing, and consumer incentives.

- In February 2025, this strategic move signaled Toyoda Gosei’s commitment to expanding its footprint in the commercial EV segment, especially across Asia.

- In February 2024, UK-based EV manufacturer Tevva completed the development of a regenerative braking system for its 7.5-ton battery-electric truck. The system is designed to enhance energy efficiency and extend vehicle range for commercial use.

- In March 2024, a multimillion-pound investment was made to boost the UK’s electric vehicle production capabilities. This initiative aims to strengthen local EV supply chains and create thousands of green jobs.

- In December 2024, Toyoda Gosei acquired a stake in EV Motors Japan, a startup developing and selling electric trucks and buses.

Conclusion

The Automotive Regenerative Braking System Market is on a strong growth path, projected to reach USD 25.2 billion by 2034, driven by rising EV adoption, fuel efficiency regulations, and government investments. With Asia Pacific leading in production and OEMs integrating RBS to boost performance and reduce emissions, the market is poised for rapid expansion. Despite cost and integration challenges, ongoing technological advancements and clean mobility trends will continue fueling demand globally.