Table of Contents

Introduction

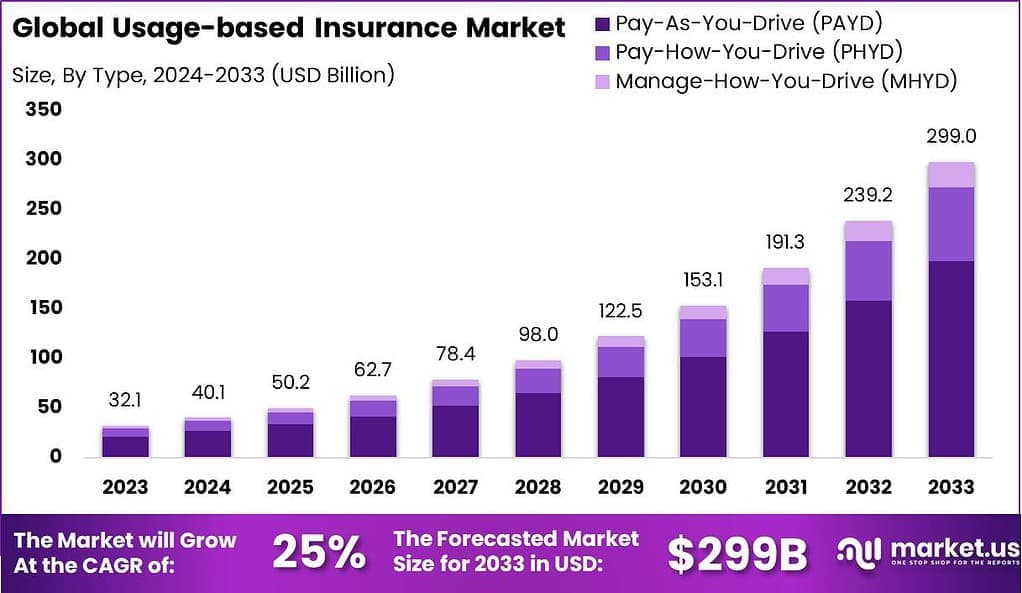

The global Usage-based Insurance (UBI) market is expected to experience substantial growth, projected to reach USD 299 billion by 2033, up from USD 32.1 billion in 2023, reflecting a robust compound annual growth rate (CAGR) of 25.5% from 2024 to 2033. North America currently dominates the market, holding over 40.5% of the market share, with a revenue of USD 13 billion in 2023. The growth is driven by the increasing demand for personalized insurance products, the rise in telematics technology, and consumer preferences for more flexible, data-driven pricing models.

How Growth is Impacting the Economy

The rapid expansion of the Usage-based Insurance market is having a positive impact on the global economy by driving innovation in the insurance sector. The rise in UBI adoption is enabling insurers to offer personalized, flexible pricing models based on individual driving behaviors and other data-driven insights. This shift is leading to greater customer satisfaction, higher retention rates, and increased competition among insurance providers.

Furthermore, the demand for telematics devices and mobile apps is boosting technological advancements, creating job opportunities in the tech sector. With the increased adoption of UBI, businesses can reduce operational costs by utilizing data to assess risk more accurately. This technology-driven disruption is promoting efficiency and transparency, allowing insurers to streamline processes and improve decision-making. Additionally, UBI has the potential to create new revenue streams for companies, as more customers demand customized, usage-based policies, driving economic growth in the digital insurance market.

➤ Unlock growth! Get your sample now! – https://market.us/report/usage-based-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

The growth of the Usage-based Insurance market is driving the demand for telematics devices and data analytics solutions, resulting in increased costs for businesses involved in providing these technologies. Insurers must invest in the infrastructure needed to support UBI platforms, such as IoT sensors, data storage, and AI algorithms. Additionally, supply chain shifts are occurring as insurers increasingly rely on technology providers and third-party data firms for telematics and customer insights. Businesses in the insurance sector may face challenges in managing these costs, especially in emerging markets with limited access to advanced technology.

Sector-Specific Impacts

In the insurance industry, UBI is transforming how premiums are calculated, leading to more accurate and personalized pricing models. The automotive sector is directly impacted as UBI relies on driving data collected via telematics devices, encouraging partnerships between insurers and automotive companies. Additionally, UBI has led to changes in customer behavior, as consumers become more aware of the potential for lower premiums based on their driving habits. These sector-specific impacts are creating new opportunities for insurers to expand their offerings while promoting competition and innovation in the market.

Strategies for Businesses

To capitalize on the growing UBI market, businesses should invest in the necessary technology infrastructure to support telematics-based insurance models. Partnering with telematics providers and data analytics companies will help insurers gain access to accurate data and improve pricing accuracy.

Additionally, businesses should focus on customer education, highlighting the benefits of UBI products, such as lower premiums for safe driving. Expanding into emerging markets with increasing smartphone penetration and mobile technology adoption will also help insurers tap into new customer bases. Offering tailored UBI solutions for various customer segments, including young drivers, commercial fleets, and high-risk individuals, can further enhance market share and customer loyalty.

Key Takeaways

- The global UBI market is projected to reach USD 299 billion by 2033, growing at a CAGR of 25.5%.

- North America holds over 40.5% of the market share, contributing USD 13 billion in 2023.

- Key drivers include the growing demand for personalized, data-driven pricing models and telematics technology.

- Rising costs and infrastructure investment are challenges for businesses adopting UBI models.

- Businesses should invest in technology, customer education, and strategic partnerships to remain competitive.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=131981

Analyst Viewpoint

The UBI market is currently experiencing rapid growth, with significant adoption in North America and increasing interest from global markets. The future looks promising, as UBI allows insurers to offer more tailored and flexible pricing models, improving customer satisfaction. As telematics and IoT technologies continue to evolve, insurers will be able to further enhance their risk assessment capabilities, driving greater efficiency and reducing costs. The UBI market is expected to expand at an even faster rate as innovations emerge, offering opportunities for insurers to grow while providing more personalized insurance experiences.

Use Case and Growth Factors

| Category | Use Cases | Growth Factors |

|---|---|---|

| Automotive | – Telematics-based insurance for car owners. – Data-driven discounts for safe driving behavior. | – Increasing adoption of IoT and connected cars. – Growing focus on driver behavior data for insurance risk assessment. |

| Personal Insurance | – Customized premiums for individual drivers. – Real-time tracking of driving habits. | – Demand for personalized, flexible insurance products. – Consumer interest in pay-per-use insurance models. |

| Commercial Fleets | – UBI solutions for fleet management. – Usage-based pricing for vehicle fleets. | – Rising interest in telematics for operational efficiency and cost reduction. – Need for data-driven solutions. |

| Healthcare | – Health-related insurance premiums based on activity tracking. – Integration of health data. | – Increased focus on wellness and preventative health measures. – Rising demand for personalized insurance models. |

| Smart Cities | – Insurance products for smart city infrastructure. – Real-time risk assessment for urban vehicles. | – Rise in smart city projects and IoT integration. – Need for adaptive insurance solutions in urban settings. |

Regional Analysis

North America holds a dominant position in the UBI market, accounting for over 40.5% of the market share in 2023, with USD 13 billion in revenue. This dominance is driven by the region’s advanced adoption of telematics technology and a mature insurance industry that has embraced data-driven pricing models.

Europe is seeing steady growth, with a focus on environmental insurance policies and expanding demand for personalized insurance solutions. The Asia-Pacific region is experiencing rapid growth in UBI adoption due to the increasing smartphone penetration, urbanization, and demand for flexible insurance products. Latin America and the Middle East are emerging as potential growth regions for UBI as digital infrastructure improves.

Business Opportunities

The UBI market presents numerous business opportunities, particularly in developing personalized insurance solutions using telematics and data analytics. Insurers can expand their offerings by targeting specific customer segments, such as young drivers, commercial fleets, and high-risk individuals, with tailored pricing models.

Additionally, partnerships with automotive companies, telematics providers, and mobile technology firms will allow insurers to offer innovative UBI solutions. As global urbanization continues, offering UBI products for vehicles in smart cities will open new revenue streams. In emerging markets, where smartphone penetration is growing, insurers can expand their reach by offering mobile-based UBI products.

➤ Don’t Stop Here—check Our Library

- Kids Digital Advertising Market

- Free Space Optics (FSO) Communication Market

- Horse Insurance Market

- Cloud Enabling Technology Market

Key Segmentation

The UBI market can be segmented by technology, application, and region. By technology, key segments include telematics-based solutions, mobile applications, and IoT-enabled devices. Applications span across automotive, personal insurance, commercial fleets, healthcare, and smart cities. Geographically, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. As digitalization and telematics adoption increase, the demand for usage-based insurance models is set to grow rapidly, with North America, Europe, and Asia-Pacific leading the charge.

Key Player Analysis

Key players in the UBI market are focusing on developing innovative telematics-based solutions to offer personalized pricing models. These companies are investing in data analytics, IoT integration, and mobile technology to provide accurate and flexible insurance options. Strategic partnerships with telematics providers, automotive manufacturers, and technology firms are essential for expanding market reach. To remain competitive, companies are focusing on customer-centric solutions, offering tailored UBI products for various segments such as young drivers, commercial fleets, and health-conscious individuals. Maintaining leadership in data-driven risk assessment and developing scalable solutions is key to staying ahead in the growing UBI market.

- Progressive Corporation

- Allianz SE Company Profile

- AXA Group

- Allstate Corporation

- State Farm

- Desjardins General Insurance

- Generali Group

- Liberty Mutual Insurance

- Insure The Box Limited

- UnipolSai Assicurazioni S.p.A.

- Aviva plc

- Zurich Insurance Group

- Other Key Players

Recent Developments

- Launch of mobile-based UBI solutions that track driving behavior in real-time.

- Partnerships between automotive manufacturers and insurers to offer usage-based policies.

- Introduction of UBI programs targeting commercial fleets to reduce operational costs.

- Expansion of UBI solutions in emerging markets with growing smartphone penetration.

- Implementation of telematics in smart cities to offer adaptive insurance solutions for urban vehicles.

Conclusion

The Usage-based Insurance market is experiencing rapid growth, driven by the increasing demand for personalized and data-driven insurance models. With the growing adoption of telematics and IoT technology, insurers are well-positioned to offer flexible, cost-effective policies that cater to the evolving needs of consumers and businesses. The future of UBI is promising, with numerous opportunities for innovation and market expansion.