Table of Contents

Market Overview

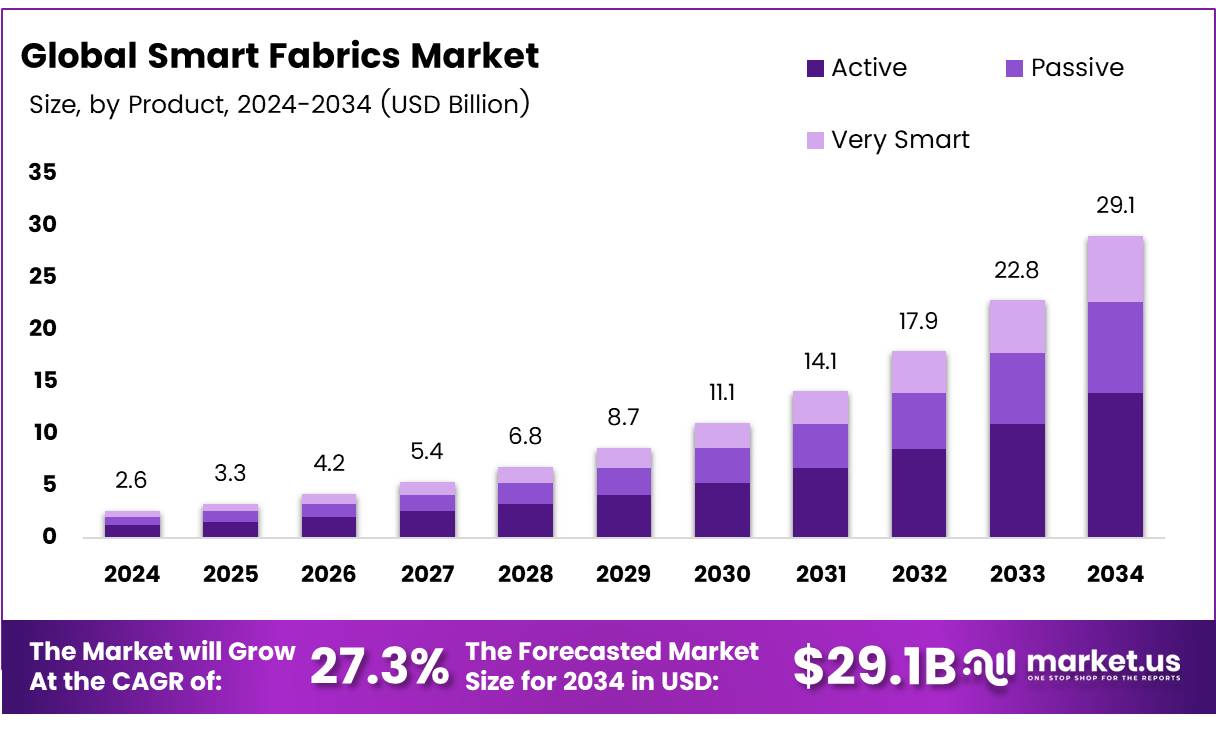

The Global Smart Fabrics Market size is expected to be worth around USD 29.1 Billion by 2034, from USD 2.6 Billion in 2024, growing at a CAGR of 27.3% during the forecast period.

The Smart Fabrics Market is growing fast due to rising demand for wearable tech. Health tracking and comfort features drive smart fabric adoption. Key sectors include healthcare, sports, military, and fashion. Smart textiles are used to monitor heart rate, temperature, and movement. Brands are investing more in R&D to create innovative products.

There is high market opportunity in medical and fitness wear. Hospitals use smart fabrics for remote patient monitoring. Sports brands use them to track performance. Military forces use them for safety and real-time updates. This opens new doors for smart fabric suppliers. Companies can gain by offering sensor-based, lightweight materials.

Governments are supporting this industry with funding and initiatives. The US and EU have invested in digital textile projects. They promote smart fabric innovation in public and defense sectors. Regulatory bodies are also setting quality and safety standards. This helps ensure product trust and faster market entry.

With strong demand, funding, and support, the smart fabrics market has big potential. To succeed, companies must focus on product quality, low cost, and mass production.

Key Takeaways

- The Global Smart Fabrics Market is expected to reach USD 29.1 Billion by 2034, growing at a CAGR of 27.3% from 2025 to 2034.

- Active smart fabrics held the largest share in 2024 with 43.8%, due to their advanced performance features.

- Sensing functionality led the market in 2024, capturing 37.6% share, driven by rising demand for wearable technology.

- The Defense & Military sector was the top end-user in 2024, accounting for 29.3% of the total market.

- North America dominated the market in 2024, holding a 48.6% share, valued at approximately USD 1.2 Billion.

Market Drivers

- Healthcare: Smart fabrics enable real-time, non-invasive health monitoring for patients and elderly care.

- Sports & Fitness: Athletes use them to track performance, posture, and fatigue with enhanced comfort.

- Defense: Military uniforms integrate smart fabrics for threat detection, communication, and temperature control.

- Fashion & Entertainment: Interactive clothing reacts to music, movement, and social media for unique user experiences.

- Automotive & Home: Smart textiles offer ambient control and sensing features in cars and smart home interiors.

Challenges

- High Costs: Specialized materials and tech make smart fabrics expensive to produce and adopt.

- Durability Issues: Maintaining functionality after washing and wear is a key challenge.

- Power Needs: Integrating efficient, flexible power sources remains a technical hurdle.

- Lack of Standards: Absence of uniform regulations affects safety, privacy, and compliance.

Segmentation Insights

Product Analysis

In 2024, Active smart fabrics led the market with 43.8% share due to features like real-time sensing and adaptability, widely used in healthcare, sports, and defense. Passive fabrics focus on comfort but offer less functionality, while Very Smart fabrics are advanced but limited by high costs.

Function Analysis

Sensing was the top function in 2024, holding a 37.6% share, driven by demand for smart wearables. Energy Harvesting is rising for self-powered fabrics. Aesthetic and thermoelectric features also grow, but sensing remains the key function.

End-use Analysis

Defense & Military led with a 29.3% share, using smart fabrics for safety, health tracking, and performance. Fashion & Entertainment is growing with smart clothing trends. Other sectors like medical, sports, and transport also boost market demand.

Regional Insights

North America leads the smart fabrics market with 48.6% share (USD 1.2 billion), driven by strong tech companies, high wearable adoption, and government support.

Europe holds a solid share, with growth led by fashion-forward countries like France, Germany, and Italy, and a push for sustainable textiles.

Asia Pacific is the fastest-growing region, thanks to China, Japan, and South Korea, supported by low manufacturing costs and tech innovation.

Middle East & Africa and Latin America are emerging markets, with growing interest in healthcare and defense applications, especially in UAE and Brazil.

Recent Developments

In November 2024, Myant Inc. acquired Nanoleq and Osmotex Technologies to boost its smart fabric capabilities with advanced sensing and electro-osmotic technologies. This strategic move strengthens Myant’s portfolio in textile computing, enhancing innovations in health-monitoring and responsive fabrics.

In April 2024, Altair acquired Cambridge Semantics to enhance its capabilities in enterprise data fabrics and generative AI applications. The acquisition supports Altair’s push into next-gen data integration solutions, enabling smarter decision-making across high-value industries.

Conclusion

The Global Smart Fabrics Market is set for rapid growth, projected to reach USD 29.1 Billion by 2034 at a CAGR of 27.3%. Key drivers include rising demand for wearable tech in healthcare, sports, defense, and fashion, along with strong government support and R&D investment. Despite challenges like high costs and durability concerns, smart fabrics offer major opportunities especially in medical and military sectors. North America leads the market, while Asia Pacific shows fastest growth. Success depends on delivering affordable, durable, and innovative smart textile solutions at scale.