Table of Contents

Market Overview

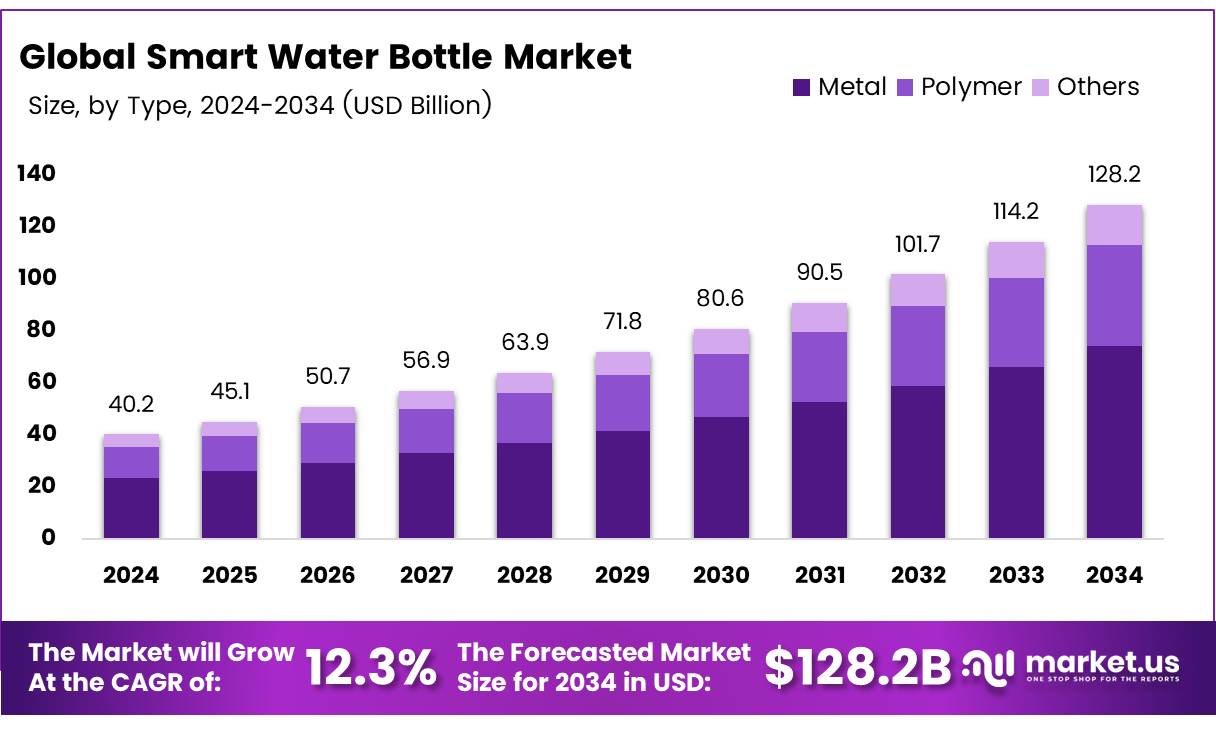

The Global Smart Water Bottle Market size is expected to be worth around USD 128.2 Billion by 2034, from USD 40.2 Billion in 2024, growing at a CAGR of 12.3% during the forecast period.

The Smart Water Bottle Market is set for strong growth. 75% of Americans are chronically dehydrated. This creates a clear demand for smart hydration tools. Smart bottles track water intake through sensors and apps. They help users stay hydrated every day. Proper hydration is vital for aging adults.

It supports metabolism, brain health, and energy levels. Around 20% of daily fluids come from food. The rest must come from drinks. This gives smart bottles a big share to capture.

Governments are investing in public health programs. Many run hydration awareness campaigns. These target schools, offices, and communities. Health tech funding is increasing worldwide. This creates a better market for smart bottles. Regulations ensure product safety and quality. They focus on materials that touch drinking water. IoT and wearable tech integration is on the rise.

This adds personalized tracking features. The trend matches consumer demand for health monitoring. The market offers strong opportunities for brands. Startups and global players can benefit. The industry is ready for rapid expansion.

Key Takeaways

- The global Smart Water Bottle market is expected to reach USD 128.2 billion by 2034, growing at a CAGR of 12.3%.

- The Metal segment holds a dominant 58.1% market share, led by demand for stainless steel bottles.

- Hydration Tracking Apps lead the component segment, driven by increasing health and wellness awareness.

- The Online distribution channel captures 65.2% of the market, boosted by e-commerce convenience and variety.

- Asia Pacific leads with a 32.6% share, valued at about USD 13.2 billion.

Market Drivers

- Technological Advancements – Motorsport pushes innovations in materials, engines, and telematics that enhance performance and safety.

- Rising Fan Engagement – Digital platforms and esports broaden motorsport’s global reach.

- Commercialization & Sponsorship – Premium branding draws sponsors, boosting funding and development.

- Sustainable Technologies – Electric racing showcases eco-friendly mobility innovations.

Challenges

- High Costs – Expensive vehicles, logistics, and safety needs limit new team entry.

- Safety & Compliance – High-speed risks and strict regulations demand constant upgrades.

- Environmental Criticism – Combustion engines draw scrutiny despite rising electric formats.

- Limited Diversity – Low representation hinders inclusivity and market expansion.

Segmentation Insights

Type Analysis

In 2024, metal smart water bottles led with 58.1% share, valued for durability, premium look, and temperature retention. Stainless steel appeals to eco-conscious buyers, while cheaper polymer bottles are lighter but less premium. Glass and hybrid types stay niche.

Component Analysis

Hydration tracking apps dominated in 2024, driven by rising health focus. They let users track intake, set reminders, and get tips. Built-in sensors and hardware add value but play a secondary role to app engagement.

Distribution Channel Analysis

Online sales held 65.2% share in 2024, boosted by convenience, variety, and digital marketing. Offline stores remain useful for immediate purchases but are losing ground to e-commerce.

Regional Insights

In 2024, Asia Pacific led the smart water bottle market with 32.6% share and USD 13.2 billion, driven by strong demand in China, India, and Japan for tech-enabled health products, rising disposable incomes, and a tech-savvy population.

North America saw strong growth fueled by fitness awareness and connected device adoption, with the U.S. as the largest contributor.

Europe also held a major share, led by Germany, the UK, and France, where health trends and eco-consciousness boost demand.

The Middle East & Africa and Latin America remain smaller but growing markets, supported by urbanization, rising incomes, and increasing interest in fitness technology.

Recent Developments

- In Dec 2022, Geekdom awarded $25,000 to a smart water bottle startup, providing crucial seed capital to fuel product development and market entry. This investment underscored the growing investor interest in health-focused hydration technology.

- In Feb 2024, Brita announced its acquisition of Bay Area-based startup Larq, aiming to combine Brita’s global reach with Larq’s innovative self-cleaning bottle technology. This move positioned both brands to accelerate innovation and capture a larger share of the premium hydration market.

- In Dec 2024, The Coca-Cola Company revealed its acquisition of a premium alcohol ready-to-drink brand in Australia, marking its strategic expansion into the growing RTD alcoholic beverage sector. This acquisition aligned with Coca-Cola’s diversification strategy to tap into new consumer trends.

- In Apr 2024, smartwater launched its sleekly designed aluminum cans, enhancing its sustainability profile while appealing to environmentally conscious consumers. The new packaging also offered a premium aesthetic to strengthen brand positioning.

- In Jul 2024, watertech startup Boon secured $5 million in funding from Roca Group Ventures to advance cutting-edge solutions in water management and purification. This capital injection was aimed at scaling operations and accelerating innovation in water sustainability technologies.

Conclusion

The global Smart Water Bottle market will grow from USD 40.2B in 2024 to USD 128.2B by 2034 at a 12.3% CAGR, driven by rising health awareness, tech integration, and government hydration campaigns. Metal bottles and hydration tracking apps lead the market, with online sales at 65.2% and Asia Pacific holding 32.6% share. Strategic acquisitions and startup funding are boosting innovation, making the sector ripe for rapid expansion despite cost and regulatory challenges.