Table of Contents

Introduction

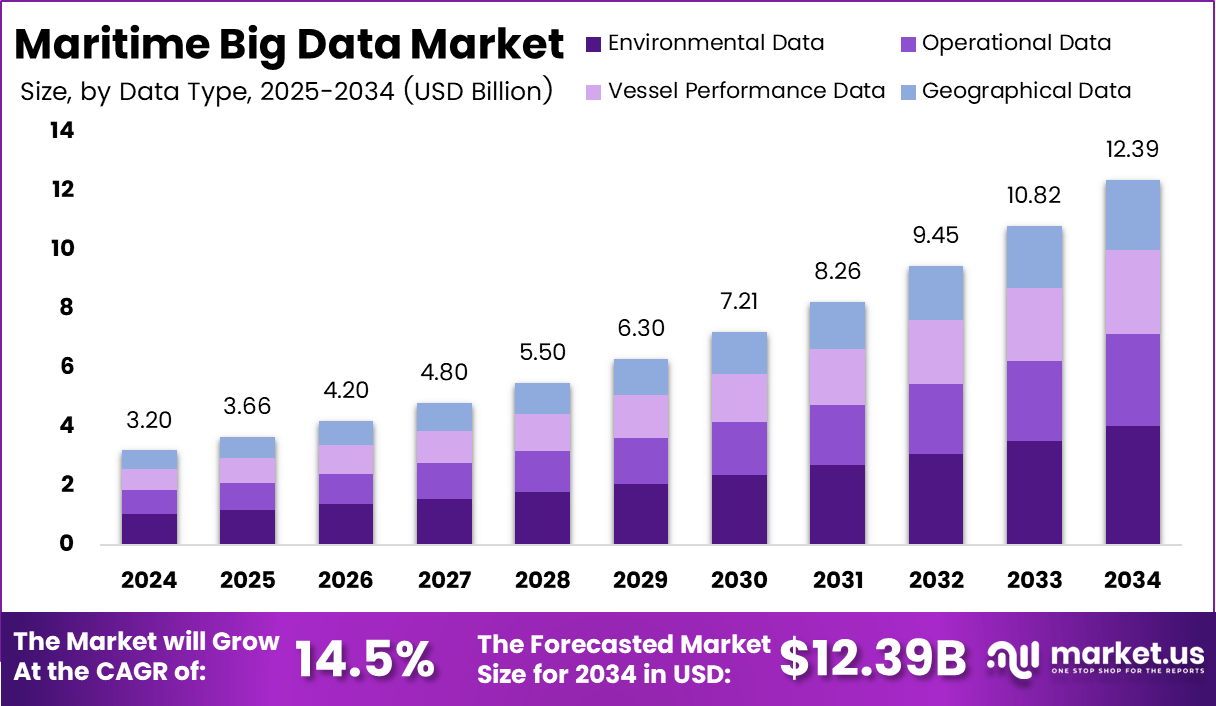

The Global Maritime Big Data Market is expected to reach USD 12.39 Billion by 2034, up from USD 3.2 billion in 2024, growing at a CAGR of 14.5% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) holds a dominant market share of 36.5%, generating USD 1.15 Billion in revenue. This growth is driven by the increasing adoption of big data technologies in the maritime industry to enhance operational efficiency, safety, and environmental sustainability.

How Growth is Impacting the Economy

The expansion of the Maritime Big Data Market is contributing to the digital transformation of the maritime sector, improving operational efficiencies, safety measures, and environmental performance. The use of big data allows shipping companies, port authorities, and logistics providers to optimize route planning, fuel consumption, and maintenance schedules. As a result, operational costs are reduced, and productivity is increased across the industry.

Furthermore, the growing demand for data-driven solutions in maritime operations is spurring investments in technology infrastructure, creating job opportunities in data analytics, AI development, and cybersecurity. The sector’s growth also has a positive impact on the broader economy by supporting sustainable maritime operations and driving innovation across related industries such as logistics, shipping, and port management.

➤ Unlock growth! Get your sample now! – https://market.us/report/maritime-big-data-market/free-sample/

Impact on Global Businesses

As the Maritime Big Data Market grows, businesses in the shipping, logistics, and port management sectors are adopting advanced data analytics and AI-driven solutions to enhance operational efficiencies. However, integrating big data solutions into existing maritime operations requires significant investment in technology infrastructure, leading to increased upfront costs.

Additionally, the increased reliance on data-driven solutions is pushing businesses to invest in advanced cybersecurity measures to protect sensitive maritime data from potential threats. Supply chains are also shifting as companies use big data for predictive maintenance, inventory management, and route optimization, reducing delays and operational disruptions. The maritime industry’s shift toward big data also improves environmental sustainability by optimizing fuel consumption and reducing emissions.

Strategies for Businesses

- Invest in Big Data Infrastructure: Companies should invest in robust data storage and analytics platforms to collect and process vast amounts of maritime data.

- Focus on Predictive Analytics: Leverage big data to anticipate potential issues such as equipment failures, weather disruptions, and fuel inefficiencies, optimizing operations.

- Embrace IoT Integration: Integrate Internet of Things (IoT) devices with big data platforms to monitor vessel conditions in real-time, improving safety and efficiency.

- Enhance Environmental Sustainability: Use data analytics to reduce emissions and optimize fuel usage, aligning with increasing environmental regulations.

- Ensure Data Security: Implement advanced cybersecurity measures to protect sensitive operational data from cyber threats.

Key Takeaways

- The Maritime Big Data Market is expected to reach USD 12.39 Billion by 2034.

- APAC holds a dominant market share of 36.5%, contributing USD 1.15 Billion in revenue in 2024.

- Growth is driven by increasing adoption of big data technologies in maritime operations for route optimization, predictive maintenance, and fuel efficiency.

- Maritime companies are leveraging data analytics to enhance safety, reduce costs, and improve environmental sustainability.

- The market is poised for continued growth as businesses adopt AI-driven and IoT-powered solutions to improve operational efficiency.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=156798

Analyst Viewpoint

The Maritime Big Data Market is set for significant growth, fueled by the increasing need for efficient and sustainable operations in the maritime industry. With the rise of digitalization, big data technologies are enabling maritime businesses to optimize their operations, improve decision-making, and ensure compliance with environmental standards.

The future of this market looks promising as businesses continue to invest in data-driven solutions to enhance safety, operational efficiency, and sustainability. Moreover, advancements in AI, machine learning, and IoT integration are expected to further accelerate the growth of the market.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Route Optimization | Increasing need for fuel efficiency and time-saving route planning. |

| Predictive Maintenance | Rising demand for preventing equipment failures and reducing downtime. |

| Port Operations Optimization | Adoption of big data for inventory management and docking schedules. |

| Environmental Impact Reduction | Growing focus on sustainability and fuel optimization to meet regulations. |

Regional Analysis

In 2024, Asia Pacific (APAC) dominates the Maritime Big Data Market with a 36.5% market share, contributing USD 1.15 Billion in revenue. The region’s growth is driven by the increasing digitalization of maritime operations in countries like China, Japan, and South Korea, where large shipping and logistics companies are leveraging big data for route optimization, fuel management, and predictive maintenance. North America and Europe are also witnessing strong growth, driven by the adoption of big data technologies for improving port operations and reducing emissions. The Middle East & Africa and Latin America are expected to experience gradual growth as these regions increase investments in big data solutions for maritime operations.

Business Opportunities

The growing Maritime Big Data Market presents significant opportunities for technology providers, data analytics companies, and IoT solution providers. As the demand for big data solutions rises, businesses can capitalize on opportunities to offer AI-driven predictive analytics, route optimization, and fleet management services. Additionally, companies that provide cybersecurity solutions for the maritime industry will see increased demand as businesses work to secure sensitive data. There is also growing demand for solutions that focus on environmental sustainability, offering opportunities for companies to develop and implement fuel optimization technologies, carbon footprint tracking, and emission reduction solutions.

Key Segmentation

Key segments in the Maritime Big Data Market include:

- By Application: Route optimization, predictive maintenance, port operations optimization, environmental impact reduction, and others.

- By Technology: AI, machine learning, IoT, big data analytics platforms.

- By Region: Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Key Player Analysis

The Maritime Big Data Market features key players focused on delivering AI-powered and data analytics-driven solutions for the maritime industry. These companies are investing heavily in the development of big data platforms that integrate with existing maritime infrastructure to enhance operational efficiency. By partnering with shipping companies, port authorities, and logistics providers, these players are helping the maritime sector adopt innovative technologies for predictive maintenance, route optimization, and environmental sustainability.

- Microsoft Corporation

- Amazon Web Services, Inc.

- KONGSBERG

- Fugro NV

- Inmarsat Global Limited

- Iridium Communications Inc.

- Siemens Aktiengesellschaft

- Planet Labs PBC.

- DigitalOcean Holdings, Inc.

- International Business Machines Corporation (IBM)

- Oracle Corporation

- Schneider Electric SE.

- Google LLC

- Others

Recent Developments

- In 2024, companies are implementing AI-driven analytics to optimize fuel consumption and reduce emissions in maritime operations.

- The integration of IoT devices in vessels and port operations is becoming more widespread to gather real-time data for better decision-making.

- Predictive maintenance technologies are being widely adopted to reduce downtime and maintenance costs for ships and port equipment.

- Environmental regulations are pushing the maritime industry to adopt big data solutions that optimize fuel usage and reduce carbon footprints.

- Big data platforms are becoming increasingly integrated with cloud-based systems for better scalability and real-time data processing.

Conclusion

The Maritime Big Data Market is on a robust growth trajectory, driven by the increasing adoption of data analytics and AI technologies to improve operational efficiency, reduce costs, and ensure sustainability in the maritime industry. With significant opportunities for innovation and expansion, the future of the market looks promising, as businesses continue to integrate big data solutions for route optimization, predictive maintenance, and environmental impact reduction.