Table of Contents

Introduction

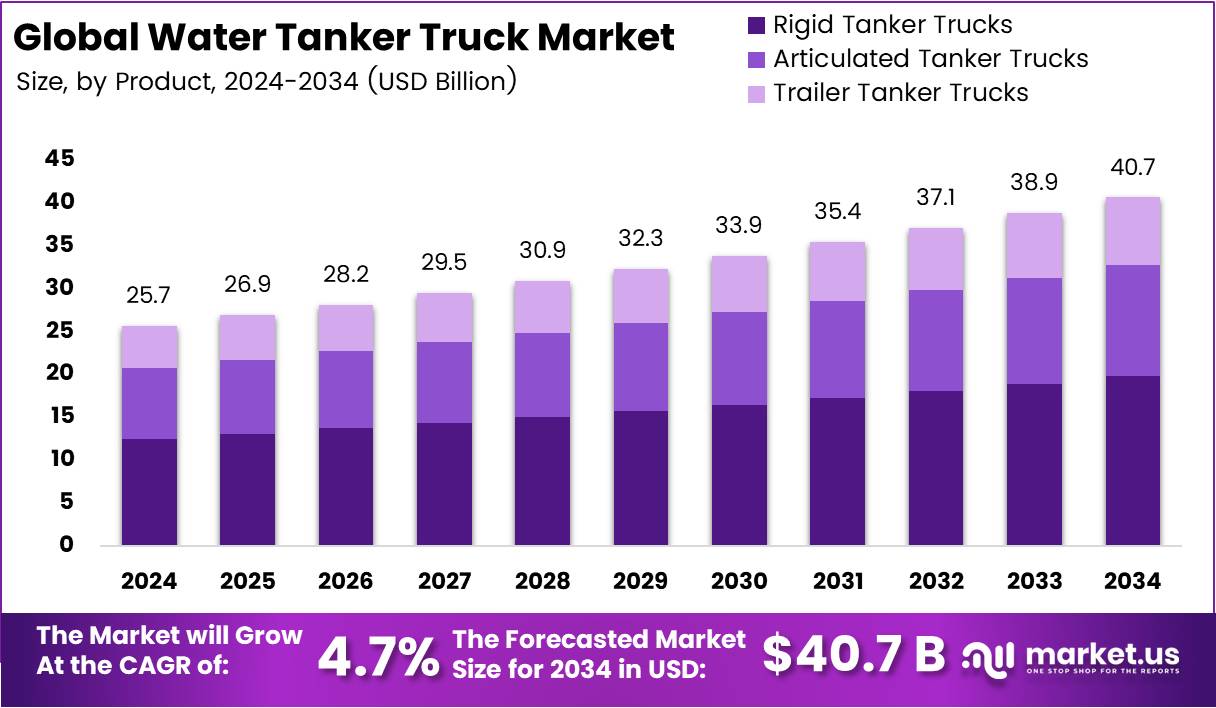

The global Water Tanker Truck Market is poised for remarkable growth, with projections showing a rise from USD 25.7 Billion in 2024 to USD 40.7 Billion by 2034, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. This growth trajectory reflects the increasing demand for water distribution, driven by urbanization, rural development, and the rising global need for sustainable water management. Water tankers play a crucial role in delivering water to areas lacking infrastructure, supporting critical sectors such as agriculture, construction, and municipal water supply.

The market is witnessing a transformation with technological innovations, including the integration of smart technologies like GPS tracking, automated systems, and eco-friendly alternatives such as electric water tankers. These advancements are driving market growth, alongside government investments aimed at improving water infrastructure and ensuring better water accessibility.

As regions face the ongoing challenges of water scarcity and increasing demand, water tanker trucks are becoming an indispensable solution for effective water transportation and distribution. The market’s growth is further supported by the rising demand for water in industries like agriculture and construction, where bulk water transportation is essential for operational success.

Key Takeaways

- The global Water Tanker Truck Market is expected to reach USD 40.7 Billion by 2034, growing at a CAGR of 4.7% from 2025 to 2034.

- Rigid Tanker Trucks held 48.6% of the market share in the By Product segment in 2024, owing to their durability and versatility in various industries.

- North America dominated the market in 2024, capturing 43.8% of the global market share, valued at USD 11.2 Billion, driven by urban infrastructure growth and government investments.

- The 5,001 – 10,000 Gallons segment held a dominant position in 2024, commanding 37.9% of the market share, offering the ideal balance between payload and maneuverability.

- Diesel was the leading fuel type in 2024, with a 73.5% share, thanks to its proven performance, fuel efficiency, and availability of infrastructure.

- Steel was the leading material for tanker trucks in 2024, holding 48.2% of the market share due to its durability and strength in heavy-duty operations.

- The Government sector was the largest end-user segment in 2024, holding 28.8% of the market share, primarily driven by public water supply projects and infrastructure development.

Market Segmentation Overview

- By Product: The market is primarily driven by rigid tanker trucks, which accounted for 48.6% of the market share in 2024. Articulated and trailer tanker trucks follow as alternatives in specific industrial and large-scale transportation needs.

- By Capacity: The 5,001 – 10,000 Gallons segment led the market in 2024, capturing 37.9% of the share, providing an ideal balance between payload capacity and maneuverability.

- By Fuel Type: Diesel is the dominant fuel type, holding 73.5% of the market share, followed by gasoline and alternative fuel-powered tanker trucks.

- By Material: Steel remained the leading material for tanker trucks in 2024, with 48.2% of the market share, owing to its durability and strength in heavy-duty operations.

- By End-Use: Government applications dominated the market with 28.8% of the market share, primarily due to public sector water supply projects and infrastructure development.

Drivers

- Rising Demand for Clean Water Supply: Increasing urbanization and industrialization are escalating the need for efficient water distribution systems. Water tanker trucks are essential for delivering clean water to urban and rural areas, where existing water supply infrastructure is insufficient or nonexistent. Governments and private sectors are investing heavily in water distribution systems to address this issue, which is contributing to the market’s growth.

- Government Investments in Water Infrastructure: Governments worldwide are making significant investments to improve water distribution systems. Public utilities and government agencies are expanding their water tanker fleets to ensure better access to clean water, especially in underserved regions. These investments are creating a steady demand for water tanker trucks and are expected to continue driving market expansion.

Use Cases

- Agriculture: Farmers and agribusinesses rely heavily on water tanker trucks for irrigation, livestock watering, and crop protection activities. These vehicles ensure a continuous and reliable water supply, especially in drought-prone areas or regions with limited irrigation infrastructure.

- Construction and Industrial Operations: The construction industry requires large volumes of water for dust suppression, equipment cleaning, and concrete mixing. Water tanker trucks are essential for ensuring smooth operations, especially in large construction sites where a consistent water supply is needed. In addition, industries like mining and manufacturing also rely on water tanker trucks for process water requirements.

Major Challenges

- Stringent Regulatory and Environmental Standards: Increasing environmental regulations, including emission standards for heavy-duty vehicles, pose challenges to the market. Companies must comply with these regulations, which increase operational costs. Furthermore, maintaining water quality standards while transporting water adds another layer of complexity, necessitating investments in technology and certifications.

- High Operational Costs: Operating and maintaining a fleet of water tanker trucks can be expensive. High fuel costs, maintenance, and the need for skilled drivers create financial pressures on companies. Additionally, the upfront cost of purchasing or leasing water tanker trucks remains a significant barrier for some operators, especially in developing regions.

Business Opportunities

- Eco-Friendly Alternatives: As global sustainability efforts intensify, there is increasing demand for electric and hybrid water tanker trucks. Manufacturers are exploring these energy-efficient alternatives to meet regulatory standards and reduce operational costs. Companies that innovate in eco-friendly transportation solutions stand to benefit from the growing demand for greener technologies.

- Technological Advancements: The integration of GPS, IoT, and automated systems in water tanker trucks is an exciting business opportunity. These technologies help operators optimize routes, monitor water quality, and improve overall efficiency. Businesses that invest in smart water tanker trucks and automated systems can gain a competitive edge by offering enhanced customer service and operational efficiency.

Regional Analysis

- North America: The North American market held 43.8% of the global market share in 2024, valued at USD 11.2 Billion. The region’s dominance is attributed to the development of urban infrastructure and increasing investments in water distribution systems. Additionally, the industrial demand for water, particularly in mining and construction, is driving market growth.

- Asia Pacific: The Asia Pacific region is poised to witness significant growth, driven by rapid urbanization and industrial expansion in countries like India and China. Government investments in water supply systems and industrial water demands are contributing to this region’s growth potential.

- Europe: Europe is experiencing steady growth, with a strong emphasis on sustainable water transportation solutions. Stringent environmental regulations and government support for advanced infrastructure are factors propelling market growth.

- Middle East and Africa: The Middle East and Africa market is expanding due to the need for efficient water supply systems in water-scarce regions. The region’s increasing industrialization and urban development are driving demand for water tanker trucks.

- Latin America: Latin America shows moderate growth, supported by the agricultural sector’s increasing water demands. The region faces challenges such as budget constraints and infrastructure limitations but remains a key market for water tanker trucks.

Recent Developments

- Caterpillar unveiled the Cat 789D autonomous water truck in March 2025, showcasing advancements in automation for mining and construction industries. The truck features cutting-edge technology for improved safety, efficiency, and reduced operational costs.

- In August 2025, NWC expanded its fleet to include trucks designed for clearing and maintaining sewer lines, enhancing its capabilities in urban infrastructure services.

- Re:Group acquired the world’s first autonomous fleet of Scania trucks, including an electric water truck, for the Butcherbird Mine expansion in October 2024. This acquisition underscores the company’s commitment to sustainability and automation in its operations.

Conclusion

The global water tanker truck market is on a strong growth trajectory, driven by increasing water demands, government investments in infrastructure, and technological advancements. With eco-friendly and automated solutions becoming more prevalent, the market offers substantial business opportunities for companies that can innovate to meet regulatory requirements and address consumer needs. As urban and rural regions alike continue to face challenges related to water distribution, water tanker trucks will remain essential in ensuring the reliable delivery of water across various industries.