Table of Contents

Introduction

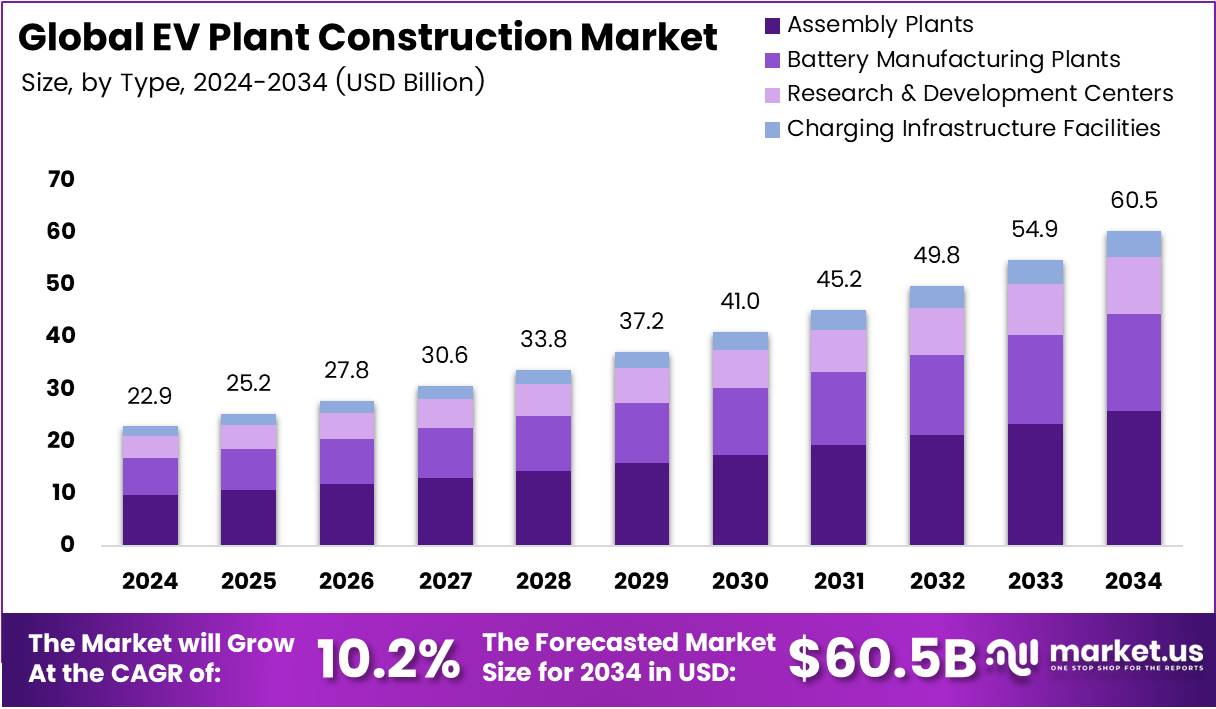

The global EV plant construction market is experiencing a significant expansion, driven by the rapid growth in electric vehicle (EV) adoption and the increasing demand for sustainable transportation solutions. The market is anticipated to reach a value of USD 60.5 billion by 2034, from USD 22.9 billion in 2024, reflecting a CAGR of 10.2% from 2025 to 2034.

The surge in the number of EVs on the road is pushing automakers to establish and expand production facilities, including gigafactories, battery plants, and assembly lines, to meet the growing demand. This dynamic is also fueled by global decarbonization targets and government incentives, positioning EV plant construction as a strategic priority within the automotive sector.

Governments are playing a crucial role in supporting this transition, with strategic investments in infrastructure, subsidies, tax benefits, and land allocations. These factors, along with increasing consumer demand for cleaner vehicles, are expected to drive the market’s growth trajectory.

Key Takeaways

- The global EV plant construction market is projected to reach USD 60.5 billion by 2034, from USD 22.9 billion in 2024, growing at a CAGR of 10.2%.

- Assembly Plants held the largest share in 2024, with a dominant 42.7% share, driven by increasing EV demand and automation needs.

- New Plant Construction dominated the By Construction segment in 2024, holding a 59.9% share, supported by large-scale investments in new facilities.

- Auto-Makers led the By End User segment, with a 45.6% share in 2024, reflecting strong investments in EV manufacturing infrastructure.

- APAC was the leading regional market in 2024, with a 34.8% share valued at USD 1.0 billion.

Market Segmentation Overview

- By Type: The Assembly Plants segment holds the largest market share due to their pivotal role in large-scale EV production. Other important segments include Battery Manufacturing Plants, which are vital to ensure localized supply chains, and Research & Development Centers, which contribute to next-gen EV technologies.

- By Construction: New Plant Construction is the dominant segment, driven by large-scale investments in greenfield projects. Plant Expansion is also growing as automakers adapt existing facilities for dual production of conventional and electric vehicles, while Renovation & Upgrades focus on modernizing older facilities to meet EV production needs.

- By End User: Auto-Makers dominate this segment, accounting for a significant share of the market, as automakers continue to ramp up their investments in dedicated EV plants. Other end-users include Battery Manufacturers and Charging Infrastructure Providers, both crucial for supporting the EV ecosystem.

Drivers

- Government Mandates for Domestic EV Manufacturing: Governments across major economies are mandating domestic EV manufacturing to reduce reliance on imports and strengthen energy security. These policies promote local production hubs and encourage automakers to establish EV plants within national borders, fostering market growth.

- Private Sector Investments: Private companies, particularly automakers and energy firms, are committing billions of dollars into gigafactories and EV plant infrastructure to meet rising consumer demand. These investments create jobs and stimulate technological innovations in the construction process.

- Increasing Demand for Localized Supply Chains: The rising need for localized EV supply chains is driving construction activities. Countries are prioritizing supply chain resilience to reduce disruptions in battery and component imports, leading to the expansion of EV manufacturing plants.

- Urbanization: The rapid urbanization across Asia and other regions is increasing the demand for cleaner transportation alternatives. As urban centers grow, the need for large-scale EV infrastructure, including manufacturing plants and charging networks, accelerates.

Use Cases

- Gigafactories: These large-scale facilities are essential for the mass production of electric vehicles. They integrate assembly lines, battery production, and other related functions to meet the increasing demand for EVs. The rise of gigafactories is a key driver in the market’s growth.

- Battery Plants: Battery production facilities are necessary to ensure the supply of high-performance batteries for electric vehicles. These plants are vital for reducing dependency on external suppliers and minimizing costs.

- Charging Infrastructure: As the adoption of electric vehicles grows, the demand for charging infrastructure is also increasing. EV plants that focus on building charging stations and networks are crucial in supporting the widespread use of EVs.

Major Challenges

- High Upfront Capital Expenditure: Building EV plants, especially new facilities, requires significant financial investments for land acquisition and infrastructure setup. The high costs can deter smaller firms from entering the market and slow down the expansion of existing companies.

- Skill Shortage: There is a shortage of skilled labor specializing in advanced construction techniques, automation integration, and cleanroom environments needed for EV plants. This skill gap leads to extended construction timelines and higher costs, hindering market growth.

- Supply Chain Disruptions: Despite efforts to localize production, global supply chain disruptions still pose a threat to the timely completion of EV plant projects. Shortages in critical components, such as semiconductors and raw materials, can delay construction schedules.

Business Opportunities

- Emerging Markets: Developing countries, particularly in Southeast Asia and South America, are becoming attractive locations for new EV plant construction. These regions offer lower land costs, government incentives, and growing consumer demand for electric vehicles.

- Modular Construction: The adoption of modular and prefabricated construction techniques is gaining traction. These methods reduce construction timelines, minimize costs, and improve flexibility, allowing for rapid scaling of EV production facilities.

- Renewable Energy Integration: Incorporating renewable energy systems such as solar and wind power into EV plant designs offers long-term value. These sustainable practices reduce the environmental impact of plant construction and lower operational costs.

Regional Analysis

- APAC: In 2024, APAC dominated the market with a 34.8% share valued at USD 1.0 billion. The region benefits from strong government incentives and strategic investments in gigafactories, particularly in China, India, and Southeast Asia. The rising adoption of EVs and localized supply chain strategies continue to strengthen APAC’s position in the market.

- North America: The U.S. is a major contributor to the growth in North America, with strong government support and increasing private sector investments. Federal funding programs and state-level EV mandates are accelerating the construction of EV manufacturing facilities.

- Europe: The European market is advancing due to strong regulatory backing, including the European Green Deal and AFIR mandates. European countries are focusing on sustainable EV plant construction, with an emphasis on green technologies and regulatory compliance.

- Latin America: Brazil and Mexico are leading the charge in Latin America, with growing government support and consumer interest in EVs. The region is prioritizing localized production to reduce reliance on imports and strengthen regional supply chains.

Recent Developments

- Feb 2025: The U.S. government offered $710 million in loans to accelerate EV technology projects, boosting domestic innovation and supporting clean energy manufacturing.

- Jun 2025: Lumina raised $20-40 million in Series A funding to expand its electric construction equipment line and market presence.

- Jul 2025: The European Union committed €852 million to enhance EV battery manufacturing, supporting regional supply chains and global competitiveness.

Conclusion

The global EV plant construction market is poised for substantial growth, driven by increasing EV adoption, government support, and strategic investments in infrastructure. As automakers and energy companies ramp up efforts to meet demand, significant opportunities are emerging in emerging markets, renewable energy integration, and modular construction techniques. While challenges such as high upfront costs and skill shortages persist, the market’s long-term prospects remain strong, with APAC leading the charge and North America and Europe quickly catching up.