Table of Contents

Overview

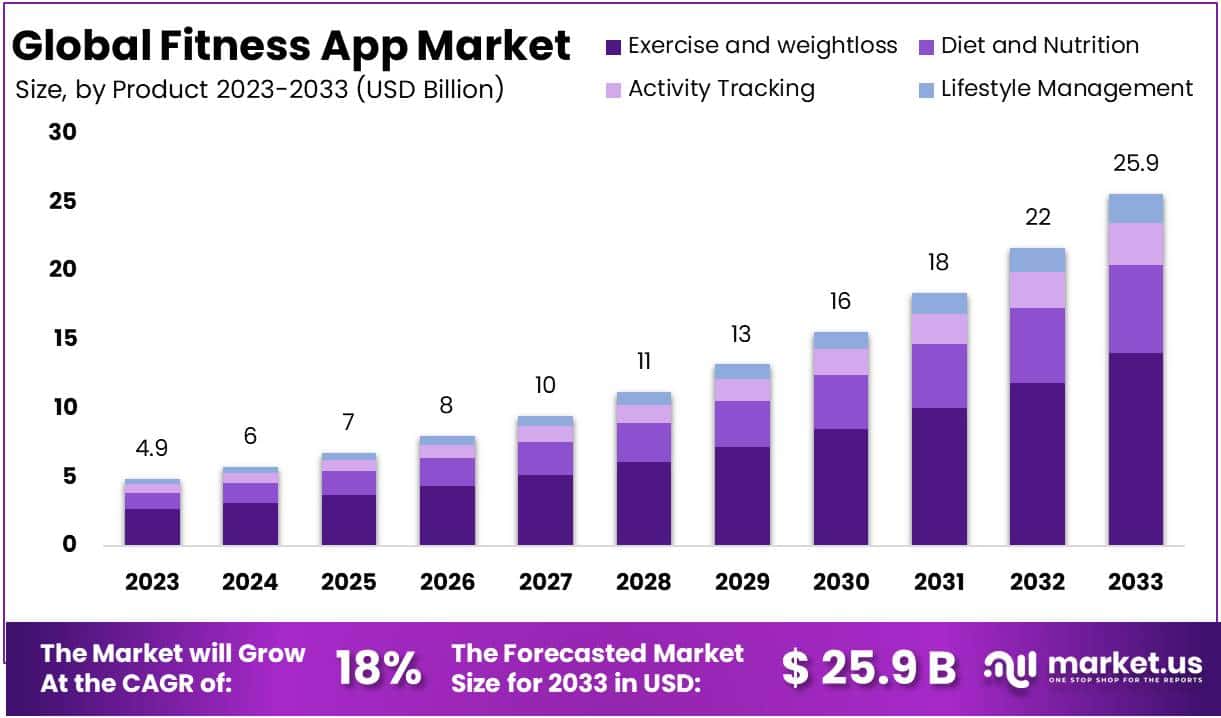

New York, NY – Sep 17, 2025 – The Global Fitness App Market size is expected to be worth around USD 25.9 Billion by 2033 from USD 6 Billion in 2024, growing at a CAGR of 18% during the forecast period from 2025 to 2033.

A new fitness application has been introduced with the objective of redefining how individuals engage with personal health and wellness. Designed to meet the growing demand for personalized fitness solutions, the app offers users a comprehensive platform to track physical activity, monitor dietary habits, and receive AI-driven workout recommendations. The app integrates seamlessly with wearable devices, enabling real-time data syncing and performance analytics.

Backed by cutting-edge technology, the platform delivers tailored workout programs based on user goals, fitness levels, and preferences. Features such as progress tracking, habit-building tools, and virtual coaching are embedded to enhance motivation and long-term adherence. The inclusion of social challenges and community-based engagement tools further fosters accountability and support among users.

The growth of the digital fitness market has been significant, driven by increased health awareness and the shift towards at-home workouts. The launch of this app aligns with the rising preference for flexible, tech-enabled wellness solutions. By focusing on data-driven insights and behavior-based personalization, the app is positioned to address the limitations of one-size-fits-all fitness programs.

The app is now available on both iOS and Android platforms, with a free trial period followed by tiered subscription plans. Future updates will include mental wellness integrations, AI coaching advancements, and localized fitness content. The development team emphasizes that the mission is not only to promote physical activity but to foster sustainable lifestyle changes through continuous innovation. The launch marks a significant step in reshaping how people interact with fitness in a digital age.

Key Takeaways

- Market Size: The Global Fitness App Market size is expected to be worth around USD 25.9 Billion by 2033 from USD 6 Billion in 2024.

- Market Share: The market growing at a CAGR of 18% during the forecast period from 2025 to 2033.

- Diverse Solutions: Fitness apps are available in various formats, including workout and exercise apps, meal planning tools, mental health and mindfulness apps, and comprehensive health and wellness platforms.

- Features and Functionalities: Common features include workout planning, activity tracking, coaching support, heart rate and sleep monitoring, nutritional tracking, and community engagement to enhance user interaction and motivation.

- Customized Workout Plans: Many apps utilize user inputs and algorithm-based recommendations to create personalized workout plans tailored to individual goals, fitness levels, and preferences.

- Wearable Device Integration: Integration with wearable devices such as smartwatches and fitness trackers enables real-time monitoring, creating effective feedback loops for user performance and health data.

- Nutrition and Meal Planning: Nutrition-focused features include meal tracking, diet recommendations, and guidance tools that support users in managing their nutritional habits as part of a broader wellness approach.

- Mental Fitness and Wellbeing: Several apps now include mental wellness components, offering meditation sessions, stress management exercises, and mindfulness practices to support overall psychological health.

- Regionla Analysis: In 2023, North America held a dominant market position, capturing more than a 49.1% share and holding USD 2.4 Billion market value for the year.

Fitness App Technology Analysis

The fitness app ecosystem is driven by advancements in mobile technology, wearable integration, and data analytics. Cloud computing and real-time synchronization allow seamless data storage and access across devices. Most applications are built on native iOS and Android platforms using Swift, Kotlin, or cross-platform frameworks like Flutter and React Native. Integration with wearables such as Apple Watch, Fitbit, and Garmin enables accurate tracking of metrics including heart rate, sleep, and calories burned.

AI and machine learning algorithms personalize workout plans and recommend nutrition based on user behavior and health data. Additionally, GPS and motion sensors support features like route tracking and step counting. Backend systems employ scalable cloud services (e.g., AWS, Google Cloud) to support large user bases and high-volume data processing. Secure APIs and encrypted data transmission ensure user privacy and compliance with regulations like GDPR and HIPAA. Continuous technological innovation is expected to further enhance user engagement and health outcomes.

Regional Analysis

In 2023, North America dominated the global fitness app market, accounting for over 49.1% of the market share, with a total valuation of approximately USD 2.4 billion. This leadership can be attributed to high smartphone penetration, a strong fitness-oriented culture, and the widespread popularity of digital health platforms. The region hosts several leading fitness applications such as Peloton, MyFitnessPal, and Fitbit, particularly in the United States, where user engagement has grown significantly.

Europe has established itself as a key market, driven by increasing consumer awareness around health and wellness. The region has witnessed the launch and expansion of numerous fitness applications, including notable platforms like Body by Apple, reflecting the region’s appetite for holistic digital wellness solutions.

The Asia Pacific region is experiencing rapid growth in the fitness app segment, supported by increasing smartphone usage and heightened interest in health-conscious lifestyles. Key markets such as China, India, and Japan are at the forefront, with a range of localized apps tailored to regional preferences and cultural nuances.

In Latin America, the fitness app market is emerging steadily, with Brazil leading regional adoption. New applications such as 99FIRE and Asana Rebel have gained traction, signaling growing demand for mobile fitness solutions.

The Middle East and Africa are also witnessing a rising trend in fitness app usage, underpinned by growing health awareness. Recent launches such as Fiit Arabia and 7 Minute Workout aim to meet the evolving needs of users across these developing markets.

Emerging Trends

- Prevention and population health alignment is strengthening.

Physical inactivity remains high about 27% of adults and >80% of adolescents do not meet WHO activity recommendations. This keeps prevention a priority and sustains demand for apps that help people meet weekly targets. - Integration with national health portals is accelerating.

Large, government-backed portals now reach mass scale and are being used monthly by tens of millions. The NHS App recorded ~56.5 million login sessions and 12.2 million unique users in July 2025 alone. This creates opportunities for fitness apps to integrate with prescription refills, test results, and appointment tools. - Patient access to records via apps is rising in the U.S.

HHS/ONC reports that more patients than ever accessed their medical records in 2024 using web and smartphone apps, reflecting the impact of interoperability rules that allow patients to use an app of their choice. This trend supports deeper linkage between fitness apps and clinical data. - Clear activity gaps persist creating addressable outcomes for apps.

In the U.S., only ~26.4% of adults met both aerobic + muscle-strengthening guidelines in 2024 (leisure-time measure). This quantifies the behavior change challenge that fitness apps can target with nudges and structured plans. - Government digital health capacity in Europe is maturing.

EU eHealth “maturity” improved to a 79% composite score in 2024, with most Member States progressing on electronic access to health records supporting cross-border interoperability and device/app connections. - Youth segments show strong propensity to track health online.

In Canada, female youth were more likely than male youth to track fitness/health online (36% vs 26%), indicating sizable sub-segment opportunities for tailored UX and content. - National platforms create measurable engagement baselines.

The NHS App’s scale (see Trend 2) and monthly usage provide reference baselines for what “good” engagement can look like when fitness features are embedded in trusted public platforms (e.g., push notifications, identity, secure data pipes). - Guideline-anchored design remains essential.

WHO and CDC emphasize weekly targets (e.g., ≥150 minutes moderate-intensity activity plus muscle-strengthening on ≥2 days/week), which should be operationalized into app journeys and progress dashboards.

Use Cases

- Guideline adherence coaching (primary prevention)

- What to build: Weekly activity planner that converts WHO/CDC targets into daily, 10–30-minute sessions; automated reminders; simple strength routines logged twice weekly.

- Why it matters (quant): Only ~26.4% of U.S. adults meet both aerobic and strength guidelines—leaving a large improvement headroom that can be tracked in-app.

- Portal-linked medication and appointment adherence

- What to build: Secure connections to national portals (e.g., NHS login), showing prescriptions, results, and appointments alongside activity plans; send “walk to the pharmacy” step prompts on refill days.

- Why it matters (quant): 12.2 million unique NHS App users in July 2025 demonstrate scalable engagement for integrated tasks (refills, results).

- Clinician-connected activity summaries

- What to build: FHIR-based summaries of weekly steps, minutes of moderate/vigorous activity, and strength sessions that patients can share with clinicians.

- Why it matters (trend): ONC notes growth in patients accessing and using digital tools to manage records in 2024, implying readiness for bi-directional data flows from consumer apps into care.

- Youth engagement and female-focused programs

- What to build: Programs for school/college schedules, menstrual-cycle-aware training, and social challenges.

- Why it matters (quant): 36% of female youth in Canada track fitness/health online vs 26% of male youth, supporting targeted feature sets and campaigns.

- Workplace wellness and inactivity risk reduction

- What to build: Micro-break prompts, “active meetings,” and stair/use prompts; organizational dashboards that report the share of employees hitting 150-minute weekly targets anonymously.

- Why it matters (trend): WHO continues to flag inactivity as a major NCD risk, with 27% of adults insufficiently active globally. Apps can make incremental gains visible at population level.

- Strength training adherence for older adults

- What to build: Low-impact, equipment-light routines with safety checks, balance drills, and fall-prevention tips; weekly progress tracking toward 2+ strength days.

- Why it matters (quant): Strength adherence is typically the limiting factor inside the combined guideline; national data show a minority meet both components (see 26.4% figure).

- Localization for public systems (EU focus)

- What to build: Country-specific identity (eIDAS), language packs, and record-access integrations aligned to the EU’s rising eHealth maturity (79%); consent flows tuned to GDPR.

- Why it matters (trend): Member State progress on patient access supports wider app adoption and clinical data linkages.

Conclusion

The introduction of this fitness application represents a pivotal moment in digital health, combining AI-driven personalization, wearable integration, and community engagement. With features that extend beyond physical activity to include nutrition, virtual coaching, and future mental wellness tools, the app addresses the demand for holistic and flexible wellness solutions.

Its launch coincides with strong market growth, estimated at USD 25.9 billion by 2033, and a rising global focus on preventive health. By aligning with government guidelines and leveraging data-driven insights, the platform is well-positioned to reshape user behavior, enhance adherence, and foster sustainable lifestyle transformation.