Table of Contents

Overview

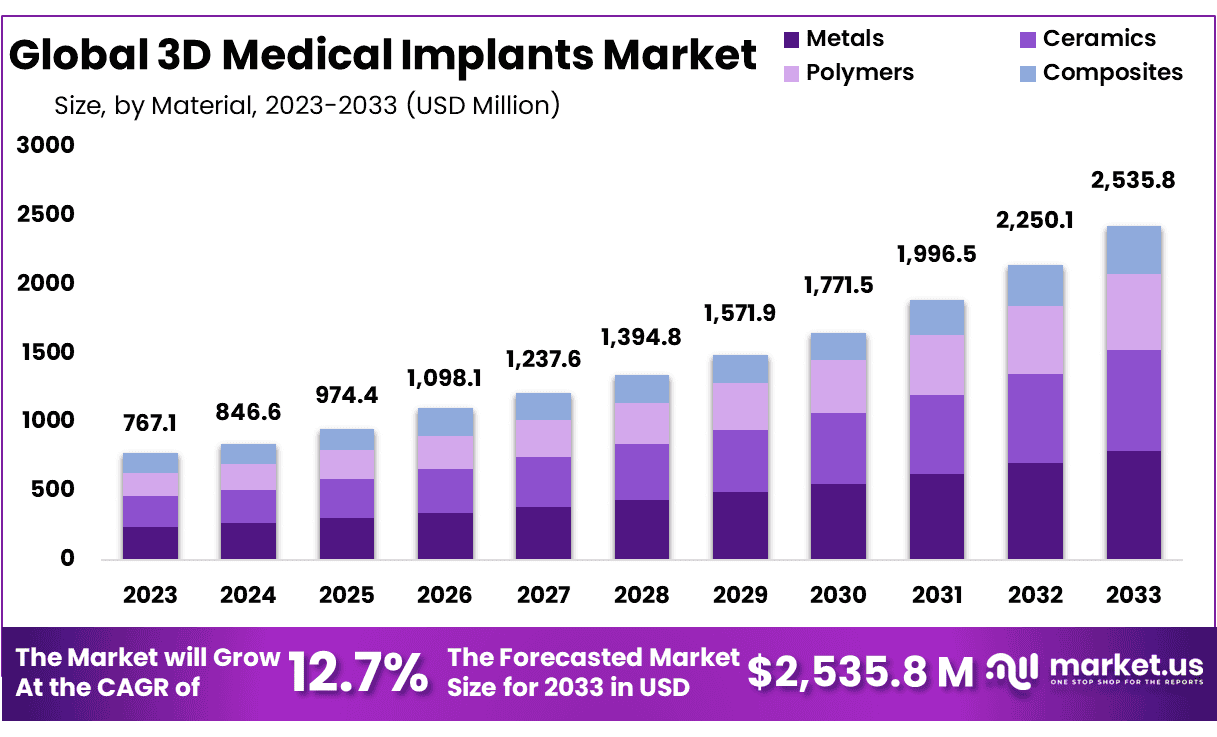

New York, NY – Sep 18, 2025 – The Global 3D Medical Implants Market size is expected to be worth around USD 2535.8 Million by 2033 from USD 767.1 Million in 2024, growing at a CAGR of 12.7% during the forecast period from 2025 to 2033.

The 3D medical implants market is experiencing significant momentum, driven by advancements in additive manufacturing technologies, rising demand for personalized healthcare, and increasing prevalence of chronic conditions requiring surgical interventions. The adoption of 3D printing in medical applications has enabled the production of patient-specific implants with higher precision, improved biocompatibility, and reduced surgical risks.

Orthopedic, dental, and cranial implants remain the dominant application segments, with hospitals and specialized surgical centers increasingly adopting 3D-printed solutions. Titanium and bioresorbable polymers are emerging as preferred materials due to their strength, durability, and ability to promote tissue integration. Furthermore, collaborations between medical device manufacturers, research institutions, and healthcare providers are accelerating innovation and commercialization.

The global market outlook remains favorable, supported by regulatory approvals, declining production costs, and expanding healthcare infrastructure across emerging economies. North America and Europe lead adoption, while Asia-Pacific is projected to witness the fastest growth due to rising medical tourism and increased investment in advanced healthcare technologies.

Key players are focusing on research and development, product portfolio expansion, and strategic partnerships to strengthen their market presence. The growth trajectory of the 3D medical implants market reflects the broader shift toward precision medicine, with opportunities anticipated in customized prosthetics, spinal implants, and tissue engineering applications.

As technological advancements continue to shape the healthcare sector, 3D medical implants are expected to redefine standards of patient care and surgical outcomes.

Key Takeaways

- Market Size: The 3D medical implants market is projected to reach USD 2,535.8 million by 2033, rising from USD 767.1 million in 2023.

- Market Growth: The market is anticipated to expand at a CAGR of 12.7% between 2024 and 2033, reflecting robust demand for advanced implant solutions.

- Material Insights: Metals dominate the material segment, accounting for 31.2% of market share, owing to their strength, durability, and compatibility.

- Application Insights: Dentistry remains the largest application area, contributing 33.11% of the total market share.

- Regional Insights: North America leads the global market with a 46.9% share, generating USD 359.7 million in revenues.

- Strategic Initiatives: Growth is being shaped by product innovations, mergers, acquisitions, and collaborative ventures that strengthen market presence.

- Affordability Factor: The cost-effectiveness of 3D medical implants is emerging as a critical driver of adoption in an increasingly competitive marketplace.

- Resilience & Adaptability: The market demonstrates resilience and adaptability, enabling sustained expansion despite evolving healthcare needs and industry challenges.

3D Medical Implants market technical Analysis

The technical analysis of the 3D medical implants market reveals strong momentum, supported by advancements in additive manufacturing technologies. Precision engineering, biocompatible materials, and integration with computer-aided design (CAD) systems have enhanced the structural reliability and customization of implants. Titanium and polymer-based implants dominate, with titanium favored for its strength-to-weight ratio and corrosion resistance.

The increasing adoption of 3D printing has reduced lead times and manufacturing costs, while enabling patient-specific solutions in orthopedics, dental, and craniofacial applications. However, challenges remain in ensuring regulatory compliance, quality assurance, and scalability.

Strategic partnerships between medical device companies and technology providers are strengthening supply chains, while investment in bioresorbable materials and multi-material printing is expanding the innovation pipeline. Overall, the market exhibits robust growth potential, driven by demand for minimally invasive procedures and rising prevalence of orthopedic and dental conditions.

Regional Analysis

North America accounts for 46.9% of the global 3D medical implants market, generating revenues of USD 359.7 million. This dominance is supported by the rising demand for advanced dental and orthopedic implants across the region. According to data from the Centers for Disease Control and Prevention (CDC), nearly 51% of Americans aged 30 years and above suffer from dental or orthopedic conditions, representing approximately 64.7 million individuals.

Such a large patient base highlights the critical need for innovative and high-quality implant solutions. The increasing preference for personalized and high-end treatment options has further accelerated the adoption of 3D medical implants, particularly within dentistry and orthopedic care. This trend underscores the importance of continuous innovation and the integration of advanced technologies in the healthcare sector. As healthcare needs evolve, North America remains at the forefront of driving growth and shaping the trajectory of the 3D medical implants market.

Emerging Trend

- Patient-specific (custom) implants move into routine use

Hospitals and manufacturers are increasingly using medical images to design one-off implants matched to a patient’s anatomy. FDA guidance recognizes “patient-matched device design” and details expectations for software workflows, material controls, validation, and labeling indicating that this pathway is maturing. - Engineered porous/lattice metal designs for better bone integration

Additive manufacturing enables internal lattices and controlled porosity that are difficult with traditional methods. FDA notes these design capabilities and the related testing/sterilization demands, especially for complex internal structures. Clinical literature reports improved fusion for porous titanium interbody cages versus conventional PEEK designs. - Point-of-care (PoC) manufacturing inside hospitals

The FDA has outlined regulatory scenarios for 3D printing at the point of care and highlighted the challenges (quality system responsibilities, validation, and oversight). This is pushing new operating models where hospitals produce certain patient-matched devices on-site under a defined regulatory approach. - Quality-by-Design and process control across the digital thread

Health-system and academic authors have extended Quality-by-Design principles to AM, emphasizing end-to-end control—from imaging and CAD to printing parameters, post-processing, and verification to ensure consistent performance of implants. - Materials innovation: toward bioactive and antimicrobial surfaces

Research published via NIH/PMC describes work on copper-containing and other tailored titanium alloys intended to reduce infection and support bone formation, pointing to next-gen implant surfaces produced by AM. - Clearer regulatory expectations for custom-made devices in the EU

The EU Medical Device Coordination Group (MDCG) has issued Q&A guidance on custom-made devices under MDR, including those produced with AM clarifying documentation and conformity pathways for patient-matched implants.

Use Cases

- Orthopedics (spine, joint, trauma)

- Spinal interbody cages (porous titanium): Studies report higher fusion rates versus traditional PEEK cages after additively manufacturing lattice structures that promote osseointegration. (Exact percentages vary by study and indication; see cited clinical comparison.)

- Custom tumor/defect reconstruction: Systematic reviews of custom 3D-printed orthopedic implants report acceptable safety profiles and functional improvements across series; reported complications include implant loosening in subsets (e.g., one series cited implant loosening in ~25% within 10 months, underscoring the need for careful follow-up and design iteration).

- Preoperative planning and patient-specific guides (adjacent to implants): Across surgical series, 3D printing has been associated with mean operating room (OR) time reductions of ~62 minutes per case (estimated $3,720 saved per case in U.S. cost models) and with reductions in surgical time reported in ~41% of studies in broader reviews. These process gains often accompany customized implant procedures.

- Cranio-maxillofacial (CMF) reconstruction

- Patient-matched plates, meshes, and segmental replacements: NIH/PMC reviews document improved fit and reduced intraoperative adjustments when custom implants are used, with associated decreases in OR time and improved aesthetic and functional outcomes in case series.

- Dental and oral implants

- Patient-specific dental implants and GBR meshes: Reviews via NIH/PMC describe expanding use of AM in implantology and bone augmentation. Personalized meshes and fixtures aim to lower exposure and infection rates, while bioactive/alloyed AM titanium is under study to further reduce infection risk.

- Arthroplasty and revision surgery

- Custom acetabular or glenoid components: Patient-specific metal implants are used to address severe bone loss where standard implants fail. Regulatory guidance emphasizes mechanical testing, dimensional verification, and sterilization validation for these complex AM components.

- Pediatrics and rare anatomy

- Growth-accommodating or anatomy-conforming devices: Patient-matched implants can be designed for unique congenital or post-traumatic anatomy, reducing the need for intraoperative reshaping and potentially shortening anesthesia time (documented as part of the broader OR-time reductions above).

- Hospital-based (Point-of-Care) implant workflows

- On-site customization with hospital quality systems: The FDA’s discussion paper frames scenarios where hospitals can manufacture certain devices on-site under defined roles and controls, enabling faster turnaround for urgent reconstructions and complex cases.

Conclusion

The 3D medical implants market demonstrates strong growth momentum, supported by advances in additive manufacturing, biocompatible materials, and increasing demand for patient-specific solutions. Orthopedic, dental, and craniofacial applications dominate, while titanium and bioresorbable polymers are emerging as preferred materials due to durability and tissue integration.

Regulatory clarity, strategic collaborations, and declining production costs are accelerating adoption across developed and emerging economies. North America leads in market share, while Asia-Pacific is expected to expand rapidly. With proven benefits such as reduced surgical time, better anatomical fit, and improved patient outcomes, 3D medical implants are positioned to redefine modern healthcare.